Surgical Site Infection Control Market Summary

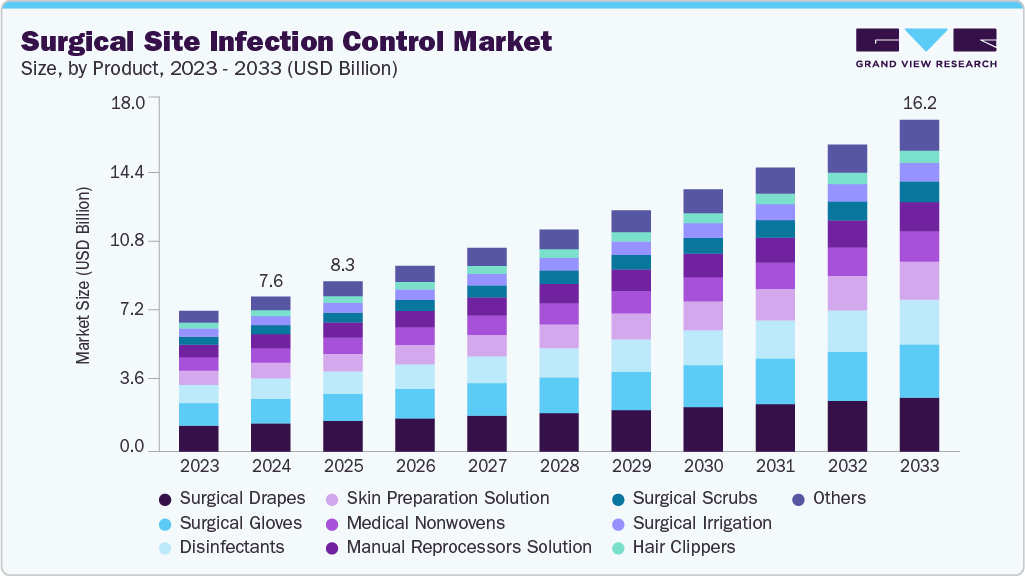

The global surgical site infection control market size was estimated at USD 7.57 billion in 2024 and is expected to reach USD 16.22 billion by 2033, growing at a CAGR of 8.73% from 2025 to 2033. This growth is attributed to the growing number of surgical procedures being conducted globally, driven by the rising incidence of chronic illnesses such as cancer, cardiovascular diseases, and diabetes.

Key Market Trends & Insights

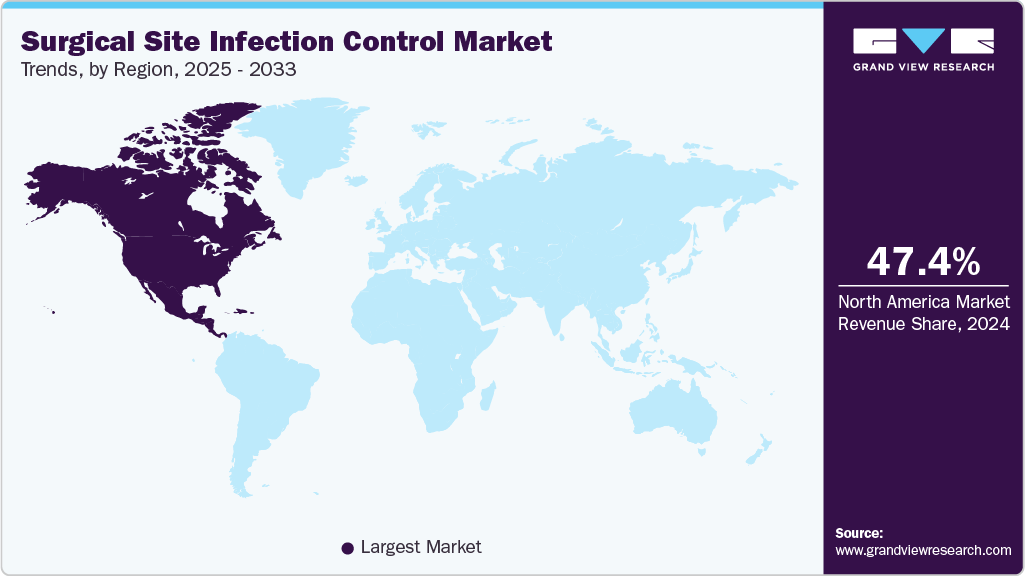

North America dominated the global surgical site infection (SSI) control market in 2024 with the largest revenue share of 47.42%.

The Mexico surgical site infection (SSI) control industry is anticipated to register the fastest CAGR from 2025 to 2033.

By product, the surgical drapes segment held the largest revenue share in 2024.

Market Size & Forecast

2024 Market Size: USD 7.57 Billion

2033 Projected Market Size: USD 16.22 Billion

CAGR (2025-2033): 8.73%

North America: Largest market in 2024

Moreover, heightened awareness among healthcare professionals and patients about the risks and complications of surgical infections has intensified the emphasis on patient safety and quality care. Innovations in technology, such as antimicrobial sutures, specialized wound dressings, and sterilization tools, are also enhancing the effectiveness of infection control strategies.

Rising Number of Surgical Procedures:

As the global population ages and conditions such as cancer, cardiovascular diseases, obesity, and diabetes become more prevalent, a growing number of individuals require surgical interventions to manage or treat these issues. For instance, in 2023, 20% of the cardiac surgeries performed at Cleveland Clinic’s Main Campus, Hillcrest, and Fairview hospitals were reoperations, meaning that one in five procedures involved patients who had already undergone previous heart surgery. This highlights the complexity and recurring nature of cardiac conditions, where initial surgeries may not fully resolve underlying issues or new complications arise over time.

This rise in surgical procedures inevitably leads to a heightened risk of infections at the surgical site, potentially resulting in complications, extended hospital stays, and increased healthcare expenses. To tackle these challenges, healthcare providers are investing in advanced infection control products and protocols to reduce the risk of surgical site infections. The growing volume of surgeries, particularly in emerging markets with developing healthcare systems, drives a critical need for effective preventive strategies. Hence, there is an increasing demand for antimicrobial dressings, sterilization equipment, and other infection control technologies, which is fueling the overall growth of the SSI control market. This trend emphasizes the vital role of infection prevention in ensuring safe surgical care and enhancing patient safety.

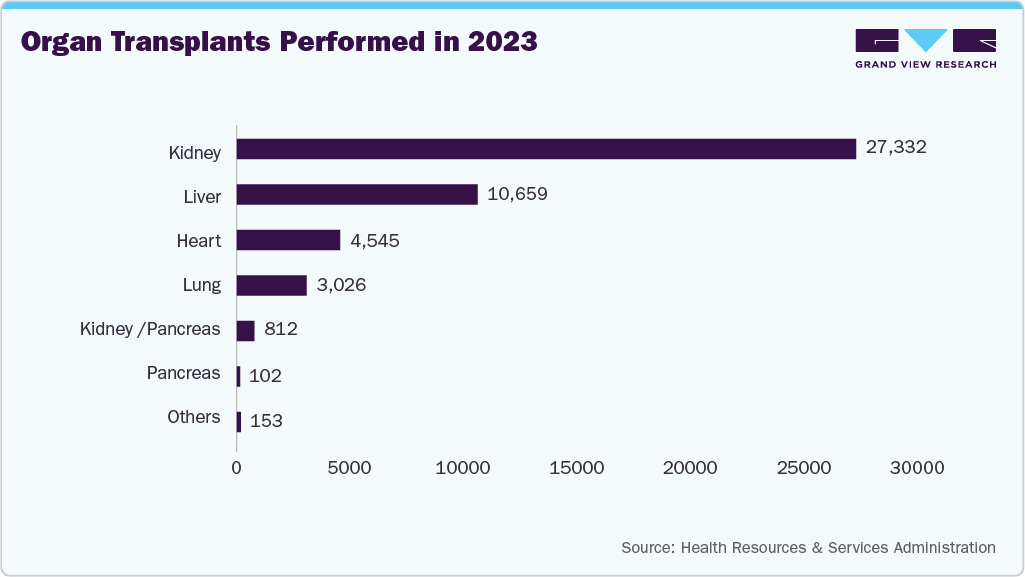

Increasing Aging Population and Rising Organ Transplants:

As people grow older, they often face chronic health issues and weakened immune systems, making them more vulnerable to infections after surgery. In addition, patients who undergo organ transplants are usually given immunosuppressive medications to prevent organ rejection, which further hinders their ability to fend off infections. These circumstances lead to a heightened risk of surgical site infections, prompting healthcare providers to implement strict infection control practices to safeguard these at-risk patients. With a global rise in life expectancy and a higher demand for organ transplants, healthcare facilities are under pressure to ensure safer surgical outcomes. As a result, there has been an increase in investment in advanced infection prevention products, technologies, and protocols, as hospitals strive to decrease infection rates, enhance patient recovery, and reduce related healthcare expenses, consequently driving growth in the SSI control market.

According to the United Nations’ World Population Prospects 2024 report published in July 2024, the global population is projected to reach about 10.3 billion by the mid-2080s, up from 8.2 billion in 2024. However, trends vary by region. In 63 countries, making up 28% of the global population, numbers have peaked or are declining due to aging populations and low birth rates, with a projected decrease of around 14% over the next thirty years. Countries such as China, Japan, and Germany are included in this group. Conversely, 48 countries, accounting for 10% of the population, are expected to see growth peak between 2025 and 2054, driven by higher birth rates and improved healthcare.

Moreover, data from the Health Resources and Services Administration published in May 2025 indicates that more than 48,000 transplants were successfully performed in 2024, offering lifesaving and life-enhancing treatments to countless patients. However, the demand continues to outpace supply, as every 8 minutes, another person is added to the transplant waiting list. In addition, over 103,000 men, women, and children are currently waiting for an organ transplant in the U.S.

Increasing Healthcare-Associated Infections (HAIs):

The increasing prevalence of HAIs is a significant factor influencing the surgical site infection (SSI) control industry. As per the National Library of Medicine study published in July 2025, HAIs present a significant challenge in hospitals across the globe, leading to increased rates of illness, fatalities, extended hospitalizations, and higher healthcare expenditures. On any given day, one in 31 hospitalized patients is impacted by at least one HAI. The World Health Organization estimates that more than 42.7 million hospitalized patients acquire HAIs each year, raising serious concerns about patient safety. In Europe, approximately 4.3 million patients are affected annually, while nearly 687,000 HAIs are reported in acute care settings in the U.S., resulting in around 72,000 deaths. The financial strain is considerable as well, with annual direct and indirect costs ranging from USD 96 to USD 147 billion in the U.S. and around USD 13 billion in Africa.

In response to the need for improved patient outcomes and reduced financial implications of these infections, hospitals and healthcare providers are placing greater emphasis on implementing strict infection control measures. This trend has led to a surge in the adoption of advanced SSI prevention tools and technologies, including antimicrobial dressings, sterilization equipment, and monitoring systems, to effectively manage and reduce the risk of infections during and after surgical procedures. Thus, the urgent need to tackle the widespread issue of HAIs is driving investment in infection control solutions, thereby propelling market growth.

Stringent Regulatory Policies and Growing Focus on Patient Safety & Quality of Care:

Healthcare organizations, governments, and insurance companies are increasingly focused on reducing postoperative complications and improving clinical outcomes. To support this effort, regulatory bodies and accreditation organizations such as the Joint Commission International (JCI), Centers for Disease Control and Prevention (CDC), and World Health Organization (WHO) have established stringent infection control guidelines that hospitals must adhere to. The launch of the WHO handbook in October 2024, on HAIs, significantly impacts the surgical site infection (SSI) control market by offering standardized definitions and guidelines for monitoring infections. This initiative helps healthcare facilities track and reduce SSIs, improve infection prevention protocols, encourage best practices, and aid hospitals in achieving global patient safety standards. Following these standards lowers the risk of surgical site infections and affects hospital ratings, funding, and overall reputation.

Moreover, in October 2024, at CAHOTECH, the Consortium of Accredited Healthcare Organizations (CAHO) launched several initiatives to enhance patient safety and infection control in India’s healthcare system. A key highlight was the iCOMPLY program, aimed at improving infection control and antimicrobial stewardship through compliance auditing, training, and best practices. Moreover, CAHO introduced the ENDOSAFE Excellence Program to improve endoscope reprocessing practices, ensuring safety standards are met. In addition, they launched the Health-Tech Excellence Forum, a platform for healthcare professionals and innovators to collaborate on technology-driven solutions for infection prevention and control.

Therefore, healthcare facilities are investing in cutting-edge SSI prevention products, such as antimicrobial sutures, sterilization technologies, and specialized wound care solutions, contributing to the expansion of the SSI control market.

Technological Advancements in Infection Control:

Advancements in technology for infection control are key factors propelling the surgical site infection (SSI) control market, as they greatly improve the effectiveness of preventive strategies in surgical settings. Innovations such as antimicrobial sutures, cutting-edge wound dressings, negative pressure wound therapy devices, and advanced sterilization equipment are helping healthcare professionals reduce the risk of infections after surgery. Moreover, the creation of sophisticated diagnostic tools and real-time infection monitoring systems allows for early detection and prompt action, further decreasing the occurrence of SSIs. These technological enhancements lead to better patient outcomes and shorten hospital stays, and lower healthcare costs, encouraging healthcare facilities to adopt more widely and drive the growth of the SSI control market.

In December 2024, People and Technology, in partnership with SNet Systems and Cisco Korea, introduced the smart infection control system. This innovative solution uses advanced IoT technology to enhance infection management in healthcare environments. It includes features such as entry management, location tracking, and epidemiological investigation, allowing facilities to better monitor and mitigate infection risks. This system reflects the increasing integration of technology in infection prevention, enabling real-time monitoring and informed decision-making to improve patient safety and reduce healthcare-associated infections.

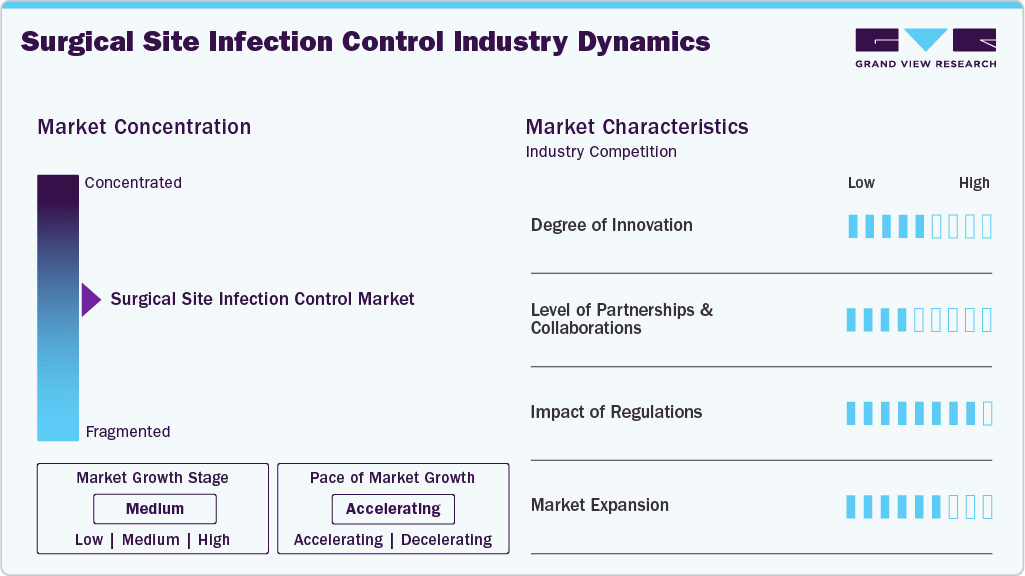

Market Characteristics & Concentration

The chart below represents the relationship between industry concentration, industry characteristics, and industry participants. There is a moderate degree of innovation, a low level of partnership & collaboration activities, high impact of regulations, and moderate expansion of industry.

Innovation in controlling SSI has progressed through advanced materials, monitoring techniques, sterilization methods, and predictive technology. Key developments include smart biomaterials such as antimicrobial sutures and implants that release or are coated with antimicrobial agents (such as Ethicon’s Plus sutures), as well as antibiotic-coated devices, including intramedullary nails to prevent colonization. Moreover, theranostic wound dressings aid in healing and sense infections, providing visual signals (such as dye pH indicators) for early intervention. There are also two-layer electrospun fibers designed to manage wound exudate while offering visual cues for infection response.

Several key players are actively engaging in partnerships & collaborations to promote growth & innovation and improve their competitiveness by combining the expertise & efforts of different organizations. For instance, Johnson & Johnson (J&J) partnered with Health First Europe (HFE) to draw attention to the substantial gaps existing between what clinical evidence recommends and what is practiced in European hospitals regarding preventing SSIs. Through a virtual roundtable convened in November 2020, they launched an HFE Insight Report titled “Identifying the gaps between evidence and practice in the prevention of surgical site infections.”

In recent years, global guidelines have been established to improve surgical practices and prevent surgical site infections (SSIs) while combating antimicrobial resistance (AMR).

The WHO’s “Global Guidelines for the Prevention of Surgical Site Infection” provides 29 evidence-based recommendations covering all surgical phases, emphasizing hygiene protocols, timely antibiotic administration, and limiting prophylactic use.

In 2020, a guideline from the University of Birmingham focused on nine essential, low-cost interventions for low- and middle-income countries, particularly in abdominal surgery.

Most recently, the 2023 “Declaration on Infection Prevention and Management in Global Surgery” urges global commitment to infection prevention and responsible antibiotic use, highlighting the importance of surveillance and education in tackling AMR.

In October 2023, Spartan Medical, Inc., a veteran-owned company, launched a campaign to raise awareness about SSIs and reduce their incidence. They are supplying innovative sterile instruments and implants to minimize contamination during surgeries, along with advanced wound care products to promote healing and reduce post-surgery infection risks. By integrating technology with evidence-based strategies, Spartan Medical aims to enhance patient safety, improve outcomes, and alleviate the financial burden of SSIs on healthcare systems.

Product Insights

The surgical drapes segment held a significant revenue share of 18.25% in 2024, due to the growing emphasis on infection prevention in operating rooms, where even minor contamination can lead to severe postoperative complications. Stricter regulatory guidelines and hospital infection control protocols mandate the adoption of sterile barrier products such as drapes to minimize SSI risks. Moreover, technological advancements such as antimicrobial-coated and fluid-repellent drapes enhance protection and efficiency, further driving their uptake. The rising economic burden of SSIs, coupled with growing awareness about patient safety and hospital-acquired infections, also strengthens the market demand for surgical drapes as a critical component of infection control strategies.

The skin preparation solution segment is expected to grow at the fastest CAGR during the forecast period. This growth is attributed to the rising incidence of HAIs and the increasing volume of surgical procedures worldwide. With SSIs being one of the most common and costly postoperative complications, hospitals and surgical centers are adopting advanced antiseptic formulations, such as chlorhexidine, iodine, and alcohol-based solutions, to reduce microbial load on the skin before surgery. Stringent infection prevention guidelines from organizations such as the WHO and CDC, along with government initiatives to minimize surgical complications, are further fueling demand. In addition, advances in product formulations, such as faster-acting, longer-lasting antiseptics with better skin tolerability, also contribute to the increasing adoption of skin preparation solutions in surgical settings.

Procedure Insights

The cesarean section segment held a significant share of 16.93% in 2024, due to the high risk of postoperative infections associated with this procedure. As one of the most common surgeries performed worldwide, C-sections inherently involve opening the abdominal cavity and uterus, creating significant exposure to pathogens. Rising global C-section rates, driven by factors such as maternal age, multiple pregnancies, elective procedures, and increased use of assisted reproductive technologies, further elevate the demand for effective SSI prevention strategies. Hospitals and healthcare providers are increasingly adopting advanced infection control products such as antimicrobial sutures, prophylactic antibiotics, wound protectants, and negative pressure wound therapy to reduce complications and improve maternal outcomes.

The gastric bypass segment is expected to grow at the fastest CAGR during the forecast period. This is due to the increasing prevalence of obesity and related comorbidities, which have made bariatric surgeries, particularly gastric bypass, more common worldwide. As the number of these complex surgeries rises, so does the risk of surgical site infections, driving demand for advanced infection prevention solutions such as antimicrobial sutures, wound protectants, preoperative skin preparations, and infection surveillance systems. In addition, technological advancements in minimally invasive bariatric surgery and infection-prevention protocols also support this growth by enhancing patient safety, reducing complications, and improving postoperative outcomes.

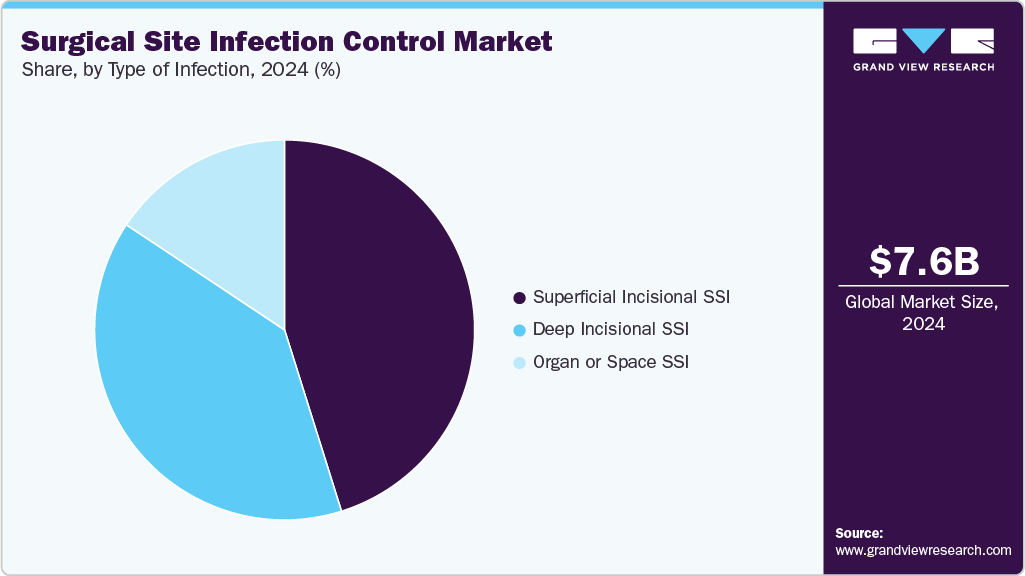

Type Of Infection Insights

The superficial incisional SSI segment led the surgical site infection (SSI) control industry with a significant share of 45.16% in 2024. The segment is expected to grow at the fastest CAGR during the forecast period. These are the most common SSI, typically occurring within 30 days of surgery and involving only skin and subcutaneous tissue. Their prevalence is largely fueled by factors such as poor skin antisepsis, inadequate hand hygiene, use of contaminated surgical instruments, and patient-related risks such as diabetes, obesity, or smoking. These infections extend hospital stays and increase treatment costs and antibiotic usage, creating a strong demand for advanced infection prevention solutions, including antimicrobial sutures, wound dressings, preoperative skin preparation agents, and sterilization technologies.

The deep incisional SSI segment is expected to grow at a significant CAGR during the forecast period. These infections, which penetrate beyond the superficial tissue into muscle and fascia, often require extended hospital stays, readmissions, revision surgeries, and intensive antibiotic therapy. Rising surgical volumes worldwide, particularly in orthopedic, cardiac, and abdominal procedures, increase the risk pool for such infections. The high morbidity, mortality, and cost implications associated with these infections push hospitals and healthcare providers to adopt advanced SSI prevention measures such as antimicrobial sutures, infection-resistant surgical dressings, sterilization technologies, and perioperative infection control protocols. This strong clinical and financial need to reduce deep incisional SSIs is a key force driving market growth.

End Use Insights

The hospitals segment accounted for the largest share of the SSI control market in 2024 and is expected to grow at the fastest CAGR during the forecast period. This is driven by the high volume of surgical procedures performed in these settings and the critical need to minimize postoperative complications. With increasing patient admissions, particularly for complex surgeries such as orthopedic, cardiovascular, and transplant procedures, hospitals face a greater risk of SSIs, which can lead to extended hospital stays, increased treatment costs, and higher mortality rates. Moreover, the rising burden of multidrug-resistant organisms and the demand for improved patient safety outcomes are compelling hospitals to invest heavily in SSI control measures, further fueling this segment’s growth.

The ambulatory surgical centers segment is expected to grow at a significant CAGR during the forecast period, owing to the rising preference for outpatient surgeries that are cost-effective, minimally invasive, and associated with shorter hospital stays. The growing patient demand for same-day procedures, coupled with advancements in surgical techniques and anesthesia, has increased the volume of surgeries performed in ASCs. This shift has increased the need for stringent infection control measures, including sterilization technologies, antimicrobial products, and advanced wound care solutions, to mitigate SSI risks in a high-throughput environment. Moreover, regulatory emphasis on patient safety, reimbursement support for outpatient care, and the cost savings ASCs offer further fuel their adoption, thereby driving demand for robust infection prevention protocols and products in these facilities.

Regional Insights

North America accounted for the largest revenue share of the Surgical Site Infection (SSI) control market in 2024 owing to the regulatory, institutional, clinical, economic, technological, and societal factors that together push healthcare systems to reduce infection rates and improve patient safety. Bodies such as the CDC (Centers for Disease Control and Prevention), CMS (Centers for Medicare & Medicaid Services), and various accreditation organizations set stringent infection-control standards, require reporting of surgical site infections, and tie compliance to reimbursement and hospital rating. Moreover, there is strong clinical evidence in North America supporting multiple prevention strategies: appropriate and timely prophylactic antibiotics, skin antisepsis (including chlorhexidine), maintaining normothermia during surgery, good glucose control, preoperative patient optimization (including smoking cessation, bowel prep for relevant cases), use of surgical checklists, and standardized protocol.

U.S. Surgical Site Infection (SSI) Control Market Trends

The U.S. Surgical Site Infection (SSI) control industry is experiencing significant growth. The December 2024 initiative by Johnson & Johnson MedTech to establish a standardized classification system for surgical site outcomes (SSOs) is expected to significantly strengthen SSI control efforts in the U.S. By providing surgeons and wound care teams with a unified framework to evaluate and report postoperative complications, the system reduces inconsistencies in diagnosis and documentation, which have historically hindered timely prevention strategies. Standardized reporting improves surveillance and benchmarking across hospitals, enabling early identification of risk patterns and more targeted interventions. Moreover, it drives better communication between multidisciplinary teams, supporting evidence-based protocols and the adoption of advanced infection-prevention technologies. In the U.S., where SSIs remain a leading cause of healthcare-associated infections and add considerable cost burden, this initiative directly enhances clinical decision-making, promotes accountability, and ultimately drives higher standards of patient safety and infection control.

Asia Pacific Surgical Site Infection (SSI) Control Market Trends

Asia Pacific is expected to grow at a significant CAGR during the forecast period due to the rise in surgical procedures and healthcare investments, creating demand for prevention products and monitoring efforts. High SSI rates have prompted the adoption of guidelines and initiatives, such as those by the Asia Pacific Society of Infection Control (APSIC), which focuses on evidence-based SSI prevention and “safe surgery” programs. Moreover, the high prevalence of multidrug-resistant organisms in parts of the region and concerns about inappropriate perioperative antibiotic use have pushed antimicrobial stewardship, infection-control training, and multidisciplinary perioperative teams to the forefront as key drivers of SSI-control strategies.

The Japan Surgical Site Infection (SSI) control market held a significant revenue share in 2024. Japan launched its first Infectious Disease Management Support System in September 2023, aimed at improving control over surgical site infections (SSIs). This system enables non-specialist physicians to efficiently consult infectious disease experts, ensuring adherence to recommended guidelines for diagnosis and treatment. It automatically captures patient data and identifies SSI risk factors early, reducing delays and miscommunication. The system also enhances monitoring by logging into consultations, allowing hospitals to track improvements and identify gaps. Promoting the appropriate use of antibiotics helps combat antimicrobial resistance, ultimately leading to better SSI prevention, lower infection rates, shorter hospital stays, and reduced costs.

The Surgical Site Infection (SSI) control market in India is driven by the growing surgical site infections. For instance, a report from the Indian Council of Medical Research (ICMR) reveals that India experiences around 1.5 million SSIs annually, with an overall SSI rate of 5.2%, significantly higher than in many high-income countries. Orthopedic surgeries, especially amputations and internal fixations, show particularly high infection rates of 54.2%. Factors that increase the risk of SSIs include longer surgeries (over 120 minutes), combination surgeries, and the type of wound. Notably, 66% of SSIs were identified after patients had already been discharged from the hospital, emphasizing the need for improved surveillance and management strategies.

Europe Surgical Site Infection (SSI) Control Market Trends

The Surgical Site Infection (SSI) control industry in Europe is expected to witness high growth over the forecast period, owing to the rising healthcare-associated infection rates across the region have prompted strict guidelines from organizations such as the European Centre for Disease Prevention and Control (ECDC) and national health authorities, pushing hospitals to adopt advanced infection-prevention protocols. The growing prevalence of complex surgeries, coupled with an aging population more susceptible to infections, is also fueling demand for effective SSI control measures. In addition, technological advancements in sterilization, antimicrobial coatings, and digital surveillance systems further support market growth.

The Germany Surgical Site Infection (SSI) control market held a significant share of the Europe industry in 2024. The real-world SSI rate of 4.9% in Germany, based on data from 4 million patients, underscores the significant burden of post-surgical complications and strongly drives the need for enhanced SSI control measures across the healthcare system. Such a high prevalence increases hospital stays, readmissions, and healthcare costs and impacts patient safety and outcomes, prompting hospitals to adopt stricter infection prevention protocols. This includes wider use of antimicrobial sutures, advanced wound dressings, pre- and post-operative antibiotic prophylaxis, and adherence to evidence-based surgical hygiene guidelines. Moreover, the data highlights the importance of surveillance systems, staff training, and compliance monitoring, pushing healthcare facilities to invest in advanced infection control technologies and standardized protocols to reduce SSI incidence. As a result, Germany’s SSI control market is being propelled by both regulatory pressure and the growing awareness among providers to minimize avoidable complications and improve surgical success rates.

Latin America Surgical Site Infection (SSI) Control Market

The Surgical Site Infection (SSI) control industry in Latin America is expected to register considerable growth over the forecast period, owing to the rising volumes of surgical procedures spurred by greater healthcare access, aging populations, growing middle class, and medical tourism means more potential for SSIs, making control more urgent. Moreover, governments, regulators, and health authorities are increasingly setting stricter infection prevention standards. Brazil’s ANVISA, PAHO initiatives, and national “hospital infection control” plans are examples of policy‐level action forcing hospitals to adopt sterilization protocols, hygiene guidelines, and accreditation requirements.

The Brazil Surgical Site Infection (SSI) control market isexpected to register significant growth over the forecast period. The Nottingham-led project in Brazil aims to reduce post-caesarean (C-section) wound infections by implementing standardized protocols for prevention, surveillance, and post-operative care, particularly in underserved regions such as Amazonas. It addresses the lack of clear infection control responsibilities among healthcare providers and promotes interdisciplinary collaboration between academic and health services to enhance technical skills and ownership. The project focuses on monitoring post-C-section surgical site infections to assess the issue’s scale and the effectiveness of interventions. In addition, it emphasizes clear preventive measures such as proper antibiotic use and hygiene practices, linking primary and hospital care to mitigate identified risk factors.

Middle East And Africa Surgical Site Infection (SSI) Control Market

The Surgical Site Infection (SSI) control industry in the Middle East & Africa (MEA) is driven by rising healthcare investment, and government-led reforms play a major role. For instance, Saudi Arabia’s Vision 2030 includes modernization of the health sector and boosting patient safety, which has led to stricter infection control policies, mandated guidelines for SSIs, enhanced sterilization practices, and adoption of new antiseptic technologies. Moreover, training of healthcare personnel, establishing infection prevention & control (IPC) units, and improving infrastructure are also strong drivers. Programs that introduce multimodal infection control interventions (bundles) have shown in Africa substantial drops in SSI rates after training and improvements in practices such as pre-operative skin prep, hand hygiene, avoiding hair removal by shaving, and others.

The UAE Surgical Site Infection (SSI) control market is growing due to the growing trend of patients in the UAE opting for surgical interventions to treat sinusitis. It has a direct impact on the focus and demand for surgical site infection (SSI) control measures. As more individuals undergo sinus surgeries, hospitals and clinics face an increased risk of post-operative infections, which can lead to prolonged recovery times, higher treatment costs, and potential complications. This rising surgical volume has prompted healthcare providers to adopt stricter infection prevention protocols, including advanced sterilization techniques, antimicrobial prophylaxis, and enhanced post-operative monitoring.

Moreover, medical device manufacturers and healthcare facilities are investing in innovative SSI control solutions, such as specialized surgical drapes, wound care products, and real-time infection tracking systems. Consequently, the surge in sinusitis surgeries is driving both regulatory emphasis and market demand for effective surgical site infection control practices across the UAE, ensuring patient safety and improved surgical outcomes.

Key Surgical Site Infection (SSI) Control Company Insights

The market is fragmented, with the presence of many country-level surgical site infection control providers.The market players undertake several strategic initiatives, such as partnerships & collaborations, product launches, mergers & acquisitions, and geographical expansion to maintain their position and grow in the market.

Key Surgical Site Infection (SSI) Control Companies:

The following are the leading companies in the surgical site infection control market. These companies collectively hold the largest market share and dictate industry trends.

Getinge Group

Steris Healthcare

3M

BD

Belimed INC.

POLYMERFILMS

ANSELL LTD.

Olympus Corporation

Systec GmbH & Co. KG

Ecolab Inc.

MMM Group

Pal International

Miele Group

Belimed AG

Recent Developments

In September 2025, a group of Northeastern University graduates launched a healthcare startup, Predictive Healthcare, aimed at reducing post-surgical infections and enhancing clinical workflows. The company’s flagship product, MyHealthPal, utilizes AI to monitor surgical wounds and detect early signs of infection. Currently, MyHealthPal is undergoing pilot testing at Massachusetts General Hospital-Brigham for pacemaker implant patients and at Tufts Medical Center for breast reconstruction patients. By integrating AI into postoperative care, Predictive Healthcare aims to streamline clinical processes, reduce administrative burdens, and enhance patient safety.

In July 2025, Mayo Clinic researchers created an AI system that detects surgical site infections (SSIs) from patient-submitted postoperative wound photos. The system employs a two-stage model: it first identifies surgical incisions and then checks for infection signs. This innovation streamlines the review process, enabling real-time assessments and improving communication between patients and healthcare teams, thus reducing diagnostic delays.

Hepatobiliary and pancreatic surgical oncologist at Mayo Clinic and co-senior author of the study said: “We were motivated by the increasing need for outpatient monitoring of surgical incisions in a timely manner. This process, currently done by clinicians, is time-consuming and can delay care. Our AI model can help triage these images automatically, improving early detection and streamlining communication between patients and their care teams.”

Surgical Site Infection Control Market Report Scope

Report Attribute

Details

Market size in 2025

USD 8.30 billion

Revenue forecast in 2033

USD 16.22 billion

Growth rate

CAGR of 8.73% from 2025 to 2033

Actual data

2021 – 2024

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, procedure, type of infection, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Getinge Group; Steris Healthcare; 3M; BD; Belimed INC.; POLYMERFILMS; ANSELL LTD.; Olympus Corporation; Systec GmbH & Co. KG; Ecolab Inc.; MMM Group; Pal International; Miele Group; Belimed AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Surgical Site Infection Control Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global surgical site infection (SSI) control market report based on product, procedure, type of infection, end use, and region:

Product Outlook (Revenue, USD Million, 2021 – 2033)

Procedure Outlook (Revenue, USD Million, 2021 – 2033)

Cataract Surgery

Cesarean Section

Dental Restoration

Gastric Bypass

Others

Type of Infection Outlook (Revenue, USD Million, 2021 – 2033)

End Use Outlook (Revenue, USD Million, 2021 – 2033)

Regional Outlook (Revenue, USD Million, 2021 – 2033)