Sajjid Chinoy, Chief India Economist at JPMorgan, said the Fed’s latest rate cut should be seen as “an insurance cut,” stating that the central bank faces stagflationary shocks from tariffs and immigration that complicate its policy choices.

He explained that while the labour market has slowed, core inflation remains firm, making the Fed cautious. For India, he added that a weaker dollar in recent months has already given emerging market central banks room to ease, reducing dependence on the Fed.

On inflation, Chinoy said it remains “extremely, extremely soft” with 2025-26 (FY26) averages around 2.8%, though base effects will push numbers higher in the coming quarters. He expects the Reserve Bank of India (RBI) to hold rates in October, while keeping space for another cut later if growth softens.

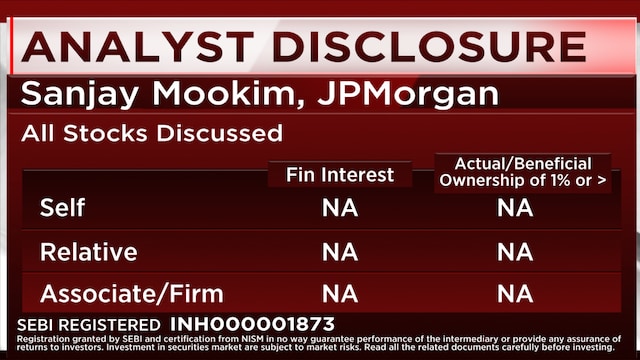

Joining him, Sanjay Mookim, Head of India Equity Research at JPMorgan, said earnings expectations have already been reset after cautious corporate commentary. “Expectations in India have actually been cut quite a bit and quite early in the fiscal year,” he said, adding that goods and services tax (GST) and direct tax cuts will support consumption and help lift discretionary sectors.

Also Read: Fed’s 25 bps cut positive for emerging markets, not yet a dovish cycle: Conrad Saldanha

Mookim also stated that valuations look more favourable now, with India trading at a discount to the S&P, and investor interest at JPMorgan’s annual India conference is the “strongest ever.”

For more details, watch the accompanying video