This article first appeared in The Edge Malaysia Weekly on December 29, 2025 – January 4, 2026

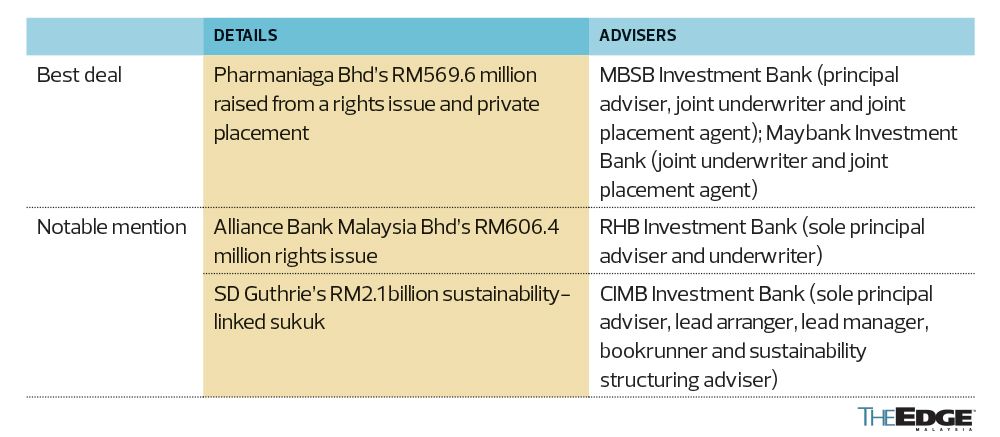

ALTHOUGH Pharmaniaga Bhd’s (KL:PHARMA) multimillion-ringgit cash call faced initial hiccups, the fundraising exercise was ultimately a success and formed a critical component of the company’s regularisation plan to lift its PN17 status.

In total, Pharmaniaga raised RM569.6 million through the issuance of 5.12 billion new shares via a combination of a rights issue and a private placement, making it the largest fundraising exercise ever undertaken in Malaysia’s healthcare sector.

What set the exercise apart was the concurrent execution of a sizeable rights issue — offering 12 rights shares for every five existing shares held — alongside a private placement.

The rights issue received strong backing from Pharmaniaga’s major shareholders, Lembaga Tabung Angkatan Tentera (LTAT) and its flagship company Boustead Holdings Bhd, both of which provided irrevocable undertakings to fully subscribe for their respective entitlements.

In addition to their entitlements, LTAT and Boustead collectively subscribed for an extra 185.6 million rights shares. Meanwhile, Maybank Investment Bank underwrote 51% of the rights issue.

The rights issue, which involved the issuance of 3.46 billion new shares priced at 10.3 sen each, recorded an oversubscription rate of 26.14% from existing shareholders.

For the private placement, Pharmaniaga pre-identified investors to ensure the successful completion of the exercise. The placement involved the issuance of 1.66 billion new shares at 13.5 sen each, which attracted participation from 19 new investors.

Following the fundraising exercise, Pharmaniaga saw the emergence of a new substantial shareholder, Jakel Capital Sdn Bhd with a 10% stake, making the group the second-largest shareholder after Boustead Holdings that owns 24.68% equity interest.

According to Maybank Investment Bank, Pharmaniaga engaged with 33 investors during its fundraising roadshow held between March 10 and March 19.

The investment bank, which acted as the joint placement agent and joint underwriter, described the exercise as the largest concurrent rights issue and primary placement in Malaysia, as well as the largest healthcare rights issue and pharmaceutical primary placement in the country.

Both new shares from the rights issue and the private placement were listed on July 31.

According to Maybank IB, based on Pharmaniaga’s closing share price of 28 sen on Oct 4, investors who participated in the rights issue and private placement would have realised returns of about 180% and 107.4% respectively.

Proceeds from the fundraising are expected to be used for the repayment of certain borrowings, capital expenditure to build or acquire new warehouses, product development for vaccines, insulin and other generic drugs, as well as working capital requirements.

Pharmaniaga was classified under PN17 in February 2023 after recognising an inventory provision of RM552.3 million related to the Sinovac Covid-19 vaccines. This was followed by a RM520 million capital reduction exercise in August to erase accumulated losses.

The completion of the regularisation plan paves the way for Pharmaniaga to exit PN17 status, which the group has targeted by the first quarter of 2026.

MBSB Investment Bank Bhd, formerly known as MIDF Amanah Investment Bank Bhd, acted as the principal adviser, as well as joint underwriter and joint placement agent, alongside Maybank Investment Bank.

Notable mention

Alliance Bank Malaysia Bhd’s (KL:ABMB) RM606.4 million rights issue — the first undertaken by a Malaysian financial institution in the last decade — earns a notable mention in the Best Fund Raising (Non-IPO) category for being a smart and timely capital exercise that was also fair to shareholders.

Announced on March 21 and completed on July 15, the exercise involved the issuance of 182.12 million renounceable rights shares at an issue price of RM3.33 apiece, on the basis of two rights shares for every 17 shares held.

The bank needed to raise fresh capital to enable it to sustain loan growth at a pace above the industry average without eroding its Common Equity Tier 1 ratio. At the time, its CET-1 ratio of 12.4% — a key measure of capital strength — was the lowest among banking peers.

“When conditions are right for you to grow, you should,” group CEO Kellee Kam told The Edge in May.

Pricing was a strong point. The rights were offered at a tight 20.1% discount to the theoretical ex-rights price, giving loyal shareholders, especially minorities, the chance to reinforce their ownership at an attractive entry point. More importantly, the renounceable nature of the issue meant that shareholders who chose not to subscribe could sell their rights on market and still benefit from the exercise.

Despite challenging market conditions, the rights issue was oversubscribed by 55.1%, underscoring investor confidence in the bank’s strategy and prospects.

In summary, the exercise strengthened the bank’s capital position while supporting its growth ambitions, without unduly penalising shareholders. As at Dec 17, the bank’s share price had risen 5.2% since completion of the rights issue. Operationally, the bank has also delivered, reporting its best quarterly performance in three years for the second quarter ended Sept 30. For the six months to date, net profit rose 11% to RM405.26 million as loans expanded 8%.

Also worth mentioning is SD Guthrie Bhd’s (KL:SDG) RM2.1 billion sustainability-linked senior Sukuk Wakalah that was not just the largest ringgit issuance ever for a plantation company but also the largest ringgit sustainability-linked issuance to date.

Taken up by an enthusiastic market, its RM700 million 10-year sukuk was priced at 3.80% and the RM1.4 billion 15-year sukuk at 3.97%. The order book reached its peak of around RM2.98 billion in the morning session of the book building exercise, almost twice the initial issuance size of RM1.5 billion.

Balancing between achieving an optimal tightest pricing for the issuer and the risk of drop out from investors, the 15-year tranche was tightened by two basis points to 3.97% while the 10-year tranche was maintained at 3.80%.

The final order book at a tightened pricing reached close to RM2.5 billion. The deal was upsized to RM2.1 billion and was distributed to about 30 accounts.

The issuance is part of SD Guthrie’s RM5 billion Islamic notes programme. The funds raised will be used to meet its near-term funding requirements, including redeeming a perpetual sukuk in March 2026 with a profit rate of 5.65% that would result in annual savings of about RM42 million for the group.

The sukuk has specific Sustainability Performance Targets (SPTs) to reduce Scope 1 and Scope 2 greenhouse gas (GHG) emissions by 30% across SD Guthrie’s global plantation upstream operations, as well as to maintain 100% Roundtable on Sustainable Palm Oil certification of palm oil mills from 2026 to 2037.

If the SPTs were not met, SD Guthrie would deposit a certain agreed amount into a dedicated account for specific sustainability initiatives and utilisation.

CIMB Investment Bank Bhd acted as sole principal adviser and lead arranger, sole lead manager and book runner, and sole sustainability structuring adviser.

Save by subscribing to us for

your print and/or

digital copy.

P/S: The Edge is also available on

Apple’s App Store and

Android’s Google Play.