The U.S. tariffs imposed on Korean goods grew at the sharpest pace among Washington’s trading partners, data showed Sunday, indicating a sharply rising burden on Korean businesses.

According to the data from the Korea Chamber of Commerce and Industry (KCCI), the cost of U.S. tariffs on Korean imports in the second quarter of this year stood at $3.3 billion, the sixth-largest among Washington’s top 10 trading partners in terms of amount. China had the highest with $25.93 billion, followed by Mexico with $5.52 billion, Japan with $4.78 billion, Germany with $3.57 billion and Vietnam with $3.34 billion.

Compared to the amount imposed during the fourth quarter of last year, the tariff on Korean imports grew by $3.23 billion, representing a 47.1-fold growth. This was the sharpest growth factor among other trading partners during the same period, followed by 19.5 for Canada, 17.8 for Mexico and 8.2 for Japan.

In contrast, China saw the largest tariff increase of $14.18 billion during the same period, but showed the slowest growth among the top 10 countries because high duties on items such as electric vehicles, batteries, semiconductors and solar panels had already been in place under the previous Joe Biden administration.

Until the first quarter of this year, Korea was largely exempt from tariffs under the Korea-U.S. Free Trade Agreement. In the second quarter, the Donald Trump administration implemented a baseline tariff of 10 percent, along with separate duties on cars, auto parts, steel and aluminum, leading to a sharp increase in total tariffs.

After Washington imposed an additional 15 percent in “reciprocal” tariffs, bringing the total to 25 percent, Seoul made a broad agreement with the U.S. in late July to lower the total rate to 15 percent, and has been negotiating the details of the agreement since.

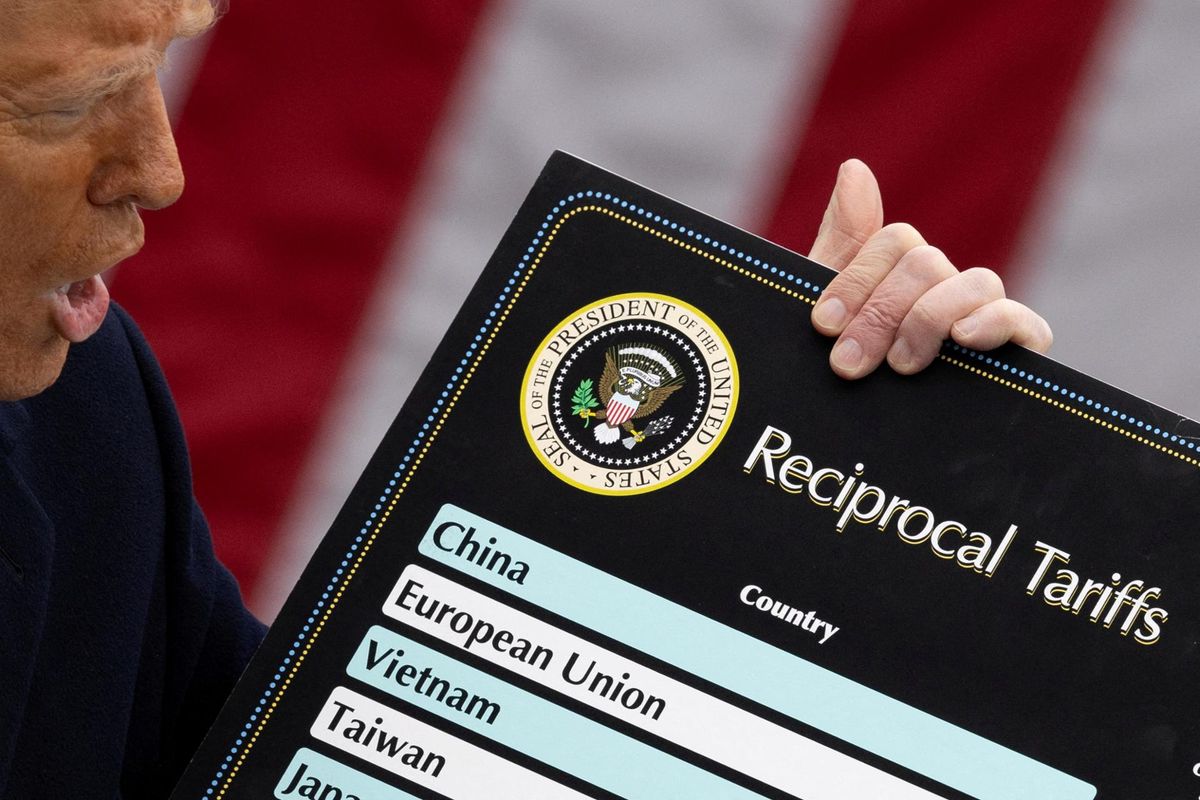

U.S. President Donald Trump delivers remarks on tariffs in the Rose Garden at the White House in Washington, April 2. Reuters-Yonhap

Breaking down Korea’s second-quarter tariff payments, the sectors hit hardest were cars and car parts, accounting for 57.5 percent of the total, as a 25 percent tariff was imposed on completed vehicles in April and on auto parts in May.

In the second quarter, Korea’s exports to the U.S. reached $32.86 billion, with tariff payments totaling $3.3 billion, resulting in an effective tariff rate of 10 percent. This was the third-highest among the top 10 exporters to the U.S., following China with 39.5 percent and Japan with 12.5 percent. Considering that Korea ranked eighth in export volume to the U.S. during the period, the figures highlight the relatively heavy tariff burden compared to its trade size, the KCCI said.

Technically, tariffs are paid by importers, but in practice, both exporters and importers share the burden through negotiations or by offsetting it through consumer prices. This means that Korean exporters do not directly pay tariffs, but they face extra difficulties given the price advantages they had under the previous free trade agreement.

According to a Goldman Sachs report released in August, U.S. importers bore about 64 percent of tariff costs as of June this year, while consumers shouldered 22 percent and exporters 14 percent. In October, however, consumers are expected to shoulder 67 percent, exporters 25 percent and importers only 8 percent, indicating that the tariff burden will increasingly shift to exporters over time.

“If tariffs are set at 15 percent and exporters shoulder one-fourth of that, it would mean that 3.75 percent of Korea’s exports to the U.S. are effectively paid in tariffs,” a KCCI official said. “Given that the operating margin of Korean manufacturers was 5.6 percent last year, it is undeniable that the burden on our companies has risen significantly.”