AI In Drug Repurposing Market Summary

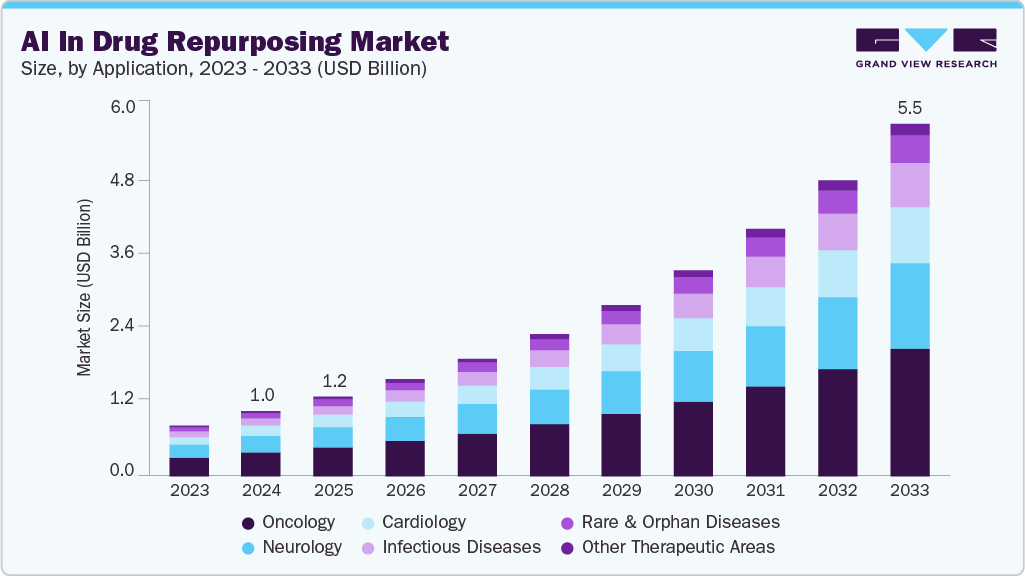

The global AI in drug repurposing market size was estimated at USD 1.02 billion in 2024 and is projected to reach USD 5.48 billion by 2033, growing at a CAGR of 20.39% from 2025 to 2033. Rising demand for cost-effective drug development, advancements in AI algorithms, and the growing prevalence of rare and complex diseases are significant factors contributing to market growth.

Key Market Trends & Insights

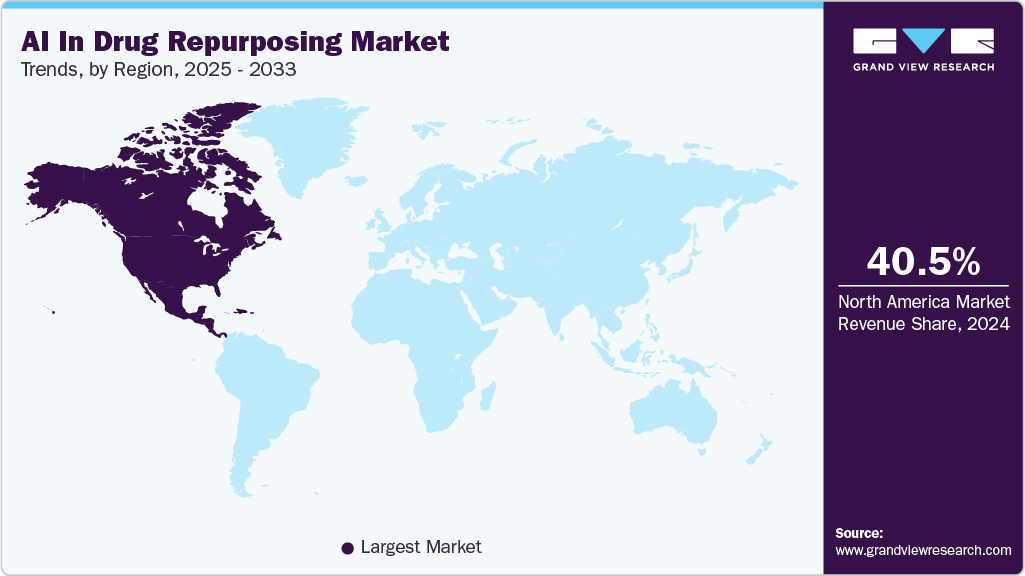

North America AI in drug repurposing market accounted for the largest revenue share of 40.47% in 2024.

The U.S. AI in drug repurposing industry held the largest share in 2024.

By component, the software & platform segment held the largest revenue share of 66.86% in 2024.

By Technology, The machine learning/deep leaning segment accounted for the largest revenue share of 46.01% in 2024.

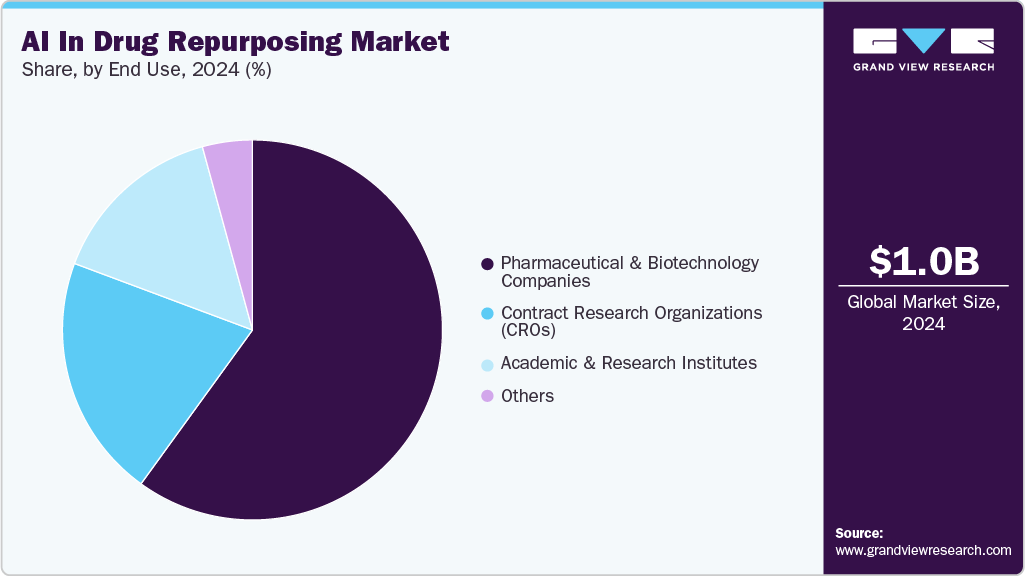

By end use, the pharmaceutical & biotechnology companies segment led the AI in drug repurposing market with the largest share of 59.80% in 2024.

Market Size & Forecast

2024 Market Size: USD 1.02 Billion

2033 Projected Market Size: USD 5.48 Billion

CAGR (2025-2033): 20.39%

North America: Largest market in 2024

In addition, increasing collaborations between pharmaceutical companies, academic institutions, and AI technology providers, and improvements in computing power and cloud infrastructure are some other factors fueling the growth.

The rising demand for cost-effective drug development strategies substantially drives the growth of the AI in drug repurposing industry. Traditional drug discovery involves lengthy timelines, often exceeding a decade, and costs frequently exceed USD 2 billion per drug. Drug repurposing offers a strategy to bypass early-stage safety testing by focusing on approved or investigational drugs for new indications. AI accelerates this process by rapidly analyzing extensive biological, chemical, and clinical datasets to identify novel drug-disease associations. This reduces development timelines and costs, offering pharmaceutical companies and healthcare providers an economically viable alternative to de novo drug development. Integrating artificial intelligence with drug repurposing effectively addresses key industry challenges by enhancing productivity while reducing associated risks and investments.

AI systems integrate multi-omics data, including genomics, proteomics, and metabolomics, with biomedical literature and real-world patient records to identify subtle and previously unrecognized drug-target interactions. These methods enable the identification of polypharmacology candidates and synergistic drug combinations, overcoming limitations of traditional hypothesis-driven discovery. For instance, in April 2025, Plex Research partnered with Ginkgo Bioworks to use AI-powered analysis on the GDPx2 dataset, a large transcriptomics survey of compound-induced gene expression. This collaboration aims to identify novel disease mechanisms, discover new therapeutic applications, and accelerate drug repurposing, linking findings with experimental data for rigorous validation.

Furthermore, the rising prevalence of rare diseases propels market growth further. For instance, according to the data published by The Lancet Journal in March 2024, around 300 million people live with rare diseases, affecting around 3.5% – 5.9% of the global population. Moreover, around 80% of rare diseases are genetically caused, almost 70% of which are present in childhood. AI facilitates the analysis of limited datasets from rare disease cohorts, enabling the identification of therapeutic candidates from existing drugs, thus expediting treatment access.

List of few AI-based drug repurposing instances

Company

Discovery

Year

Clinical

Validation Year

Regulatory / Approval Year

Initiative

BenevolentAI

2020

2020-2021

2020-2022

Identified Baricitinib for COVID-19 treatment; EUA by FDA Nov 2020; full approval May 2022.

Insilico Medicine

2023

2023

N/A

Used generative AI (PandaOmics) to repurpose Lifitegrast for endometriosis, validated preclinically.

Atomwise & DNDi

2023-2025

Ongoing

N/A

AI-driven molecule screening to find drug candidates for Chagas disease.

DeepDrug

2025

Ongoing

N/A

AI framework identifying repurposed drug combinations for Alzheimer’s disease.

Every Cure Initiative

2023

Ongoing

N/A

AI-powered platforms are mining drug repurposing opportunities for rare diseases.

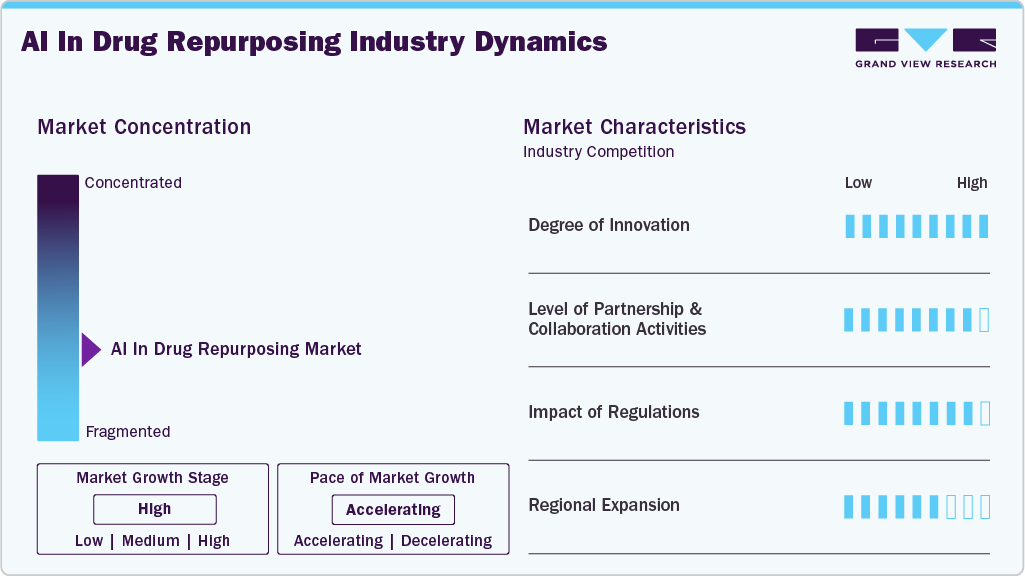

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and industry participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various industry characteristics, including industry competition, level of partnerships & collaboration activities, degree of innovation, impact of regulations, and regional expansion. The AI in drug repurposing market is consolidated. However, several emerging players are entering the market, thereby contributing to increased fragmentation within the market. The degree of innovation and the level of partnership and collaboration activities, and the impact of regulations is high. Moreover, the regional expansion of industry is moderate.

The degree of innovation in the AI in drug repurposing industry is notably high, driven by the integration of advanced computational methods with vast biomedical datasets. Generative AI models hypothesize novel drug-target interactions, while natural language processing (NLP) systems mine biomedical literature, patents, and clinical trial data for hidden insights. Additionally, collaborations between AI firms, pharmaceutical companies, and academic institutions foster the creation of dedicated platforms tailored to repurpose workflows.

The industry is experiencing a moderate level of merger and acquisition activities undertaken by several key players. This is due to the desire to gain a competitive advantage in the industry, enhance technological capabilities, and consolidate in a rapidly growing market. For instance, in July 2025, Healx partnered with SCI Ventures in a USD 2 million collaboration to accelerate therapies for spinal cord injury (SCI) using AI-driven drug discovery focused on target discovery and drug repurposing.

Global regulations governing AI in the drug repurposing market emphasize ensuring the safety, efficacy, and transparency of AI-assisted therapeutic development. Regulatory agencies such as the U.S. FDA have issued draft guidances focused on incorporating AI into drug development and regulatory decision-making processes with a risk-based approach. The framework encourages rigorous validation, interpretability, and ongoing monitoring of AI models to prevent bias and errors.

The industry is witnessing moderate geographical expansion. Companies within the AI in drug repurposing industry seek geographic expansion strategies to maintain their foothold in emerging markets and attract customers from these regions.

Component Insights

The software & platform segment held the largest revenue share of 66.86% in 2024. These solutions leverage large-scale datasets, including genomics, proteomics, and clinical trial data, to identify new therapeutic indications for existing compounds. Advanced algorithms support drug-target interaction mapping and biomarker discovery, accelerating translational research. For instance, in January 2025, NVIDIA and Innophore partnered to launch CavitOmiX, an AI-driven drug safety screening platform. Innophore’s AI-driven CavitOmiX platform, powered by NVIDIA, significantly supports drug repurposing by analyzing protein binding sites to identify hidden therapeutic opportunities between existing drugs and new targets.

The services segment is expected to grow at the fastest CAGR during the forecast period. The services segment encompasses specialized offerings that support the deployment, customization, and optimization of AI solutions for drug repurposing. These include data curation, annotation, algorithm training, model validation, and integration of AI tools into existing research workflows. Service providers also assist with regulatory compliance, ensuring AI-driven predictions align with evolving guidelines for drug development. Moreover, services are increasingly focused on collaborative projects that combine domain expertise in biology with advanced computational capabilities, propelling market growth further.

Technology Insights

The machine learning/deep leaning segment accounted for the largest revenue share of 46.01% in 2024. These technologies analyze genomic data, clinical trial results, molecular structures, and real-world patient records to identify unrecognized correlations. Deep learning models, especially neural networks, improve prediction accuracy by capturing non-linear relationships within complex biological systems. Such methods enable the rapid screening of thousands of compounds against multiple disease targets, significantly accelerating discovery timelines.

The generative AI & large language models (LLMs) segment is anticipated to register the fastest growth from 2025 to 2033. The Generative AI and LLMs segment is transforming drug repurposing by enabling rapid hypothesis generation and molecular design through advanced natural language and generative modeling capabilities. LLMs are able to analyze vast biomedical literature, clinical trial records, and omics data to identify links between existing drugs and new disease indications. Generative AI enhances this process by designing novel molecular variations or predicting drug-disease interactions with high precision. These tools reduce the time spent on manual curation, creating a scalable framework for discovering repurposing opportunities.

Application Insights

The oncology segment accounted for the largest revenue share of 36.81% in 2024. AI accelerates oncology drug repurposing by analyzing vast molecular datasets, clinical records, and therapeutic responses to identify novel cancer treatment candidates. Machine learning models reveal hidden drug-target interactions and potential synergistic drug combinations, facilitating precision oncology development. Recent advancements in AI algorithms have enhanced the prediction accuracy for oncologic indications, supporting the discovery of repurposed drugs with improved efficacy and safety profiles.

The rare & orphan diseases segment is anticipated to grow at the fastest CAGR from 2025 to 2033. Traditional drug discovery for rare diseases encounters several challenges, including small patient populations, high development costs, and limited commercial incentives. AI-driven repurposing accelerates the identification of existing drugs with potential therapeutic effects by analyzing multi-omics data, literature, and patient registries. This reduces the reliance on lengthy discovery pipelines and provides faster access to therapies for underserved patient groups.

End Use Insights

The pharmaceutical & biotechnology companies segment led the AI in drug repurposing market with the largest share of 59.80% in 2024. These organizations leverage AI-driven tools to mine clinical trial data, molecular profiles, and biomedical literature to identify new therapeutic uses for existing compounds. By reducing the costs and timelines traditionally associated with novel drug discovery, repurposing strategies allow companies to maximize ROI on their drug pipelines. AI further supports prioritization of candidates with higher translational potential, improving decision-making and portfolio management. For instance, in December 2024, Conduit Pharmaceuticals partnered with SARBORG Limited to leverage advanced AI and cybernetics technology for optimizing drug repurposing, discovery, and clinical trial monitoring.

The academic and research institutes segment is anticipated to grow at the fastest CAGR from 2025 to 2033. These institutions harness extensive biomedical data and computational expertise to develop novel AI methodologies that accelerate drug repurposing efforts. Their focus encompasses algorithm development, predictive modeling, and multi-omics data integration, facilitating the identification of potential therapeutic candidates with high precision. Moreover, academic and research institutes are essential collaborators for pharmaceutical companies and AI startups, bridging the gap between scientific discovery and commercialization.

Regional Insights

North America AI in drug repurposing market accounted for the largest revenue share of 40.47% in 2024. The market is driven by substantial R&D investments from pharmaceutical and biotechnology firms, coupled with robust venture capital funding for AI-driven drug discovery startups. In addition, the presence of advanced healthcare IT infrastructure enables efficient integration of large-scale genomic and clinical datasets. Strategic collaborations between academia, pharma, and AI companies accelerate the translation of repurposing research into clinical applications.

U.S. AI in Drug Repurposing Market Trends

The U.S. AI in drug repurposing industry held the largest share in 2024. The U.S. market benefits from the dominance of leading AI and pharmaceutical companies actively deploying AI for drug repurposing. The country has extensive biomedical data repositories, including EHRs, genomic databases, and clinical trial registries, which strengthen AI model training. Regulatory flexibility, including accelerated approval pathways for orphan drugs, encourages investment in AI-enabled repurposing.

Europe AI in Drug Repurposing Market Trends

The Europe AI in drug repurposing industry is expected to witness significant growth during the forecast period, owing to the Pan-European initiatives promoting digital health and AI integration into drug discovery. The presence of advanced healthcare systems with structured EHRs supports large-scale data utilization. In addition, the region’s robust spending on biology research and development contributes to market growth further.

The UK AI in drug repurposing market is expected to grow over the forecast period. The UK market benefits from the NHS’s centralized data infrastructure, which enables AI models to access high-quality, population-wide health records. Collaborations between AI startups, universities, and global pharmaceutical firms are rapidly accelerating clinical translation. For instance, in July 2025, UK-based Healx partnered with SCI Ventures to apply AI-powered drug discovery using Healx’s AI platform in developing therapies for spinal cord injury (SCI). This partnership aims to accelerate treatments through AI-driven target discovery and drug repurposing, with broader implications for neurological diseases like ALS, MS, and Alzheimer’s.

The AI in drug repurposing market in Germany held the largest revenue share in 2024 in Europe market. The growth is driven by its strong pharmaceutical industry and leadership in digital health innovation. For instance, Germany’s Merck KGaA focuses on AI-driven drug design through strategic partnerships with BenevolentAI and Exscientia to accelerate oncology, neurology, and immunology discovery. Moreover, the government’s Digital Healthcare Act encourages the integration of AI into clinical and research workflows, fostering drug repurposing initiatives.

Asia Pacific AI in Drug Repurposing Market Trends

The Asia Pacific AI in drug repurposing industry is propelled by expanding AI adoption in healthcare, supported by government-led digital health initiatives in countries like China, India, and South Korea. Rapid growth in clinical trial activity across the region creates diverse datasets for repurposing applications. Pharma companies are increasingly collaborating with regional AI startups to accelerate drug development. The rising burden of chronic diseases and rare conditions fuels demand for affordable, repurposed therapies. Growing investments in cloud-based healthcare infrastructure enhance the scalability of AI platforms.

The India AI in drug repurposing marketis expanding rapidly, driven by the high prevalence of chronic and rare diseases, government health initiatives, and technological innovation. Furthermore, the market is experiencing a growing adoption of AI technologies by biological research institutes in the country.

The AI in drug repurposing market in Japan is driven by its aging population and rising incidence of chronic and rare diseases, necessitating cost-effective therapeutic options. Moreover, the Pharmaceuticals and Medical Devices Agency (PMDA) regulatory reforms aid accelerated pathways for innovative therapies, including repurposed drugs. Japan’s emphasis on precision medicine further supports AI-based repurposing strategies.

Latin America AI in Drug Repurposing Market Trends

The Latin America AI in drug repurposing industry is anticipated to grow at a significant CAGR over the forecast period. Latin America’s market is driven by the increasing adoption of AI technologies in healthcare research and the rising focus on cost-effective drug development strategies. Moreover, the region benefits from its vast patient pool and rapidly growing clinical trial ecosystem, generating robust datasets for AI-based repurposing.

Middle East and Africa AI in Drug Repurposing Market Trends

The Middle East and Africa AI in drug repurposing industry is expected to grow at a significant CAGR over the forecast period. The region is driven by government-led initiatives to modernize healthcare systems and adopt AI-driven solutions. Countries such as the UAE and Saudi Arabia are actively investing in digital health and precision medicine, fostering AI-based drug repurposing research. Collaborations between international pharmaceutical firms and regional research centers are gaining traction. In addition, the growing incidence of cancer, cardiovascular, and metabolic diseases creates demand for innovative therapies. Furthermore, investment in genomic and clinical data infrastructure supports the development of AI-driven repurposing models.

Key AI In Drug Repurposing Company Insights

Key players operating in the AI in drug repurposing market are undertaking various initiatives to strengthen their market presence and increase the reach of their products and services. Strategies such as new product launches and partnerships play a key role in propelling market growth.

Key AI In Drug Repurposing Companies:

The following are the leading companies in the AI in drug repurposing market. These companies collectively hold the largest market share and dictate industry trends.

BostonGene Corporation

Ginkgo Bioworks

IBM

TxGNN

BioXcel Therapeutics Inc.

BullFrog AI Holdings, Inc.

Ignota Labs

ISOMORPHIC LABS

Insilico Medicine

Healx

Recent Developments

In August 2025, Fifty1 Labs and BioSpark AI partnered to transform over 10,000 unstructured clinical case reports into a structured, queryable database containing 2,000+ real-world patient treatment-outcome pathways. This AI-driven collaboration accelerates drug repurposing and functional medicine innovation by enabling prioritized candidate selection for chronic fatigue, neuroinflammation, and sleep disorders.

In May 2025, former Verbit CEO Tom Livne launched the startup Grace to repurpose abandoned drugs using advanced AI. Grace targets USD 10-20 million in funding to accelerate the rediscovery of drug candidates and address high attrition in clinical stages.

In May 2024, Every Cure and BioPhy partnered to transform drug repurposing using BioPhy’s AI platform, BioLogicAI, which identifies promising drug-disease matches and optimizes clinical trials to increase success rates and reduce costs.

AI In Drug Repurposing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.24 billion

Revenue forecast in 2033

USD 5.48 billion

Growth rate

CAGR of 20.39% from 2025 to 2033

Actual data

2021 – 2024

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

BostonGene Corporation; Ginkgo Bioworks; IBM TxGNN; BioXcel Therapeutics Inc.; BullFrog AI Holdings, Inc.; Ignota Labs; ISOMORPHIC LABS; Insilico Medicine; Healx

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global AI In Drug Repurposing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global AI in drug repurposing market report based on component, technology, application, end use, and region:

Component Outlook (Revenue, USD Million, 2021 – 2033)

Software & Platforms

Services

Technology Outlook (Revenue, USD Million, 2021 – 2033)

Machine Learning/Deep Learning

Natural Language Processing (NLP)

Knowledge Graphs & Network-Based AI

Generative AI & Large Language Models (LLMs)

Computer Vision

Application Outlook (Revenue, USD Million, 2021 – 2033)

Oncology

Neurology

Cardiology

Infectious Diseases

Rare & Orphan Diseases

Other Therapeutic Areas

End Use Outlook (Revenue, USD Million, 2021 – 2033)

Pharmaceutical & Biotechnology Companies

Contract Research Organizations (CROs)

Academic & Research Institutes

Others

Regional Outlook (Revenue, USD Million, 2021 – 2033)

North America

Europe

Germany

UK

France

Italy

Spain

Denmark

Sweden

Norway

Asia Pacific

China

Japan

India

South Korea

Australia

Thailand

Latin America

MEA

South Africa

Saudi Arabia

UAE

Kuwait