Report Overview

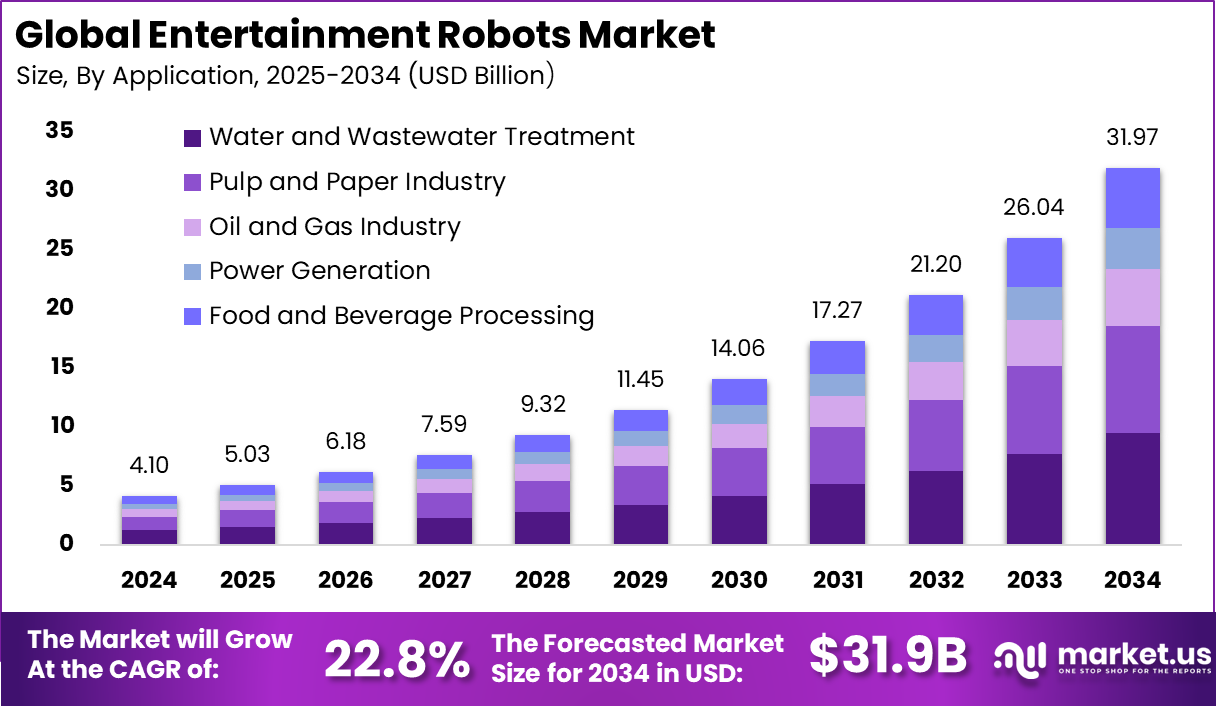

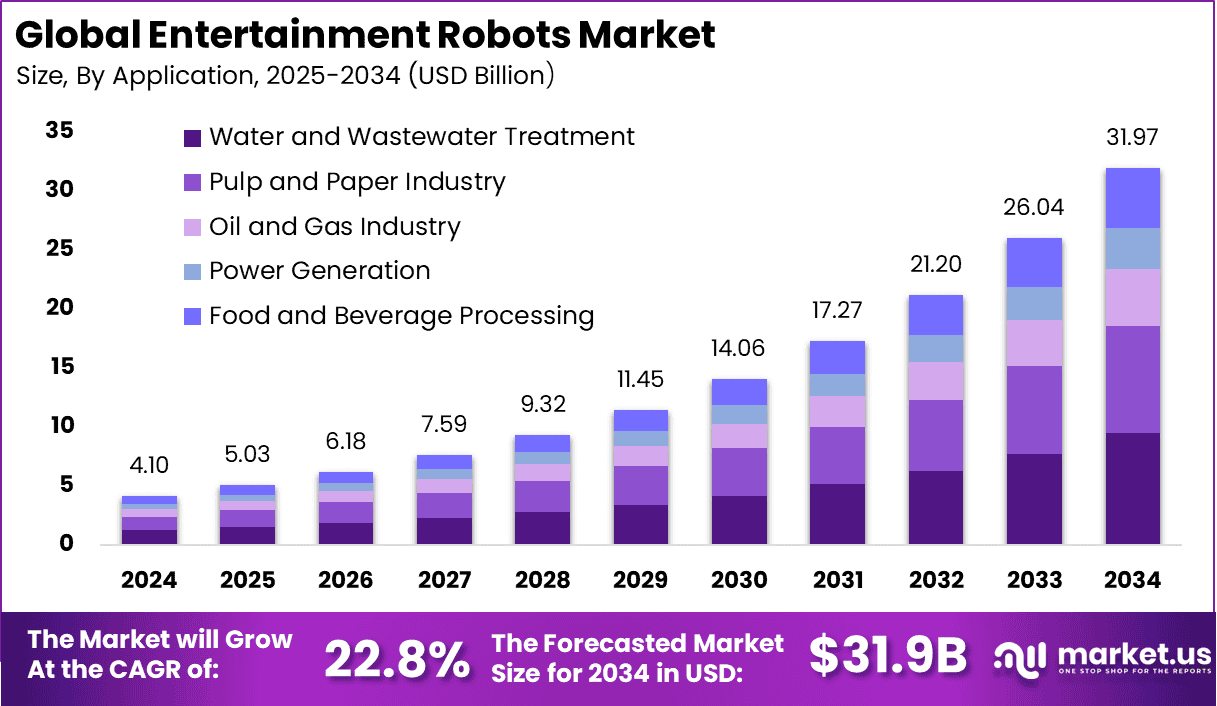

The Global Entertainment Robots Market size is expected to be worth around USD 31.97 Billion By 2034, from USD 4.10 billion in 2024, growing at a CAGR of 22.8% during the forecast period from 2025 to 2034. In 2024, North America held a dominan market position, capturing more than a 35.10% share, holding USD 1.4 Billion revenue.

The Entertainment Robots Market refers to the industry focused on the design, development, and deployment of robots used primarily for leisure, companionship, education, and interactive entertainment. These robots include robotic pets, humanoid companions, educational robots, and performance-based robots used in theme parks, exhibitions, and events.

The market is driven by rising consumer interest in interactive and intelligent entertainment solutions. The increasing adoption of smart technologies in households, coupled with the popularity of robotic toys and learning tools, fuels growth. Advancements in AI, natural language processing, and robotics are enabling more realistic and engaging experiences.

Demand is strongest in the consumer segment, where families adopt robotic toys, pets, and humanoids for entertainment and companionship. Educational institutions are using robots as interactive teaching aids to promote coding, robotics, and problem-solving skills. Theme parks, museums, and event organizers deploy entertainment robots to attract visitors and enhance customer experiences.

Key Insight Summary

By product, Robot Toys dominated with a 43.1% share, showcasing their popularity among children and households.

By application, the Entertainment segment led with 29.7% share, driven by interactive gaming and media experiences.

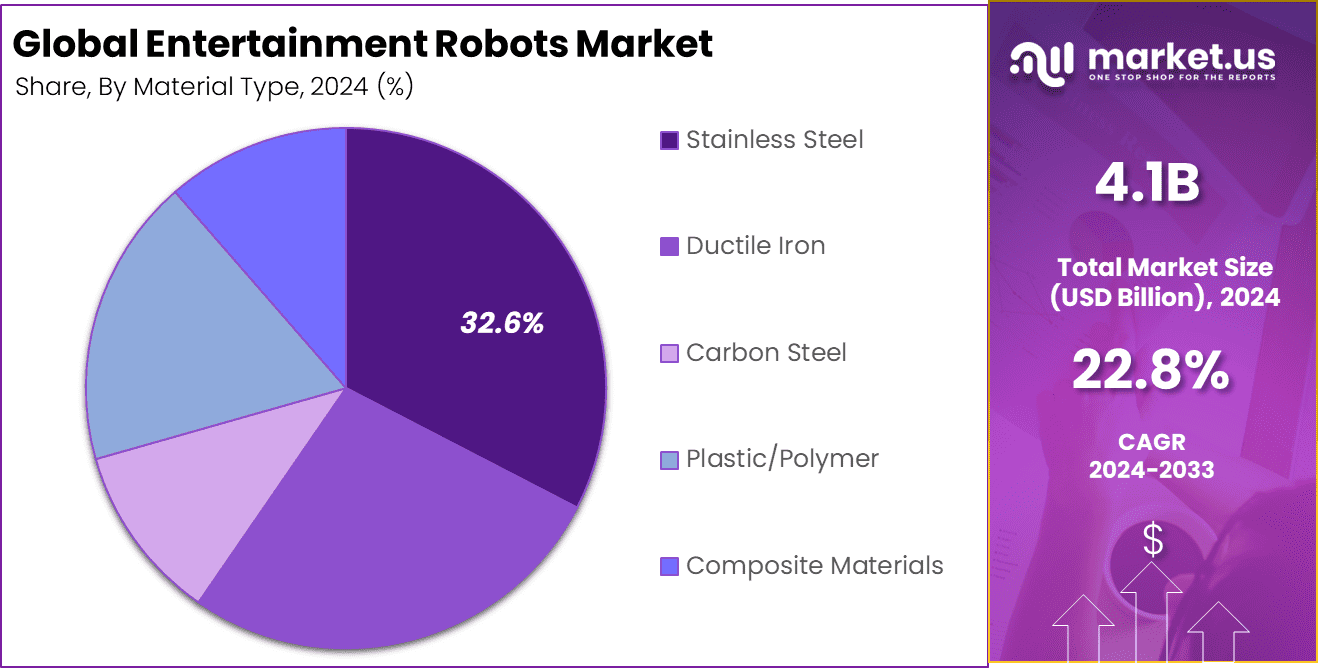

By material type, Stainless Steel accounted for 32.6% share, reflecting its durability and widespread use in robot manufacturing.

By end-user, the Education sector held a 39.2% share, highlighting the growing role of robots in learning and skill development.

Regionally, North America captured 35.1% share, supported by high adoption of robotics in education and entertainment.

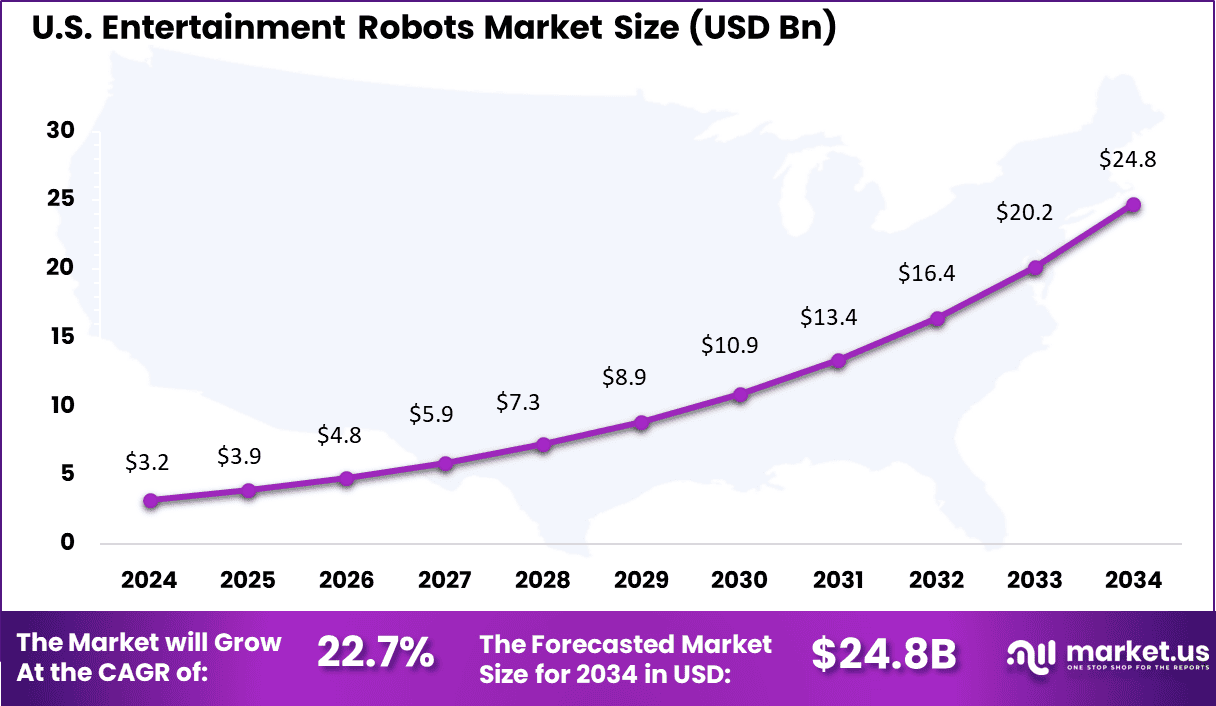

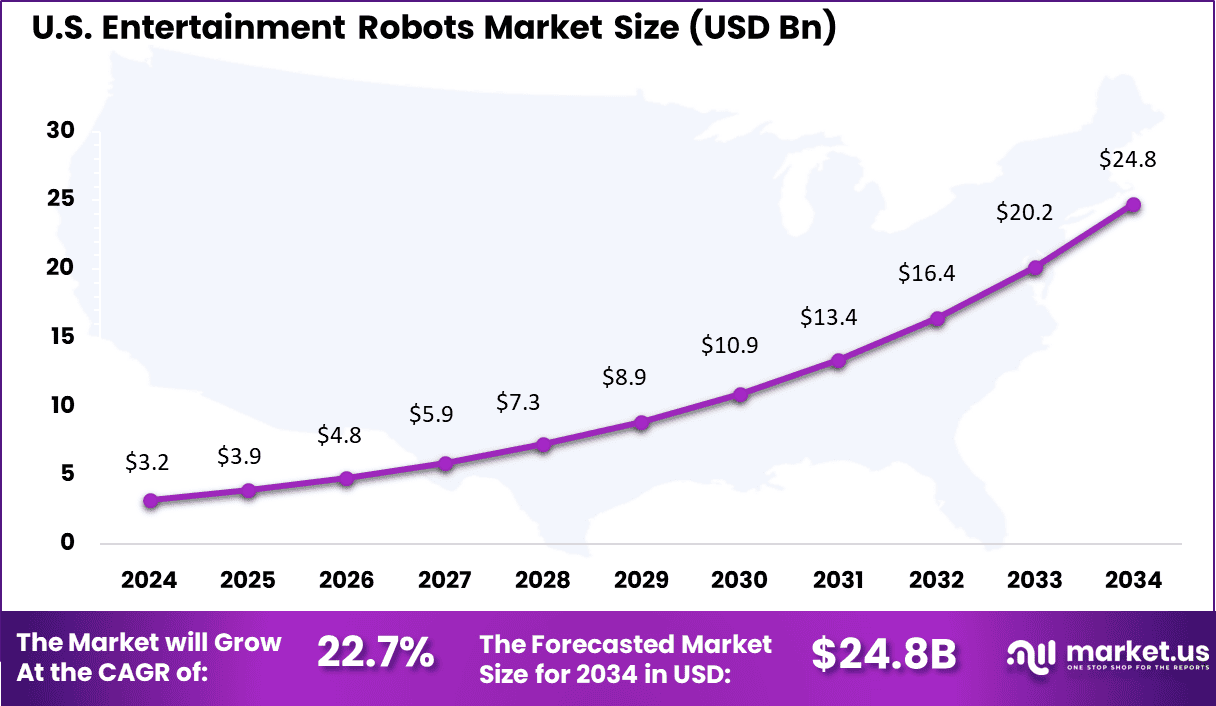

The U.S. market was valued at USD 3.20 Billion in 2024, expanding at a strong CAGR of 22.73%, underscoring its leadership in advanced robotics adoption.

Role of Generative AI

Generative AI plays a crucial role in entertainment robots by enabling them to offer richer, more interactive experiences. These robots can generate human-like responses, recognize and interpret facial expressions, voice commands, and gestures, and adapt their behavior intelligently during interactions.

This not only makes interactions feel natural but also allows robots to participate creatively in performances by understanding musical and situational cues. The emergence of multimodal generative AI models now allows these robots to create synchronized visuals, audio, and movements based on simple input prompts, supporting immersive storytelling and personalized entertainment experiences.

US Market Size

The U.S. Entertainment Robots Market was valued at USD 3.2 Billion in 2024 and is anticipated to reach approximately USD 24.8 Billion by 2034, expanding at a compound annual growth rate (CAGR) of 22.7% during the forecast period from 2025 to 2034.

North America holds a strong 35.1% market share within the global entertainment robots landscape. The region benefits from a mature technology market and high consumer spending on robotics for educational and entertainment purposes.

This growth is fueled by investments in research and development, demand for advanced interactive toys, and adoption in sectors such as education and theme parks. The broad acceptance of innovative entertainment solutions and technological readiness of consumers in North America continue to drive market expansion.

By Product Analysis

In 2024, Robot toys dominate the entertainment robots market, holding a significant 43.1% share. These toys blend fun and education, appealing to children and adults alike by offering interactive features such as dancing, singing, and responsive play. Their ability to engage users with lifelike movements and responses makes them a preferred choice for family entertainment.

The appeal of robot toys also lies in their role in early learning and development. Many are designed to promote cognitive skills and creativity through play, making them a popular pick among parents and educators. Their versatility extends across home use and specialty toy markets, helping them maintain a strong presence in the product segment.

By Application Analysis

In 2024, Water and Wastewater Treatment is the largest application of entertainment robots, with a market share of 29.7%. Robots in this category perform for audiences at theme parks, live shows, exhibitions, and private events, captivating viewers with their ability to dance, sing, and interact. These robots enhance the experience with precision and reliability that traditional human performances sometimes lack.

The integration of AI and sensors allows entertainment robots to adapt their performances in real-time, creating immersive and personalized shows. As this technology evolves, their use in entertainment is likely to become more sophisticated, appealing to wider audiences seeking novel experiences.

By Material Type Analysis

In 2024, Stainless steel accounts for 32.6% of the market by material type. It is favored for its durability, corrosion resistance, and aesthetic appeal, especially in larger entertainment robots used in public venues like theme parks and exhibitions. This material ensures the robots withstand frequent use and varying environmental conditions.

The robustness of stainless steel also supports complex mechanical movements and structural stability. Its ability to maintain a polished look over time adds to the premium perception of entertainment robots, aligning well with their role as attention-grabbing devices in competitive entertainment markets.

By End-User Analysis

In 2024, the education sector leads the end-user category with a 39.2% share. Entertainment robots are increasingly seen as educational tools that combine learning with engagement. They assist in teaching STEM concepts by making abstract ideas tangible through interactive play and demonstrations.

Schools and educational institutions are adopting these robots to encourage problem-solving, coding skills, and creativity among students at various levels. The combination of fun and functionality makes them a valuable resource for enhancing the classroom experience, promoting active learning beyond traditional methods.

Emerging Trends

The entertainment robots sector is witnessing several key trends including deep integration of AI, robotics, augmented and virtual reality technologies, and 5G connectivity. Robots are evolving beyond static performances to interactive, real-time companions in theme parks, classrooms, events, and media productions.

Social and humanoid robots that mimic human emotions and expressions are gaining traction, creating lifelike experiences that engage audiences across ages. There is also a rising focus on educational and therapeutic uses of entertainment robots, particularly for children and senior citizens. Collaborative efforts between entertainment companies and technology firms are advancing these capabilities, while robotics-as-a-service models are making solutions more accessible.

Growth Factors

The growth of entertainment robots is driven by increasing consumer interest in interactive experiences, technological advances in AI and robotics, and the expanding applications across entertainment, education, and therapy. Rising disposable incomes and demand for unique leisure activities encourage adoption, while advancements in human-robot interaction improve usability and appeal.

The market is also fueled by the adoption of entertainment robots for educational purposes, helping children learn through playful assistance and seniors maintain their activity levels. Government support in research and investment, alongside private sector innovation, underpins sustained market expansion.

Key Market Segments

By Product

Robot Toys

Educational Robots

Robotic Companion Pets

By Application

Water and Wastewater Treatment

Pulp and Paper Industry

Oil and Gas Industry

Power Generation

Food and Beverage Processing

By Material Type

Stainless Steel

Ductile Iron

Carbon Steel

Plastic/Polymer

Composite Materials

By End-User

Media

Education

Retail

Others

Regional Market Trends

Regional Insights – Asia Pacific

The Asia Pacific region is experiencing rapid growth in the entertainment robots market, largely driven by high consumer interest coupled with expanding educational investments. Countries like Japan, China, and South Korea are early adopters of these technologies, integrating robotics in both entertainment venues and learning environments.

APAC’s rising middle class and government support for technology innovation contribute to fostering demand. The market trends include the rise of interactive robots designed for cultural events and educational programs, supporting both learning and leisure activities across the region.

Regional Insights – Europe

Europe’s entertainment robots market is growing steadily, supported by strong government initiatives for digital transformation and robotics adoption in public places like museums and malls. The region places emphasis on integrating AI and machine learning for smarter, more interactive robots tailored to diverse cultures and languages.

Popular applications include educational robotics for STEM learning and therapeutic robots in healthcare, highlighting the multifunctional use of entertainment robots. Europe’s focus on safety regulations and ethical AI use supports trust and wider adoption in both commercial and educational sectors.

Regional Insights – Latin America

Latin America’s entertainment robots market is beginning to gain traction as consumer awareness and access to robotic technologies improve. Growing investments in the technology sector and rising demand for immersive entertainment experiences are significant contributors to market growth.

The region’s increasing internet penetration and smartphone usage also facilitate the adoption of connected robotics devices. Initiatives aimed at incorporating educational robotics into schools and interactive public entertainment venues are expected to further accelerate market development in Latin America.

Regional Analysis and Coverage

North America

Europe

Germany

France

The UK

Spain

Italy

Russia

Netherlands

Rest of Europe

Asia Pacific

China

Japan

South Korea

India

Australia

Singapore

Thailand

Vietnam

Rest of Latin America

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

South Africa

Saudi Arabia

UAE

Rest of MEA

Driver

Rising Demand for Interactive and Personalized Experiences

The entertainment robots market is driven by rising consumer interest in interactive and personalized entertainment solutions. People across age groups are attracted to robots that can sing, dance, play games, and respond to voice and gestures, creating engaging and immersive experiences.

As technology advances, these robots offer more natural and adaptive interactions, which increases their appeal in homes, theme parks, and educational settings. For instance, theme parks are increasingly using entertainment robots to enhance visitor experiences by providing lively performances and interactive greeters, which boosts overall engagement.

This growing fascination with robots that can entertain and interact meaningfully is further propelled by innovations in artificial intelligence and machine learning. These technologies allow entertainment robots to recognize facial expressions and adapt their performances dynamically, creating unique moments for users.

Restraint

High Cost and Technical Complexity

One main restraint to the entertainment robot market is the high cost of development, purchase, and maintenance. Many advanced entertainment robots involve sophisticated AI, sensors, and custom engineering, which makes them expensive for smaller venues or individual consumers to adopt.

This cost barrier can slow down widespread deployment, especially in markets with budget constraints or where buyers are hesitant to invest heavily upfront. Alongside cost, technical complexity creates challenges in integrating entertainment robots smoothly into existing environments.

There can be issues with limited functionality or occasional failures that do not meet consumer expectations for flawless and captivating performances. For example, theme parks and entertainment venues sometimes face difficulties ensuring robotic systems function reliably in busy, unpredictable settings, which may hinder more rapid acceptance of these technologies.

Opportunity

Expansion in Education and Edutainment

A promising opportunity for entertainment robots lies in their increasing use in education and edutainment. Robots designed for classrooms and learning environments can make subjects like coding, math, and science more fun and interactive. Many schools and parents are adopting programmable entertainment robots as teaching aids that engage students actively, going beyond traditional methods.

This opportunity grows as educational institutions seek new tools to support STEM learning and foster cognitive skills. Entertainment robots that double as educational companions appeal across various age groups and learning stages. As the market for edutainment expands, companies can innovate with robots tailored to different curricula, benefiting from both the entertainment and educational value these robots bring.

Challenge

Balancing Innovation with User Friendliness

The entertainment robots market faces the challenge of balancing rapid technological innovation with ease of use. As robots become more sophisticated with advanced AI and multi-functional capabilities, they risk becoming complicated for operators and consumers to handle effectively. This complexity can discourage adoption if users find these robots difficult to control or maintain.

Moreover, keeping entertainment robots engaging over time is difficult because consumers may lose interest if the robots do not offer fresh or personalized experiences regularly. For example, a robot that repeats the same actions could quickly become boring.

Businesses in this market must continuously innovate to keep the novelty alive and ensure that the user experience remains both exciting and user-friendly while also navigating emerging safety and regulatory standards.

Competitive Analysis

In the entertainment robots market, Sony Corporation, Hasbro, Honda Motor, and SoftBank Robotics are among the leading players. Their strong global presence and investment in consumer robotics have positioned them as pioneers in robotic toys and companion robots.

Other contributors such as Ubtech Robotics, WOWWEE Group, Lego Group, Sphero, and Blue Frog Robotics are recognized for innovative robotic toys and educational robots. Their offerings promote creativity, STEM learning, and interactive play, targeting both children and educational institutions.

Emerging and specialized players including Anki, Robotis, Furhat Robotics, Miko (Emotix), Reach Robotics, Modular Robotics, Digital Dream Labs, ROOBO, Pal Robotics, AIBrain, and Hanson Robotics add diversity to the market. Their focus ranges from AI-driven social robots to programmable kits and advanced humanoid companions.

Top Key Players in the Market

Sony Corporation

Hasbro Inc.

Ubtech Robotics Corp.

SoftBank Robotics

Honda Motor Co. Ltd.

WOWWEE Group Limited

Lego Group

Sphero Inc.

Blue Frog Robotics

Anki

Robotis Co. Ltd.

Furhat Robotics

Miko (Emotix)

Reach Robotics

Modular Robotics

Digital Dream Labs

ROOBO

Pal Robotics

AIBrain Inc. and HANSON Robotics

Others

Recent Developments

April 2025: Hasbro launched an advanced robotic pet line featuring AI-driven behavioral learning and personalized interaction, enhancing user engagement in the entertainment robot category.

February 2025: UBTECH unveiled its latest humanoid robots at LEAP 2025, including Walker S series and Panda Robot Youyou, focusing on industrial, commercial service, and household companionship scenarios. The company reported over 500 intent orders from electric vehicle manufacturers for humanoid robots deployed in production lines.

August 2025: UBTECH showcased five humanoid robots at the World Robot Conference, highlighting innovations such as autonomous battery swapping in Walker S2 and humanoid robot swarm intelligence technology for multi-task industrial use.

Report Scope