Track your investments for FREE with Simply Wall St, the portfolio command center trusted by over 7 million individual investors worldwide.

DIC (TSE:4631) has drawn fresh attention after its recent share price move, with the stock showing a 0.5% gain over the past day and relatively steady performance over the past week.

For context, the company reports annual revenue of ¥1,049,335.0 and net income of ¥32,413.0, with annual revenue growth of 1.3% and net income growth of 5.1%. These figures help frame how current pricing lines up against its underlying business.

Over the past month, DIC’s return sits around a 0.5% decline, while the past 3 months show a 2.1% return and the past year an 18.7% total return. Year to date, the stock has returned 4.0%, and the 3 year and 5 year total returns are each very large, close to 8x.

Based on one measure of estimated intrinsic value, the shares currently reflect an intrinsic discount of about 30.8%, suggesting the market price is meaningfully below that reference point. The stock also carries a value score of 5, which some investors might use as an initial flag for further fundamental work.

See our latest analysis for DIC.

With the share price now at ¥3,777.0 and a modest 90 day share price return of 2.1%, the stronger 1 year total shareholder return of 18.7% suggests longer term momentum has been more supportive than the very recent trading action. Some investors might weigh this against the indicated intrinsic discount.

If this kind of steady mover interests you, it could be a good moment to broaden your search and check out fast growing stocks with high insider ownership.

So with DIC trading at ¥3,777 and one intrinsic value estimate pointing to roughly a 31% discount, are you looking at a genuine mispricing here, or is the market already accounting for potential future growth?

On a simple P/E check, DIC’s current share price of ¥3,777 lines up with an earnings multiple of roughly 11x, which screens as cheap versus its peers.

The P/E ratio compares what you are paying for each unit of current earnings, and it is a common yardstick for diversified chemicals companies that already generate profits. For DIC, this sits against a peer average P/E of 19.2x and a Japan chemicals industry average of 13.5x, so the current market tag is lower on both counts.

That gap suggests the market is pricing DIC’s earnings at a discount even though forecasts point to earnings growth of about 5.1% per year and the business has recently moved back into profitability. Against an estimated “fair” P/E of 14.7x, there is also some room for the multiple to shift higher over time if sentiment and earnings quality line up with that benchmark.

Compared with other chemicals names on 13.5x and a peer basket at 19.2x, DIC’s 11x P/E stands out as materially lower, while the fair P/E of 14.7x signals a level the market could move towards if expectations change.

Explore the SWS fair ratio for DIC

Result: Price-to-Earnings of 11x (UNDERVALUED)

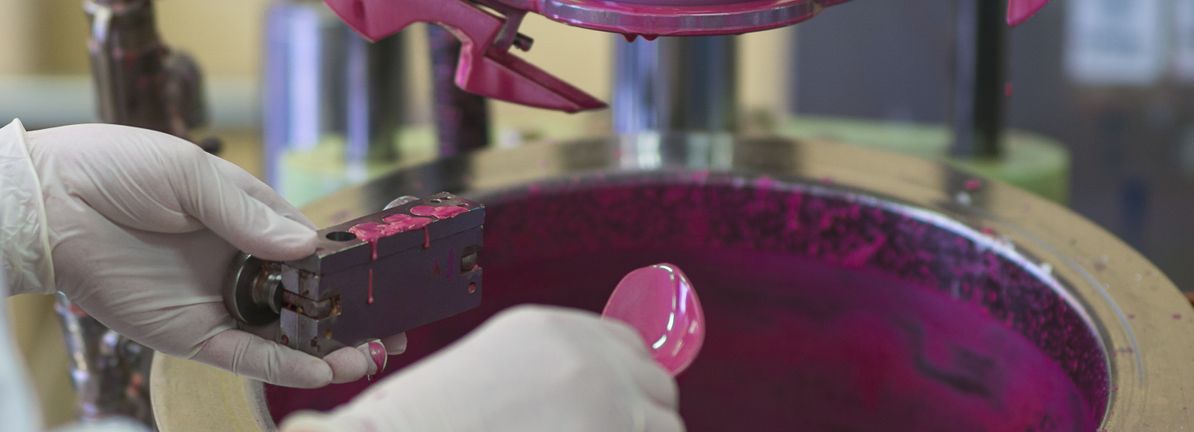

However, there are still risks here, including potential pressure on demand for printing and display materials, as well as any setback in earnings relative to that 11x P/E.

Find out about the key risks to this DIC narrative.

If you put the P/E to one side and look at our DCF model, you get a stronger signal. On that view, DIC at ¥3,777 sits below an estimated future cash flow value of ¥5,455.51, pointing to an undervalued setup that is more aggressive than the 11x P/E suggests.

This gap can look tempting, but it also raises a practical question for you as an investor: which lens do you trust more when earnings quality, one off items and modest growth forecasts all sit in the background?

Look into how the SWS DCF model arrives at its fair value.

4631 Discounted Cash Flow as at Jan 2026

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out DIC for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 864 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match – so you never miss a potential opportunity.

If you read this and think the story looks different, or simply want to test your own assumptions against the data, you can easily build a custom view and Do it your way in just a few minutes.

A great starting point for your DIC research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

If DIC has caught your eye, do not stop here. Widen your watchlist with a few focused stock ideas that match different styles and priorities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include 4631.T.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com