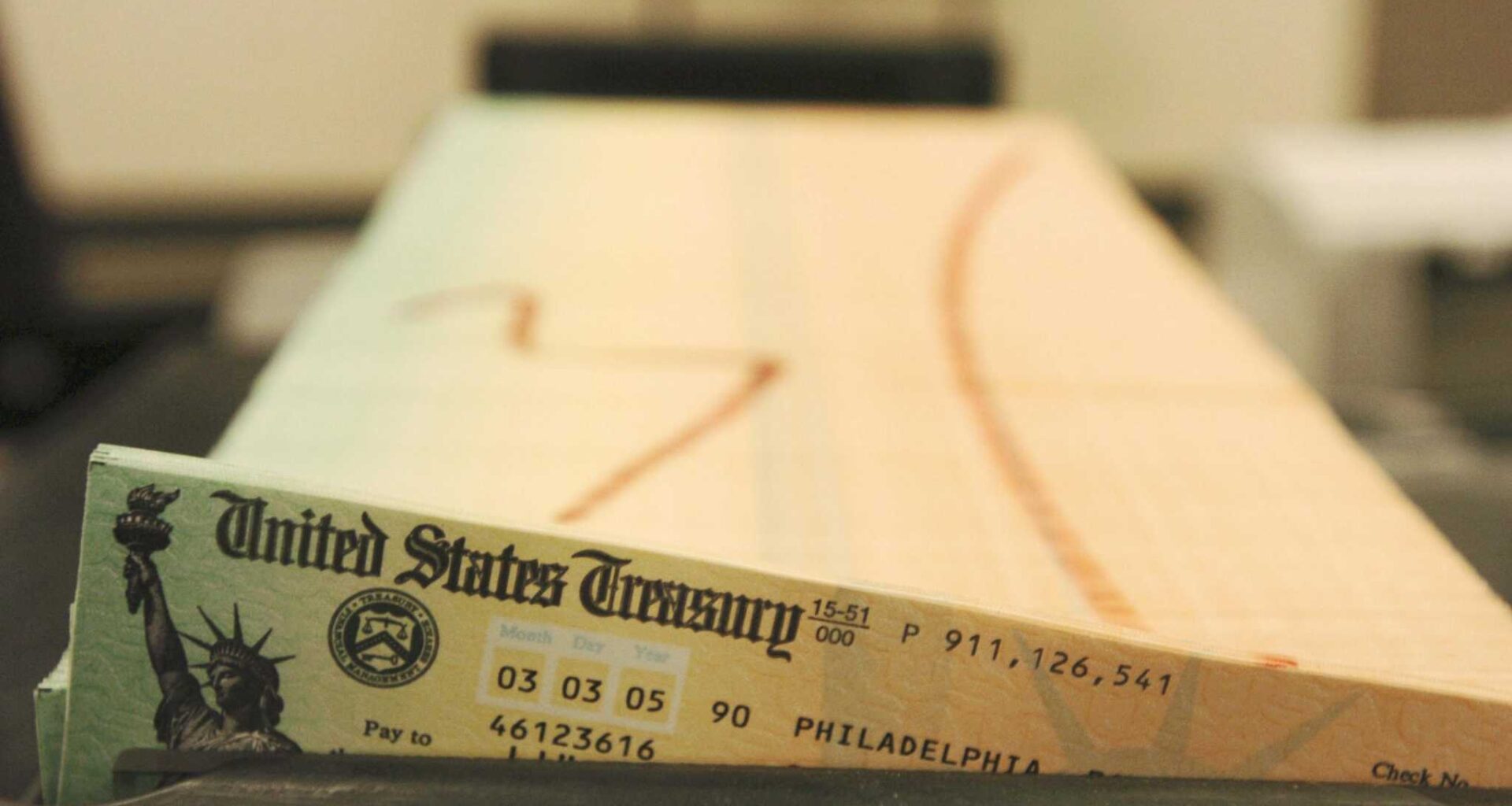

Trays of printed social security checks wait to be mailed from the U.S. Treasury’s Financial Management services facility in Philadelphia.

Bradley C Bower, FRE / AP

Of the over 71 million Americans who receive regular Social Security payments, some will receive their January benefits this week. There will also be another SSI check distributed at the end of the month.

Here’s what to know about January’s payments, along with new changes in 2026.

Article continues below this ad

More: Trump says Americans could get $2,000 stimulus checks ‘toward end of the year’

JTNDZGl2JTNFJTBBJTNDYSUyMGhyZWYlM0QlMjJodHRwcyUzQSUyRiUyRnd3dy5nb29nbGUuY29tJTJGcHJlZmVyZW5jZXMlMkZzb3VyY2UlM0ZxJTNEc3RhdGVzbWFuLmNvbSUyMiUzRSUwQSUzQ2ltZyUyMHNyYyUzRCUyMmh0dHBzJTNBJTJGJTJGcy5oZG51eC5jb20lMkZwaG90b3MlMkYwMSUyRjU0JTJGMzUlMkYzNiUyRjI4NDMyMzA3JTJGMyUyRnJhd0ltYWdlLmpwZyUyMiUzRSUwQSUzQyUyRmElM0UlMEElM0MlMkZkaXYlM0U=

JTNDZGl2JTNFJTBBJTNDYSUyMGhyZWYlM0QlMjJodHRwcyUzQSUyRiUyRnd3dy5nb29nbGUuY29tJTJGcHJlZmVyZW5jZXMlMkZzb3VyY2UlM0ZxJTNEc3RhdGVzbWFuLmNvbSUyMiUzRSUwQSUzQ2ltZyUyMHNyYyUzRCUyMmh0dHBzJTNBJTJGJTJGcy5oZG51eC5jb20lMkZwaG90b3MlMkYwMSUyRjU0JTJGMzUlMkYzNiUyRjI4NDMyMzA3JTJGMyUyRnJhd0ltYWdlLmpwZyUyMiUzRSUwQSUzQyUyRmElM0UlMEElM0MlMkZkaXYlM0U=

When will I get my January disability payment? Social Security payment schedule 2026

The Social Security Administration’s yearly distribution schedule for 2026 is available online so that you can use the calendar for budgeting purposes. Regular Social Security retirement benefits are being sent out on the SSA’s schedule, with the first round of January payments arriving Wednesday.

Article continues below this ad

For retirees and disability beneficiaries who began receiving payments after May 1997, the January payment schedule is as follows:

Wednesday, Jan. 14 — for those with birthdays between the 1st and 10th

Wednesday, Jan. 21 — for birthdays between the 11th and 20th

Wednesday, Jan. 28 — for birthdays between the 21st and the end of the month

Those who started receiving benefits before May 1997 — or who receive both Social Security and SSI — should have received their payments on Friday, Jan. 2.

Article continues below this ad

A sign identifies a building as a Social Security Administration (SSA) office.

Don and Melinda Crawford/UCG/Universal Images Group via Getty Images

JTNDZGl2JTNFJTBBJTNDYSUyMGhyZWYlM0QlMjJodHRwcyUzQSUyRiUyRnd3dy5nb29nbGUuY29tJTJGcHJlZmVyZW5jZXMlMkZzb3VyY2UlM0ZxJTNEc3RhdGVzbWFuLmNvbSUyMiUzRSUwQSUzQ2ltZyUyMHNyYyUzRCUyMmh0dHBzJTNBJTJGJTJGcy5oZG51eC5jb20lMkZwaG90b3MlMkYwMSUyRjU0JTJGMzUlMkYzNiUyRjI4NDMyMzA3JTJGMyUyRnJhd0ltYWdlLmpwZyUyMiUzRSUwQSUzQyUyRmElM0UlMEElM0MlMkZkaXYlM0U=

SSI payment schedule 2026

Those who qualify for SSI should have received their January payment on Dec. 31, 2025. This month’s payment was distributed a day early, because Jan. 1 was New Year’s Day and the SSA doesn’t issue payments on weekends or federal holidays. The Social Security Administration suggests that if you didn’t receive your payment on the expected date, allow three additional mailing days before contacting the agency; most arrive timely because 99% of beneficiaries are paid electronically.

Article continues below this ad

Although January’s payment came in December, there will be one distributed at the end of the month. Feb. 1 falls on a Sunday, so the month’s check will be sent on the Friday before.

Here’s the full 2026 SSI schedule:

Friday, Jan. 30, 2026 (Check for February 2026)

Friday, Feb. 27, 2026(Check for March 2026)

Wednesday, April 1, 2026 (Check for April 2026)

Friday, May 1, 2026(Check for May 2026)

Monday, June 1, 2026(Check for June 2026)

Wednesday, July 1, 2026(Check for July 2026)

Friday, July 31, 2026(Check for August 2026)

Tuesday, Sept. 1, 2026(Check for September 2026)

Thursday, Oct. 1, 2026(Check for October 2026)

Friday, Oct. 30, 2026(Check for November 2026)

Tuesday, Dec. 1, 2026 (Check for December 2026)

Social Security COLA changes for 2026

Social Security benefits and Supplemental Security Income (SSI) will increase 2.8% in 2026, the Social Security Administration announced on Oct. 24. The announcement was delayed by nine days due to the government shutdown.

Article continues below this ad

Retirement benefits will increase by an average of about $56 per month, beginning in January 2026. While this rate is lower than the average increases over the last decade (3.1%), it’s a boost from the 2.5% COLA adjustment for 2025.

“Social Security is a promise kept, and the annual cost-of-living adjustment is one way we are working to make sure benefits reflect today’s economic realities and continue to provide a foundation of security,” SSA Commissioner Frank J. Bisignano said. “The cost-of-living adjustment is a vital part of how Social Security delivers on its mission.”

Prior to each year, the SSA adjusts benefits for Social Security and SSI recipients to keep pace with inflation. COLA is a percentage by which benefits increase from December to January of the next year, based on third-quarter (July-September) inflation. The agency uses inflation figures from the Labor Department’s September Consumer Price Index data.

No tax on Social Security in 2026? Will Social Security be taxed next year?

Depending on your combined income, Social Security benefits may be taxable. Combined income “includes your adjusted gross income, tax-exempt interest income and half of your Social Security benefits,” according to the SSA. Here are what you can be taxed based on your combined income, or adjusted gross income (AGI):

Article continues below this ad

below $25,000 ($32,000 for joint filers): no tax

between $25,000 and $34,000 ($32,000 and $44,000 for joint filers): you must pay taxes for up to 50% of your benefits

above $34,000 ($44,000 for joint filers): you must pay taxes for up to 85% of your benefits

However, the Big Beautiful Bill has changed federal tax law to reduce taxable AGI, via higher standard deductions and new senior-specific deductions. This means more retirees will remain below the combined income thresholds, thus reducing the benefit amount eligible to be taxed.

Here’s a quick breakdown:

Senior deduction

Beneficiaries ages 65 and older can claim a new additional deduction of up to $6,000, or $12,000 for married couples who file jointly, against taxable income. This can, in turn, lower AGI and reduce the amount of Social Security benefits subject to tax.

Article continues below this ad

Standard deduction increase

The standard deduction has increased for all beneficiaries:

$16,100 for single filers

$32,200 for married filing jointly

How much can Austin-area taxpayers expect to save under Trump’s ‘Big Beautiful Bill’ tax cuts?

Article continues below this ad

Why is my Social Security check smaller this month? What to know about Social Security repayments

Those who have been overpaid by the Social Security Administration and haven’t begun the repayment process may have noticed their monthly benefits shrinking. At the end of July 2025, the SSA began withholding 50% of monthly benefits from individuals with outstanding overpayments. This marks a new phase in the agency’s effort to recover billions in accidental overpayments.

While the SSA hasn’t publicly confirmed how many beneficiaries are affected, records obtained via a Freedom of Information Act request show the agency attempted to reclaim overpayments from about 2 million people in the fiscal year ending September 2023, according to KFF and Cox Media Group.

If you received more money than you were entitled to through Social Security or Supplemental Security Income (SSI) and haven’t arranged a repayment plan, your benefits may be reduced by half. This applies even if the overpayment wasn’t your fault.

Article continues below this ad

Under its new policies, the SSA said it would begin issuing overpayment notices on April 25, 2025, and would start withholding 50% of the recipient’s benefits after about 90 days (or approximately July 24, at the earliest), until the overpayment is repaid.

Withholding began: Around July 24, 2025, depending on when you received your overpayment notice

Repayment options: Online bill pay, credit card or check

Waiver requests: You can ask the SSA to waive the repayment if:

The overpayment wasn’t your fault

You can’t afford to repay

Repayment would be unfair

Waiver and repayment information is available on the SSA website.

What is SSI?

Supplemental Security Income provides monthly benefits to those with limited income or resources who are 65 or older, blind or have a qualifying disability. Children with a qualifying disability can also get SSI, according to the SSA’s website.

Article continues below this ad

In general, adults who qualify for SSI do not have monthly wages above $2,019.

Those who may be eligible for SSI can begin the application process online, in person at their local Social Security office, or by calling 1-800-772-1213 (TTY 1-800-325-0778) from 8 a.m. to 7 p.m. local time, Monday through Friday.

How to get a new Social Security card

A Social Security card is shown in Tigard, Ore., Oct. 12, 2021.

Jenny Kane/AP

Article continues below this ad

The most convenient and secure method is to request a new Social Security card online if you:

are a U.S. citizen age 18 or older

have a U.S. mailing address

don’t need to change the name or other information on the card

have a driver’s license or state-issued ID

have a personal my Social Security account

An application for a new card can be completed by visiting a local Social Security office. You may be able to start the application (Form SS-5) online before scheduling an appointment, or fill out the entire application in-office. In addition to Form SS-5, you must bring unexpired identification documents to the office.

Article continues below this ad

The third and final option for getting a new Social Security card is by mail. You can complete the application (Form SS-5) and mail it along with original or certified copies of required documents, which include those that verify:

Identity:U.S. driver’s license, state-issued non-driver identification card or U.S. passport.

U.S. citizenship: U.S. birth certificate or U.S. passport.

Once approved, the SSA will typically send you a replacement card within 7 to 10 business days.

Article continues below this ad

What is the Social Security full retirement age for 2026?

The full, or “normal,” retirement age has gradually increased in recent years, rising by two months for each successive birth year. Here are the full retirement ages (FRA) by year of birth for 2026:

1943-1954: age 66

1955: age 66 and two months

1956: age 66 and four months

1957: age 66 and six months

1958: age 66 and eight months

1959: age 66 and 10 months

1960 and later: age 67

Can people under the retirement age get their benefits now?

Yes, but there are consequences for tapping in too early. Workers can choose to receive benefits as early as age 62, though at a reduced amount. However, those who delay claiming benefits until age 70 are rewarded with a higher monthly payout.

Article continues below this ad

Changes to Social Security in 2026 include a larger cost-of-living adjustment (2.8%, up from 2.5%) and an increase in the maximum taxable earnings limit from $176,100 to $184,500. Just as in 2025, Social Security offices nationwide will generally require an appointment.

What is the maximum Social Security benefit in 2026?

In 2025, the highest Social Security benefit for individuals retiring at full retirement age was $4,018 per month, according to the SSA. Due to certain inflation adjustments in how Social Security is calculated and how past earnings are adjusted for inflation, the maximum benefit rose to $5,251 per month, totaling over $63,000 annually in 2026.

Article continues below this ad

Social Security office near me

Click here to find a Social Security office near you.