Key insights: Fiserv’s fourth-quarter earnings were in line with expectations. What’s at stake: The bank-technology seller is trying to recover after an earnings shortfall three months ago.Forward look: Fiserv is developing tools to support agentic AI for small to mid-sized businesses.

Like a lot of financial-technology sellers, Fiserv is betting heavily on artificial intelligence to stay relevant with banks and merchants while containing costs.

Processing Content

“We have identified ample room to simplify [our] business,” said Fiserv CEO Mike Lyons during Tuesday’s earnings call, discussing a strategic review that the company launched in October to address an earnings slump.

Fiserv is reviewing how to deploy new forms of AI across the company and at clients, with a particular focus on agentic commerce, a form of AI that is gaining popularity among retailers.

“We can bring agentic capabilities to small to mid-sized organizations,” Lyons said, noting the challenges smaller banks, credit unions and businesses may have in embracing the new technology at scale.

Fiserv’s earnings

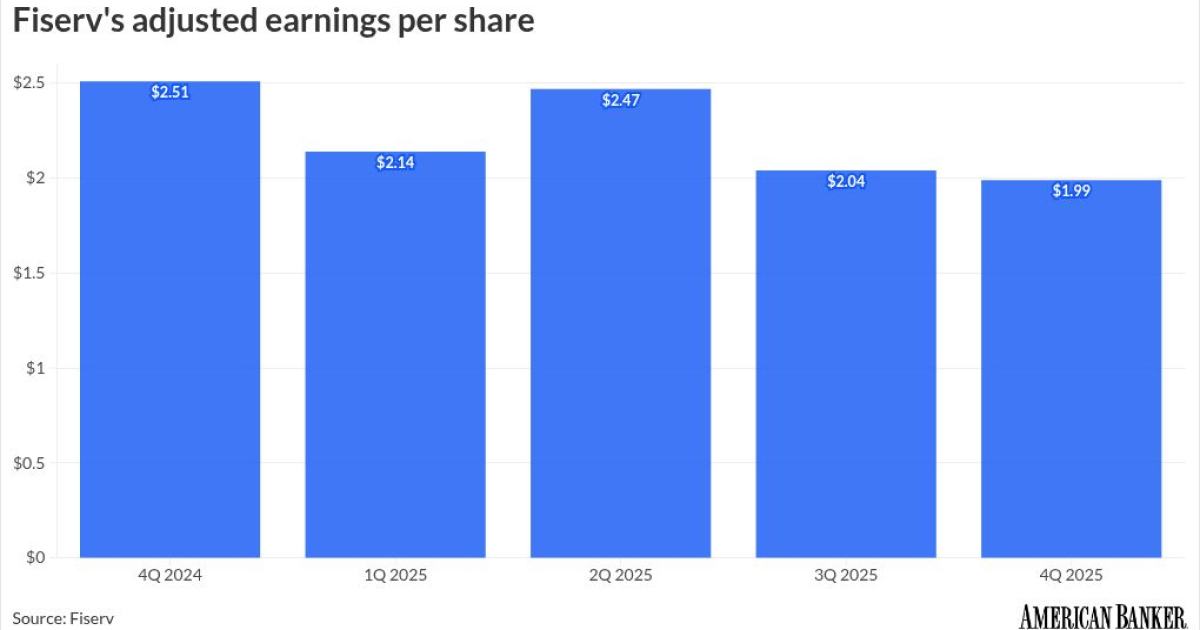

The bank technology company reported earnings that are stabilizing following Fiserv’s third quarter-earnings miss.

For the fourth quarter, Fiserv reported adjusted earnings per share of $1.99, down 21% from 2024’s fourth quarter. EPS for the full year 2025 were $8.64, down 2% from 2024. Fiserv’s adjusted revenue for the fourth quarter was $4.90 billion, flat compared to the prior year; and full year adjusted revenue was $19.80 billion, up 4% from 2024.

For 2026, Fiserv projected organic revenue growth of 1% to 3% and EPS of $8.00 to $8.30.

The earnings were largely in line with analyst expectations. Analysts at Jeffries projected EPS of $1.90 and revenue of $4.87 billion; and noted Wall Street analysts’ average projections were EPS of $1.90 and revenue of $4.9 billion.

Fiserv’s third-quarter earnings widely missed analyst expectations At the time, Lyons said the company would undergo a review and restructuring plan called One Fiserv. As part of the plan, Fiserv in October also named Paul Todd chief financial officer, replacing Bob Hau, who was Fiserv’s CFO since 2016. The company additionally named Chief Operating Officer Takis Georgakopoulos to be co-president with Dhivya Suryadevara, the former CEO of Optum Financial Services and Optum Insight at UnitedHealth Group.

“There were no major surprises relative to the outlook we set in October,” Lyons said.

Fiserv’s performance will be below the company’s expectations for the first half of 2026 before showing improvement later in the year, according to Lyons.

“We’ve also added senior talent, increased client-facing resources and revamped our work with tech consultants,” Lyons said.

Lyons became CEO of Fiserv in February, taking over for Frank Bisignano, the long-time CEO of Fiserv as well as First Data — the payment processor Fiserv acquired in 2020. Bisignano has joined the Trump administration as head of the Social Security Administration and CEO of the Internal Revenue Service.

“With how muted/convoluted expectations were coming in, we don’t view [the fourth quarter earnings] as a narrative changer,” Jeffries analysts said in a note. Jeffries’ third-quarter analyst note said the sudden deceleration was a signal that management had “taken its eye off of the ball.” Fiserv, like other large financial technology companies such as FIS, has also in recent years faced a growing challenge from payment-focused fintechs such as Stripe and Block that sell to small merchants.

New tech

Fiserv’s recent moves to bolster its technology menu include an expanded strategic partnership with enterprise artificial-intelligence firm ServiceNow, a deal that will add to improve Fiserv’s IT departments and the customer service units that support Fiserv’s clients. Fiserv hopes these improvements will improve efficiency when addressing performance anomalies, locating emerging issues earlier and addressing them faster.

“We are working with Google, Mastercard and Visa to bring agentic commerce to the mainstream,” Lyons said. He did not elaborate, but Google, Visa and Mastercard have all made recent moves to expand standards for agentic AI.

“In the bank market, the AI investments are primarily internal, using AI tools to improve their own modernization strategy, and which appears to be paying off,” Aaron Press, research director of worldwide payment strategies for IDC, told American Banker.

It’s too early for the AI moves to bear fruit for Fiserv, according to Aaron McPherson, principal at AFM Consulting. “That said, AI is unquestionably a vital area, and the alliance with ServiceNow should improve performance over time,” McPherson told American Banker. “The focus seems to be on improving performance and efficiency, not product development or something that directly drives revenues.”

In another recent deal, Fiserv enhanced its partnership with buy now/pay later lender Affirm to bring installment loans to payment cards, in addition to Fiserv merchants offering Affirm’s BNPL loans at checkout.

The partnership will allow banks and credit unions to enable pre- and post-purchase BNPL loans on their debit cards, allowing consumers to break up most purchases into fixed payments anywhere debit cards are accepted. For pre-purchase, customers are able to request a payment plan through their financial institution’s app prior to making the purchase.

Outside of the U.S., Fiserv announced a strategic partnership with Sumitomo Mitsui Card Company to sell an integrated payments and business management platform to small businesses in Japan. In late 2026, Fiserv will release a tailored version of Clover in Japan to take advantage of a government-backed initiative to reduce cash payments by 65% over the next four years.

“The Affirm integration makes Fiserv’s debit products more competitive, but I’m not sure it is enough to take share back from competitors,” McPherson said. “I’m more encouraged by the Sumitomo Mitsui Card Company partnership, which opens up new opportunities in Japan. Leveraging its global reach to grow revenues is probably the best way to restore earnings, at least in the short run.”