ROBERT CURRAN, Contributing Editor, Calgary, Canada

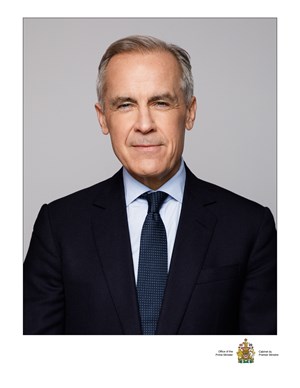

Fig. 1. Canadian Prime Minister Mark Carney. Image: Official Portrait.

Since coming to power in late April 2025 with yet another Liberal minority government, rookie Prime Minister Mark Carney (Fig. 1) has seemingly abandoned the autocratic and divisive style of his predecessor. However, many of the anti-hydrocarbon policies and laws brought in by the Liberals over the past 10 years remain in effect, including the so-called “no new pipelines” legislation.

Governmental policy. Although it continues to advocate for climate action, Carney’s government acknowledges the oil and gas industry’s role in Canada’s economy, a significant departure from previous Liberal administrations. Efforts to improve market access include support for pipeline modernization, export infrastructure, and diversification of energy products. The administration encourages investment in liquefied natural gas (LNG) facilities and partnerships to supply global markets, positioning Canadian resources as part of a responsible energy mix.

Global economic forces clearly demonstrate that Canada’s federal policies targeting hydrocarbons over the past ten years have been at best, aggressive, and at worst, virtual signaling that damages Canada’s competitiveness, is completely out of step with the stark reality that oil and gas will continue to drive the global economy for decades to come.

The oil and gas industry directly and indirectly supports hundreds of thousands of jobs across Canada, particularly in provinces like Alberta, Saskatchewan, and Newfoundland and Labrador, Fig. 2. Federal policies that restrict new exploration, increase carbon pricing, or impose stricter regulations—without viable alternatives in place—risk job losses, reduced investment, and declining provincial revenues. These outcomes disproportionately affect working families and local economies that rely on the sector for their livelihood.

Fig. 2. Pictured during its initial tow-out in June from the assembly yard at the Port of Argentia, the West White Rose platform base and related projects are supporting hundreds of upstream jobs in Newfoundland and Labrador. Image: Allseas.

Market factors. According to the International Energy Agency, oil demand is up again in 2025. The IEA also notes that oil and gas companies spend about half a trillion dollars annually, just to maintain current production levels. Growth opportunities tend to focus on increasing maximization from mature fields. But an increasing number of countries are looking to take advantage of heretofore untapped reserves that technical and computing innovation have made accessible. Many of these enhancements have been developed in Canada. If the federal government follows through on its promises to encourage development, the Canadian industry is poised to become a leading exporter of knowledge and innovation, in addition to oil, gas, and other hydrocarbons.

The opportunities are legion: Europe is looking to eliminate its dependance on Russian natural gas, Japan is increasing its LNG tanker fleet by 50%, and Mexico is fully committed to boosting its LNG capabilities. Many of these growing markets would jump at the chance to buy their critical energy supplies from Canada. With its political stability, commitment to environmentally sustainable practices, and technical innovation, the opportunities could benefit Canada and its allies for decades.

Meeting the global demand for natural gas would mean high-paying jobs at home and stronger alliances abroad. Pragmatism and real-world problem solving are driving Canadian governments to responsibly take advantage of the country’s rich resources.

Fig. 3. The first cargo departs LNG Canada in Kitimat, British Columbia, June 30, 2025. Image: LNG Canada.

Federal priorities. Prime Minister Carney, acknowledging that it is almost impossible to build major infrastructure projects under the current rules, announced in September that it was time to “get out of the way,” and promote what he calls “nation-building projects.” A Major Projects Office will be established in Calgary, and the federal government released an initial list of five projects to be fast-tracked:

Phase two of LNG Canada in Kitimat, B.C., doubling its production of LNG, 3.

The Darlington New Nuclear Project in Clarington, Ont., which will make small modular reactors.

Contrecoeur Terminal Container Project, to expand the Port of Montreal.

The McIlvenna Bay Foran Copper Mine Project in Saskatchewan.

Expanding the Red Chris Mine in northwestern B.C.

Pipelines are key. But critics were quick to point out that the list does not include any pipelines, which are critical to expanding access to overseas markets and decreasing dependance on foreign crude and natural gas in Eastern Canada. Until clear progress has been made, Canadian producers will continue to face an uphill climb attracting capital, which has fallen to historical lows over the past decade.

The future of Canada’s oil and gas pipelines is marked by both uncertainty and opportunity. Projects, such as the Trans Mountain Pipeline Expansion and Enbridge Line 3 Replacement, demonstrate ongoing investment and confidence, increased export capacity, and economic benefits for the country.

The interest is there, and the ongoing trade war with the U.S. has underscored how vulnerable Canada is to its southern neighbor and highlighted how important and challenging achieving energy self-sufficiency would be. And there is some hope this is achievable, given the federal government’s recent moves.

But experts warn that even with the support of the federal government, any new pipelines will take at least five years to go from the application stage to operational, and that is a best-case scenario, Fig. 4. For the time being, there is little interest from transportation companies in pursuing new projects, particularly those that must cross Quebec, which has stated that it would oppose any proposal for a pipeline that crosses its borders.

Fig. 4. In the best of cases, any new pipeline will take at least five years to go from the application stage to operational. Image: Canada Energy Regulator.

In July, the federal government announced $21.5 million in funding for five Alberta carbon capture, utilization and storage (CCUS) projects, funded under the Energy Innovation Program. It also put out a call for CCUS technology proposals.

Bad legislation needs an overhaul. Meanwhile, Carney has not indicated if his government is ready to reconsider policies and legislation that target the industry, including Bill C-69, which makes building large-scale projects, like pipelines, almost impossible; the West Coast offshore moratorium on oil tankers; aggressive climate policies on carbon dioxide (CO2) reductions and mandated electric car production targets; and the notorious Bill C-59, passed just over a year ago.

Critics warn that these policies risk ceding competitive advantage to countries with less stringent regulations, potentially resulting in increased imports and higher global emissions. Furthermore, undermining domestic oil and gas production threatens Canada’s energy security, making the country more vulnerable to external market shocks and price volatility.

Bill C-59 is an excellent example. It requires that any claims made about the environmental benefits of products or technologies must be proven in accordance with “international standards.” It is unknown which standards are referenced, although they clearly would not favor hydrocarbon producers.

The penalties for not meeting the unknown standards are substantial: up to $10 million for the first offense and up to $15 million for a second. In addition, starting in 2025, activists can bring claims against oil and gas companies for “greenwashing,” a.k.a. having the audacity to publish results from emissions reduction efforts. In response, many oil and gas companies pulled all environmental reporting from their websites and publications. In August 2025, a shareholder advocacy group filed a greenwashing complaint with the Alberta Securities Commission, claiming Cenovus Inc. and Enbridge Inc. have issued misleading environmental disclosures.

Production. Nonetheless, production continues to rise. According to the IEA, Canadian oil supply increased to a record high of 6.5 MMbpd in July 2025 and is projected to average 6.3 MMbpd for the year, an increase of 190,000 bpd over 2024 levels. In 2026, the IEA projects more modest growth of 70,000 bpd.

The uptick in production has not been matched in a number of key areas, including drilling, land sales, and spending. With the unpredictability of the American government and its tariff crusade, costs rising, and subdued market prices, it’s a mixed bag for the Canadian industry in 2025.

M&A activity. On the mergers and acquisitions front, activity through the first half of the year vastly exceeded projections, topping the C$20 billion mark, as well as last year’s total. Consolidation is the theme in 2025, as the industry battles low commodity prices, environmental policies, and access to capital. In response, some operators are looking to take advantage of a buyers’ market, as others focus their spending on core assets.

Notable transactions include:

In April 2025, Enbridge and Pembina Pipeline Corporation agreed to merge their midstream operations in Western Canada. This all-share transaction, valued at $12 billion, created one of the largest pipeline and midstream entities in North America.

Tourmaline Oil acquired Birchcliff Energy in a C$1.8 billion cash and stock deal in May 2025 expanding Tourmaline’s presence in the Montney and Peace River regions, adding significant natural gas reserves and production.

Canadian Natural Resources Limited (CNRL) acquired Kelt Exploration in July, for C$1.2 billion, adding unconventional oil and gas assets in the Montney formation.

And in August 2025, Whitecap Resources acquired Tamarack Valley Energy for $950 million, further consolidating its position as a leading light oil producer in Western Canada.

Still pending is the proposed C$7.9 billion offer from Cenovus Energy to acquire MEG Energy Corp. Strathcona Resources Ltd., which holds just over 14% of MEG shares, had submitted its own offer in early September, but that offer was subsequently rejected by MEG’s board of directors. A shareholders’ vote on the Cenovus offer is scheduled to take place in early October.

Capital spending. Second-quarter results indicate that overall, spending is up slightly over last year, with combined second-quarter expenditures hitting a ten-year high. Canadian Natural Resources Limited leads the way, with spending pegged at just over C$6 billion this year, up approximately 12% over last year’s $5.4 billion. Suncor Energy plans to spend C$5.8 billion this year, down 9.4% from $6.4 billion in 2024; Cenovus Energy Inc. is on track to maintain its capital program at C$4.8 billion, almost unchanged from last year’s $4.75 billion.

Other notables include Tourmaline Exploration Inc., which has increased spending by just under 37%, to C$2.98 billion ($2.18 billion in 2024), and Imperial Oil Limited, up 17.6% at $2 billion ($1.7 billion in 2024). Whitecap Resources Inc. doubled its spending this year, at $2 billion ($1 billion last year), and ARC Resources Ltd. increased spending 5.6%, to $1.9 billion ($1.8 billion in 2024).

Land sales. Crown land sales across Western Canada regressed from 2024 levels in the first half of this year, coming in at just C$188 million, down over 37% from C$300 million. Alberta brought in $131.6 million ($491.93 per hectare) dropping by just over 50% from $263.7 million ($794.76/ha) in 2024.

Fig. 5. Canadian drilling was up slightly during first-half 2025, but the question is whether that trend can last through the entire year. Image: Precision Drilling.

British Columbia is back on track, after resuming land sales in December 2024. BC halted dispositions in June 2021, after the Blueberry River First Nations successfully argued that the provincial government breached the treaty agreement signed over 120 years ago by permitting development without the community’s approval. BC collected $31.83 million in the first half of 2025 ($3,122.90/ha).

Saskatchewan garnered $24.15 million ($640.93/ha), a drop of almost 27% versus $32.9 million ($763.95/ha) in 2024. And Manitoba collected $422,000 ($118.42/ha) in the first half, compared to $29,000 ($85.86/ha), an increase of more than 1,350%.

Drilling totals are up slightly, compared to 2024 mid-year totals, with 1,994 wells drilled in the first half of this year, a 3.7% increase from 1,923, according to Daily Oil Bulletin records, Fig. 5. This included 1,180 wells drilled in Alberta, down 11% from 1,331 last year, 520 wells in Saskatchewan, up 6% from 489 in 2023, 144 wells drilled in British Columbia, a 31% decrease from 208, while four wells were completed in Newfoundland, compared to zero in 2024, and no wells were completed in Manitoba, the same as the year previous.

Heavy oil plays dominated Canadian drilling activity in the first half of 2025, with operators increasingly deploying open-hole multilateral wells across formations beyond the Clearwater, with 1,142 lateral legs drilled. However, the Waseca and Sparky Members of the Mannville Group totaled 1,218 lateral legs. The Bluesky formation also saw considerable multilateral drilling, with 459 lateral legs.

World Oil survey results paint a slightly bleaker picture for 2025, with projections coming in below 2024 levels. The Canadian Association of Petroleum Producers is forecasting a total of 5,610 wells drilled this year, down 2.8% from 5,769 in 2024. Saskatchewan is more optimistic, projecting a modest 1.5% increase this year to 1,300 wells drilled, versus 1,281 last year.

Meanwhile, the Canadian Association of Energy Contractors is sticking with its original November 2024 drilling forecast of 6,604 wells drilled in 2025—an increase of 448 (+7.3%) from 2024 (6,156).

(Mr. Curran is a Calgary-based freelance writer.)

Related Articles

FROM THE ARCHIVE