Energy Gel Product Market Size and Share Forecast Outlook 2025 to 2035

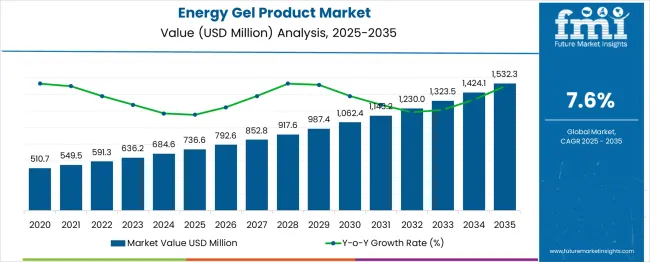

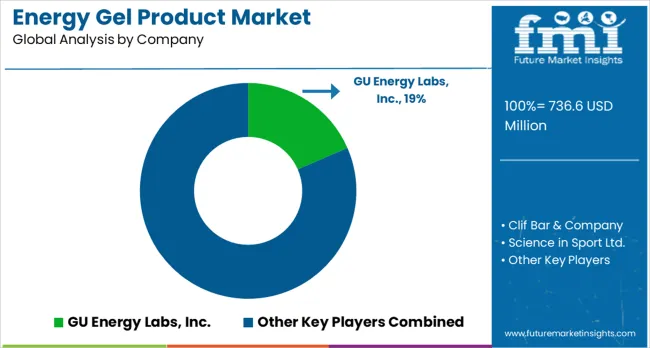

The global energy gel product market is projected to grow from USD 736.6 million in 2025 to approximately USD 1,532.3 million by 2035, recording an absolute increase of USD 783.0 million over the forecast period. This translates into a total growth of 106.3%, with the market forecast to expand at a compound annual growth rate (CAGR) of 7.6% between 2025 and 2035. The overall market size is expected to grow by approximately 2.1X during the same period, supported by the rising adoption of energy supplements among athletes and fitness enthusiasts, increasing participation in endurance sports, and growing awareness of performance nutrition products.

Quick Stats for Energy Gel Product Market

Energy Gel Product Market Value (2025): USD 736.6 million

Energy Gel Product Market Forecast Value (2035): USD 1,532.3 million

Energy Gel Product Market Forecast CAGR: 7.6%

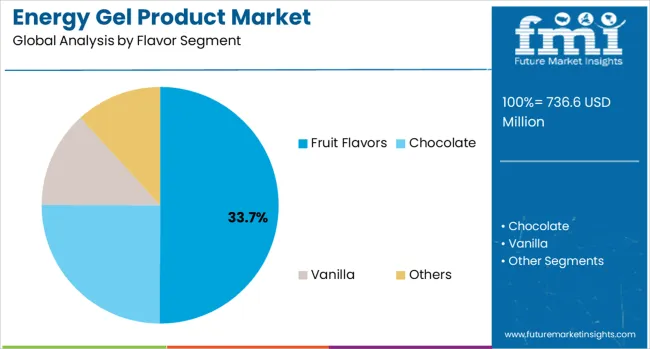

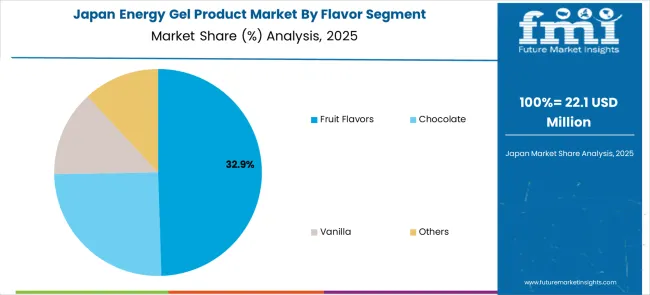

Leading Flavor Segment in Energy Gel Product Market: Fruit Flavors (33.7%)

Key Growth Regions in Energy Gel Product Market: North America, Europe, and Asia Pacific

Key Players in Energy Gel Product Market: GU Energy Labs, Inc. (18.5%), Clif Bar & Company (15.2%), Science in Sport Ltd. (12.8%), PowerBar Inc. (11.3%), and Hammer Nutrition Ltd. (9.7%)

Between 2025 and 2030, the energy gel product market is projected to expand from USD 736.6 million to USD 1,075.4 million, resulting in a value increase of USD 338.8 million, which represents 43.3% of the total forecast growth for the decade. This phase of growth will be shaped by rising participation in endurance sports, increasing awareness of sports nutrition benefits, and growing adoption of energy gels among recreational athletes. Manufacturers are expanding their flavor portfolios and distribution networks to address the growing demand for convenient energy solutions across various athletic activities.

From 2030 to 2035, the market is forecast to grow from USD 1,075.4 million to USD 1,532.3 million, adding another USD 444.2 million, which constitutes 56.7% of the overall ten-year expansion. This period is expected to be characterized by expansion of online retail channels, integration of natural and organic ingredients, and development of specialized formulations for different sporting disciplines. The growing adoption of personalized nutrition approaches will drive demand for customized energy gel products and targeted performance solutions.

Between 2020 and 2025, the energy gel product market experienced steady expansion, driven by increasing marathon and triathlon participation rates and growing consumer awareness of endurance nutrition requirements. The market developed as sports nutrition companies recognized the need for portable, easily digestible energy sources during prolonged physical activities. Fitness enthusiasts and professional athletes began emphasizing proper fueling strategies to optimize performance and recovery outcomes.

Energy Gel Product Market Key Takeaways

Metric

Value

Energy Gel Product Market Value (2025)

USD 736.6 million

Energy Gel Product Market Forecast Value (2035)

USD 1,532.3 million

Energy Gel Product Market Forecast CAGR

7.6%

Why the Energy Gel Product Market is Growing?

Market expansion is being supported by the rapid increase in endurance sports participation worldwide and the corresponding need for convenient, quick-absorbing energy sources during prolonged physical activities. Modern athletic training regimens emphasize proper nutrition timing and energy replenishment strategies, creating demand for specialized products that can deliver rapid carbohydrate absorption without gastrointestinal distress. The growing popularity of marathons, cycling events, and triathlon competitions is driving consistent demand for energy gel products across diverse athletic populations.

The growing complexity of sports nutrition science and increasing performance optimization requirements are driving demand for high-quality energy gel products from established manufacturers with proven formulation expertise. Athletic organizations and coaching professionals are increasingly recommending specific energy gel protocols for endurance events to prevent bonking and maintain optimal performance levels. Scientific research and sports medicine recommendations are establishing standardized energy gel consumption patterns that require specialized formulations and reliable product availability.

Segmental Analysis

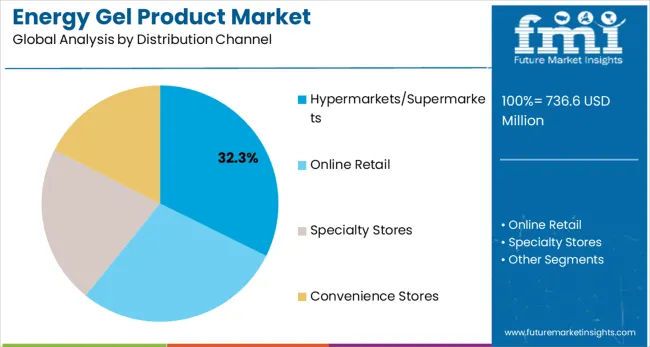

The market is segmented by flavour type, distribution channel, and region. By flavour type, the market is segmented into fruit (orange, strawberry, raspberry, lemon), vanilla, chocolate, and others (mint, coffee, caramel, and mixed flavors). By distribution channel, the market is categorized into supermarket/hypermarket, specialty store, online store, and others (convenience stores, vending machines, and direct sales). Regionally, the market is divided into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

By Flavor Type, Fruit Flavors Segment Accounts for 33.7% Market Share

Fruit flavors are projected to account for 33.7% of the energy gel product market in 2025. This leading share is supported by the widespread consumer preference for natural-tasting, refreshing flavors during intense physical activities. Fruit-based formulations provide familiar taste profiles that are well-tolerated during exercise while offering variety through different fruit combinations. The segment benefits from established flavor technology and broad appeal across diverse consumer demographics and sporting disciplines.

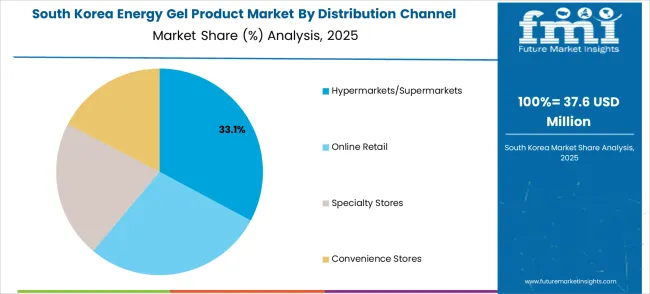

By Distribution Channel, Hypermarkets/Supermarkets Segment Accounts for 32.3% Market Share

Hypermarkets and supermarkets are expected to represent 32.3% of energy gel product distribution in 2025. This dominant share reflects the accessibility and convenience of retail locations for regular consumers purchasing energy gels for training and recreational activities. Large retail chains provide extensive product selection and competitive pricing while offering visibility to casual fitness enthusiasts. The segment benefits from growing mainstream acceptance of sports nutrition products and increasing retail space allocation for performance nutrition categories.

What are the Drivers, Restraints, and Key Trends of the Energy Gel Product Market?

The energy gel product market is advancing steadily due to increasing endurance sports participation and growing recognition of proper fueling strategies for athletic performance. However, the market faces challenges including taste palatability concerns during exercise, need for education on proper consumption timing, and varying individual tolerance to gel formulations. Innovation efforts and flavor development programs continue to influence product acceptance and market expansion patterns.

Expansion of Natural and Organic Formulations

The growing deployment of natural and organic ingredients in energy gel formulations is enabling products that appeal to health-conscious consumers while maintaining performance effectiveness. Advanced formulations using real fruit extracts and natural sweeteners provide clean-label alternatives without compromising rapid energy delivery. These developments are particularly valuable for consumers seeking performance products aligned with their overall dietary preferences and lifestyle choices.

Integration of Specialized Athletic Applications

Modern energy gel manufacturers are incorporating sport-specific formulations and targeted nutrient profiles that address unique requirements of different endurance disciplines. Integration of electrolytes, caffeine, and amino acids creates comprehensive fueling solutions for specific athletic demands. Advanced product development supports specialized applications including ultra-endurance events, high-altitude activities, and extreme weather conditions requiring modified energy delivery systems.

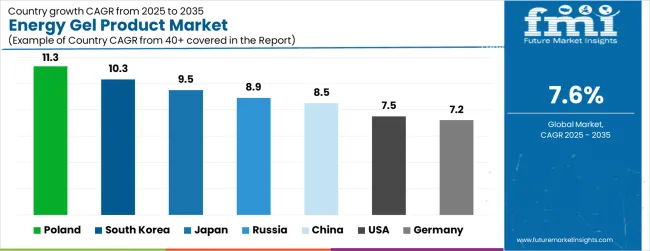

Analysis of Energy Gel Product Market by Key Country

Country

CAGR (2025 to 2035)

Poland

11.3%

South Korea

10.3%

Japan

9.5%

Russia

8.9%

China

8.5%

USA

7.5%

Germany

7.2%

The energy gel product market demonstrates varied growth patterns across key countries, with Poland leading at 11.3% market share, followed by South Korea at 10.3%, Japan at 9.5%, Russia at 8.9%, China at 8.5%, USA at 7.5%, and Germany at 7.2%. These markets reflect different stages of sports nutrition awareness, athletic participation rates, and retail infrastructure development that influence energy gel product demand and consumption patterns.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Poland Leads Market Share with Growing Athletic Participation

Revenue from energy gel product in Poland commands the largest 11.3% CAGR driven by increasing participation in endurance sports and growing awareness of sports nutrition benefits across diverse athletic populations. The country’s expanding fitness culture and successful international athletic performances are creating significant demand for performance nutrition products. Major sports retailers and specialty stores are establishing comprehensive distribution networks to serve both competitive athletes and recreational fitness enthusiasts requiring energy supplementation during training and events.

Government sports development programs are supporting increased participation in running events and cycling competitions, driving demand for energy gel products across major metropolitan areas.

Athletic training initiatives focus on proper nutrition education, supporting adoption of specialized energy gel consumption strategies among developing athletes nationwide.

South Korea Demonstrates Strong Fitness Culture Development

Revenue from energy gel product in South Korea holds 10.3% CAGR of the global energy gel product market, supported by robust fitness industry growth and increasing consumer awareness of performance nutrition products. The country’s expanding health and wellness sector and growing participation in international sporting events are driving consumption of energy gel products across athletic and recreational segments. Korean consumers are investing in premium nutrition solutions to optimize training outcomes and athletic performance.

Fitness industry modernization programs are facilitating adoption of advanced sports nutrition products across major training facilities and athletic centers.

Professional development initiatives enhance consumer education about proper energy gel usage, enabling effective product adoption that meets evolving fitness and performance requirements.

Japan Maintains Advanced Sports Nutrition Market

Demand for energy gel product in Japan accounts for 9.5% CAGR, driven by advanced sports science research and high consumer awareness of performance optimization strategies. The country’s emphasis on precision training methods and detailed nutrition planning creates consistent demand for specialized energy gel formulations across endurance sports applications. Japanese manufacturers and retailers focus on developing innovative products and educational resources for proper energy gel utilization.

Sports nutrition industry investments prioritize advanced research and development programs that support superior product efficacy and consumer satisfaction.

Professional certification programs ensure comprehensive knowledge among fitness professionals, enabling specialized energy gel recommendations that meet evolving athletic performance requirements.

Russia Shows Growing Endurance Sports Interest

Demand for energy gel product in Russia represents 8.9% CAGR, characterized by increasing participation in endurance events and growing awareness of sports nutrition benefits. The country’s expanding athletic programs and international competition participation are driving demand for performance nutrition products across diverse sporting disciplines. Russian athletes and fitness enthusiasts are adopting energy gel consumption strategies to improve training outcomes and competitive performance.

Athletic development programs support increased endurance sports participation, creating demand for specialized nutrition products across major sporting regions.

Educational initiatives focus on proper sports nutrition practices, supporting adoption of effective energy gel protocols among competitive and recreational athletes.

China Demonstrates Expanding Fitness Market Potential

Demand for energy gel product in China holds 8.5% CAGR, supported by rapid fitness industry growth and increasing consumer interest in performance nutrition products. The country’s expanding middle-class population and growing participation in recreational sports are creating significant opportunities for energy gel product adoption. Chinese consumers are increasingly investing in fitness-related products and seeking performance enhancement solutions for training activities.

Fitness industry expansion programs are facilitating broader access to sports nutrition products across major urban centers and emerging markets.

Consumer education initiatives enhance understanding of energy gel benefits, enabling effective product adoption that supports diverse fitness and athletic goals.

USA Maintains Established Sports Nutrition Market

Demand for energy gel product in the United States accounts for 7.5% CAGR, driven by established endurance sports culture and mature sports nutrition industry infrastructure. The country’s extensive marathon, triathlon, and cycling event calendar creates consistent demand for energy gel products across diverse athletic populations. American manufacturers and retailers provide comprehensive product selection and educational resources for optimal energy gel utilization strategies.

Sports nutrition market maturity enables sophisticated product development and targeted marketing approaches that serve specific athletic segments and performance requirements.

Professional sports medicine integration supports evidence-based energy gel recommendations that enhance athletic performance and training outcomes.

Germany Focuses on Performance Optimization and Quality

Demand for energy gel product in Germany represents 7.2% CAGR, characterized by emphasis on product quality, scientific validation, and precision nutrition approaches. The country’s strong sporting culture and focus on athletic excellence create demand for premium energy gel products that meet stringent performance requirements. German consumers prioritize scientifically-backed formulations and reliable product consistency for training and competition applications.

Athletic performance programs emphasize systematic nutrition planning and evidence-based supplementation strategies that incorporate energy gel usage.

Professional sports science integration ensures comprehensive energy gel recommendations that support optimal performance outcomes across diverse endurance sporting disciplines.

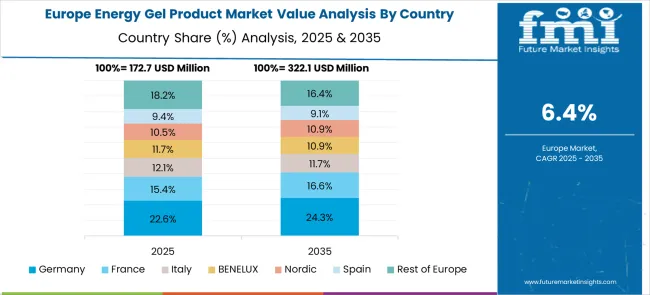

Europe Split by Country

The global energy gel product market is projected to grow from USD 736.6 million in 2025 to USD 1,532.3 million by 2035, registering a CAGR of 7.6% over the forecast period. Germany is expected to maintain its leadership position, slightly increasing its share from 22.4% in 2025 to 23.1% by 2035 within Europe, driven by its robust sports nutrition retail network and growing endurance sports participation rates.

The UK is projected to see moderate growth, maintaining its share at approximately 18.7% throughout the forecast period, supported by established running communities and premium sports nutrition demand. France is anticipated to experience marginal gains, expanding its market share from 16.2% to 16.8%, attributed to increased cycling culture and triathlon participation. Italy shows steady performance with share growing from 14.1% to 14.6%, benefiting from expanding marathon events and sports nutrition awareness.

The rest of Europe region is expected to demonstrate the strongest growth trajectory, increasing its collective share from 13.8% to 15.2%, driven by rising athletic participation in Eastern European countries and expanding retail distribution of sports nutrition products. BENELUX and Spain maintain relatively stable positions at 8.4% and 6.4% respectively, with minor fluctuations reflecting mature market conditions and established consumer preferences for traditional sports nutrition formats.

Competitive Landscape of Energy Gel Product Market

The energy gel product market is defined by competition among specialized sports nutrition companies, established food manufacturers, and performance nutrition brands. Companies are investing in advanced formulation technologies, flavor innovation systems, natural ingredient sourcing, and athlete endorsement programs to deliver effective, palatable, and scientifically-backed energy gel products. Strategic partnerships, product innovation, and market education are central to strengthening brand recognition and consumer loyalty.

GU Energy Labs, Inc. leads the market with 19% share, offering comprehensive energy gel solutions with focus on rapid absorption, flavor variety, and athletic performance optimization. Clif Bar & Company holds 15.2% market share, providing natural ingredient formulations and sustainable packaging solutions for environmentally-conscious consumers. Science in Sport Ltd. maintains 12.8% share through scientific research-based products and professional athlete partnerships.

PowerBar Inc. commands 11.3% of the market, emphasizing proven formulations and extensive distribution networks for mainstream consumer accessibility. Hammer Nutrition Ltd. holds 9.7% share, focusing on specialized endurance formulations and education-based marketing approaches for serious athletes. These companies collectively represent the leading manufacturers in the global energy gel product market, each contributing unique formulation expertise and market positioning strategies.

Key Players in the Energy Gel Product Market

GU Energy Labs, Inc.

Clif Bar & Company

Science in Sport Ltd.

PowerBar Inc.

Hammer Nutrition Ltd.

Advanced Food Concepts, Inc.

Nutrition Works Ltd

Boom Nutrition Inc.

EN-R-G Foods, LLC

Gatorade Company, Inc.

Zipvit Ltd.

Scope of the Report

Item

Value

Quantitative Units (2025)

USD 736.6 million

Flavor Segment

Fruit Flavors, Chocolate, Vanilla, anOthers

Distribution Channel

Hypermarkets/Supermarkets, Online Retail, Specialty Stores, Convenience Stores

Regions Covered

North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Countries Covered

United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries

Key Companies Profiled

Advanced Food Concepts, Inc., Nutrition Works Ltd, Boom Nutrition Inc., Clif Bar & Company, EN-R-G Foods, LLC, Gatorade Company, Inc., Hammer Nutrition Ltd., Powerbar Inc., Zipvit Ltd., Scientific Sports Nutrition (Pty) Ltd.

Additional Attributes

Market analysis by flavor preferences and distribution channels, regional demand patterns across major endurance sports markets, competitive landscape with established sports nutrition brands, consumer preferences for natural versus synthetic ingredients, formulation innovations for improved palatability and absorption, packaging developments for convenience and portability, and athletic performance applications across various endurance sporting disciplines