Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

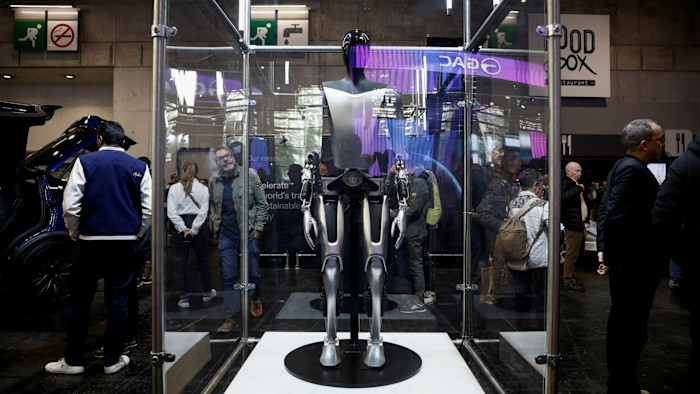

A video of a humanoid robot kicking the chief executive of Chinese robotics firm EngineAI to the ground has gone viral. Sure, the idea of droids that can beat humans in a fight is an alarming one. But it also shows how far the robot industry, which has considerable industrial applications and includes Tesla’s Elon Musk as a champion, has come in the past year.

While Tesla and Musk’s Optimus robot snatches airtime, China is making leaps in the humanoid race, leading to a rally in the sector’s shares. The Solactive China Humanoid Robotics Index rose 60 per cent from the start of last year to its peak in October, nearly triple the performance of the broader CSI 300 benchmark index. Sector leader Ubtech Robotics’ shares more than doubled last year, while local rival Unitree Robotics is planning a listing that is expected to value the company at up to $7bn.

The boom is drawing companies from other sectors: Chinese electric vehicle maker Xpeng plans to begin mass production of its Iron robot this year. Its stock rose 80 per cent last year.

On the face of it, humanoid robots look like a sector with enormous potential, and one that interlinks with the artificial intelligence boom. China has made significant advances in motion control, one of the hardest nuts to crack. Local humanoid robot makers are now nearing mass production. Ubtech Robotics produced its 1,000th unit last year. Chinese industrial robot production has increased more than a third in the first half of last year, according to official data.

Yet the reality is that robots remain very much reliant on real humans. They need traditional control systems and extensive human supervision. This is still a long way from the vision of self-improving software and low-input costs. More importantly, building droids is not yet conducive to profit. Of the nearly 150 local robot makers, many, including Ubtech, remain loss making.

Despite these limitations, China is well positioned to lead the global robotics industry — at least in its capital-intensive phase. While manufacturing scale and cost control are the key differentiators, China has an advantage. At some point, though, the real value driver in humanoid robotics will be AI and software, a model that typically brings with it higher margins, and may require different skills. Flooring a CEO is impressive, but it is just the first round in a long, drawn-out fight for supremacy.