AI and crypto are still being analyzed as technology stories. Chips, models, hash rates, capital raises. That framing is already outdated. At this stage of the cycle, growth is no longer decided by demand or funding. It is decided by power.

Not theoretical power. Not future contracts. Existing, usable electricity that can support a continuous load. That is the asset hyperscalers are quietly competing for, and it is where expansion is actually happening. Companies that already have access to it within live facilities can move. Those that do not are discovering that capital alone does not unlock growth.

That framework is what makes Datacentrex (NASDAQ:DTCX) worth a closer look, because the company is not approaching this shift from the sidelines.

It already operates across four U.S. colocation sites running continuous, power-intensive workloads, with uptime above 95%. Its current fleet of more than 3,100 wholly owned Scrypt mining rigs is live today, spread across diversified data-center load zones, and management has disclosed a funded expansion to more than 4,100 rigs in the first half of 2026. This is not a future buildout. The facilities are live, powered, and operating today, with revenue being generated under continuous load.

Look at where the biggest buyers are actually adding load. Microsoft (NASDAQ:MSFT) has concentrated new AI capacity inside existing campuses in places like Iowa and Texas, where power delivery and transmission are already settled. Google (NASDAQ:GOOG) has done the same in long-established regions such as Virginia and Ohio. These are not speculative locations. They are places where electricity shows up on time and at scale. Expansion is flowing to what already works, while projects tied to future power remain stuck.

That is the environment in which Datacentrex operates. It is not waiting on approvals or interconnection. Its sites are already live. Power is flowing, load is running, and revenue is being generated under continuous operation. At this stage of the cycle, the question is not who wants to expand, but who already can.

What matters next is how that position is used. Datacentrex is not holding power idle.

Today, it is monetized through Scrypt mining. The infrastructure is already paid for, and cash is already coming in. At the same time, the company sits adjacent to a data center and AI market already measured in the hundreds of billions of dollars a year.

Secured access to live power does not promise outcomes, but it determines who even gets a seat when demand shifts.

How Datacentrex Uses Its Power Today

For now, Datacentrex uses its contracted, energized capacity the way infrastructure businesses usually do: by putting it to work.

Datacentrex’s current revenue engine is Scrypt mining, a faster-growing and less saturated corner of crypto infrastructure that has outperformed expectations over the past cycle.

Scrypt mining secures networks such as Litecoin and Dogecoin using specialized hardware designed for steady, always-on operation.

It is a different market from Bitcoin mining. The field is smaller. Competition is thinner. Scale is not dominated by a handful of megasites, and that helps shape returns.

Over the past year, that gap has been visible in operating results.

While Bitcoin miners have dealt with rising difficulty, higher capital intensity, and margin pressure following the halving, Scrypt economics have held up better. Company materials show that Scrypt mining delivered stronger realized profitability than SHA-256 mining for much of 2024. And it’s all because of the structure.

A clearer way to gauge mining economics is to look at what the networks pay miners. CoinMetrics network data show that total miner revenue on Scrypt networks such as Dogecoin and Litecoin stayed comparatively steady through 2024. Bitcoin miner revenue did not. The halving cut payouts sharply, and margins across the SHA-256 ecosystem tightened.

Scrypt mining also allows a single machine to earn rewards from two networks at the same time, most commonly Litecoin and Dogecoin. Power use does not increase, but output does. That feature is known as merged mining.

For many operators, merged mining creates a secondary problem. Rewards arrive in more than one cryptocurrency, each with its own liquidity and conversion process. Turning production into usable cash can involve multiple steps, additional timing risk, and unnecessary friction.

Datacentrex (NASDAQ:DTCX) handles this differently. Mining output is consolidated into bitcoin rather than managed across several smaller assets. The result is a simpler cash flow. Fewer conversions. Less exposure to liquidity bottlenecks. Revenue moves from production to cash without detours.

That shows up in operating results. Datacentrex has disclosed that its Scrypt operations have been EBITDA positive from the start. Power costs are covered. Sites fund themselves. Expansion is incremental rather than speculative.

Source: https://x.com/ElphaPex/status/2003624000581464457

This defines Scrypt’s role in the business today. It is not framed as a destination. It is the current workload on energized sites. Cash is generated, infrastructure stays active, and the company retains the option to reallocate capacity over time. In a market where power is scarce, that combination matters.

Treasury Strategy: Liquidity First

Datacentrex pays attention to how revenue becomes usable capital, not just how it is produced.

Scrypt mining generates value across multiple networks. As a result, many operators end up managing several different crypto assets. That complicates cash flow. Conversion timing matters. Liquidity varies. None of that improves mining performance, but it can affect outcomes.

Datacentrex (NASDAQ:DTCX) avoids that problem by consolidating mining proceeds into a single settlement asset. Revenue is realized quickly and cleanly. There is no need to manage multiple small positions or wait for favorable conversion windows.

The result is a liquid treasury because operating costs are covered without the need to sell. Capital can be held, deployed, or left idle depending on conditions. Decisions are not dictated by short-term price moves or balance-sheet pressure.

That flexibility is the point. The treasury does not try to add returns on its own. It preserves the ability to act when opportunities appear and to sit still when they do not.

Execution: Scale, Control, and Cash Discipline

Execution at Datacentrex begins with ownership. The company owns its machines and operates directly within third-party colocation facilities directly. There are no leased rigs and no vendor liens embedded in the fleet. Decisions around uptime, expansion, and capital allocation stay simple because nothing lies between the company and its assets.

Today, Datacentrex runs more than 3,100 Scrypt ASICs across four U.S. colocation sites. Power is delivered and consumed under continuous load. These facilities are operating now, and utilization is happening in real time.

Growth builds from that base. Management has disclosed plans to expand the fleet beyond 4,100 rigs in the first half of 2026, adding capacity inside facilities that are already running. Power, cooling, and operating processes are in place. Capital goes toward machines, not construction.

The economics are already visible. Datacentrex has said its Scrypt subsidiary, dogehash technologies’ operations have been EBITDA positive from inception. Power costs are covered. Sites carry themselves. Expansion follows cash flow.

The company is also carrying cash. Datacentrex has disclosed roughly $45 million on hand, no long-term debt, and full ownership of its operating equipment. It is not forced to raise capital to keep operating or to add capacity.

The people involved have been through cycles where that distinction mattered. Members of the board and management have built and run crypto and data infrastructure businesses during periods when power tightened and capital disappeared. They have seen where leverage breaks things first.

That experience shows up in how the business is run. Assets are owned outright. Capacity is added where operations already work. Liquidity stays intact. The company is not built to chase scale just to justify fixed costs.

Management has been explicit about how it sees the model evolving. Datacentrex (NASDAQ:DTCX) has pointed to companies such as IREN, Cipher Mining, and TeraWulf as examples of businesses where the market stopped valuing hash rate alone and started valuing who has secured access to power,, balance sheets, and operating flexibility. The asset is not the output. It is the infrastructure underneath it.

For investors, execution here is straightforward. The system is operating, and cash is coming in, while capacity can be added without rebuilding the business.

Capital, Revenue, and the Size of the Playing Field

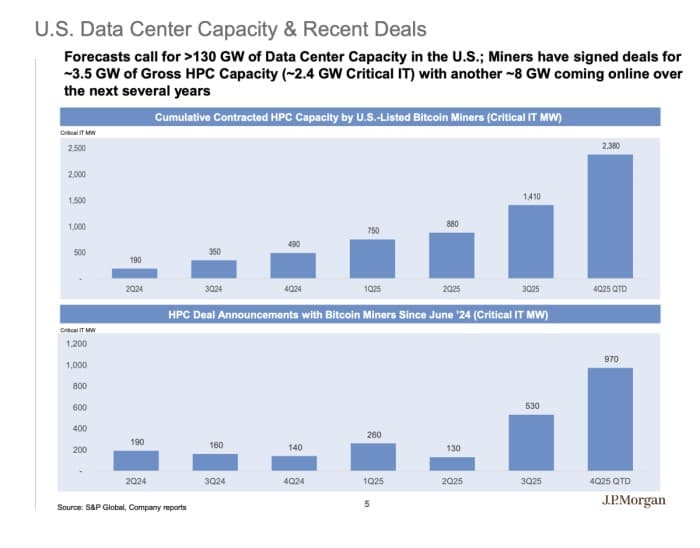

The scale of what is unfolding in data centers and AI infrastructure is already well defined. J.P. Morgan estimates that U.S. data center capacity could exceed 130 gigawatts by 2030, up from roughly 20–30 gigawatts today, with total infrastructure and hardware investment required to support that buildout running north of $3 trillion. Power, not demand, is the gating factor. Generation exists. Transmission, interconnection, and delivery do not move at the same speed.

J.P. Morgan’s work shows where capacity already exists. U.S.-listed bitcoin miners are operating more than 8.5 gigawatts of energized power, with approvals in place for roughly another 8 gigawatts. These are not plans on paper. The sites are connected, permitted, and already drawing load. Moving from mining to higher value computing is expensive, but the most difficult step is already complete. Electricity is reaching the site.

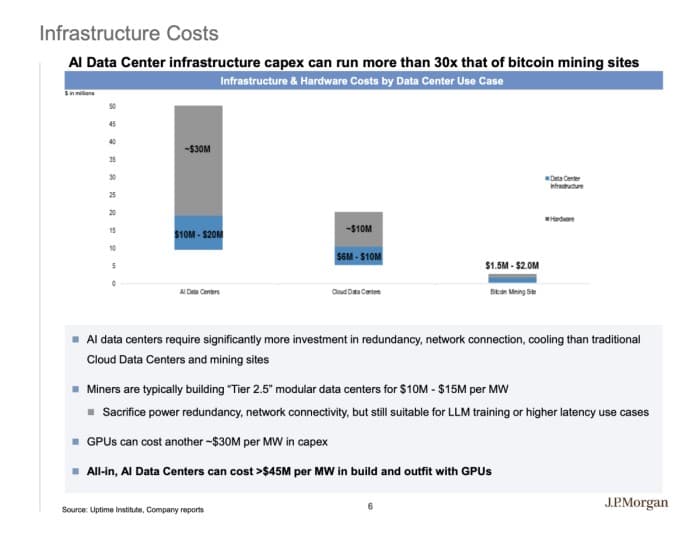

J.P. Morgan estimates that converting existing mining power capacity to HPC applications could cost roughly $10-15 million per megawatt before GPUs, with all-in AI data center costs exceeding $45 million per megawatt once hardware is included. That math explains why expansion across the sector is gravitating toward sites that already work, rather than projects that still need power.

This is where Datacentrex fits in. The company is not trying to solve the power problem. It is operating after it. Its business decisions concern how to use existing capacity, not how to secure it.

At this point in the cycle, outcomes hinge on where electricity is already being consumed.

Other companies to keep a close eye on in the space:

NVIDIA Corporation (NASDAQ:NVDA)

NVIDIA is the dominant global supplier of GPUs and accelerated computing platforms that underpin artificial intelligence, high-performance computing, and modern data centers. Its data center segment has become the company’s primary growth engine, driven by demand for AI training and inference workloads from hyperscalers, sovereign cloud projects, and enterprise customers. NVIDIA’s strength lies not only in hardware, such as its H100 and upcoming Blackwell platforms, but also in its tightly integrated CUDA software ecosystem, networking solutions, and AI development tools. As power availability and infrastructure constraints become limiting factors for AI deployment, NVIDIA’s ability to deliver higher performance per watt further strengthens its competitive position across global data center buildouts.

Nebius Group (NASDAQ:NBIS)

Nebius Group is positioning itself as a next-generation AI infrastructure and cloud services provider, focused on large-scale GPU computing and AI-optimized data centers. The company caters to enterprises and AI developers seeking high-performance compute capacity outside traditional hyperscaler ecosystems. Nebius’ strategy reflects a broader shift toward diversified and sovereign AI infrastructure, where access to power, land, and advanced cooling solutions is becoming as critical as capital. As demand for AI workloads accelerates globally, Nebius stands to benefit from structural shortages in GPU-ready data center capacity, particularly in regions prioritizing localized AI compute.

Micron Technology, Inc. (NASDAQ:MU)

Micron is a leading producer of DRAM and NAND memory, supplying critical components for data centers, AI accelerators, and advanced computing systems. The rapid expansion of AI workloads has materially improved the company’s long-term outlook, particularly through rising demand for high-bandwidth memory (HBM), which is essential for training large AI models. After navigating a cyclical downturn, Micron is benefiting from tightening supply conditions and improving pricing dynamics. Its continued investment in advanced memory technologies positions it as a key enabler of AI data center growth, where memory bandwidth and efficiency are increasingly decisive performance constraints.

Advanced Micro Devices, Inc. (NASDAQ:AMD)

AMD has emerged as a major force in high-performance computing, with expanding exposure to data center CPUs, AI accelerators, and cloud infrastructure. Its EPYC server processors continue to gain traction among hyperscalers and enterprise customers seeking alternatives in mission-critical data center deployments. AMD is also scaling its Instinct GPU platform to compete in AI training and inference, particularly as customers seek supplier diversification amid surging AI demand. The company’s focus on performance-per-watt efficiency aligns well with growing power constraints in data centers, making AMD an increasingly relevant player in AI-driven infrastructure spending cycles.

Apple Inc. (NASDAQ:AAPL)

Apple remains a global consumer technology leader, with a vertically integrated ecosystem spanning devices, custom silicon, software, and services. While Apple is not a direct competitor in hyperscale AI data centers, it is increasingly embedding AI capabilities into its products through on-device processing and energy-efficient chip design. Apple’s custom silicon strategy prioritizes performance within strict power and thermal limits, a philosophy that contrasts with brute-force data center AI models. As AI features become standard across consumer devices, Apple’s ability to deploy intelligence efficiently at scale strengthens its ecosystem while limiting dependence on external data center capacity.

Amazon.com, Inc. (NASDAQ:AMZN)

Amazon’s strategic importance increasingly rests on Amazon Web Services (AWS), the world’s largest cloud computing platform and a cornerstone of global AI and data center infrastructure. AWS continues to be a primary beneficiary of rising demand for AI training, inference, and enterprise cloud migration, driving large-scale investments in data centers, custom silicon, and energy procurement. Amazon’s in-house chips, including Trainium and Inferentia, reflect a growing effort to control costs and performance as power availability becomes a limiting factor in AI expansion. Beyond AI, AWS plays a central role in blockchain infrastructure, cybersecurity services, and cloud-native compliance, positioning Amazon as a critical enabler of next-generation digital and financial systems.

Alphabet Inc. (NASDAQ:GOOG)

Alphabet, through Google Cloud and its global network of hyperscale data centers, is one of the most technologically advanced AI infrastructure operators in the world. The company has long leveraged AI internally for search, advertising, and optimization, and is now commercializing those capabilities via cloud-based AI platforms and large language models. Google’s vertically integrated approach — combining custom TPUs, advanced cooling systems, and renewable energy sourcing — gives it a structural advantage as AI workloads strain global power grids. Alphabet is also a major player in cybersecurity through its cloud security offerings and acquisitions, and maintains indirect exposure to blockchain technologies through infrastructure services rather than speculative crypto activity.

Meta Platforms, Inc. (NASDAQ:META)

Meta is undergoing a fundamental transformation from a social media company into an AI-first platform operator, supported by one of the largest privately owned data center footprints in the world. The company is investing aggressively in AI infrastructure to power content recommendation, advertising optimization, and generative AI applications across its ecosystem. Meta’s data center strategy increasingly emphasizes custom silicon, high-density computing, and energy efficiency, reflecting the growing importance of power access and cooling in AI scalability. While Meta has pulled back from earlier crypto ambitions, its experience in blockchain and digital identity continues to inform its approach to secure digital platforms and data governance.

Microsoft Corporation (NASDAQ:MSFT)

Microsoft sits at the center of the AI, cloud, and enterprise software convergence, with Azure serving as one of the world’s leading hyperscale cloud platforms. The company’s deep partnership with OpenAI has driven massive demand for AI-optimized data centers, GPUs, and networking infrastructure. Microsoft is also investing heavily in energy procurement, nuclear partnerships, and grid resilience to support long-term AI growth. Beyond AI, Microsoft remains a dominant force in cybersecurity through its integrated enterprise security stack, making it a critical vendor for governments and corporations navigating rising digital threats. Its cloud services also support blockchain, identity, and compliance solutions at institutional scale.

Palantir Technologies Inc. (NYSE:PLTR)

Palantir specializes in data integration, analytics, and AI-driven decision platforms, with deep roots in national security, defense, and critical infrastructure. Its software enables governments and enterprises to fuse vast datasets, apply AI models, and make operational decisions in complex, high-risk environments. As AI adoption accelerates, Palantir is increasingly positioned as an application-layer beneficiary of data center and cloud expansion, rather than an infrastructure provider itself. The company’s focus on secure, auditable AI systems aligns with growing concerns around cybersecurity, compliance, and the use of AI in sensitive domains. Palantir’s platforms are also relevant to monitoring crypto-related risks, supply chains, and financial networks, particularly for state and institutional clients.

By. Tom Kool

IMPORTANT NOTICE AND DISCLAIMER

Neither the author nor the publisher, Oilprice.com, was paid to publish this communication concerning Datacentrex (NASDAQ:DTCX). The owner of Oilprice.com owns shares and/or stock options of the featured company and therefore has an incentive to see the featured company’s stock perform well. The owner of Oilprice.com has no present intention to sell any of the issuer’s securities in the near future but does not undertake any obligation to notify the market when it decides to buy or sell shares of the issuer in the market. This share ownership should be viewed as a major conflict with our ability to be unbiased. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

Readers should beware that third parties, profiled companies, and/or their affiliates may liquidate shares of the profiled companies at any time, including at or near the time you receive this communication, which has the potential to hurt share prices. Frequently companies profiled in our articles experience a large increase in volume and share price during the course of investor awareness marketing, which often ends as soon as the investor awareness marketing ceases. The investor awareness marketing may be as brief as one day, after which a large decrease in volume and share price may likely occur.

This communication is not, and should not be construed to be, an offer to sell or a solicitation of an offer to buy any security. Neither this communication nor the Publisher purport to provide a complete analysis of any company or its financial position. The Publisher is not, and does not purport to be, a broker-dealer or registered investment adviser. This communication is not, and should not be construed to be, personalized investment advice directed to or appropriate for any particular investor. Any investment should be made only after consulting a professional investment advisor and only after reviewing the financial statements and other pertinent corporate information about the company. Further, readers are advised to read and carefully consider the Risk Factors identified and discussed in the advertised company’s SEC, SEDAR and/or other government filings. Investing in securities, particularly microcap securities, is speculative and carries a high degree of risk. Past performance does not guarantee future results. This communication is based on information generally available to the public and does not contain any material, non-public information. The information on which it is based is believed to be reliable. Nevertheless, the Publisher cannot guarantee the accuracy or completeness of the information.

FORWARD LOOKING STATEMENTS. This publication contains forward-looking statements, including statements regarding expected continual growth of the featured companies and/or industry. The Publisher notes that statements contained herein that look forward in time, which include everything other than historical information, involve risks and uncertainties that may affect the companies’ actual results of operations. Factors that could cause actual results to differ include, but are not limited to, changing governmental laws and policies concerning, among other things, recreational and medical cannabis sales, success of the company’s proprietary technology, the size and growth of the market for the company’s products and services, the company’s ability to fund its capital requirements in the near term and long term, pricing pressures, etc.

INDEMNIFICATION/RELEASE OF LIABILITY. By reading this communication, you acknowledge that you have read and understand this disclaimer, and further that to the greatest extent permitted under law, you release the Publisher, its affiliates, assigns and successors from any and all liability, damages, and injury from this communication. You further warrant that you are solely responsible for any financial outcome that may come from your investment decisions.

TERMS OF USE. By reading this communication you agree that you have reviewed and fully agree to the Terms of Use found here http://oilprice.com/terms-and-conditions If you do not agree to the Terms of Use http://oilprice.com/terms-and-conditions, please contact Oilprice.com to discontinue receiving future communications.

INTELLECTUAL PROPERTY. Oilprice.com is the Publisher’s trademark. All other trademarks used in this communication are the property of their respective trademark holders. The Publisher is not affiliated, connected, or associated with, and is not sponsored, approved, or originated by, the trademark holders unless otherwise stated. No claim is made by the Publisher to any rights in any third-party trademarks.