Asia Pacific Pharmacy Automation Market Summary

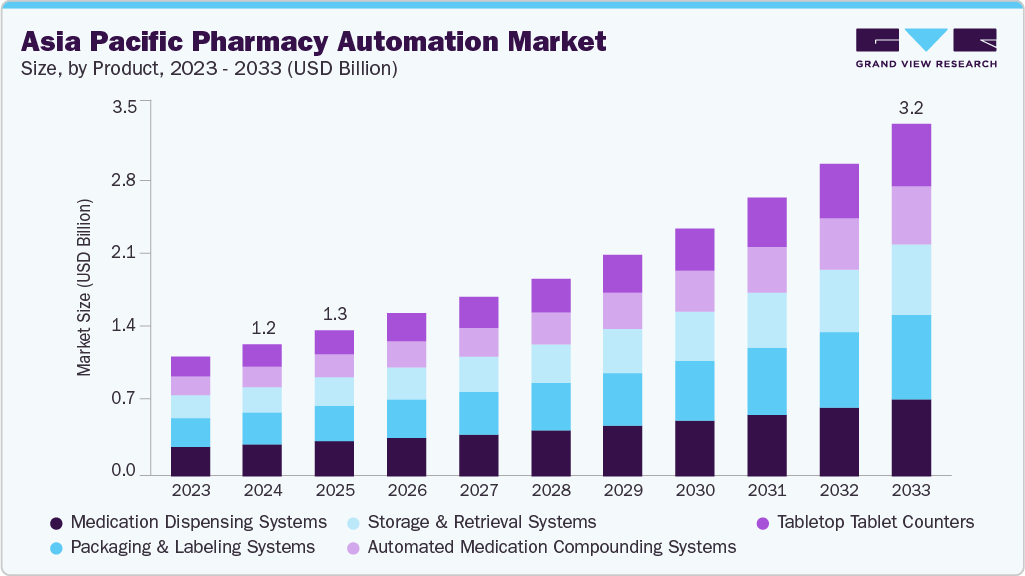

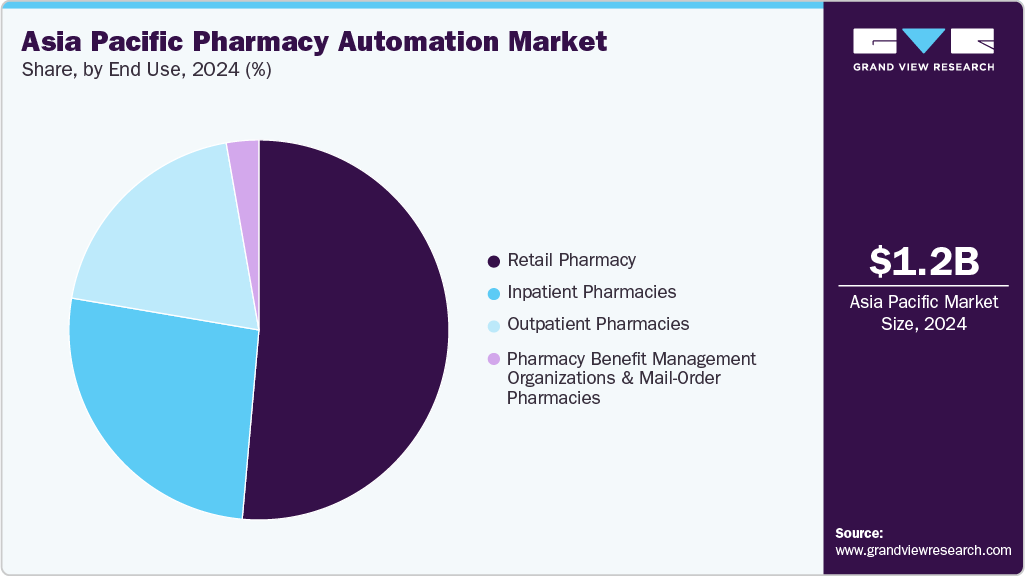

The Asia Pacific pharmacy automation market size was estimated at USD 1.20 billion in 2024 and is projected to reach USD 3.20 billion by 2033, growing at a CAGR of 11.63% from 2025 to 2033. This is attributed to the rising demand for specialty drug prescription-filling solutions due to the increasing incidence of chronic and life-threatening diseases, the rising need to minimize medication errors, and the decentralization of pharmacies. Moreover, an increasing dispensing of medications and technological advancements in automation systems have significantly enhanced the efficiency and accuracy of pharmacy operations.

Increasing Demand for Specialty Drug Prescription Filling Solutions

These drugs are created to manage complex and chronic illnesses such as cancer, autoimmune disorders, and some uncommon diseases. These types of drugs are sensitive, requiring careful preparation, appropriate storage, and exact dosing. With healthcare expanding access to complex therapies, an increasing number of pharmacies are receiving precise prescriptions requiring the advanced and favorable resolution of complex inefficiencies to fulfill the precision needed. In July 2022, Bushu Pharma contributed to the launch of specialty drugs in Japan and across the Asia-Pacific region. Bushu Pharma’s “Gateway to Asia” initiative streamlines the importation, inspection, labeling, packaging, and distribution of specialty drugs in Japan and the Asia-Pacific region. This service model simplifies compliance with regulatory requirements and ensures careful handling, increasing the accessibility of specialty medications to meet the rising demand for automated prescription-filling solutions.

Furthermore, the use of automated aids for prescription delays and medication adherence is essential for optimizing treatment processes. Governments and healthcare stakeholders in the Asia Pacific region are increasingly aware of the need to automate prescription-filling procedures. This automation aims to enhance treatment outcomes and ensure safe and timely access to specialty medications, addressing the complex demands of the healthcare environment.

Focus on Patient Safety and Error Reduction

Ensuring patient safety and preventing medication mistakes are essential and imminent issues in the healthcare industry. This problem is particularly acute in Asia, where patient intake and intricate treatment parameters are increasing. With pharmacy automation such as automated dispensers, robotics-assisted medication preparation, and barcode scanning systems, the need for human healthcare workers is declining. These automated systems, without staff intervention, enhance filling precision, dosages and dosages administered, and detection intervention while deploying medications. This yields better health results and instills dedication in healthcare systems.

Hospitals in Japan have implemented automated dispensing systems to streamline medication distribution, significantly decreasing prescription errors. For instance, in April 2022, I&H introduced Zebra Solutions to improve pharmacy operations by boosting productivity, accuracy, and patient safety. With rising medication management complexities and prescription error risks, they sought advanced technology to streamline processes. Zebra’s solutions, such as barcode scanning and real-time tracking, enhance inventory control and medication dispensing, ensuring accurate dosing and timing to minimize errors that could affect patient health.

Technological Advancements and System Integration

With rapid developments in robotics, artificial intelligence (AI), machine learning, and cloud computing, pharmacies are increasingly adopting automated systems to streamline medication dispensing, inventory management, and prescription verification processes. These innovations help reduce human errors, improve workflow efficiency, and enhance patient safety. Moreover, seamless integration with healthcare information systems, such as electronic health records (EHRs) and hospital management systems, ensures accurate data sharing, better tracking of patient medications, and adherence to treatment protocols. As healthcare facilities in countries such as China, India, and Japan continue to expand, the demand for reliable, scalable, and efficient automation solutions is rising. This technological integration is essential for improving operational efficiency and reducing healthcare costs.

The table below highlights how technology and system integration are transforming pharmacy operations, making automation a vital component in addressing the growing demands of the Asia Pacific healthcare sector.

Technology

Application in Pharmacy Automation

Impact on the Market

Robotics-assisted dispensing

Automated machines dispense medicines based on prescriptions

Reduces medication errors and improves dispensing speed

Artificial Intelligence (AI)

Analyzes prescription patterns and assists in error detection

Enhances patient safety and supports clinical decisions

Machine Learning Algorithms

Predict inventory requirements and optimize stock levels

Minimize stockouts and overstocking, reducing costs

Cloud-based Pharmacy Systems

Centralizes patient data and medication tracking

Enables remote monitoring and integration across facilities

Health Level Seven (HL7) Standards

Facilitate data exchange between pharmacy and healthcare systems

Ensures interoperability and seamless workflow coordination

Barcode Scanning and RFID

Tracks medications from storage to patient delivery

Improves accuracy and traceability in the supply chain

Decentralization of Pharmacies

As healthcare services expand beyond traditional hospital settings to include community-based clinics, retail outlets, and rural health centers, there is an increasing requirement for efficient, scalable, and accurate medication management solutions. Decentralized pharmacies often operate with limited staff and face high prescription volumes, making automation essential for reducing errors, ensuring patient safety, and maintaining operational efficiency. The rise in e-pharmacy platforms and telemedicine services has encouraged pharmacies to adopt automated systems capable of managing complex inventory, remote prescription filling, and secure medication dispensing.

Countries such as India, China, and Indonesia, where healthcare access is improving in semi-urban and rural areas, are seeing a rise in the deployment of automated dispensing systems, robotics, and digital inventory platforms. These advancements enable pharmacies to deliver high-quality care while addressing workforce limitations and logistical challenges.

Below are the decentralization trends, coupled with increasing healthcare demands, highlighting why automation solutions are becoming indispensable in ensuring that decentralized pharmacy networks operate effectively and safely across the region:

Country

Decentralization Trend

Automation Use Case

Impact

India

Expansion of retail pharmacy chains and e-pharmacy platforms in tier-2 and tier-3 cities

Automated dispensing units and inventory management systems

Improved medication accessibility and reduced prescription errors in rural areas

China

Growth of community health centers and integration with online healthcare services

Robotics-assisted prescription filling and AI-based drug interaction alerts

Enhanced patient safety and efficient handling of high prescription volumes

Indonesia

Government-supported rural health programs expanding pharmacy access

Cloud-based inventory management and automated packaging systems

Better stock control, reduced wastage, and timely medication delivery

Philippines

Proliferation of decentralized drugstores linked to telemedicine consultations

Smart cabinets with temperature monitoring for sensitive medications

Secure storage and improved compliance with treatment protocols

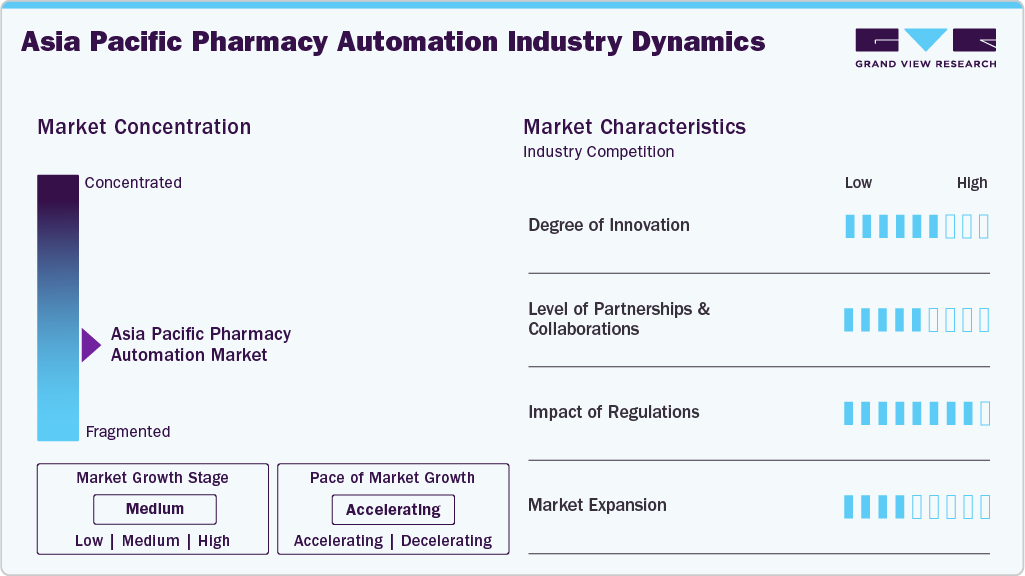

Market Concentration & Characteristics

The chart below represents the relationship between industry concentration, industry characteristics, and industry participants. The industry is fragmented, with many products and end users in the market. There is a high degree of innovation, moderate level of partnerships and collaboration activities, high impact of regulations, and moderate expansion of industry.

The industry is experiencing a high degree of innovation. Robotic dispensing units are transforming medication management by handling a wide range of medications with precision. Centralized pharmacy automation systems are being adopted to manage medication dispensing on a larger scale, improving efficiency and reducing costs. In April 2025, Manipal Hospitals partnered with Google Cloud to implement generative AI (GenAI) solutions that significantly enhance pharmacy operations and nurse handoff processes across its 37 hospitals in India. The ePharmacy platform has reduced prescription processing times from 15 minutes to under 5 minutes by automating tasks such as prescription validation, drug data transfer, and order processing.

Partnership & collaboration activities in the industry are high, driven by growing demand and consolidation among companies. For instance, in August 2025, Haier Biomedical announced a strategic partnership with Thailand’s RAM Medical Group, a leading private hospital network. This collaboration aims to advance pharmacy automation and develop comprehensive smart healthcare solutions tailored to the Southeast Asian market. By combining Haier Biomedical’s cutting-edge technology with RAM Medical Group’s extensive healthcare infrastructure, the partnership seeks to enhance operational efficiency and patient care across Thailand and the broader region.

The regulatory landscape in the market is driven by government-led healthcare reforms, strict licensing requirements, and increasing emphasis on quality assurance and patient safety. Countries such as Australia, Japan, South Korea, Singapore, and India have established specific regulations to ensure the safety, efficacy, and quality of pharmacy automation. For instance, in South Korea, the Digital Medical Products Act implemented in January 2025, establishes a regulatory framework for digital medical devices, including pharmacy automation systems, with a strong emphasis on safety and effectiveness. Similarly, Japan’s Pharmaceuticals and Medical Devices Agency (PMDA) regulates medical devices, including those utilized in pharmacy automation, to ensure they meet rigorous safety and effectiveness standards.

Pharma 4.0 is transforming India’s pharmaceutical manufacturing by integrating AI, robotics, and automation to improve efficiency, quality, and compliance. It addresses the demand for innovative production systems that can handle personalized and complex medicines. The adoption of this approach is increasing, with industry leaders highlighting its potential in revolutionizing drug development and manufacturing. For example, AI is being utilized to speed up drug discovery, optimize clinical trials, and enhance regulatory compliance, as demonstrated by companies such as Amgen and Parexel in reducing trial costs and times.

Product Insights

Based on product, the medication dispensing systems segment held a significant share of 24.21% in 2024. This growth is primarily driven by the growing demand for efficiency and accuracy in pharmaceutical operations. Automated medication dispensing systems streamline workflows, reduce human errors, and enhance patient safety, effectively addressing the challenges associated with manual dispensing methods. This shift toward automation is particularly prominent in inpatient and outpatient pharmacies, where precise medication management is crucial. Technological advancements also play a vital role in this transformation. By integrating advanced technologies such as robotics, AI, and machine learning into dispensing systems, pharmacies can achieve real-time tracking, improved inventory management, and personalized medication delivery. These innovations enhance operational efficiency and help meet the increasing complexity of pharmaceutical care.

The automated medication compounding systems segment is expected to grow at a significant CAGR during the forecast period. This growth is attributed to the growing demand for customized and personalized medications, especially in fields such as parenteral nutrition and oncology, where precise formulations are essential. Automated compounding systems allow pharmacies to prepare complex mixtures with high accuracy, reducing the risk of human error and ensuring consistent dosages. This capability is particularly important in regions with a high prevalence of chronic diseases and an aging population, where the need for specialized treatments continues to increase.

End Use Insights

Based on end use, the retail pharmacy segment held a significant share of 51.40% in 2024 and is expected to grow at the fastest CAGR during the forecast period. This is due to the increasing need to enhance operational efficiency, reduce medication errors, and improve patient safety drives the adoption of automation solutions in retail pharmacies. Technologies such as robotic dispensing systems, automated pill counters, and sorting machines enable pharmacies to manage high prescription volumes accurately and efficiently. These tools streamline workflows and allow pharmacists to dedicate more time to patient counseling and care, which ultimately enhances the overall quality of service. Furthermore, automation supports inventory management by ensuring optimal stock levels and minimizing the risk of medication shortages or overstocking.

The outpatient pharmacies segment is expected to grow at a significant CAGR during the forecast period. These pharmacies serve patients visiting healthcare facilities or filling prescriptions without hospital admission to handle large volumes of transactions daily. To enhance their workflow, reduce dispensing errors, and improve inventory management, these pharmacies utilize automation devices such as robotic dispensing systems, automated packaging machines, and medication tracking tools. Moreover, automation enhances adherence to treatment plans by providing improved patient counseling and medication management tools, ultimately leading to better health outcomes.

Country Insights

Japan pharmacy automation industry is experiencing significant growth, fueled by technological advancements and demographic changes. Government policies in Japan are supporting the expansion of the pharmacy automation market. Initiatives aimed at promoting the adoption of advanced technologies in pharmacies focus on improving efficiency and safety in pharmaceutical practices. These policies encourage the development and implementation of automation devices, such as robotics and automated dispensing systems, to enhance medication management and optimize workflow processes in pharmacies.

In Japan, Tomod’s is focused on expanding its services and promoting digital transformation (DX) to enhance the health and well-being of residents in regional areas. By utilizing advanced technologies and innovative healthcare solutions, the company aims to improve access to medical services and provide personalized care. This initiative addresses local health needs and enhances overall quality of life, positioning Tomod’s as a key partner in creating sustainable and efficient healthcare systems for regional populations.

The pharmacy automation industry in India has been significantly impacted by the recent expansion of DavaIndia’s digital platform in Pune. With the launch of its e-commerce app, which offers features such as 60-minute delivery, 10-minute in-store pickup, and support for 14 regional languages, DavaIndia is improving access to affordable healthcare solutions. This digital transformation requires the integration of advanced pharmacy automation systems to handle the increased volume of prescriptions, ensure accurate dispensing, and streamline inventory management. The company’s implementation of AI-assisted supply chains, predictive inventory, and automated warehousing further emphasizes the growing demand for automation in the pharmacy sector. As Davaindia continues to expand its digital presence across India, the need for sophisticated automation devices to support efficient operations becomes increasingly critical, driving growth in the pharmacy automation market.

The pharmacy automation industry in South Korea has been hugely impacted by the introduction of Hugel’s botulinum toxin, Letybo (known as Botulax in South Korea) in August 2025. As the leading neurotoxin brand for seven consecutive years, Letybo’s widespread use in aesthetic procedures has driven the demand for efficient pharmacy automation solutions. The increasing volume of injectable treatments has created a need for streamlined workflows, accurate inventory management, and precise dosing-all of which are supported by advanced pharmacy automation. This growth is primarily attributed to Letybo’s strong performance in both domestic and international markets, as noted on hugel-inc.com. Consequently, Letybo’s success has strengthened Hugel’s position in the global aesthetic market and has accelerated advancements in pharmacy automation technologies within South Korea.

Key Asia Pacific Pharmacy Automation Company Insights

In September 2025, ConnectiveRx launched a new dispensing pharmacy to enhance patient support services and improve access to medications. The pharmacy promotes closer coordination among healthcare providers, patients, and supports programs to address barriers such as affordability and accessibility, ultimately improving treatment outcomes and patient satisfaction. This move underscores ConnectiveRx’s commitment to comprehensive, patient-centered care.

In December 2024, Swisslog Healthcare partnered with BD to enhance pharmacy inventory management in U.S. hospitals using advanced robotics and intelligent software. This collaboration merged Swisslog’s automation capabilities with BD’s Pyxis Logistics, creating a comprehensive medication management solution. It focuses on improving operational efficiency, accuracy, and patient care by automating inventory tracking and medication ordering.

Cory Kwarta, President and CEO of Swisslog Healthcare said:

“This collaboration represents a significant advantage for hospital pharmacies as they implement pharmacy automation solutions,” “Our joint effort demonstrates our commitment to innovation, customer-centricity, and a focused strategy centered on robotic medication management solutions. This collaboration provides health systems with broader access to technology, enhancing their visibility of inventory across both automated and manual storage units while ensuring smoother implementation and seamless connectivity across multiple offerings.”

In November 2024, Catalyx, partnered with INEL, an advanced machine builder specializing in the pharmaceutical and medical device sectors. This strategic collaboration aims to provide innovative, end-to-end packaging solutions. Together, they are aimed at enhancing inspection, verification, serialization, and labeling processes, resulting in improved efficiency and regulatory compliance.

Boštjan Dokl Menih, CEO of INEL said:

“We are excited to partner with Catalyx, whose geographic reach and process optimization expertise perfectly complement our strengths in automation and labeling systems. Together, we can deliver unparalleled solutions to our clients across a broad range of industries and geographies.” By joining forces, Catalyx and INEL aim to streamline high-volume manufacturing tools, ensuring the next generation of pharmaceutical production meets stringent standards while driving industry innovation.

Key Asia Pacific Pharmacy Automation Companies:

OMNICELL Inc

BD

Scriptpro LLC

McKesson Corporation

Parata Systems, LLC

ARxIUM

Baxter

KUKA AG

Pearson Medical Technologies

RxSafe, LLC

Swisslog Healthcare AG

Yuyama

Innovation Associates

Talyst

Medacist Solutions Group, LLC

Capsa Healthcare

Cerner Corporation

Touchpoint Medical, Inc.

Accu-chart Plus Healthcare Systems, Inc

Cerner Oracle

Fulcrum Pharmacy Management, Inc.

Asia Pacific Pharmacy Automation Market Report Scope

Report Attribute

Details

Market size in 2025

USD 1.33 billion

Revenue forecast in 2033

USD 3.20 billion

Growth Rate

CAGR of 11.63% from 2025 to 2033

Actual data

2021 – 2023

Forecast data

2025 – 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Regional Scope

Asia Pacific

Segments covered

Product, end use, country

Country scope

Japan; China; India; Australia; Singapore; South Korea; Hong Kong; Thailand; Rest of APAC

Key companies profiled

OMNICELL Inc; BD; Scriptpro LLC; McKesson Corporation; Parata Systems, LLC; ARxIUM; Baxter; KUKA AG; Pearson Medical Technologies; RxSafe, LLC; Swisslog Healthcare AG; Yuyama; Innovation Associates; Talyst; Medicast Solutions Group, LLC; Capsa Healthcare; Touchpoint Medical, Inc.; Accu-chart Plus Healthcare Systems, Inc.; Cerner Oracle; Fulcrum Pharmacy Management, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Asia Pacific Pharmacy Automation Market Report Segmentation

This report forecasts revenue growth, regional and country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033 For this study, Grand View Research has segmented the Asia Pacific pharmacy automation market report based on product, end use, and country.

Product Outlook (Revenue, USD Billion, 2021 – 2033)

Medication dispensing systems

Packaging and labeling systems

Storage and retrieval systems

Automated medication compounding systems

Tabletop Tablet Counters

End Use Outlook (Revenue, USD Billion, 2021 – 2033)

Country Outlook (Revenue, USD Billion, 2021 – 2033)

Japan

China

India

Australia

Singapore

South Korea

Hong Kong

Thailand

Rest of APAC