Bentonite Clay Market Overview

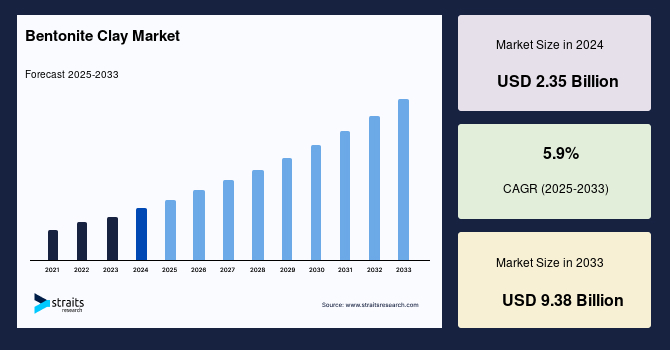

The global bentonite clay market size was valued at USD 2.35 billion in 2024 and is projected to reach from USD 2.49 billion in 2025 to USD 9.38 billion by 2033, growing at a CAGR of 5.9% during the forecast period (2025-2033). The growth of the global market is primarily driven by rising demand from key industries such as construction, cosmetics, and agriculture. Each industry utilises specific grades of bentonite clay, expanding its applications across diverse sectors. This growing demand continues to fuel higher production levels globally.

Key Market Indicators

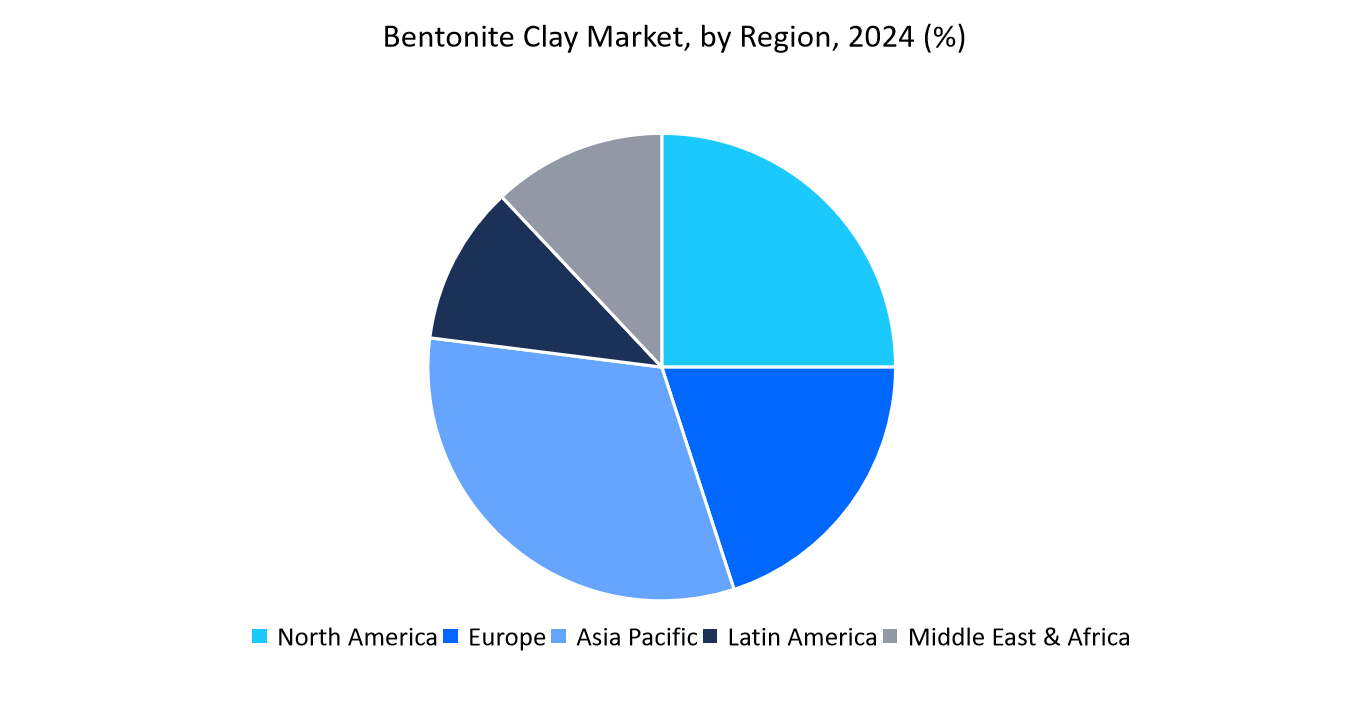

Asia Pacific is the dominant market in the global bentonite clay industry with a 32.69% revenue share in 2024.

Based on product, sodium bentonite clay dominated the bentonite clay industry in 2024 with a 46.83% revenue share.

Based on end-use construction, the end-use segment led the market in 2024 with a 26.79% revenue share.

Market Size & Forecast

2024 Market Size: USD 2.35 Billion

2033 Projected Market Size: USD 9.38 Billion

CAGR (2025-2033): 5.9%

Largest market in 2024: Asia Pacific

Fastest-growing region: North America

.png)

Source: Indian Bureau of Mines

According to the Indian Bureau of Mines (IBM), the governmental agency responsible for mineral and ore development and search, Indian exports of Bentonite clay have recorded a trend of changing volumes but constantly increasing values in recent times. The figures show that despite the times when the volume of exports decreased, the total revenues from Bentonite still rose, indicating an improved pricing environment as well as a move towards supplying high-quality grades to world markets.

Exports have more recently surged back in terms of volume, as well as registering an additional increase in value, which signifies both a rebound in shipment levels and ongoing appreciation of Bentonite on the world trade scale. The IBM report highlights that this trend captures not just India’s consistent position as a top exporter but also increasing global industries’ affinity for quality-oriented Bentonite from India.

Market Trends

Innovative Bentonite Clay Improving Metal Casting Efficiency

Producers are developing Bentonite clay grades to improve metal casting efficiency.

For example, Clariant produced GEKO OPT, a high-performance sodium Bentonite, and ECOSIL, a Bentonite-coal blend that enhances mould flowability, strength, and minimises toxic BTEX emissions, offering cleaner and smoother castings

Foundwell India launched its “Hyper Bond” grade with large montmorillonite content, superior thermal stability, and wet tensile strength

This minimises mould rejection and also improves casting quality, particularly in the case of high-pressure molding lines. These developments show how customised Bentonite solutions have an instantaneous influence on casting results, reducing defects but optimising sustainability and productivity in the foundry sector.

Negatively Charged Bentonite Clay: A Smart Way to Capture Impurities

Anionically charged Bentonite clay is negatively charged and repels positively charged impurities like excess oils, soil, and toxins. Due to electrostatic attraction, it picks up and removes the impurities efficiently.

For instance, ASEA Redox Clay Mask, which blends Bentonite clay and proprietary redox signalling molecules. The clay traps skin impurities, while redox molecules help in aiding cellular communication and regeneration. The mask cleanses and enhances skin health and allows for a freshened and rejuvenated appearance.

This is how Bentonite’s natural charge can be utilised in cutting-edge skincare products to cleanse effectively.

Market Drivers

Increase in Steel Production & Demand: Upscale the Demand of Bentonite Clay for Casting & Moulding

The steady growth in global steel demand, driven by its durability and extensive applications in construction, automotive, and infrastructure, is directly accelerating the need for bentonite clay. As a critical material in metal casting and moulding, bentonite clay demand surges subsequently.

For example, according to the India Brand Equity Foundation, from 2008 to 2025, India’s steel production has increased by 75% and domestic demand has increased by 80%.

This parallel increase in production and consumption is directly boosting the need for bentonite clay in steel casting and moulding, thereby propelling overall market growth.

Rapidly Growing Cosmetics Industry Directs Demand for Bentonite Clays

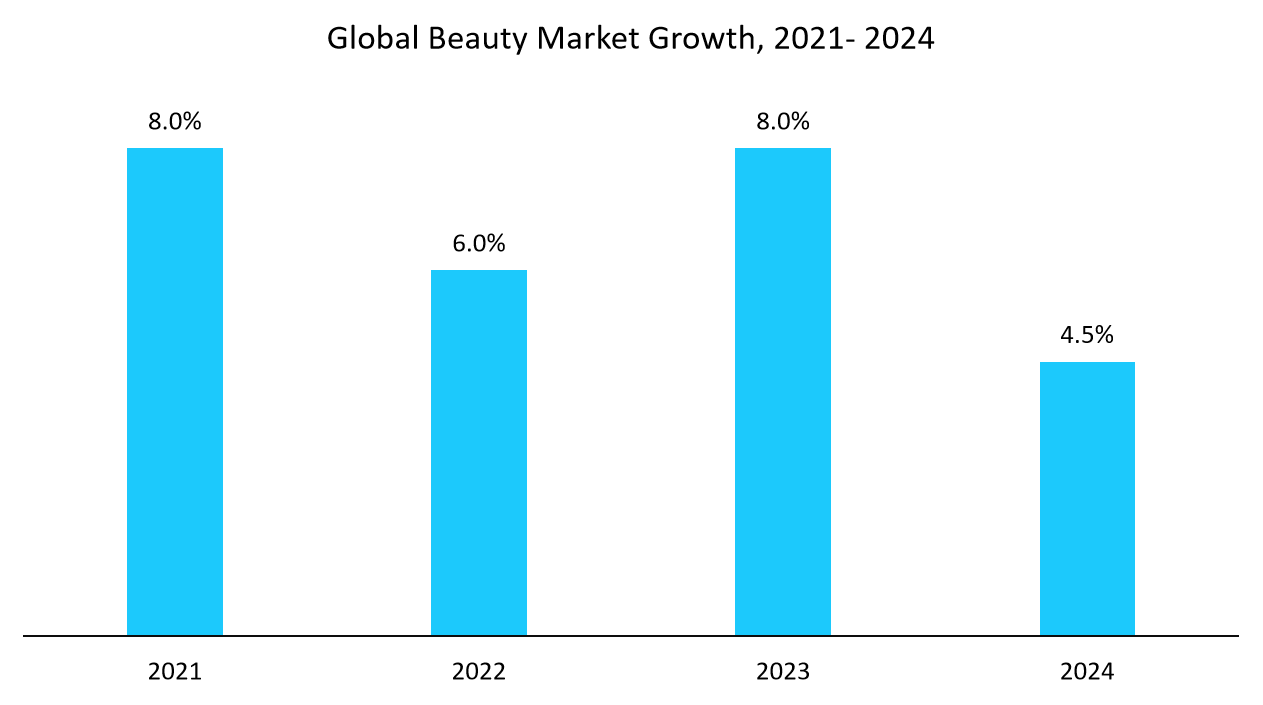

Bentonite clay has become a key ingredient in cosmetics and skincare formulations, serving multiple functions as a thickener, absorbent, filler, texturizer, and binder. These versatile properties reinforce its widespread adoption across a variety of beauty and personal care products. With the consistent expansion of the global cosmetics industry, the demand for bentonite clay is rising in parallel.

According to L’Oréal, the beauty market is growing over the years. The graph below indicates an estimated growth over the years.

Source: Loreal

This sustained growth in beauty and personal care consumption underscores the increasing reliance on bentonite clay, thereby propelling overall market expansion.

Market Restraint

Availability of Alternatives

The versatility of bentonite clay supports its adoption across industries such as construction, agriculture, and cosmetics. However, the market faces restraint from the availability of alternative materials that demonstrate comparable or even superior properties. Minerals like attapulgite, sepiolite, and synthetic clays share similar physicochemical characteristics and better flow properties, enabling them to serve as substitutes in multiple end-use industries.

Market Opportunity

Middle East Exploration: Unlocking Opportunities in Bentonite Resources

The Middle East is rich in mineral reserves, including substantial deposits of bentonite, positioning the region as a potential hub for supply. Global companies are increasingly focusing on resource-rich countries to secure access to these reserves and strengthen their raw material base.

For instance, in June 2024, the county government of Laikipia, Kenya and China’s IPL Business Ltd held discussions on mining opportunities and economic benefits in Laikipia for bentonite and other minerals.

Such exploration and investment activities not only emphasise the growing demand for bentonite clay but also create new avenues for future market growth through resource development and cross-border collaborations.

Regional Analysis

The Asia Pacific region dominated the market with a revenue share of 32.69% in 2024. This growth is driven by expanding industries such as construction and cosmetics, along with strong regional dominance in agriculture and metal manufacturing. Bentonite clay plays a critical role in these sectors, fuelling high demand across the region.

China and India are key players, exporting bentonite to numerous industries, including construction, metallurgy, agriculture, and cosmetics. For example, China was the globe’s top producer of crude steel, increasing the demand for bentonite utilised in casting and moulding, while India’s rapidly growing cosmetics market further increased the use of clay. China’s leadership in steel production and India’s rapidly growing cosmetics industry are key contributors to market expansion.

China holds the major share in the production of crude steel. Metal casting is one of the applications of bentonite clay, where it is widely used. According to Worldsteel, China held a share of 53.3% for crude steel production in 2024, which was 49.1% in 2014. This increase and dominance in steel production directs the demand for bentonite clay in China.

India’s growing cosmetics industry, with rising investments for development and manufacturing, sets a goal of reaching the world’s top 5 cosmetic markets. India Brand Equity Foundation, India will constitute 5% of the global cosmetics market and reach the top five global markets in terms of revenue.

Source: Straits Research Analysis

North America Market Trends

North America will grow at the highest CAGR of 2025-2033, driven by rising industrial demand and multiple applications. It is driven by the United States, with strong growth in pharmaceuticals, cosmetics, oil & gas, and construction industries. Bentonite clay has wide usage in drilling muds, cosmetic products, and sealing applications.

The U.S. market is experiencing strong growth driven by the expanding cosmetics industry, where bentonite is widely used as a thickener, absorbent, and detoxifying agent. For instance, the U.S. FDA allocated USD 8 million to continue the development of modernised cosmetics.

Europe Market Trends

Germany is Europe’s leading construction sector, and it is experiencing continuous growth. As the construction industry is facing challenges with respect to environmental barriers, bentonite clay’s major role as a barrier between construction and environmental factors signifies its demand in construction.

Latin America Market Trends

Brazil is the largest oil producer of Latin America, with the largest ultra-deep oil reserves in the world. For the production of oil, the crude oil needs to be extracted from the reserves. This process requires drilling, and bentonite is widely used in the oil and gas industry for smooth drilling purposes. These large reserves and high production of oil significantly direct the demand for bentonite clay.

Product Insights

The sodium bentonite clay segment dominated the market with a revenue share of 46.83% in 2024. The growth is primarily due to its swelling, absorbing, and sealing properties. These characteristics drive its extensive use in sectors such as cosmetics, construction, and drilling, where the material provides essential functional benefits.

End Use Insights

The construction segment dominated the market with a revenue share of 26.79% in 2024. The growth is driven by multiple and effective applications of bentonite clay in construction, such as waterproofing, sealing, drilling, tunnelling, and resisting barriers that are able to damage the construction. Bentonite clay has good absorbent and swelling properties that allow the construction to hold moisture, making it strong and resistant to environmental barriers.

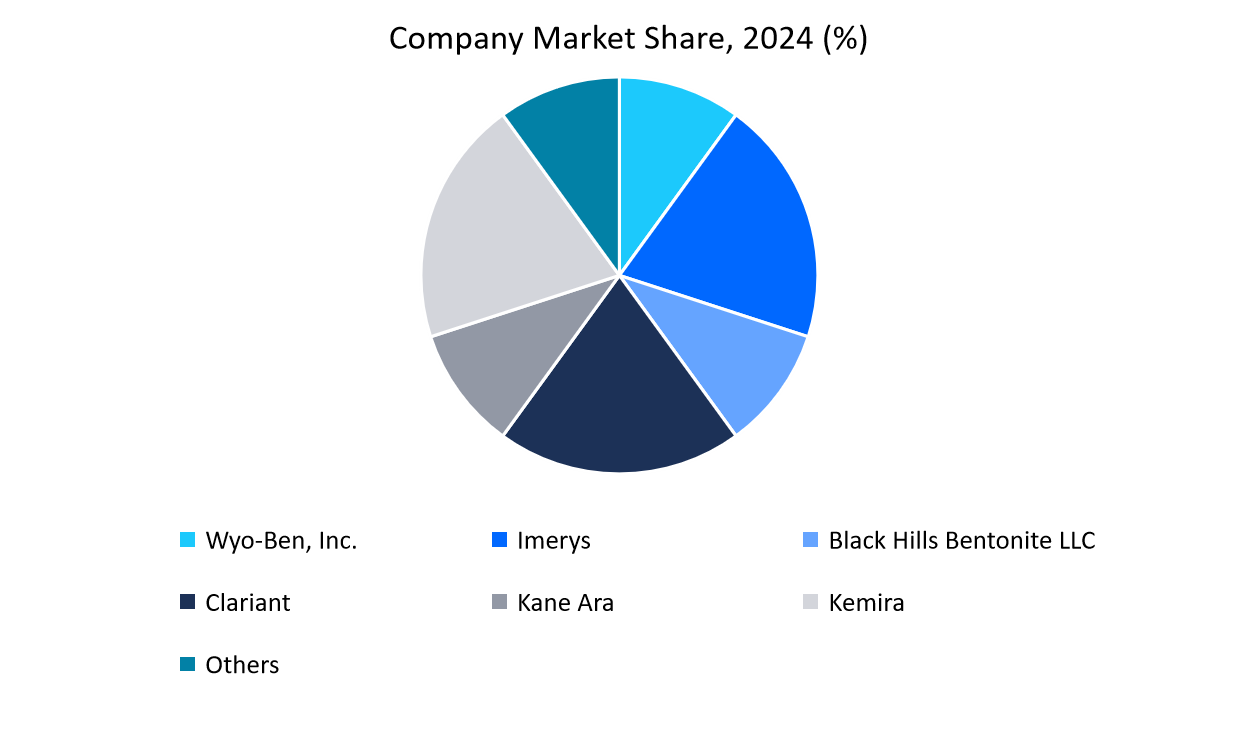

Company Market Share

The global bentonite clay market is fragmented in nature, owing to collaborations, mergers and acquisitions, and new product development. The top players in the industry are Imerys, Clariant, Wyo-Ben, Inc., Kemira, Black Hills Bentonite LLC, and Kane Ara.

Kemira: A potential player in the bentonite clay market

Kemira is an international chemicals group based in Helsinki, Finland, with expertise in water-challenged industries like paper and board, water treatment, and oil and gas. The company provides a variety of top-quality bentonites, such as microparticle bentonites like FennoLite, which are applied in retention and drainage uses in the paper industry. The products are formulated to improve fibre retention, enhance dewatering performance, and build sheet strength, thus maximising the efficiency and quality of paper making.

Source: Straits Research Analysis

Recent developments by Kemira

March 2025: Kemira diversified its business by acquiring Water Engineering, Inc., an industrial water treatment company. The acquisition broadens Kemira’s capability to offer integrated water treatment solutions, including applications that utilise bentonite-based products in different industries

June 2024: Kemira started working with CuspAI to utilise artificial intelligence’s potential for speeding up new material development for clean water. The first project aims at the removal of per- and polyfluoroalkyl substances (PFAS), or “forever chemicals,” from water sources. It is expected to enhance the efficiency and efficacy of water treatment processes

List of key players in Bentonite Clay Market

Imerys

Clariant

Minerals Technologies Inc.

Wyo-Ben, Inc.

Ashapura Group

Gimpex Private Limited

Bentonite Performance Minerals LLC

Kemira

KUNIMINE INDUSTRIES CO., LTD.

Black Hills Bentonite LLC

Western Clay Corp (WCC)

Western Clay Company

Teague Mineral Products

Di-Corp, Inc.

Kane Ara

Others

Recent Developments

In September 2025 : Imerys and Denka entered into a collaborative agreement to co-develop and deliver innovative, low-carbon, high-performance solutions. This collaboration enhances the utilisation of its bentonite clay products

In July 2025 : a Scientific Reports study introduced bentonite nano clay applied via Nano-Pico Spray to enhance mortar in historic brick structures. A 4% solution reduced rain and frost penetration, confirmed through FESEM, XRD, and porosity tests. This offers a sustainable, minimally invasive method to protect and preserve heritage buildings

In June 2024 : Clariant showcased Geko, a special clay for moulding and sustainability-focused Ecosil, a blend of bentonite and coal, among feature products at the Metal China exhibition

In April 2024 : Clariant completed the acquisition of Lucas Meyer Cosmetics. This acquisition will add a cosmetics portfolio for Clariant, where bentonite clay can be utilised.

Analyst Opinion

The global bentonite clay market is surging with rising demand from various industries such as cosmetics, construction, agriculture, oil and gas, metal manufacturing, and food. Each of these industries demands a different grade, and the grades are available in the market. With the growth of these industries, the demand for bentonite clay is increasing. Furthermore, countries such as the U.S., India, and China are leading the production of bentonite clays, serving the industries requiring bentonite. Moreover, collaborations, mergers and acquisitions, and integration of bentonite in the development of multiple products expand the reach of bentonite.

Report Scope

Report Metric

Details

Market Size in 2024

USD 2.35 Billion

Market Size in 2025

USD 2.49 Billion

Market Size in 2033

USD 9.38 Billion

CAGR

5.9% (2025-2033)

Base Year for Estimation 2024

Historical Data2021-2023

Forecast Period2025-2033

Report Coverage

Revenue Forecast, Competitive Landscape, Growth Factors, Environment & Regulatory Landscape and Trends

Segments Covered

By Product,

By End Use,

By Region.

Geographies Covered

North America,

Europe,

APAC,

Middle East and Africa,

LATAM,

Countries Covered

U.S.,

Canada,

U.K.,

Germany,

France,

Spain,

Italy,

Russia,

Nordic,

Benelux,

China,

Korea,

Japan,

India,

Australia,

Taiwan,

South East Asia,

UAE,

Turkey,

Saudi Arabia,

South Africa,

Egypt,

Nigeria,

Brazil,

Mexico,

Argentina,

Chile,

Colombia,

Explore more data points, trends and opportunities Download Free Sample Report

Bentonite Clay Market Segmentations

By Product (2021-2033)

Sodium Bentonite Clay

Calcium Bentonite Clay

Potassium Bentonite Clay

By End Use (2021-2033)

Construction

Agriculture

Metallurgy

Oil & Gas

Pharmaceuticals & Cosmetics

Others

By Region (2021-2033)

North America

Europe

APAC

Middle East and Africa

LATAM

Frequently Asked Questions (FAQs)

The global bentonite clay market size was valued at USD 2.35 billion in 2024 and is projected to reach from USD 2.49 billion in 2025 to USD 9.38 billion by 2033.

Increase in Steel Production & Demand: Upscale the Demand of Bentonite Clay for Casting & Moulding is a significant growth driver in the market.

The key players in the global bentonite clay market include Imerys, Clariant, Minerals Technologies Inc., Wyo-Ben Inc., Ashapura Group, Gimpex Private Limited, Bentonite Performance Minerals LLC, Kemira, Kunimine Industries Co. Ltd., Black Hills Bentonite LLC, Western Clay Corp (WCC), Western Clay Company, Teague Mineral Products, Di-Corp Inc., Kane Ara, and others.

Asia Pacific region dominated the market with a revenue share of 32.69% in 2024.

The sodium bentonite clay segment dominated the market with a revenue share of 46.83% in 2024.