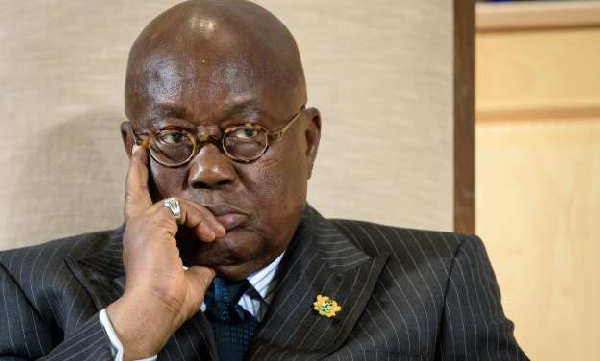

Nana Addo Dankwa Akufo-Addo is the former president

Nana Addo Dankwa Akufo-Addo is the former president

The World Bank has pushed back against the erstwhile Akufo-Addo administration’s long-held narrative that Ghana’s 2022 economic collapse was the result of global turmoil, the COVID-19 pandemic and the Russia-Ukraine war.

It insisted that the economic meltdown was “homegrown”.

In its latest 2025 Policy Notes on Ghana, the Bank made clear that while the COVID-19 pandemic and Russia’s invasion of Ukraine worsened the situation, they were not the root cause.

“The deterioration of global conditions… was not the cause of the 2022 macroeconomic crisis; rather, it merely exposed an economy already beset with deep structural vulnerabilities and precarious macroeconomic conditions,” the report said.

The government has frequently blamed external shocks for the collapse, which saw inflation spiral, the cedi plummet, and the country default on its debt.

But the World Bank said years of weak governance, fiscal indiscipline, and stalled reforms were the real culprits of Ghana’s “dark days”.

Interbank Market: Cedi trades at GH¢12.35 to $1

The bank also argued that the easy access to international credit and expectations of resource windfalls encouraged short-term political decisions at the expense of long-term stability.

The report noted that the cycle of expansionary spending followed by painful corrections, one that has forced Ghana into 17 IMF programs over the past 68 years, is damaging.

“Sudden macroeconomic stops and crises have led the country to request a record number of IMF programs, remaining under active IMF support for 40 out of its 68 years of history,” the Bank said.

The report also noted that more than 800,000 people were pushed into poverty in the aftermath of the 2022 crisis, with per capita incomes stuck at around US$2,200 for over a decade.

Today, more than a quarter of Ghanaians live below the poverty line, it noted.

Looking ahead, the Bank also raised alarms about Ghana’s fiscal management in the 2024 election year.

It flagged unbudgeted spending commitments of roughly US$4.8 billion, equivalent to 5.7% of GDP, much of it accumulated outside official financial systems.

“Spending indiscipline poses a critical challenge…undermining efforts to maintain fiscal discipline and compromising long-term sustainability,” the report cautioned.

Also, the energy sector arrears still cost around 2% of GDP annually, while COCOBOD’s debts reached US$1.8 billion in 2024, with interventions distorting markets and hurting farmers.

The bank warned that Ghana now stands at a critical crossroads, and temporary fixes will not be enough.

“There is an urgent need to signal a clear break from the past and a commitment to change… Success will ultimately be measured by the ability of the government to regain the trust of its citizens.”

Its recommendations are focused on restoring fiscal discipline, broadening the tax base, reforming state-owned enterprises, and enhancing governance.

Without decisive reforms, the World Bank cautions, Ghana risks remaining trapped in its cycle of crisis and bailouts for decades to come.

SSD/SA

Watch the latest Health Focus on PCOS below

Watch the latest edition of BizTech below: