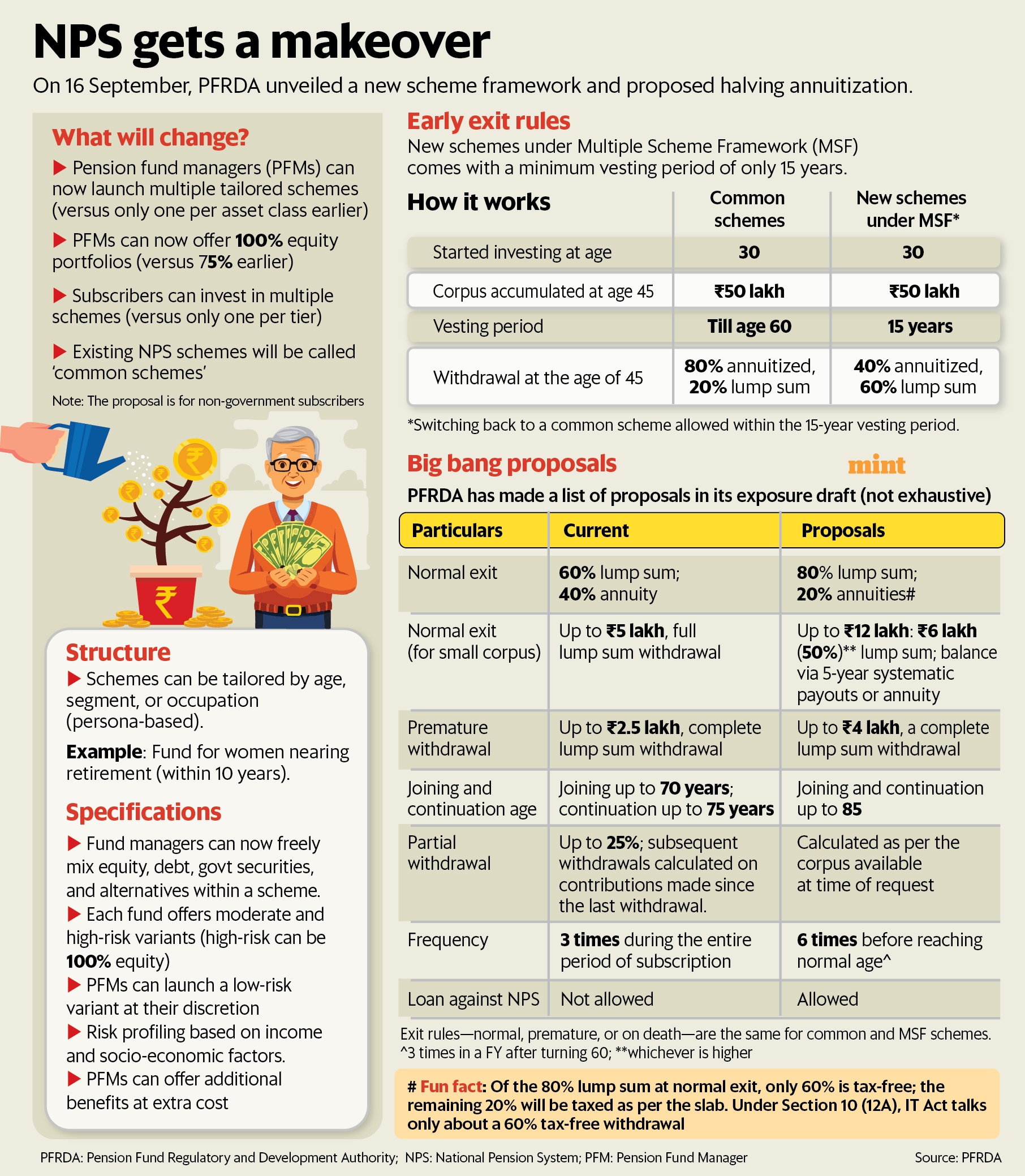

From 1 October, pension fund managers (PFMs) can launch customized schemes under a new multiple schemes framework (MSF). These will allow allocations of up to 100% in equities, breaking the current 75% cap. The schemes for non-government subscribers can be tailored by persona, gender, or profession. While variants with moderate and high risk will be available, managers can launch a low-risk variant at their discretion.

The Pension Fund Regulatory and Development Authority (PFRDA) also issued a draft exposure proposing a list of changes relating to exits and withdrawals. The big sweeping proposal is to offer more lump sum to individuals by proposing 80% corpus withdrawal at retirement, up from 60% currently, and reducing the mandatory annuities from 40% to 20%. The proposal to reduce the annuities portion and the new schemes under MSF are only for non-government subscribers.

In this article, we discuss the big changes underway in the NPS architecture and what they mean for the common investor. The first part discusses changes that will come into effect on 1 October, and the subsequent part discusses the amendments in the NPS that are in the proposal stage.

Multiple scheme framework

Currently, an NPS subscriber can hold a single permanent retirement account number (PRAN) with one of the three central recordkeeping agencies (CRAs). Once an account is created, the subscriber can allocate their funds into four buckets: equities (stocks), corporate debt, government debt, and alternative investments.

View Full Image

Credit: Mint

Each of the ten pension fund managers provides a scheme dedicated to managing each asset class. The maximum allocation to equity is currently 75% and a cap of 5% for alternative investments. Subscribers can decide how much to allocate to each asset class and select the pension manager by choosing the active mode, or they can opt for the auto mode, where the allocation to each asset class is determined automatically based on the subscriber’s age.

After 1 October, pension funds can also launch tailored schemes, which will have a mix of the asset classes and can go up to 100% in equities.

Sriram Iyer, CEO of HDFC Pension, said this will give more flexibility to fund managers to design portfolios. In the current form, PFMs can have only one scheme under each asset class, and the asset allocation is completely out of their control.

For instance, they can launch a scheme for those retiring in 10 years, he said. In such schemes, the fund manager can ensure the portfolio is structured to minimise volatility. “This is not possible in the current architecture as there is only one scheme that we can run under each asset class.”

The framework will help pension fund managers create customised schemes for different segments of the market, said Sumit Shukla, CEO of Axis Pension. “It will leave the choice of where to invest to the expert fund managers who are experts and have a good track record of investment. Also, 100% equity for a long-term product is a boon because if you see data in any long tenure, equity has beaten all asset classes. This will attract Gen Z/Gen X customers who have kept away from NPS.”

The existing NPS will be called ‘common schemes’. Once the CRA adopts the new framework in its backend system, subscribers will be able to hold multiple common schemes and schemes under MSF under one umbrella. They can use the account aggregator framework to track NPS investment across accounts using PAN.

Unlike common schemes, the new schemes will have a vesting period of 15 years. If a subscriber starts investing in the new scheme at age 30, they can exit the scheme at 45, after holding for at least 15 years. A common scheme becomes eligible for a normal exit at age 60.

On normal exit, 60% of the corpus can be taken out without paying any tax, while 40% is to be invested in annuities, the same for both common and new schemes under section 20 (2) of the PFRDA Act.

“The new proposals are good and give investors more flexibility. However, NPS is not the plain vanilla product that it used to be. With multiple fund options coming in, the investor needs to be more mindful while choosing their investment and not to fiddle with it frequently,” said Ravi Saraogi, a Sebi-registered investment advisor and co-founder of Samasthiti Advisors.

Other big reforms

The pension regulator has also proposed some big reforms in the NPS. Many people have an issue with the mandatory annuitization of 40% on normal exit. If the subscriber opts for a premature withdrawal, 80% is put into annuities.

The PFRDA proposes to cut mandatory annuitization from 40% to 20%. If you invest in a common scheme and reach age 60 or the end of the vesting period in the new schemes, you will be able to withdraw 80% of the corpus instead of 60%.

However, experts say only 60% withdrawn amount can be tax-free as per the current income tax rules, and the remaining 20% is subject to taxation. New schemes can be withdrawn before 60 if the 15-year vesting period is met.

The joining and continuation age of NPS is also expected to be extended up to 85. At present, subscribers join the scheme until they’re 70 and have to exit by age 75.

“Reducing annuity to 20% is a great reform, as NPS customers were captive to life insurance annuity and they were getting low returns. This will reduce this big negative and will surely start to attract everyone. Multiple withdrawals will help in flexibility to customers to take money when it is needed,” said Shukla of Axis Pension.

If the subscriber has up to ₹12 lakh in their NPS at the time of exit (age 60), then it is proposed to allow them to withdraw 50% or ₹6 lakh, whichever is higher, as a tax-free lump sum.

The remaining 50% is to be taken out periodically for at least five years or invested in annuities or a mix of both. For context, current rules allow complete withdrawal if your corpus is within ₹5 lakh.

Withdrawal rules

Conditions for premature exit and partial withdrawal before the exit age of 60 have also been relaxed. If the corpus is up to ₹4 lakh, a complete withdrawal of the lump sum is allowed, up from the current limit of ₹2.5 lakh. For partial withdrawal, the current rule says you can withdraw up to 25% of your own contribution.

However, for subsequent requests, only incremental contributions made from the date of the previous partial withdrawal are considered. It is now proposed to consider the entire corpus available at the point of submission request.

The frequency of partial withdrawal is also proposed to be increased from three to six times, with an interval of four years between each withdrawal. Once the subscriber turns 60, they can withdraw three times in a financial year. At present, subscribers can apply for withdrawal only three times during the entire subscription period.

With the recent spate of proposals, the pension regulator is strongly looking to develop the marketplace for NPS, but for you, this could mean more complex choices that you will need to navigate carefully.