U.S. Artificial Corneal Implants Market Summary

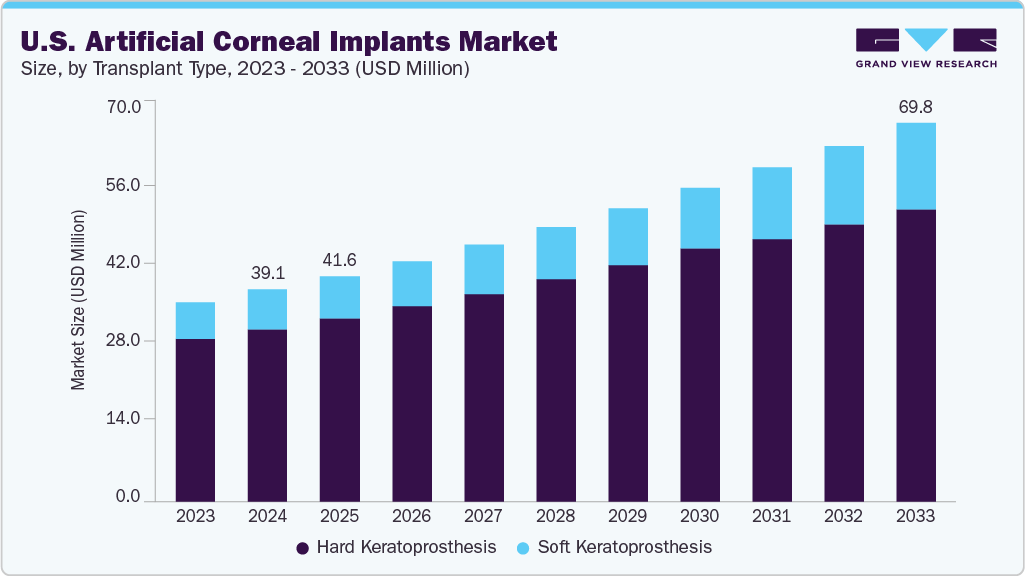

The U.S. artificial corneal implants market size was estimated at USD 39.1 million in 2024 and is projected to reach USD 69.8 million by 2033, growing at a CAGR of 6.7% from 2025 to 2033. The market is driven by an increasing prevalence of corneal disorders such as corneal blindness and a shortage of cornea donors, which is leading patients and surgeons to seek synthetic alternatives.

Key Market Trends & Insights

By transplant type, the hard keratoprosthesis held the highest market share of 81.4% in 2024.

By indication, the keratoconus segment held the highest market share of 33.2% in 2024.

By implant type, the synthetic segment held the highest market share of 93.7% in 2024.

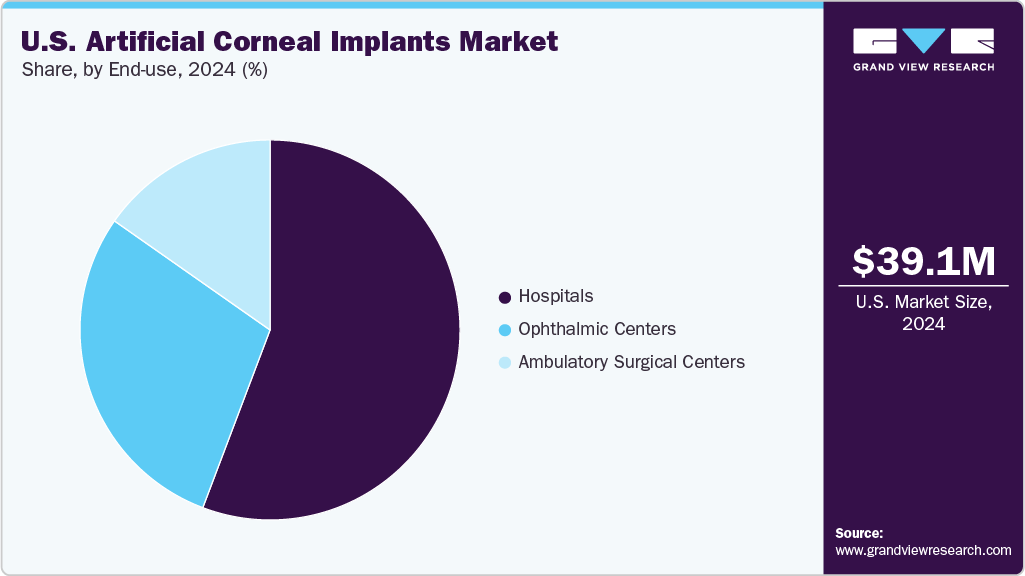

By end-use, the hospital segment held the largest revenue share in 2024.

Market Size & Forecast

2024 Market Size: USD 39.1 Million

2033 Projected Market Size: USD 69.8 Million

CAGR (2025-2033): 6.7%

The market is driven by increasing incidences of Keratoconus, Stevens-Johnson syndrome, and corneal scarring, which remain leading causes of vision impairment. The increasing prevalence of these disorders among the aging U.S. population has further increased the need for effective treatment solutions. According to the National Council on Aging, in 2022, the U.S. had 57.8 million adults aged 65 and older, comprising 31.9 million women and 25.9 million men.

To address this demand, key market participants invest heavily in R&D, securing regulatory approvals, and collaborating with clinical and academic institutions to introduce innovative implant solutions. Strategic initiatives, including partnerships, geographic expansion, and integration of advanced biomaterials, enhance their competitive positioning and expand market reach. In January 2025, Pantheon Vision collaborated with Eyedeal Medical to advance production and commercialization of its bioengineered corneal implant. Pantheon completed three FDA review meetings for Premarket approval (PMA) guidance. The partnership aimed to address limitations of donor corneas by offering bioengineered corneal implants and restoring vision in patients with corneal blindness.

Transplant Type Insights

The hard keratoprosthesis segment dominated the market with a revenue share of 81.4% in 2024. The segment is driven by the increasing prevalence of advanced corneal disorders where conventional transplantation often fails. Limited donor cornea availability further accelerates the need for synthetic alternatives, positioning keratoprosthesis as a reliable option.

The soft keratoprosthesis segment is expected to grow at the fastest CAGR of 9.4% over the forecast period. This increasing disease burden has strengthened the need for advanced therapeutic solutions, such as artificial corneal implants. Recent developments and regulatory milestones are further supporting market growth

Indication Insights

The keratoconus segment held the largest revenue share in 2024. The market is driven by the increasing prevalence of keratoconus in the U.S. According to the Cornea Research Foundation of America, Keratoconus affects an estimated 50 to 200 individuals per 100,000 globally. In the U.S., a study reported a prevalence rate of 54.5 cases per 100,000 population. This rising disease burden has created a significant demand for advanced treatment options, particularly artificial corneal implants, which offer effective visual rehabilitation in patients with insufficient conventional therapies such as contact lenses or corneal cross-linking.

The ocular cicatricial pemphigoid (OCP) segment is expected to grow at the fastest CAGR over the forecast period. OCP is a rare, chronic autoimmune disorder characterized by progressive scarring of the ocular mucous membranes, particularly the conjunctiva. If left untreated, it can result in substantial visual impairment. According to a 2024 review article published in the Annals of Eye Science Journal, the reported incidence of OCP in ophthalmology patients ranges from 1 in 8,000 to 1 in 46,000, highlighting its clinical significance in managing advanced ocular diseases.

Implant Type Insights

The synthetic segment held the largest revenue share in 2024 and is anticipated to experience the fastest CAGR over the forecast period.The segment is driven by a shortage of donor corneas, with millions of patients awaiting transplants and increasing investments by key players in the industry. In March 2021, EyeYon Medical secured USD 25 million in funding to advance the development of its flagship product, EndoArt, the world’s first synthetic corneal implant. The investment was anticipated to support the expansion of ongoing clinical trials and enable the company to pursue regulatory approvals in the U.S., China, and Europe.

The biosynthetic segment is expected to register significant growth for the forecast period. The segment is driven by increasing technological advancements, the rising prevalence of conditions such as keratoconus and corneal edema, and an aging population increasingly susceptible to degenerative eye diseases. These implants, engineered from advanced biomaterials and cellular technologies, address the critical shortage of donor corneas while offering consistency, reduced risk of immune rejection, and faster recovery times.

End-use Insights

The hospital segment held the largest revenue share in 2024. The market is driven by an increasing prevalence of corneal diseases, limited availability of donor tissue, and advances in implant technology that have improved safety and outcomes.

The ambulatory surgical centers segment is expected to grow at the fastest CAGR over the forecast period, owing to a shift toward outpatient care, with ASCs offering lower costs and greater efficiency than hospitals. Limited donor cornea availability has increased reliance on artificial implants, while advancements in device design and surgical techniques have improved outcomes and reduced risks, making outpatient settings clinically feasible.

Key U.S. Artificial Corneal Implants Company Insights

Some prominent players in the U.S. artificial corneal implants market include CorneaGen, KeraMed, Inc., and Alcon Inc.

CorneaGen is a U.S.-based company that advances corneal care through transplantation and artificial implant solutions. The company emphasizes surgeon education, innovation in transplant techniques, and partnerships with leading academic centers to expand access to advanced corneal care across the United States.

Key U.S. Artificial Corneal Implants Companies:

CorneaGen

AJL Ophthalmic S.A.

Alcon Inc.

KeraMed, Inc.

FCI

U.S. Artificial Corneal Implants Market Report Scope

Report Attribute

Details

Revenue forecast in 2033

USD 69.8 million

Growth rate

CAGR of 6.7% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 – 2023

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Transplant type, indication, implant type, end-use

Key companies profiled

CorneaGen; AJL Opthalmic S.A.; Alcon Inc.; KeraMed, Inc.; FCI

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Artificial Corneal Implants Market Report Segmentation

This report forecasts revenue growth at country level as well as provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. artificial corneal implants market report on the basis of transplant type, indication, implant type, and end-use:

Transplant Type Outlook (Revenue, USD Million, 2021 – 2033)

Hard Keratprosthesis

Soft Keratoprosthesis

Indication Outlook (Revenue, USD Million, 2021 – 2033)

Stevens-Johnson Syndrome (SJS)

Ocular Cicatricial Pemphigoid (OCP)

Ocular burns

Keratoconus

Corneal Stromal Dystrophies

Others

Implant Type Outlook (Revenue, USD Million, 2021 – 2033)

End-use Outlook (Revenue, USD Million, 2021 – 2033)