Back in February 2025, Scoot quietly brought back payment processing fees in Singapore, undoing its earlier decision to scrap them in 2019 (which it gave itself a fair bit of kudos for, mind you!).

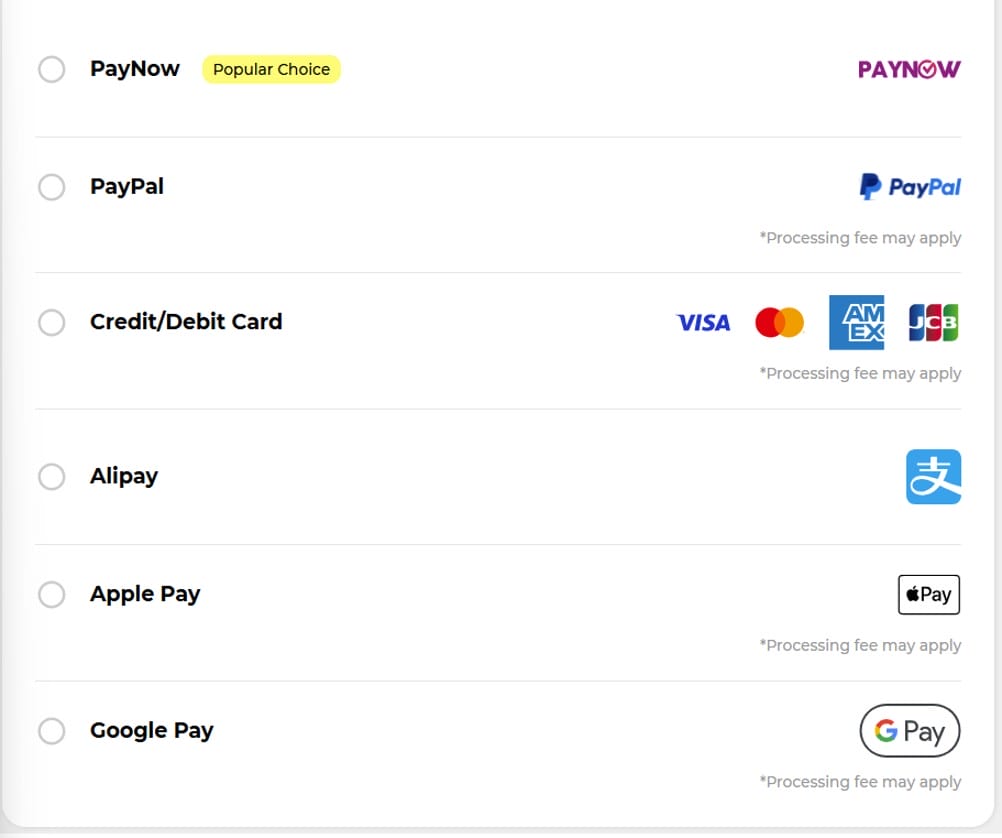

These junk fees, which went as high as 2.26%, could initially be avoided by “wrapping” your credit card in Apple Pay, Google Pay, or PayPal, but we always knew that it was only a matter of time before Scoot closed that loophole too.

Sure enough, Scoot has now expanded its payment processing fee to cover these payment methods too. But if it makes you feel any better, Scoot has also, in its infinite generosity, lowered the fee from 2.26% to 2.2%.

So…yay?

Scoot expands payment processing fees to Apple Pay, Google Pay and PayPal

Scoot has brought back junky payment processing fees

Scoot has brought back junky payment processing fees

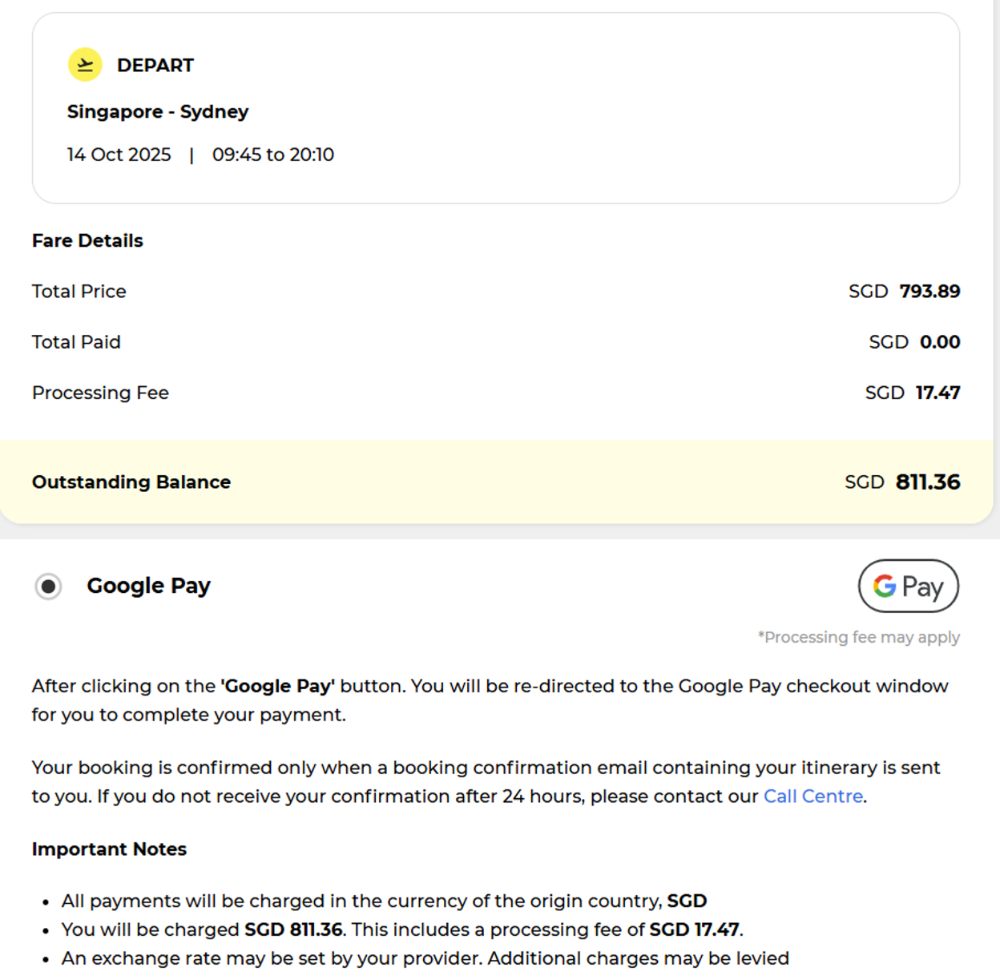

Scoot customers departing from Singapore will now be hit by the following payment processing fees.

American Express

2.2%

Japan Credit Bureau (JCB)

2.2%

Mastercard

2.2%

Visa

2.2%

Apple Pay

2.2%

Google Pay

2.2%

PayPal

2.2%

It’s worth noting that these fees have changed slightly since they were first reintroduced in February 2025:

American Express has increased from 1.93% to 2.2%

JCB has increased from 1.81% to 2.2%

Mastercard & Visa have decreased from 2.26% to 2.2%

UnionPay has been removed as a payment method

This processing fee applies to both commercial and award bookings. It will be automatically calculated and added at the final stage, after you’ve entered your credit card number.

Following this change, the only fee-free payment options for Scoot are:

Bookings paid with Alipay

Bookings paid entirely with Scoot vouchers

Bookings paid entirely with KrisFlyer miles (not award flights; this refers to Miles + Cash bookings)

PayNow (a “popular choice”, if you believe Scoot!)

All payment processing fees are non-refundable, but in any case Scoot fares are almost always non-refundable except in situations of medical emergencies, bereavement, or a schedule change of more than two hours. It’s unclear what happens to payment processing fees in those scenarios.

Payment processing fees also apply to departures from Australia, Japan, Taiwan, Thailand, Indonesia or Vietnam.

Malaysia flights are exempt from payment processing fees

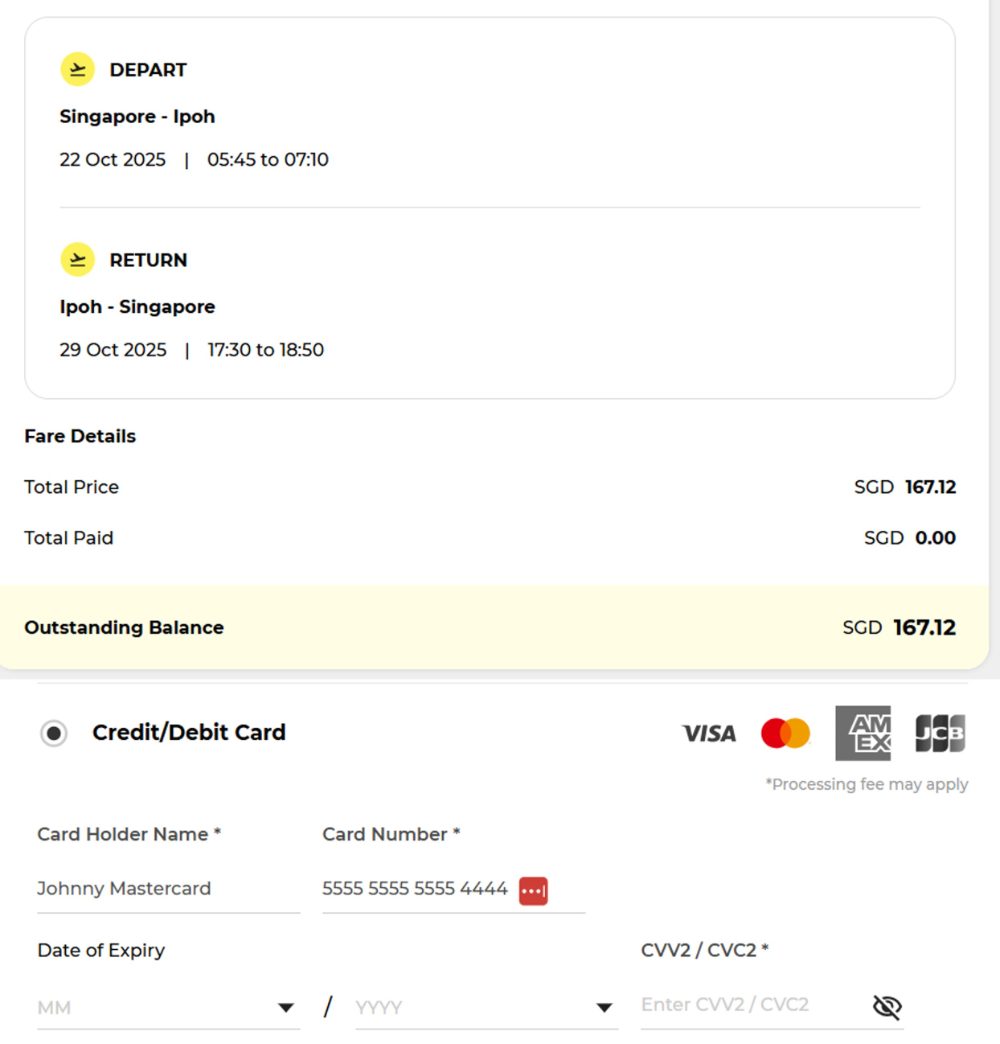

There is one exception to Scoot’s payment processing fees: flights to and from Malaysia.

For example, here’s a flight between Singapore and Ipoh, which prices at S$167.12. No processing fee appears, even after I enter my Mastercard number.

Scoot’s PR team has confirmed that this behaviour is intentional, and flights to and from Malaysia are exempt from processing fees (though how long that’s the case is anyone’s guess).

It no longer costs you “extra” to use the KrisFlyer UOB Card

A strange quirk that arose from the decision to reintroduce credit card processing fees was that the Scoot privileges granted to KrisFlyer UOB Cardholders were no longer free.

For KrisFlyer UOB Credit Cardholders to enjoy their Scoot privileges, they have to book their tickets through the dedicated KrisFlyer UOB x Scoot booking portal. However, this portal only accepts payment with a “naked” KrisFlyer UOB Credit Card. There is no option to wrap it in Apple Pay, Google Pay or PayPal.

Therefore, your choices were:

Book through the KrisFlyer UOB x Scoot portal, enjoy the benefits, but pay an extra processing fee

Book through the public website, forgo the benefits, but save on the processing fee by using Apple Pay, Google Pay or PayPal

Now that the payment processing fee applies to both naked cards and Apple Pay, Google Pay and PayPal, this discrepancy no longer exists. In other words, your KrisFlyer UOB Credit Card’s Scoot perks are free once again, though given the context I wouldn’t exactly consider that an enhancement!

Why reintroduce payment processing fees?

Let’s turn the clocks back to September 2019, when Scoot removed its payment processing fees worldwide. I distinctly remember reading a press release about this, but even though it still shows up on Google…

…Scoot has attempted to scrub it from existence.

Nice try, but the internet never forgets.

The evolution of payment systems over the years, driven by technological improvements, has helped to significantly defray the associated costs required to support and maintain the payment infrastructure.

…

Mr Lee Lik Hsin, Scoot’s Chief Executive Officer, said, “When Scoot first started, we offered a limited range of payment methods at a higher implementation and maintenance cost. As we expanded globally and heard our customers’ feedback, we took advantage of advances in payment technology to implement many more payment methods to improve our customers’ experience.

In order to pass on the savings to our customers as our costs came down, we have since March 2018 progressively removed payment processing fees in selected markets. Now, we are ready to do away with it globally. We hope this gives our customers better value and more reasons to escape the ordinary with us.”

-Scoot Press Release

So, what are we to make of all this? Has there been some sort of global technological regression that necessitates the reintroduction of processing fees? Have payment systems deteriorated to an extent that the only way to escape the ordinary now is by paying a surcharge?

Well, no. Scoot simply saw that competitors like Air Asia and Jetstar didn’t follow suit (though AirAsia no longer has processing fees for flights starting and ending in Malaysia), and has decided it might as well improve its margins.

The only good news I can see here is that Scoot has not reverted to its previous system of imposing a flat fee per passenger, per flight. That, quite frankly, was extortionate and a clear money grab, since it had little to do with the actual cost of processing payments.

🇦🇺 Australia

A$10

🇯🇵 Japan

JPY 800

🇸🇬 Singapore

S$10

🇹🇼 Taiwan

TWD 240

🇹🇭 Thailand

THB 200

Of course, I’m under no illusions that payment processing fees were always there, just baked into the fare. But so long as they were, Scoot had to adjust its fares to ensure the overall price remained competitive, or lose out on business from OTA search results. As you can imagine, the LCC market is extremely price-sensitive.

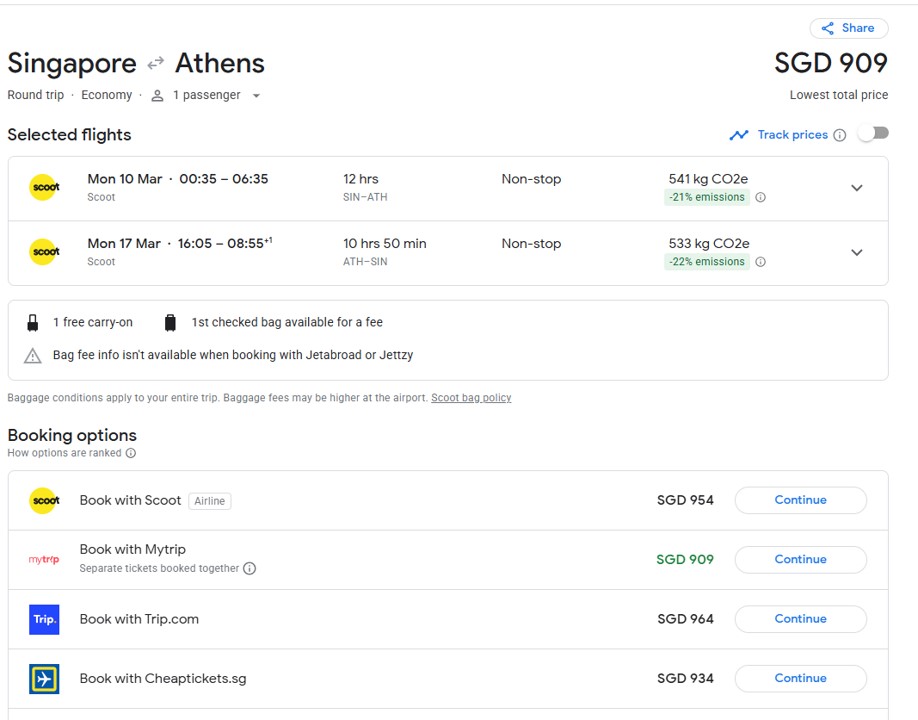

By charging separate payment processing fees, Scoot can make its flights appear artificially cheap in OTA searches

By charging separate payment processing fees, Scoot can make its flights appear artificially cheap in OTA searches

By charging payment processing fees separately, Scoot is able to show a lower price upfront during the all-important search stage, before increasing it later in the booking process (a similar analogy would be resort fees charged by hotels). It’s basically a kind of drip pricing, which makes prices less transparent to the consumer.

Should you still use a credit card with Scoot?

With the reintroduction of payment processing fees, you’re basically paying for the privilege of earning credit card miles. Whether or not that makes sense boils down to how many miles you earn, and how much you value a mile.

Here are the cards which earn the most miles for Scoot tickets.

Assuming a 4 mpd card and a valuation of 1.5 cents per mile, a surcharge of 2.2% can still be justified. It offsets the value of the miles somewhat, but you should still come out ahead.

In any case, rewards are not the only benefit of paying with a credit card. I can think of at least three other reasons:

Paying with a credit card has cashflow benefits, since you have up to 55 interest-free days to pay (versus PayNow which deducts money instantly from your bank account)

Paying with a credit card gives you chargeback protection, in case something goes wrong with your trip and you want to raise a dispute (just witness how slow airlines were to offer refunds for cancelled flights during COVID-19)

Paying with a credit card can give you complimentary travel insurance

Conclusion

Scoot has closed the loophole which allowed customers to circumvent its junky credit card fees by using Apple Pay, Google Pay or PayPal instead.

You will now pay a 2.2% processing fee for these wallets, as well as all card networks, with Alipay and PayNow the only fee-free payment methods.

It’s very disappointing that Scoot has decided to U-turn on its previous decision to scrap these charges, and done it so surreptitiously no less. It also means that prices will be less transparent, and you’ll want to make sure you’re doing like-to-like comparisons when reviewing OTA results.