Total foreign debt crosses $112b by June-end

18 September, 2025, 11:15 pm

Last modified: 18 September, 2025, 11:27 pm

Infographic: TBS

“>

Infographic: TBS

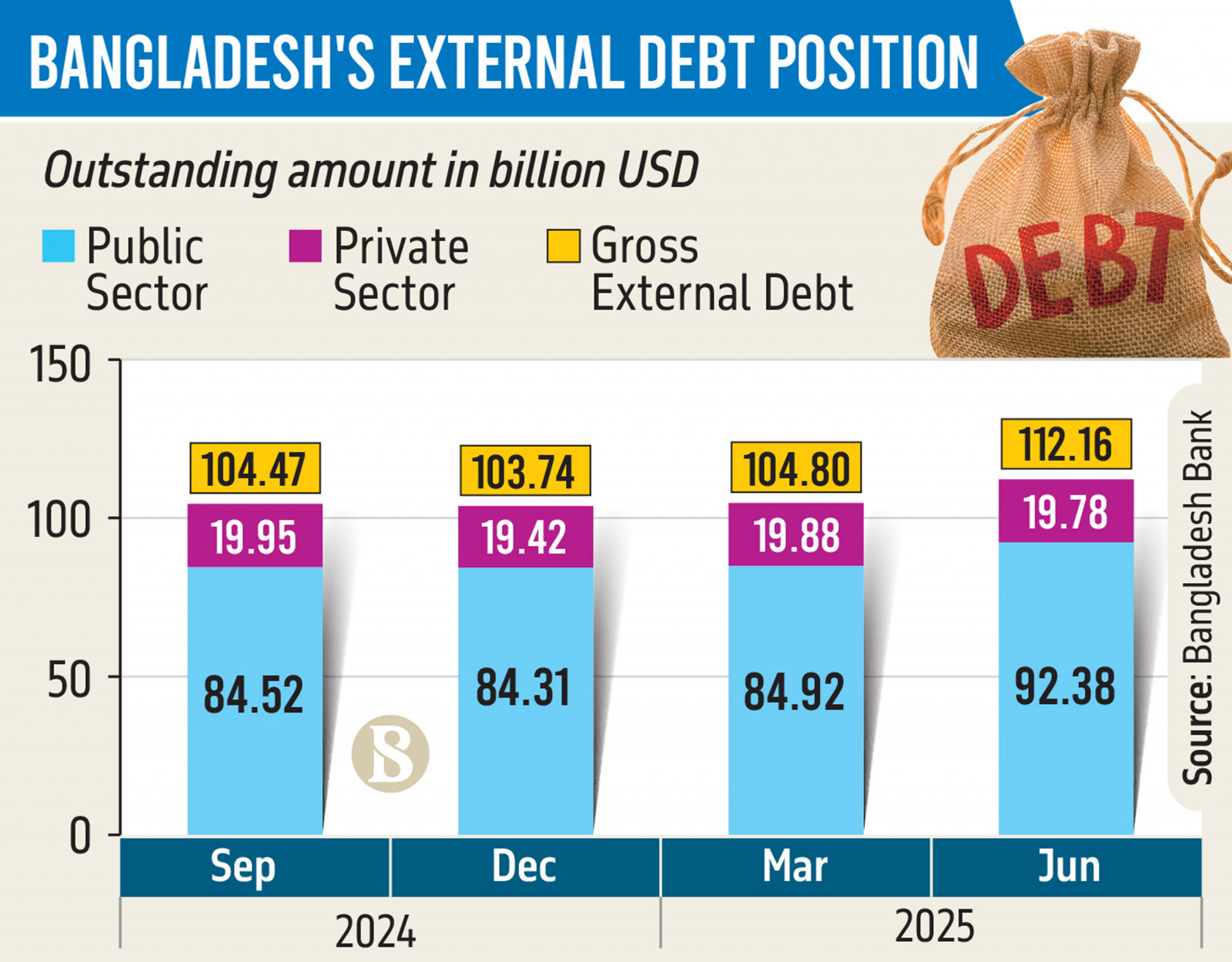

From March-end to June-end of this year, Bangladesh’s external debt rose by $7.35 billion, with the majority of the inflow going to the public sector, according to data released by Bangladesh Bank today (18 September).

By the end of the June quarter, the last quarter of FY25, total external debt, including both public and private sectors, reached $112.15 billion, up from $104.80 billion at the end of the March quarter.

While government-sector borrowing surged, foreign debt in the private sector declined by $110 million during this period, attributed to a lack of new investment.

In June, Bangladesh secured loans from several international lenders, including the International Monetary Fund (IMF), Asian Infrastructure Investment Bank (AIIB), Japan, and OPEC funds.

Keep updated, follow The Business Standard’s Google news channel

Economists and senior Bangladesh Bank officials said that fund release from multiple donor agencies has been the main driver behind the rise in public-sector external debt.

Zahid Hussain, former lead economist at the World Bank’s Dhaka office, told TBS, “Loans have come from various institutions – for example, $1.3 billion from the IMF alone. Additionally, budgetary support of around $3 billion has been received from the World Bank, ADB, and AIIB. These funds have been added to the government’s foreign debt.”

He said that these inflows are strengthening the overall economy and have helped stabilise the currency market, keeping the dollar exchange rate relatively steady.

“These loans have enabled the government to finance various expenditures, playing a crucial role in budget funding,” Zahid Hussain added.

Foreign loan misuse risks adding to debt burden

Economists said that foreign loans in Bangladesh’s public sector must be used efficiently, particularly as much of the borrowing is allocated to government projects. If these funds fail to boost production or generate revenue, they could become a burden rather than a benefit.

Professor Mustafizur Rahman, a distinguished fellow at the Centre for Policy Dialogue (CPD), said, “These loans must be used with caution, as they carry certain risks – namely, high interest rates and very short grace periods. Therefore, projects must be carefully assessed. Moreover, the use of these government loans must be accompanied by good governance.”

Zahid Hussain said, “If development project funds do not lead to proper revenue collection or production, repayment will strain the economy. These loans must be fully utilised to contribute meaningfully to economic growth.”

He noted that profitable projects like the Metro Rail and Padma Bridge are essential to ensure revenue collection, while caution is needed as some ongoing projects risk losses.

Reflecting Zahid Hussain’s view, a senior Bangladesh Bank official also said that proper use of foreign loans can benefit the economy.

Meanwhile, the US Federal Reserve cut interest rates by 25 basis points, bringing it to a range of 4–4.25%, the first reduction since December.

The Bangladesh Bank official said this could offer opportunities for the country to repay foreign loans at lower interest rates in the future.

Private-sector foreign loans dip amid weak new investment

Bangladesh Bank data shows that by the end of the June quarter, private-sector foreign loans stood at $19.77 billion, down from $19.88 billion in March – a decline of $110 million over three months, indicating that repayments outpaced fresh borrowing.

A senior official at Bangladesh Bank said new investment in the country remains sluggish, as businesses are hesitant to commit to fresh projects. This slowdown has reduced both foreign borrowing and bank credit flows to the private sector.

Mohammad Ali, managing director of Rupali Bank, told TBS, “Low new investment is the main reason private-sector foreign loans are falling. It is expected that with the upcoming elected government, businesses will boost investment.”

Bangladesh Bank data also shows that capital machinery imports fell by 25.5% last fiscal year.

Economists believe that the depreciation of the taka against the US dollar has hurt many businesses, raising operating costs compared to before. As a result, many in the private sector are avoiding foreign loans.

CPD’s Mustafizur Rahman said, “Most foreign loans in the private sector come as trade finance. But due to the taka’s depreciation, many businesses have suffered losses, as higher dollar prices have significantly increased costs. Since the cost of doing business must be carefully considered, local entrepreneurs are now taking fewer foreign loans. The high interest on these short-term loans has also become burdensome for them.”