Bitcoin faces pressure amid $3.2bn liquidation wave

Bitcoin continued its decline last week, driven by US dollar strength, diminished risk appetite, and significant liquidations of long positions.

Bitcoin spot exchange-traded funds recorded $897 million in net outflows between 22 and 26 September according to Coinglass. The cryptocurrency data analysis platform revealed liquidations of long positions exceeding $3.2 billion during the same period, indicating substantial market deleveraging. Options worth $22 billion expiring on 26 September contributed additional price volatility.

The options market lacks clear directional consensus, with open interest on the most popular call option expiring 3 October targeting the $122,000 level, whilst bearish positioning anticipates the cryptocurrency declining below either $105,000 or $100,000 on Deribit.

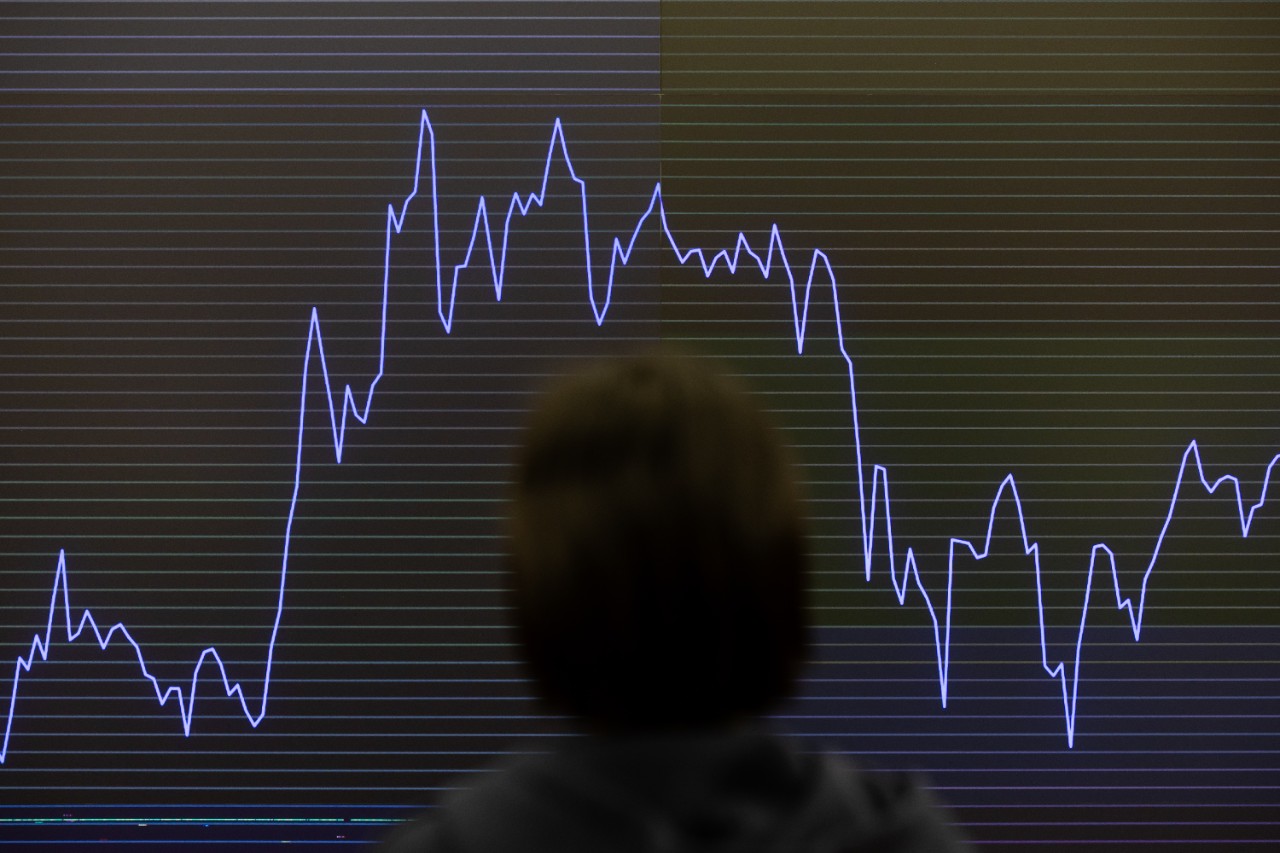

Following the breach below the 100-day MA, Bitcoin’s technical momentum further deteriorated, with the moving average convergence divergence (MACD) indicator crossing into negative territory. This movement confirms our previous analysis identifying Bitcoin’s entry into Wave C under Elliott Wave theory, with $107,232 serving as critical support. A rebound above this support level could potentially return Bitcoin to the recent high of $117,877. Conversely, failure to maintain support opens the possibility of testing the 200-day MA at around $104,300.

Figure 3: Bitcoin (daily) price chart