Radiation Curable Coatings Market Size and Share Forecast Outlook 2025 to 2035

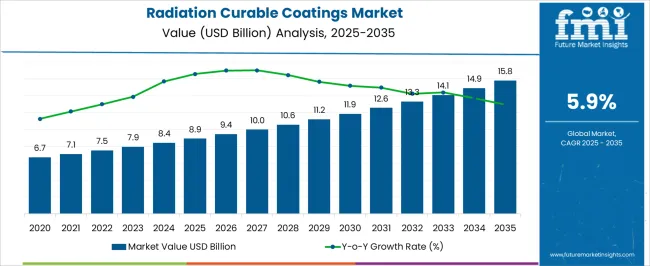

The radiation curable coatings market is estimated to be valued at USD 8.9 billion in 2025 and is projected to reach USD 15.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period.

The radiation curable coatings market is projected at USD 8.9 billion in 2025 and anticipated to reach USD 15.8 billion by 2035, expanding at a CAGR of 5.9% during the forecast period. Year-on-year growth trends indicate steady momentum, with the market advancing from USD 6.7 billion in 2020 to USD 7.1 billion in 2021 and gradually progressing toward USD 8.9 billion by 2025. By 2030, the market is expected to reach USD 11.9 billion, showing clear acceptance across industrial and consumer-driven applications.

Demand has been influenced by the increasing use of UV and EB curable coatings in packaging, electronics, and automotive, as these coatings provide durability, fast curing, and reduced emissions compared to conventional alternatives. Growing regulatory pressure to reduce solvent-based coatings has reinforced the adoption of radiation curable systems, pushing industries toward safer and more efficient processes.

The expansion of e-commerce packaging and the need for protective finishes in high-performance electronics are also strengthening demand. Each incremental year delivers growth between 5.5 to 6.1%, proving that this is not a market prone to fluctuations but one sustained by consistent industrial uptake. Toward the end of the period, the market reaches USD 14.9 billion in 2034 and USD 15.8 billion in 2035, underlining the long-term commercial viability of these coatings. In an opinionated sense, the stability of the CAGR demonstrates that this market is not just following cyclical trends but represents a structural shift in how industries view surface finishing and curing technologies.

Quick Stats for Radiation Curable Coatings Market

Radiation Curable Coatings Market Value (2025): USD 8.9 billion

Radiation Curable Coatings Market Forecast Value (2035): USD 15.8 billion

Radiation Curable Coatings Market Forecast CAGR: 5.9%

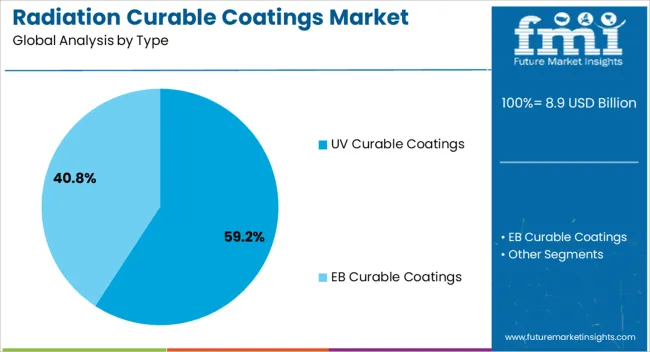

Leading Segment in Radiation Curable Coatings Market in 2025: UV Curable Coatings (59.2%)

Key Growth Regions in Radiation Curable Coatings Market: North America, Asia-Pacific, Europe

Top Players in Radiation Curable Coatings Market: BASF SE, DSM Coating Resins, Allnex, Covestro AG, Bayer MaterialScience AG, Royal DSM N.V., Eternal Materials Co.Ltd., Sartomer (a subsidiary of Arkema), Bomix Chemie GmbH, Red Spot Paint & Varnish Co., Inc., Miwon Specialty Chemical Co., Ltd., IGM Resins B.V., Dymax Corporation, Toyo Ink SC Holdings Co., Ltd., BASF-YPC Co., Ltd.

Radiation Curable Coatings Market Key Takeaways

Metric

Value

Radiation Curable Coatings Market Estimated Value in (2025 E)

USD 8.9 billion

Radiation Curable Coatings Market Forecast Value in (2035 F)

USD 15.8 billion

Forecast CAGR (2025 to 2035)

5.9%

The radiation curable coatings market is strongly influenced by five interconnected parent markets that collectively define its adoption and commercial growth. The packaging industry holds the largest share at 40%, as demand for UV and EB curable coatings in flexible packaging, labels, and folding cartons has surged due to fast curing speed, durability, and compliance with low-VOC regulations. The automotive sector contributes 25%, driven by the rising need for scratch-resistant, weatherable, and high-gloss finishes in both interior and exterior components. The electronics market accounts for 15%, supported by the increasing use of protective coatings in printed circuit boards, connectors, and high-performance consumer devices.

The wood and furniture industry holds nearly 12% share, as radiation curable coatings are widely used to enhance appearance and durability in flooring, panels, and decorative items. The printing and graphic arts market makes up around 8%, where coatings improve adhesion, gloss, and resistance in commercial printing, magazines, and specialty packaging. Together, these five parent markets form the backbone of adoption, with packaging and automotive accounting for 65% of share while electronics, wood, and printing industries contribute to diversification. In an opinionated sense, this balanced distribution ensures that the radiation curable coatings market benefits from both industrial scale and niche applications, providing resilience against cyclical downturns.

Why is the Radiation Curable Coatings Market Growing?

The radiation curable coatings market is witnessing significant expansion, driven by increasing demand for environmentally friendly and high-performance surface protection solutions. The market growth is being fueled by the rapid adoption of energy-efficient UV and electron beam curing technologies that reduce volatile organic compound emissions while providing faster drying and superior coating performance. Rising industrialization across automotive, packaging, electronics, and furniture sectors is supporting the increasing use of radiation curable coatings for high-durability and protective applications.

Continuous advancements in coating formulations and curing equipment are enabling improved surface properties, including scratch resistance, chemical resistance, and aesthetic finishes. Manufacturers are also focusing on developing multi-functional coatings that combine protection, performance, and visual appeal.

Regulatory mandates promoting low-emission materials and sustainable production processes are further accelerating market adoption As industries seek coatings that reduce production time and operational costs while maintaining superior quality, the radiation curable coatings market is expected to continue its upward trajectory, with opportunities for innovation in UV curable technologies, specialty applications, and enhanced performance functionalities.

Segmental Analysis

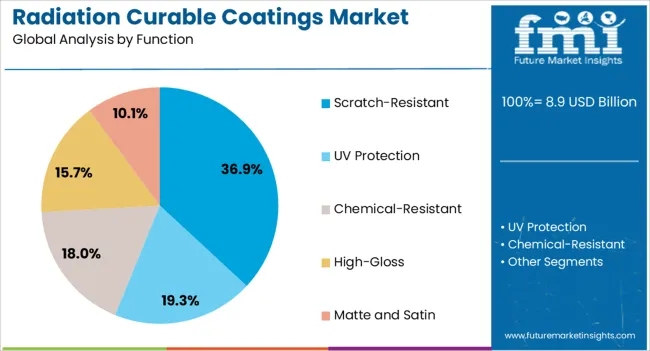

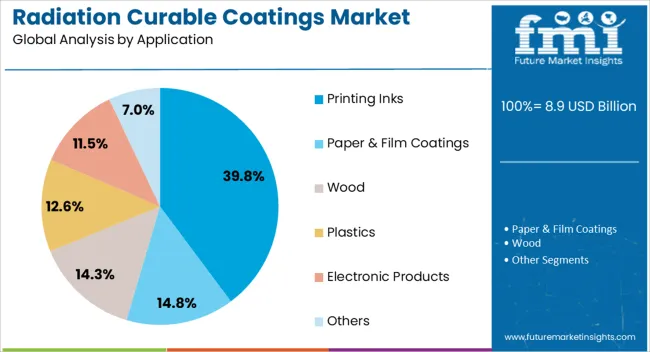

The radiation curable coatings market is segmented by type, function, application, end-use, and geographic regions. By type, radiation curable coatings market is divided into UV curable coatings and EB curable coatings. In terms of function, radiation curable coatings market is classified into scratch-resistant, UV protection, chemical-resistant, high-gloss, and matte and satin. Based on application, radiation curable coatings market is segmented into printing inks, paper & film coatings, wood, plastics, electronic products, and others.

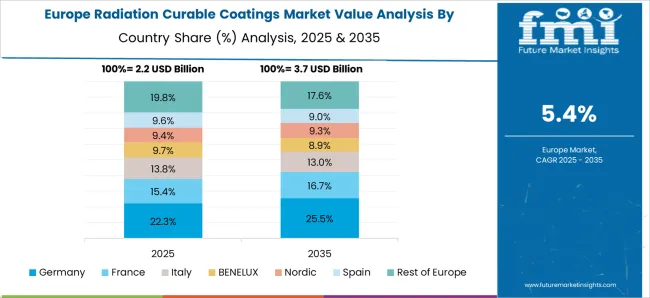

By end-use, radiation curable coatings market is segmented into wood coatings, metal coatings, plastic coatings, printed materials, electronic components, optical coatings, automotive coatings, aerospace coatings, and other. Regionally, the radiation curable coatings industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Insights into the UV Curable Coatings Type Segment

The UV curable coatings segment is projected to hold 59.2% of the radiation curable coatings market revenue share in 2025, establishing it as the leading product type. Its dominance is being driven by rapid curing speed, high efficiency, and minimal energy consumption compared to conventional coatings.

UV curable formulations allow for precise application on diverse substrates while maintaining superior durability and chemical resistance, which supports widespread adoption in industrial manufacturing and printing processes. The segment benefits from the flexibility to integrate functional additives, such as scratch resistance, abrasion protection, and gloss enhancement, enhancing overall product performance.

Manufacturers are increasingly leveraging UV curable coatings to reduce production cycle times and operational costs, which has encouraged adoption in sectors requiring high-volume throughput and rapid surface finishing Continuous innovation in photoinitiators and resin systems has further expanded the functional capabilities of UV curable coatings, reinforcing their position as the preferred choice in applications that demand superior performance, efficiency, and sustainability.

Insights into the Scratch-Resistant Function Segment

The scratch-resistant function segment is expected to account for 36.9% of the radiation curable coatings market revenue share in 2025, making it the leading functional category. This growth is being supported by increasing consumer demand for durable and long-lasting surfaces across furniture, electronics, automotive, and industrial applications. Scratch-resistant coatings enhance product lifespan, reduce maintenance costs, and improve aesthetic appeal, which is driving preference among manufacturers and end users.

Advanced coating formulations enable high hardness and surface integrity without compromising flexibility or adhesion, supporting application across a wide range of substrates. Continuous development in crosslinking agents, curing technologies, and surface engineering has further strengthened the performance and adoption of scratch-resistant coatings.

Regulatory emphasis on sustainable and low-VOC coatings has also encouraged manufacturers to focus on high-performance formulations that provide surface protection while reducing environmental impact The combination of functional effectiveness, operational efficiency, and compliance with environmental standards reinforces the segment’s leadership in the market.

Insights into the Printing Inks Application Segment

The printing inks application segment is anticipated to hold 39.8% of the radiation curable coatings market revenue share in 2025, making it the largest application area. This dominance is being driven by the requirement for fast-drying, high-quality, and durable inks in packaging, labels, and decorative printing. Radiation curable coatings enhance print sharpness, adhesion, and resistance to abrasion and chemicals, which is essential for maintaining product quality during handling, transportation, and use.

The segment benefits from the ability to apply coatings on diverse substrates, including plastics, metals, paper, and laminates, making it highly versatile for commercial and industrial applications. Continuous improvements in UV curing equipment and ink formulations have enhanced production efficiency and reduced energy consumption, which is encouraging adoption among manufacturers.

Increasing focus on sustainable and low-emission coatings further supports market growth As demand for high-performance printing inks continues to rise, radiation curable coatings with superior functional properties are expected to remain a key contributor to market expansion.

What are the Drivers, Restraints, and Key Trends of the Radiation Curable Coatings Market?

The radiation curable coatings market is witnessing steady growth, propelled by increasing demand across packaging, automotive, electronics, and wood applications. In the packaging sector, these coatings provide rapid curing, durability, and superior surface finish, while in automotive and electronics, they enhance scratch resistance, chemical stability, and aesthetic appeal. Wood applications benefit from improved coating efficiency and long-lasting protection. The wide-ranging applicability of radiation curable coatings underscores their versatility, supporting consistent industrial adoption and ensuring long-term market stability across multiple end-use segments globally.

Expanding Applications Across Packaging and Printing

The radiation curable coatings market is gaining steady momentum in packaging and printing, where demand is shaped by fast-curing, durable, and low-emission coatings. Flexible packaging, folding cartons, and labeling rely on UV and EB curing to deliver superior adhesion, resistance, and visual appeal. Growth in e-commerce and food packaging has pushed adoption further, as manufacturers prioritize coatings that support high-speed processing and compliance with environmental regulations. Printing applications, including magazines, catalogs, and specialty materials, have also benefited from these coatings due to enhanced gloss and abrasion resistance. In an opinionated view, packaging and printing remain the strongest pillars of adoption, making them critical revenue drivers for this market segment.

Rising Demand from Automotive and Transportation

Automotive and transportation sectors are becoming significant contributors to the radiation curable coatings market, with rising use in scratch-resistant, weatherable, and protective coatings. These coatings enhance the durability of vehicle exteriors, interiors, and components while offering aesthetic improvements such as high gloss finishes. Electric vehicle manufacturing is further increasing adoption, as companies pursue coatings that ensure long-term performance in demanding conditions. Fast curing and reduced process time also provide clear advantages in large-scale production lines. The integration of advanced finishes in aerospace and marine applications adds further traction. In an opinionated sense, automotive adoption underscores the ability of radiation curable coatings to outperform conventional alternatives in durability and efficiency.

Growing Role in Electronics and Consumer Devices

Electronics manufacturing has emerged as a strong driver for radiation curable coatings, with widespread use in protective layers for printed circuit boards, connectors, and display components. These coatings ensure resistance against heat, chemicals, and abrasion while supporting miniaturized electronic assemblies. Consumer devices such as smartphones, tablets, and wearables are also incorporating radiation curable coatings for improved durability and performance. The sector benefits from coatings that allow thin, uniform application and high-speed curing, which align with mass production needs. In an opinionated perspective, electronics adoption illustrates the market’s ability to adapt to precision-driven industries, making radiation curable coatings indispensable for ensuring both functionality and long-term reliability in sensitive applications.

Expanding Opportunities in Wood and Furniture

The wood and furniture industry represents another growing avenue for radiation curable coatings, with strong use in flooring, decorative panels, and furniture surfaces. These coatings deliver enhanced scratch resistance, chemical durability, and appealing finishes, which are highly valued in consumer-facing products. Fast curing times also improve productivity in furniture manufacturing lines, where efficiency and high-quality finishes are equally important. Increasing residential and commercial construction activities have indirectly fueled demand by raising the need for flooring and decorative surfaces. In an opinionated view, the adoption of radiation curable coatings in wood applications reflects their long-term relevance in industries that balance aesthetics, performance, and cost-effectiveness across consumer and commercial products.

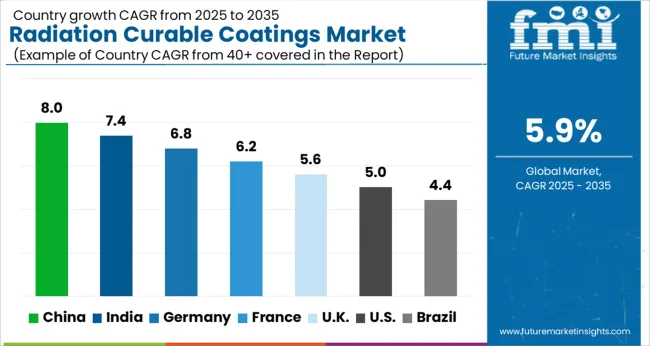

Analysis of Radiation Curable Coatings Market By Key Countries

Country

CAGR

China

8.0%

India

7.4%

Germany

6.8%

France

6.2%

UK

5.6%

USA

5.0%

Brazil

4.4%

The global radiation curable coatings market is projected to expand at a CAGR of 5.9% between 2025 and 2035. China leads with an 8.0% growth rate, supported by industrial expansion and electronics applications. India follows at 7.4%, driven by packaging, automotive, and increasing infrastructure needs. Germany holds a 6.8% CAGR, where engineering and precision manufacturing sustain demand. The UK shows a 5.6% rate, with growing applications in healthcare and industrial goods. The USA grows at 5.0%, driven by regulatory compliance and industrial coatings demand. Asia dominates with faster adoption in manufacturing and packaging, while Europe and North America are focused on quality standards and specialized coating applications. The analysis spans over 40+ countries, with the leading markets shown below.

Expansion Outlook on Radiation Curable Coatings Market in China

The radiation curable coatings market in China is projected to grow at a CAGR of 8.0% from 2025 to 2035, supported by the country’s extensive industrial base and expanding packaging and electronics sectors. China’s leadership in manufacturing and high-volume exports makes it one of the largest consumers of UV and EB curable coatings. Increasing applications in automotive coatings, wood finishing, and printed circuit boards further strengthen growth. Local and international players are investing in production facilities within China to meet rising demand for eco-friendly and efficient curing technologies. Supportive government policies that encourage advanced materials and cost-efficient production methods are also contributing to adoption. With fast-growing domestic consumption and global supply chain dominance, China remains the cornerstone for radiation curable coating adoption and export expansion.

Expanding demand in packaging, electronics, and automotive

High manufacturing capacity and export-driven growth

Government support for advanced material adoption

Growth Prospects for Radiation Curable Coatings Market in India

India’s radiation curable coatings market is expected to grow at a CAGR of 7.4% between 2025 and 2035, supported by packaging, automotive, and infrastructure applications. The rapid expansion of e-commerce and food packaging creates consistent demand for coatings that enhance durability and appearance. Automotive manufacturers increasingly rely on radiation curable coatings for improved scratch resistance and faster curing times. The government’s push for “Make in India” and rising investments in industrial manufacturing are further driving demand. Local players are expanding capacity, while multinational firms are collaborating with domestic partners to strengthen their market presence. Growing awareness about advanced coating solutions among Indian industries is expected to accelerate adoption across multiple end-use applications. India’s combination of large-scale consumer demand and government-backed initiatives positions it as a critical growth hub.

“Make in India” driving industrial expansion

High demand in e-commerce packaging sector

Automotive and infrastructure driving coating adoption

Future Outlook on Radiation Curable Coatings Market in Germany

Germany’s radiation curable coatings market is projected to register a CAGR of 6.8% from 2025 to 2035, supported by the country’s advanced engineering, automotive, and industrial sectors. The German market emphasizes precision manufacturing and premium product quality, with significant use in automotive finishing, wood coatings, and high-end packaging. Leading German manufacturers and suppliers are innovating to provide coatings with faster curing, superior resistance, and cost efficiency. Strong demand from the automotive industry, especially in coatings that enhance durability and appearance, continues to drive growth. Regulatory standards in Europe also encourage the adoption of low-VOC and high-performance coatings, making Germany a leader in environmentally compliant products. Export opportunities across Europe further reinforce Germany’s position as a key market.

High adoption in automotive and wood finishing

Focus on premium quality and engineering standards

Export opportunities supporting wider European demand

Market Expansion for Radiation Curable Coatings in the United Kingdom

The radiation curable coatings market in the UK is projected to expand at a CAGR of 5.6% between 2025 and 2035, supported by applications in healthcare, packaging, and industrial coatings. The country’s packaging industry, particularly in food and pharmaceuticals, is adopting UV-curable solutions to ensure faster curing times and improved surface protection. Healthcare applications, including medical device coatings, are also contributing to market momentum. While the UK market is smaller than Germany or China, it focuses on high-value applications where quality and regulatory compliance are critical. The growing demand for durable and aesthetic finishes in consumer goods and industrial products is also shaping adoption. Local distributors and global suppliers are collaborating to deliver tailored solutions for niche industries.

Healthcare and pharmaceutical packaging driving adoption

Strong demand in food and consumer goods packaging

Focus on niche, high-value applications

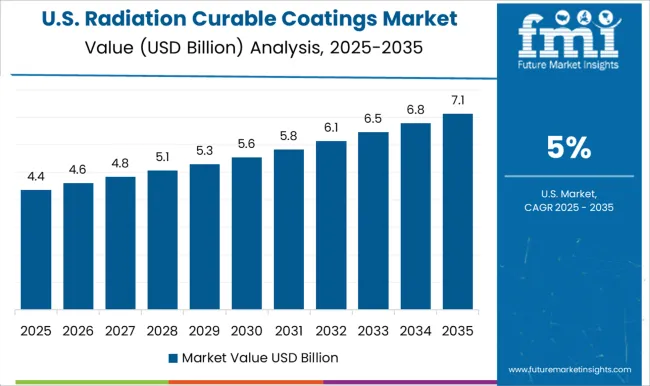

Growth Insights for Radiation Curable Coatings Market in the United States

The radiation curable coatings market in the USA is forecasted to grow at a CAGR of 5.0% between 2025 and 2035. The market benefits from strong demand in industrial coatings, automotive manufacturing, and advanced packaging. Adoption is also increasing in electronics and wood finishing sectors, driven by the need for durable, high-performance coatings. Strict regulatory guidelines by the EPA encourage the shift toward low-emission, energy-efficient solutions, making radiation curable coatings more attractive. The USA market also places emphasis on specialty coatings tailored to sectors like aerospace and medical devices. With established multinational companies and a strong domestic demand base, the USA continues to serve as a mature but steady market, focusing on quality, compliance, and high-performance solutions.

EPA-driven demand for low-emission solutions

Adoption in aerospace, automotive, and packaging sectors

Strong presence of multinational coating companies

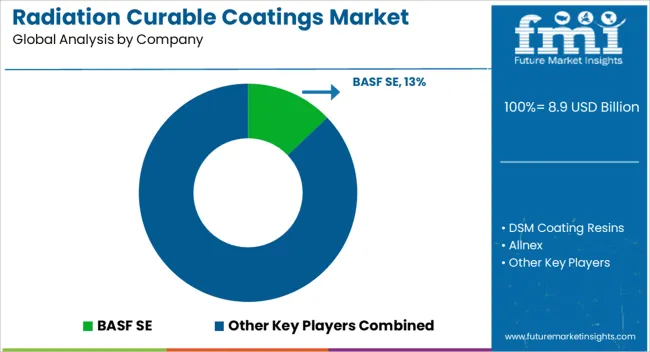

Competitive Landscape of Radiation Curable Coatings Market

Competition in radiation curable coatings is defined by cure performance, formulation flexibility, and supply chain scale. Leadership is held by BASF SE, leveraging wide resin portfolios and global distribution networks. DSM Coating Resins and Allnex follow with deep expertise in oligomers and reactive diluents that suit diverse end uses from packaging to wood finishes. Covestro AG and Bayer MaterialScience AG bring polymer chemistry capabilities that support high-performance coatings for automotive and industrial applications. Royal DSM N.V. and Sartomer, now part of Arkema, are positioned through their specialty monomers and photochemistry know-how.

Regional players such as Eternal Materials Co. Ltd., Bomix Chemie GmbH, Miwon Specialty Chemical Co., Ltd., and BASF-YPC are relied on for local production scale and faster lead times. IGM Resins B.V., Dymax Corporation, Toyo Ink SC Holdings Co., Ltd., and Red Spot Paint & Varnish Co., Inc. are acknowledged for niche offerings including low-odor systems, UV-LED curable formulations, and OEM-approved grades. Strategies across suppliers are concentrated on formulation differentiation, production capacity, and channel partnerships. Focus is placed on photoinitiator systems that enable low-dose curing and on oligomer chemistries that deliver desired hardness, flexibility, and chemical resistance.

Scale advantages are used to offer global logistics and regulatory support for market entry. Co-development programs with OEMs and coaters are being emphasized to shorten qualification cycles and secure long-term contracts. Pricing strategies and contract manufacturing services are offered to capture volume business. Portfolio depth is used as a defensive lever where single-source risk matters to large converters. Product literature is presented with technical clarity. Specifications such as recommended curing dose, Tg, pendulum hardness, adhesion class, gloss units at 60 degrees, and VOC equivalents are highlighted.

Substrate compatibility notes include paper, plastic films, metal, wood, and electronics. UV-LED curing recommendations, pot life metrics, and rheology control measures are detailed for formulators. Packaging formats, batch traceability, and OEM approvals are documented to support procurement decisions. Development kits and application notes are provided to assist integrators and coaters in scale-up and process transfer.

Key Players in the Radiation Curable Coatings Market

BASF SE

DSM Coating Resins

Allnex

Covestro AG

Bayer MaterialScience AG

Royal DSM N.V.

Eternal Materials Co.Ltd.

Sartomer (a subsidiary of Arkema)

Bomix Chemie GmbH

Red Spot Paint & Varnish Co., Inc.

Miwon Specialty Chemical Co., Ltd.

IGM Resins B.V.

Dymax Corporation

Toyo Ink SC Holdings Co., Ltd.

BASF-YPC Co., Ltd.

Scope of the Report

Items

Values

Quantitative Units

USD 8.9 billion

Type

UV Curable Coatings and EB Curable Coatings

Function

Scratch-Resistant, UV Protection, Chemical-Resistant, High-Gloss, and Matte and Satin

Application

Printing Inks, Paper & Film Coatings, Wood, Plastics, Electronic Products, and Others

End-Use

Wood Coatings, Metal Coatings, Plastic Coatings, Printed Materials, Electronic Components, Optical Coatings, Automotive Coatings, Aerospace Coatings, and Other

Regions Covered

North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

Country Covered

United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa

Key Companies Profiled

BASF SE, DSM Coating Resins, Allnex, Covestro AG, Bayer MaterialScience AG, Royal DSM N.V., Eternal Materials Co.Ltd., Sartomer (a subsidiary of Arkema), Bomix Chemie GmbH, Red Spot Paint & Varnish Co., Inc., Miwon Specialty Chemical Co., Ltd., IGM Resins B.V., Dymax Corporation, Toyo Ink SC Holdings Co., Ltd., and BASF-YPC Co., Ltd.

Additional Attributes

Dollar sales by resin type, share by end-use industries, regional demand distribution, pricing benchmarks, competitor strategies, capacity expansions, regulatory impacts, growth drivers, raw material availability, and customer adoption trends.