Report Overview

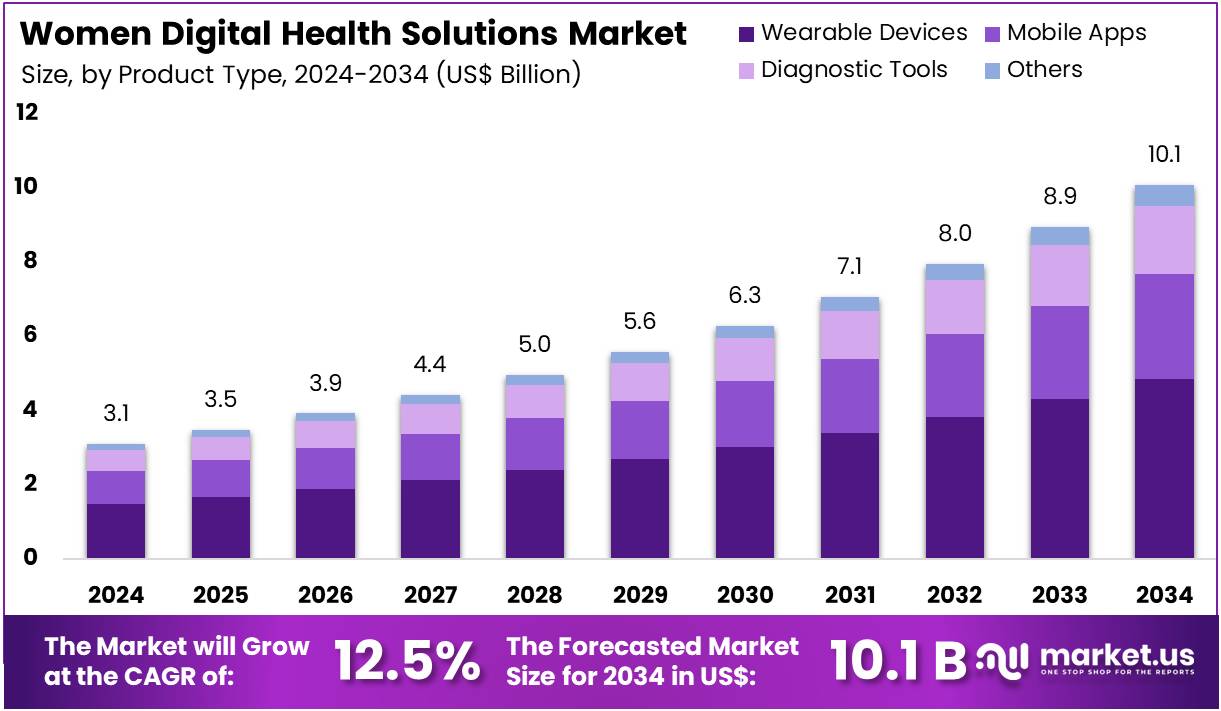

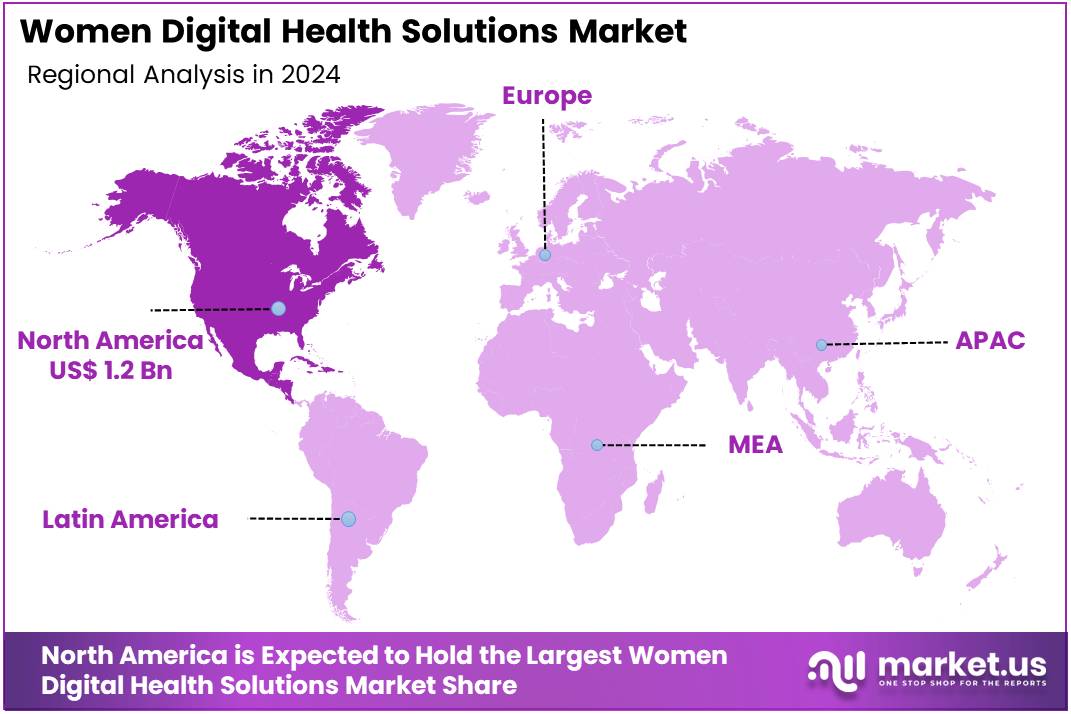

The Women Digital Health Solutions Market Size is expected to be worth around US$ 10.1 billion by 2034 from US$ 3.1 billion in 2024, growing at a CAGR of 12.5% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 38.4% share and holds US$ 1.2 Billion market value for the year.

Increasing awareness of gender-specific health needs and the rising prevalence of chronic conditions among women are key drivers for the women’s digital health solutions market. Women often have unique health journeys, including menstruation, fertility, pregnancy, and menopause, that require specialized care. However, a 2022 survey from the National Center for Health Statistics found that women were more likely than men to use telemedicine, highlighting their strong engagement with digital healthcare. This trend demonstrates a significant demand for digital health tools that provide convenient and personalized solutions for managing various aspects of women’s health.

Growing opportunities are emerging from the shift toward integrated and data-driven healthcare, as exemplified by strategic partnerships and corporate ventures. The September 2022 merger of Thirty Madison and Nurx, which combined their platforms to serve around 750,000 patients, demonstrates a trend toward creating comprehensive ecosystems that offer a full range of telehealth services, from reproductive health to mental wellness.

Similarly, AstraZeneca’s November 2023 launch of Evinova, a health-tech business, highlights a corporate focus on using advanced data analytics and digital platforms to make clinical trials more inclusive and to address women’s unique health needs. This emphasis on leveraging technology and data is paving the way for more tailored and effective health solutions.

The market is also witnessing a trend toward expanding applications beyond reproductive health into broader areas such as mental wellness and chronic disease management. For instance, digital platforms are providing resources for stress management and therapy to address the higher rates of emotional distress among women.

Research from the World Health Organization (WHO) in 2024 revealed that 1 in 3 women worldwide have experienced physical and/or sexual violence, highlighting a significant mental and physical health issue that digital solutions can help address through accessible support services. These applications are empowering women to take a more active role in their health and are creating a more holistic approach to women’s wellness.

Key Takeaways

In 2024, the market generated a revenue of US$ 3.1 billion, with a CAGR of 12.5%, and is expected to reach US$ 10.1 billion by the year 2034.

The product type segment is divided into wearable devices, mobile apps, diagnostic tools, and others, with wearable devices taking the lead in 2023 with a market share of 48.2%.

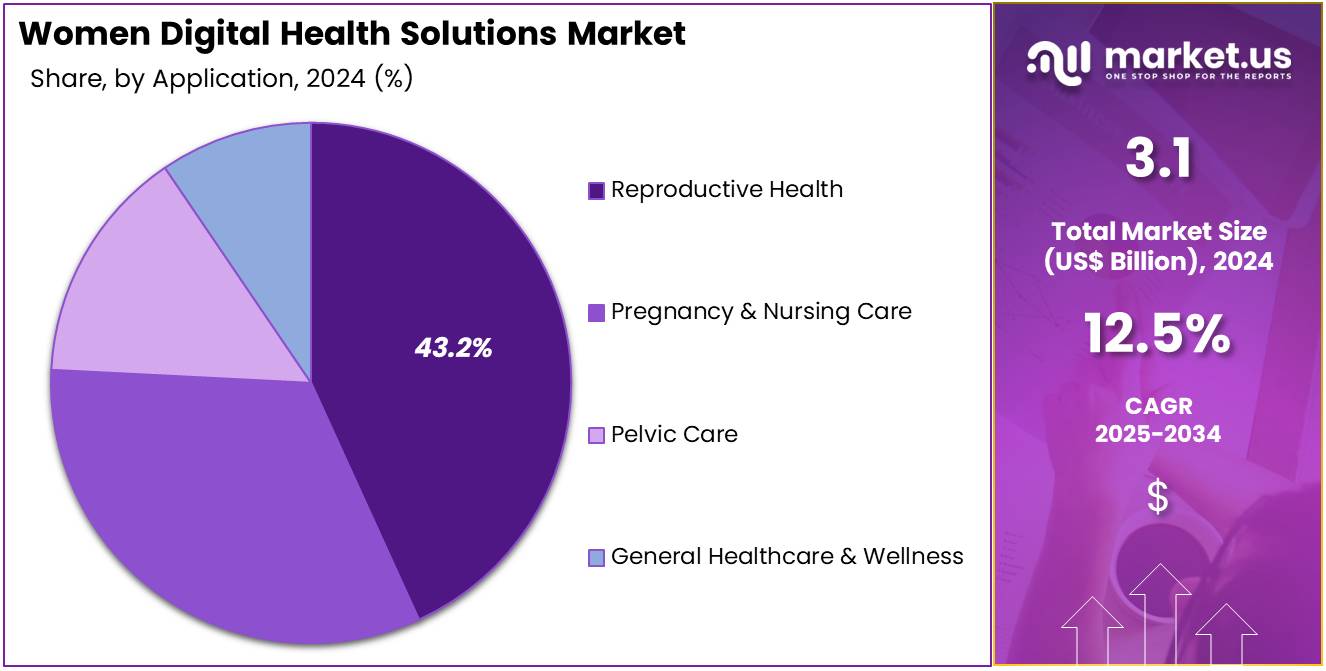

Considering application, the market is divided into reproductive health, pregnancy & nursing care, pelvic care, and general healthcare & wellness. Among these, reproductive health held a significant share of 43.2%.

North America led the market by securing a market share of 38.4% in 2023.

Product Type Analysis

Wearable Devices holds the largest share at 48.2%. The growing demand for real-time monitoring of health parameters and fitness levels is driving the adoption of wearable devices. Consumers increasingly rely on wearables to track daily health metrics, from physical activity to sleep patterns, and specific health conditions, such as reproductive health. These devices are expected to expand due to technological advancements, including the integration of AI and more sophisticated sensors.

Additionally, wearables’ growing compatibility with mobile applications that provide personalized health data insights is anticipated to further accelerate market growth. The rising awareness around women’s health issues and the need for personal health management have led to the rapid expansion of wearables in the digital health space.

Application Analysis

Reproductive Health is anticipated to continue leading the market with a share of 43.2%. The increasing focus on women’s health and the ability of digital solutions to track fertility, menstrual cycles, and other reproductive parameters is contributing to the growth of this segment. With the rise in women choosing digital health solutions for more informed reproductive healthcare decisions, the demand for mobile apps and wearables dedicated to reproductive health is expected to grow.

The increased use of fertility-tracking devices and apps in combination with growing awareness about conditions like polycystic ovary syndrome (PCOS) is projected to drive adoption further. Additionally, the ongoing push for personalized healthcare and the increasing preference for non-invasive methods of monitoring reproductive health have positioned this segment as a major growth area.

Key Market Segments

By Product Type

Wearable Devices

Mobile Apps

Diagnostic Tools

Others

By Application

Reproductive Health

Pregnancy & Nursing Care

Pelvic Care

General Healthcare & Wellness

Drivers

The increasing focus on women’s health is driving the market

The growing awareness and de-stigmatization of women-specific health issues are a key driver for the Women’s Digital Health Solutions market. Historically, many aspects of women’s health, from menstruation to menopause, have been underserved by traditional healthcare and research.

Digital health solutions, often referred to as “FemTech,” are bridging this gap by providing discreet, accessible, and personalized tools for women to manage their health. These solutions empower women to track their cycles, monitor fertility, and manage symptoms related to conditions like polycystic ovary syndrome (PCOS) or endometriosis. This is particularly relevant given the prevalence of chronic conditions that affect women.

For example, a 2024 analysis by the Australian Institute of Health and Welfare found that around two-thirds (65%) of endometriosis-related hospitalizations took place in a private hospital. Digital health platforms are providing new avenues for support and information for these conditions. As women become more informed and proactive about their health, the demand for digital tools that address their unique needs throughout their life stages—from adolescence through pregnancy to menopause-is consistently growing.

Restraints

The lack of insurance coverage and high costs are restraining the market

Despite the clear benefits, the high cost of women’s digital health solutions and the lack of comprehensive insurance coverage are significant restraints on market growth. Many innovative digital health products, such as specialized wearable devices for fertility tracking or subscription-based apps for menopause management, come with a high price tag that is often not covered by traditional health insurance plans. This financial barrier makes these solutions inaccessible to a large portion of the population.

A 2024 survey by the Consumer Technology Association found that among women aged 50 and over, 32% identified the high cost of healthcare as a challenge to obtaining care. This issue is compounded by the fact that many insurers are hesitant to cover these solutions due to a lack of clinical evidence supporting their cost-effectiveness or a general unfamiliarity with the technology.

A study in the Journal of Managed Care & Specialty Pharmacy in 2024 found that payers were uncertain if reimbursement should go through medical or pharmacy benefits, highlighting the confusion in the industry. As a result, many women who could benefit from these technologies are unable to afford them, which limits the market’s full potential.

Opportunities

The expansion of telehealth for women’s health is creating growth opportunities

The rapid expansion of telehealth services is creating a significant opportunity for the Women’s Digital Health Solutions market. Telehealth platforms provide a convenient and private way for women to access medical advice, consultations, and prescriptions without the need for an in-person visit. This is particularly beneficial for sensitive issues like reproductive health, mental health, and chronic condition management, which women may prefer to discuss from the comfort of their homes.

According to a 2024 analysis, the adoption rate of reproductive health and fertility apps in Germany was 20.8%, demonstrating a clear preference for digital access to these services. Telehealth allows for a more personalized and continuous care model, as it facilitates remote monitoring and follow-ups.

The integration of digital health apps and wearable devices with telehealth platforms enables healthcare providers to have a more holistic view of a patient’s health in real time, leading to more informed and timely clinical decisions. This convenience and accessibility are breaking down traditional barriers to care and attracting a broader user base.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical pressures shake up the women’s digital health market, pushing leaders to tackle tight budgets while seizing growth opportunities. Global inflation squeezes clinic funds, delaying rollouts of fertility tracking apps and wearable cycle monitors. Economic slumps in Latin America and the Middle East limit investment in AI tools for menopause care. US-China trade clashes and Arctic supply disruptions raise costs for sensors and data chips vital to these platforms.

Cyber threats from hostile states and inconsistent EU privacy rules slow global app launches. Yet, with 190 million women worldwide facing endometriosis per WHO, demand for digital solutions surges. Companies pivot to Nordic suppliers and blockchain security, sparking innovations that boost women’s health and market strength.

US tariffs stir the women’s digital health market by hiking costs but sparking local innovation. September 2025 tariffs-10% on global imports, 35% on Canadian tech-drive up prices for chips powering ovulation trackers, pinching profits for firms like Flo Health. Clinics delay app upgrades, fragmenting maternal care access.

EU and Mexican counter-tariffs disrupt diagnostic device supplies, hitting underserved areas hardest. Budgets shift from AI enhancements to tariff costs, stressing global supply chains. But tariffs fuel US manufacturing, tapping BioSecure grants to create jobs and secure platforms. Partnerships with local tech firms build cost-effective, private solutions. By securing key exemptions, the industry turns challenges into drivers of growth and women-focused care.

Latest Trends

The rise of menopause and perimenopause solutions is a recent trend

A prominent trend in the women’s digital health solutions market is the rapid emergence and growth of products focused on menopause and perimenopause. Historically, this life stage has been underserved by healthcare technology, but a new wave of digital solutions is now addressing the unique symptoms and challenges associated with it. These platforms offer a range of features, including symptom tracking, personalized lifestyle recommendations, access to telehealth consultations with menopause specialists, and community support forums.

A 2024 report by Healthcare IT Today highlighted that while menopause affects nearly 27 million women in the US workforce, only 7% of FemTech startups were previously focused on this area, indicating a significant untapped market. This trend is fueled by a combination of factors: an aging population, a growing willingness among women to openly discuss menopause, and increased investment in this long-neglected segment of women’s health. The focus on menopause is a testament to the market’s maturity, moving beyond a sole focus on fertility and pregnancy to address the complete spectrum of a woman’s health journey.

Regional Analysis

North America is leading the Women Digital Health Solutions Market

In 2024, North America secured a 38.4% share of the global women digital health solutions market, driven by escalating investments in remote monitoring tools for reproductive and maternal care amid rising infertility rates and postpartum support needs. Healthcare providers adopted AI-powered apps for cycle tracking and fertility prediction, enabling personalized interventions that enhance conception success and early risk detection in diverse patient demographics.

The FDA’s expedited pathways for software-based diagnostics bolstered adoption, instilling regulatory assurance in platforms offering virtual consultations for menopause symptom management. Collaborative programs between nonprofits and developers refined multilingual interfaces, addressing cultural barriers in immigrant communities through evidence-based behavioral coaching.

Post-pandemic telehealth expansions amplified demand for wearable integrations that monitor gestational diabetes, reducing maternal complications via real-time alerts to obstetric teams. Economic evaluations highlighted substantial savings from averted emergency visits, prompting insurers to expand coverage for subscription-based wellness modules.

Venture ecosystems nurtured startups focusing on endometriosis pain trackers, aligning with federal equity goals for underrepresented groups. These advancements cemented the region’s pioneering role in empowering female-centric virtual care ecosystems. The HHS Office on Women’s Health budget rose from US$ 35.1 million in FY2022 to US$ 44 million in FY2024, supporting initiatives in digital tools for preventive women’s health services.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts project the Asia Pacific women digital health solutions sector to expand vigorously during the forecast period, as governments confront widening gender health gaps through targeted tech deployments in populous emerging economies. National authorities in India and Indonesia allocate resources to mobile platforms for prenatal tracking, equipping midwives with data-driven alerts to curb neonatal mortality in rural enclaves.

Pharmaceutical firms partner with local innovators to develop AI chatbots for PCOS management, anticipating higher compliance rates among young urban professionals. Innovation hubs in Seoul and Mumbai pioneer blockchain-secured apps for breast cancer screening reminders, positioning community centers to facilitate timely mammograms across socioeconomic strata.

Regional coalitions invest in low-data fertility apps for low-connectivity zones, empowering adolescents with education on menstrual hygiene and contraception. China’s health commissions prioritize genomic-linked wearables for hereditary disorder screening, integrating them with public registries to accelerate familial counseling.

Japan advances VR-based pelvic floor therapy modules, synchronizing with insurance reimbursements for postpartum recovery. These strategies forge a foundation for accessible, stigma-free female health advancements. India’s Ayushman Bharat Digital Mission created 71.52 crore health accounts by 2024, enabling widespread digital access to women’s preventive and reproductive services.

Key Regions and Countries

North America

Europe

Germany

France

The UK

Spain

Italy

Russia

Netherland

Rest of Europe

Asia Pacific

China

Japan

South Korea

India

Australia

New Zealand

Singapore

Thailand

Vietnam

Rest of APAC

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

South Africa

Saudi Arabia

UAE

Rest of MEA

Key Players Analysis

Leading firms in the women’s digital health arena propel expansion by developing AI-enhanced apps that track cycles, fertility, and menopause symptoms to deliver personalized wellness advice. They execute mergers and collaborations with healthcare providers to integrate diagnostic tools and broaden service offerings for reproductive care. Companies invest aggressively in R&D to incorporate wearables and telehealth features, improving accessibility for chronic conditions like PCOS.

Leaders form alliances with global investors and tech partners to accelerate product launches and regulatory compliance. They penetrate high-potential regions such as Asia-Pacific and Europe, customizing platforms to address local cultural and data privacy norms. Additionally, executives roll out premium subscription tiers with community forums and expert consultations to enhance user engagement and lock in recurring revenue.

Flo Health, founded in 2015 and headquartered in London with operations in Riga, Latvia, builds a leading mobile app that empowers women with cycle tracking, ovulation predictions, and health insights across reproductive stages. The platform supports users from menstruation to menopause, offering symptom logging, educational resources, and private chats for community support.

Flo prioritizes data privacy through features like Anonymous Mode, ensuring secure, encrypted experiences amid past regulatory scrutiny. CEO Yulia Gorbunova guides a team focused on evidence-based innovations and global scalability in over 20 languages. The company partners with clinicians to provide actionable reports that aid in consultations and early detection. Flo reinforces its market leadership by blending user-centric design with advanced AI to foster informed, proactive health management.

Top Key Players in the Women Digital Health Solutions Market

UE LifeSciences Inc

Thirty Madison

NURX Inc

Natural Cycles USA Corp

MobileODT Ltd

Lucina Health

Chiaro Technology Ltd

Biowink GmbH

HeraMED

Allara Health

Recent Developments

In March 2025: Arva Health secured US$1 million in pre-seed investment to advance affordable reproductive healthcare in India. This funding supports the expansion of digital health solutions for women’s reproductive care, offering affordable, accessible services, which addresses a growing demand for digital health solutions in emerging markets.

In January 2025: Allara Health raised US$38.5 million in Series B investment to expand its virtual women’s healthcare platform. The investment will help scale hormonal healthcare solutions across the US, advancing the women’s digital health market by making specialized, remote healthcare more widely available and accessible to women nationwide.

In June 2024: HeraMED introduced HeraCARE within Telstra Health’s Smart Connected Care ecosystem, targeting GP clinics. This move strengthens the digital healthcare landscape by offering accessible, remote monitoring solutions for expectant mothers, contributing to the growth of the women’s digital health market by enhancing healthcare accessibility and providing real-time data-driven insights.

In March 2024: HeraMED partnered with FemBridge to develop a scalable and comprehensive maternity care solution for expectant mothers. This collaboration drives the women’s digital health market by addressing the diverse needs of maternity care through innovative digital health technologies that streamline care delivery, reduce costs, and improve patient outcomes.

In May 2023: HeraMED entered into a three-year partnership with Joondalup Obstetrics and Gynaecology Group (JOGG) to deploy HeraCARE for managing 120 pregnancies annually. This collaboration drives the women’s digital health solutions market by expanding the use of connected health technology in maternity care, enabling personalized and continuous monitoring for expectant mothers.

Report Scope