If you have Automatic Data Processing (ADP) on your watchlist, recent activity in the options market is hard to ignore. The October $240.00 Call options are showing high implied volatility, which usually means traders expect a big swing in the stock soon. This surge in options activity comes just as a handful of analysts have trimmed their earnings outlook, so there is a sense that investors are bracing for an event that could redefine the company’s trajectory.

Looking at the broader picture, ADP has not exactly sat still this year. Its share price has climbed nearly 9% over the past twelve months, even as momentum cooled in the last quarter. There has also been news around leadership nominations and a solid run of EPS and revenue growth, but the recent downward earnings revisions add a layer of caution. Whether this mix of long-term financial strength and short-term uncertainty signals a changing sentiment or a setup for renewed momentum is the key question.

Given the pullback in recent months and the volatility on display, is this a timely entry for investors seeking value or is the market already anticipating ADP’s next move?

Most Popular Narrative: 8.4% Undervalued

The prevailing narrative suggests that ADP’s shares are trading below their estimated fair value, based on optimistic projections for future growth and margins. According to this view, the company’s recent innovations and global expansion are expected to drive further upside if current trends continue.

Adoption of Next Gen products (like Lyric HCM and Workforce Now Next Gen) and integration of acquisitions (e.g., WorkForce Software) are accelerating demand for advanced, cloud-based, and AI-driven HR solutions. This directly locks in higher average revenue per user and supports earnings growth through margin expansion.

Curious what’s fueling this bullish outlook? The secret sauce combines major bets on innovative technology, ambitious targets for financial improvement, and a high-stakes premium compared to its industry. The math behind the headline valuation could surprise even seasoned investors. Wondering what future growth assumptions analysts are baking in? Dive into the details to see how this narrative stacks up against reality.

Result: Fair Value of $318.17 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, despite the optimism, rising competition and slowing U.S. payroll growth could pressure ADP’s revenue and margins. This may challenge the bullish case ahead.

Find out about the key risks to this Automatic Data Processing narrative. Another View: The Market’s Premium

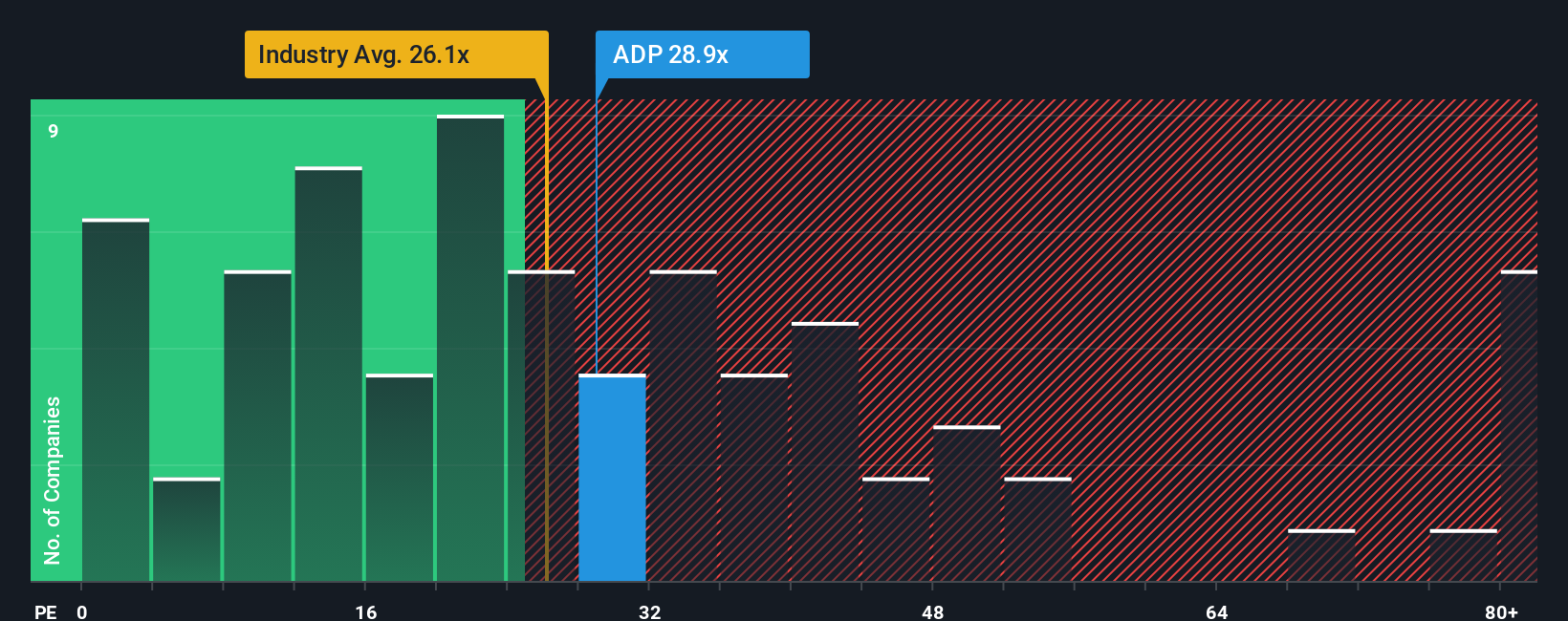

While fair value estimates suggest ADP is undervalued, a glance at how the company trades shows its share price is higher than the industry average on this key metric. Is this optimism justified, or are expectations getting ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

NasdaqGS:ADP PE Ratio as at Sep 2025

NasdaqGS:ADP PE Ratio as at Sep 2025

Stay updated when valuation signals shift by adding Automatic Data Processing to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Automatic Data Processing Narrative

If you believe there is more to the story, or you want to run the numbers your way, you can craft your own narrative quickly and see how it compares: Do it your way.

A great starting point for your Automatic Data Processing research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunities pass you by. Use the Simply Wall Street Screener to pinpoint investments that match your goals and uncover companies with strong potential. Here’s where to start:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com