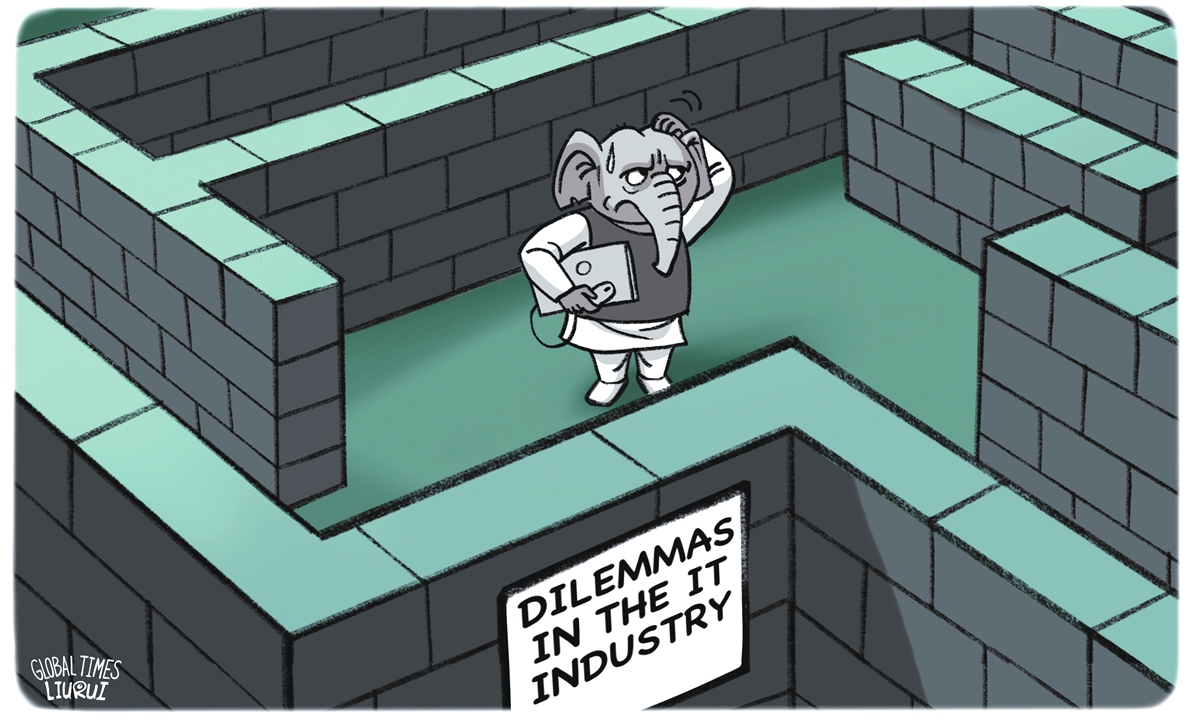

Illustration: Liu Rui/GT

India’s high-profile IT industry, long a pillar of economic growth and national pride, is facing its sternest test yet. In 2025, two seismic shocks rattled the sector: The January launch of Chinese start-up DeepSeek’s artificial intelligence (AI) model R1, which swiftly outpaced ChatGPT in downloads and prompted soul-searching in New Delhi, and India’s largest IT company Tata Consultancy Services’ (TCS) July announcement of its largest-ever layoffs – 12,000 jobs, or 2 percent of its workforce, to be cut in its 2026 financial year. These events underscore a broader reckoning: Can India’s $283 billion outsourcing juggernaut adapt to AI’s disruptive force while navigating US trade pressures, or will it succumb to a perfect storm of technological upheaval and geopolitical uncertainties?

For decades, India’s IT services have been the envy of the developing world. Since the 1990s liberalization wave, the sector has harnessed a surplus of English-speaking engineers to become the world’s back office. By 2022, information and communications technology accounted for more than half of India’s service exports, making it the second-largest IT services exporter after Ireland, claiming more than 15 percent of the global market.

This success bypassed traditional industrialization pitfalls. Unlike manufacturing, IT requires limited infrastructure, just pockets of modernity like software parks in Bengaluru and Hyderabad. It sidestepped rigid labor laws by leveraging India’s unique edge: low-cost, scalable talent fluent in English, unmatched by East Asia’s language barriers or Africa’s skill gaps. Policies like tax exemptions on hardware imports and export subsidies fueled the boom, turning “India Inc” into a foreign-exchange machine that offset chronic goods trade deficits.

Yet this model, built on volume over value, now looks brittle. India’s IT prowess masks a glaring innovation deficit. Despite proximity to Silicon Valley, where Indian CEOs helm Microsoft, Google and Adobe, the country has birthed few global tech products. No Indian operating system, browser, or social app rivals Western or Chinese counterparts. Web-based online office suites Zoho and banking software Finacle shine in niches, but they are exceptions. India’s R&D spending languishes at 0.6 to 0.7 percent of GDP, dwarfed by China’s 2.68 percent and the US’ over 3.5 percent.

This stems from a “resource curse” of cheap labor. Indian firms profit from arbitrage wage gaps, hiring coders at lower salaries without climbing the value chain. Billing by hours incentivizes low-skill, drawn-out work over efficiency. Top talent drains abroad or to foreign “global capability centers,” while domestic giants like TCS prioritize client management over R&D. Monopolistic structures stifle startups and venture ecosystems pale beside China’s. India missed the waves from desktop software to mobile apps, content with outsourcing rather than originating.

AI exacerbates this vulnerability. Tools like ChatGPT and Claude automate routine tasks like debugging and queries that form IT outsourcing’s core. While China’s DeepSeek-R1, undercutting costs dramatically, swept the world, Indian executives lamented – Why not from Bengaluru? The model, praised by India’s IT Minister Ashwini Vaishnaw for its frugality, spurred India to accelerate its national AI program, pooling 18,693 GPUs for local models. Yet, as TCS’s layoffs signal – citing AI-driven “skill mismatches” – the sector is bracing for mass displacement.

Compounding this are US policy headwinds. Half of India’s IT revenues is made in the American market. The Donald Trump administration’s tariffs, 25 percent on most Indian goods since July 2025, doubling to 50 percent at the end of August, do not directly hit services, but ripple effects loom. With AI enabling “services reshoring,” US firms may automate domestically, bypassing India to an unprecedented degree.

Politically, this threatens Indian Prime Minister Narendra Modi’s vision. IT employs 5.4 million directly, millions more indirectly, fueling India’s middle-class dream. A downturn could spike unemployment, stoking unrest in election cycles. Economically, any erosion risks rupee depreciation, inflation and strain on forex reserves. Lagging manufacturing leaves no buffer. If AI and tariffs converge, India faces a “talent mismatch” crisis: surplus low-skill workers amid demand for AI-savvy experts.

New Delhi’s responses show urgency but limitations. The AI program targets multilingual models, partnering with local AI firms for compute. Yet, higher education churns out coders, not researchers and bureaucracy hampers innovation. To pivot, India must boost R&D, reform labor laws for flexibility, and foster a startup ecosystem.

India’s IT miracle was a bypassing of industrialization woes. AI demands a rethink: from labor arbitrage to innovation leadership. Without bold reforms, the sector risks obsolescence, dragging growth. But with vision, India may well emerge resilient. The storm is here and adaptation is key.

The author is an associate researcher at the International Cooperation Center of the National Development and Reform Commission. opinion@globaltimes.com.cn