U.S. Arteriovenous Fistula Devices Market Summary

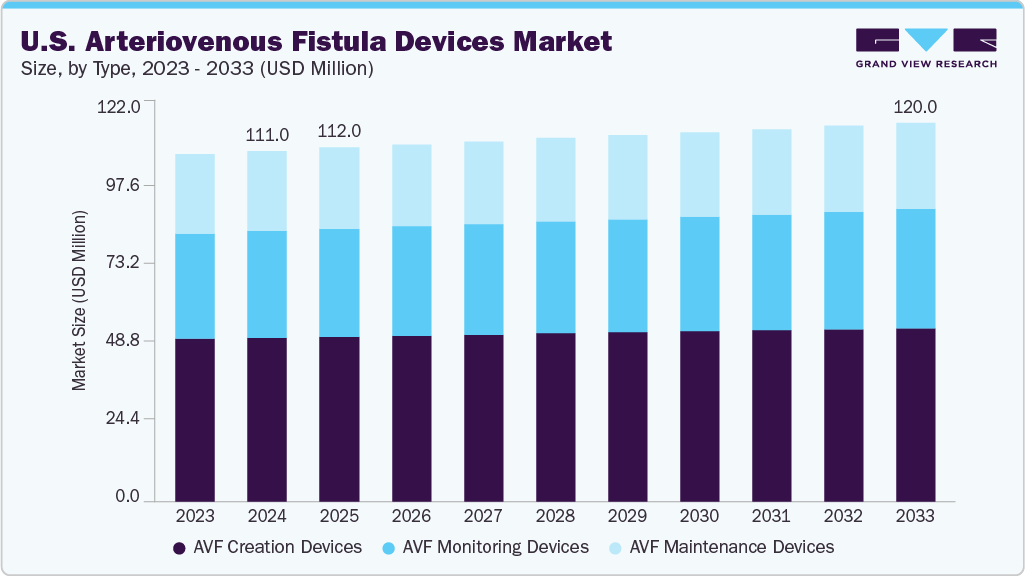

The U.S. arteriovenous fistula devices market size was estimated at USD 111.0 million in 2024 and is projected to reach USD 120.0 million by 2033, growing at a CAGR of 0.9% from 2025 to 2033. The growth is attributed to several factors, including the increasing prevalence rate of End-stage Renal Disease (ESRD) and the resulting rise in the number of patients requiring hemodialysis.

Key Market Trends & Insights

By type, the AVF creation devices segment held the largest market share of 46.9% in 2024.

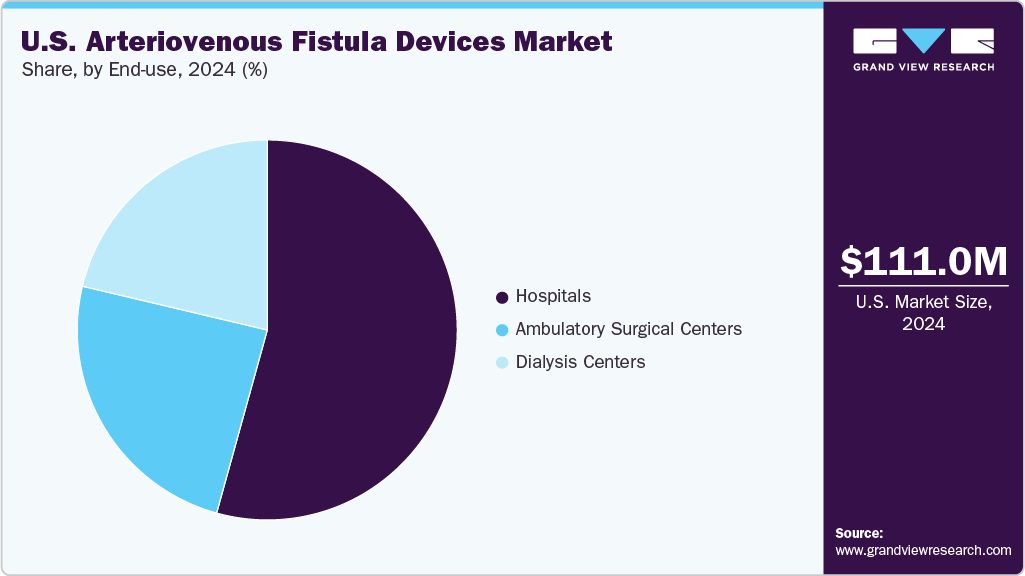

By end-use, the hospital segment held the largest market share of 54.3% in 2024.

Market Size & Forecast

2024 Market Size: USD 111.0 Million

2033 Projected Market Size: USD 120.0 Million

CAGR (2025-2033): 0.9%

The advanced healthcare infrastructure, a high incidence of diabetes & hypertension, and widespread awareness initiatives in the country are expected to drive the market growth. According to 2023 estimates by the Centers for Disease Control and Prevention (CDC), approximately 14% of adults in the U.S. are affected by chronic kidney disease (CKD). Furthermore, the American Kidney Fund reports that approximately 815,000 Americans are currently living with kidney failure, with nearly 555,000 of them undergoing dialysis, highlighting the widespread need for effective treatment solutions.

Due to the critical shortage of kidney donors, the increasing dependence on dialysis underscores the essential role of AVF devices in managing ESRD. The escalating rate of kidney disease is also driving the demand for more advanced and innovative AVF solutions. AV fistulas are preferred for long-term vascular access because of their durability, lower infection rates, and reduced complication risk compared to other access types. These factors are propelling the growth of AVF devices in the U.S.

Two other types of vascular access for hemodialysis, arteriovenous graft (AVG) and central venous catheter (CVC), are the primary substitutes for an arteriovenous fistula. The choice of access has significant clinical and economic implications, directly impacting market dynamics. While AVFs are considered the gold standard due to lower infection rates and better longevity, their long maturation time and high primary failure rate make substitutes necessary.

Type Insights

Based on type, the AVF creation devices segment accounted for the largest revenue share of 46.9% in 2024. The increasing patient population fuels the demand for innovative AVF creation devices to improve success rates and reduce complications. AVF remains the preferred vascular access method due to its superior long-term patency, lower infection rates, and improved patient survival compared to grafts and catheters. For instance, in 2022, 131,000 individuals were newly diagnosed with kidney failure, and nearly 97% of them began dialysis. Similarly, the rising focus of market players on developing technologically advanced devices drives the segment growth. In April 2025, Venova Medical announced the completion of patient enrollment for the VENOS- 2 Clinical Study of Velocity percutaneous Arteriovenous Fistula (pAVF) System, which is used to create percutaneous AVF for hemodialysis.

The AVF monitoring devices segment is projected to grow at the fastest CAGR of 1.3% over the forecast period. The need for proactive and effective monitoring to address complications like stenosis and thrombosis in hemodialysis patients is becoming increasingly critical. This demand drives the segment’s growth, as timely interventions are essential for maintaining fistula viability and improving patient care. Moreover, hospitals are increasingly prioritizing improved patient outcomes, which is driving the adoption of AVF monitoring devices in clinical settings.

End-use Insights

The hospitals segment held the largest revenue share in 2024. The growth of this end-use segment is driven by the increasing prevalence of ESRD, the critical need for reliable vascular access for hemodialysis, and the availability of various insurance options for financial coverage. For instance, Medicare is a U.S. government health insurance program that covers 80% of the dialysis treatment costs. Similarly, it is a joint federal and state government program covering most dialysis expenses. This coverage enables hospitals to carry out numerous hemodialysis procedures, many of which rely on AVF interventions. The rising demand for hemodialysis drives a greater need for AVF devices within hospital settings. As a result, the hospital segment plays a pivotal role in propelling the growth of the AVF devices market.

The ambulatory surgical centers segment is expected to record the fastest CAGR in the U.S. market. ASCs offer a compelling alternative to traditional hospital settings for AVF creation and maintenance due to their cost-effectiveness, convenience, and patient-centric approach. The increasing number of ASCs also results in the higher adoption of AVF devices across these settings. The Centers for Medicare & Medicaid Services (CMS) data reveal a continuous increase in Medicare-certified ASCs, which rose by 2.5% from 2022 to 2023, to reach 6,308 centers. The ongoing advancements in minimally invasive techniques, such as endovascular AVF creation, further facilitate this shift, as these procedures are well-suited for the outpatient setting.

Key U.S. Arteriovenous Fistula Devices Company Insights

Competition in the AVF devices market in the U.S. is moderate, with various companies working to strengthen their positions. Industry participants mainly engage in research, strategic deals, and partnerships.

Key U.S. Arteriovenous Fistula Devices Companies:

Medtronic

BD

Teleflex Incorporated

Fresenius Medical Care

B. Braun Medical Inc.

Polymed

Laminate Medical Technologies Ltd.

Cook Group

Smiths Group plc

Recent Developments

In February 2025, Teleflex Incorporated announced an agreement with BIOTRONIK SE & Co. KG to acquire its Vascular Intervention business. The estimated value of this transaction was approximately USD 793.8 million.

In April 2024, Concept Medical received Investigational Device Exemption (IDE) approval from the U.S. FDA for its MagicTouch AVF device. MagicTouch AVF is a Sirolimus drug-coated balloon (DCB) catheter designed to treat stenotic lesions of arteriovenous fistula used for hemodialysis in patients with chronic renal failure.

In September 2023, Laminate Medical Technologies Ltd. received FDA clearance for VasQ external vascular support. VasQ is used to create arteriovenous fistula (AVFs) for dialysis access.

U.S. Arteriovenous Fistula Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 112.0 million

Revenue forecast in 2033

USD 120.0 million

Growth rate

CAGR of 0.9% from 2025 to 2033

Historical Period

2021 – 2023

Historical data

2024

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use

Key companies profiled

Medtronic; BD; Teleflex Incorporated; Fresenius Medical Care; B. Braun Medical Inc.; Polymed; Laminate Medical Technologies Ltd.; Cook Group; Smiths Group plc

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Arteriovenous Fistula Devices Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. arteriovenous fistula devices market report based on type and end-use.

Type Outlook (Revenue, USD Million, 2021 – 2033)

AVF Creation Devices

Surgical Instruments

Vascular Grafts

Angioplasty Balloons

Others

AVF Monitoring Devices

AVF Maintenance Devices

Central Venous Catheters

Stents

Others

End-use Outlook (Revenue, USD Million, 2021 – 2033)