According to Bangladesh Bank data, in the first seven months of this year the private sector borrowed $12.21 billion in short-term foreign loans, while repayments of principal and interest amounted to $12.82 billion. That means repayments exceeded fresh borrowings by more than $600 million

22 September, 2025, 11:30 am

Last modified: 22 September, 2025, 02:18 pm

Illustration: TBS

“>

Illustration: TBS

Highlights:

Private sector repaid more foreign loans than borrowed

Political uncertainty deters new investment until elections

Adequate bank dollar reserves reduce borrowing pressure

Imports of capital machinery dropped 25%, curbing loan demand

Outstanding short-term foreign loans declined sharply since 2022

Exchange rate volatility drives businesses to prioritize repayments

Due to political uncertainty and sluggish new investment under the interim government coupled with adequate dollar reserves in the banks, businesses in the private sector have repaid more short-term foreign loans than they have borrowed.

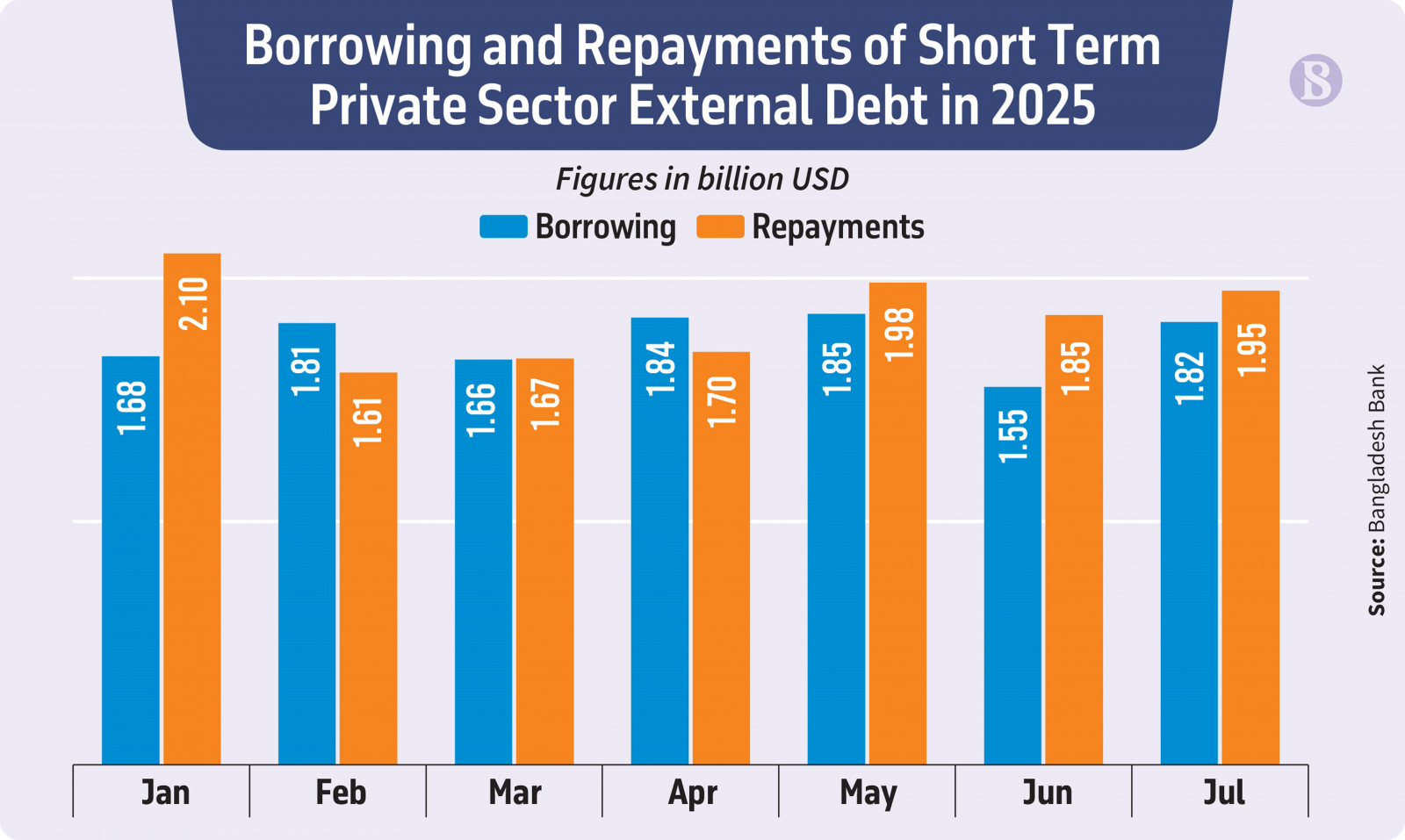

According to Bangladesh Bank data, in the first seven months of this year the private sector borrowed $12.21 billion in short-term foreign loans, while repayments of principal and interest amounted to $12.82 billion. That means repayments exceeded fresh borrowings by more than $600 million.

Keep updated, follow The Business Standard’s Google news channel

In July alone, private sector businesses borrowed $1.82 billion, compared to $1.55 billion in June — an increase of $267 million within a month.

Repayments also showed a similar pattern. In July, banks paid $1.94 billion in principal and interest, compared to $1.84 billion in June — nearly $1 billion higher within a month.

Bankers say banks currently have adequate dollar reserves. However, with no elected government in place, many businesses are refraining from making large new investments. This has reduced imports of capital machinery, which in turn has curbed demand for short-term foreign loans. As a result, businesses are repaying more than they are borrowing.

In addition, during 2023–24, when dollar shortages were acute, banks had to defer large amounts of short-term loans. This led to higher interest payments and weakened banks’ credit ratings to some extent. That is why banks are now extremely cautious, so that no new overdue payments pile up, they said.

Bangladesh Bank data shows that at the end of July this year, the outstanding stock of private sector short-term foreign loans stood at $10 billion, up slightly from $9.8 billion at the end of January. Before that, the amount had been declining for nearly eight consecutive months.

Infograph: TBS

“>

Infograph: TBS

Syed Mahbubur Rahman, Managing Director and CEO of Mutual Trust Bank, said many countries have recently cut policy interest rates, resulting in somewhat lower international loan rates.

“At the same time, exchange rate stability has begun to appear in recent months. Still, most businesses are waiting for the elected government to come. Once the elections are held in February, both domestic and external borrowing in the private sector will likely pick up. Banks have adequate dollars, and if businesses want, they can expand investment through local banks,” he added.

The central bank’s latest data shows that in FY2025, import LCs opened and settlements have risen by 7% and 18% respectively compared to the previous fiscal year.

On the other hand, imports of capital machinery have fallen by 25% and imports of intermediate goods by 6%.

Bangladesh Bank data indicates that since 2023, when the dollar exchange rate started rising, private sector short-term foreign loans have been affected. Businesses shifted focus to repaying dollar loans because exchange rate volatility was raising risk and losses.

As a result, outstanding short-term foreign loans fell from $16.42 billion at the end of December 2022 to $11.79 billion at the end of December 2023 — a decline of around $4.63 billion in one year.

From early 2024 the amount fluctuated, but since June last year it has been steadily declining. One major reason was the deterioration in political and law-and-order conditions following the fall of the Awami League government amid the student-people’s uprising in August 2024, along with exchange rate instability.

The report also noted that in July, among six key components of private sector short-term foreign loans, Buyer’s Credit fell by $286 million, while the Short-Term Loan component increased by $184 million.

Buyer’s Credit is a short-term loan facility extended by an overseas bank or financial institution to an importer, allowing immediate payment for goods and services while deferring repayment.