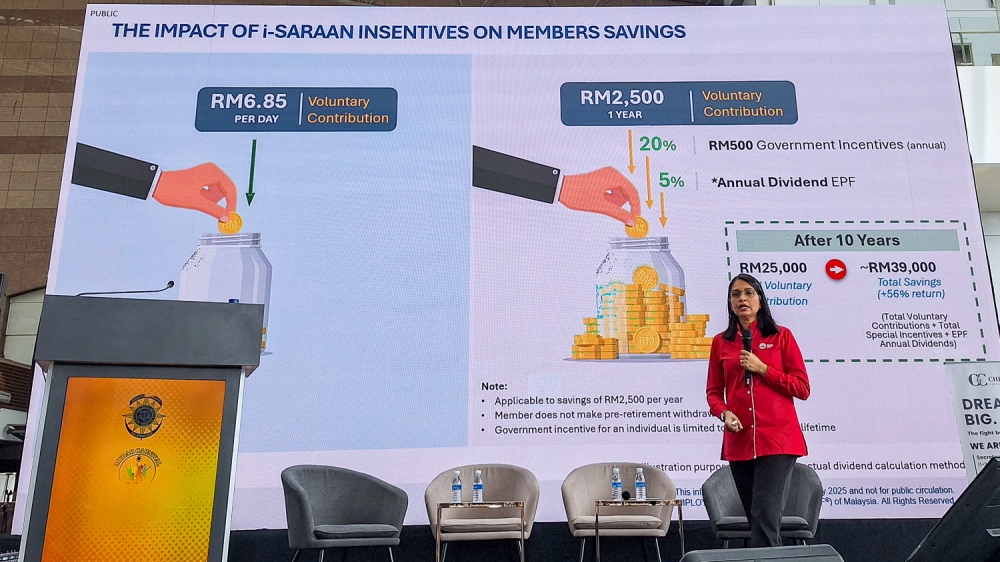

KUALA LUMPUR, Sept 30 — Imagine putting aside just RM6.85 every day into the Employees Provident Fund’s (EPF) i-Saraan scheme, and watching it grow over 10 years.

Just RM6.85 a day — that’s RM250 a month, RM2,500 a year.

After 10 years, you wouldn’t just have RM25,000 safely stored away — the money would also have earned you dividends from EPF, with compounded growth too.

Plus, the Malaysian government would be giving you money as well, simply for saving under i-Saraan.

Show me the numbers

In illustrating the benefits of i-Saraan, EPF’s Relationship & Advisory (RA) adviser Mogana Murugan @ Arujunan gave a hypothetical example.

Under this hypothetical scenario, by saving RM2,500 every year into i-Saraan (a total of RM25,000 over 10 years), you could end up with an estimated RM39,000 at the end of the 10 years.

“So, how it works? Okay, you can see this example that we do for you. It’s at RM6.85 per day, voluntary contribution. So for a year, it will accumulate to RM2,500.

“RM2,500, plus with RM500 from the government, plus with five per cent EPF dividend. So in 10 years, you use RM25,000, but the money will grow to RM39,000 — there’s a difference of RM14,000,” she said during a talk at the Malaysian Bar’s recent MyBar Carnival.

In other words, RM39,000 = RM25,000 (from money you put in) + RM5,000 (government’s maximum i-Saraan lifetime incentive) + RM9,000 (in hypothetical annual EPF dividend with compounded growth).

But do note this example is only for illustration purposes, based on the scenario where you do not withdraw money from EPF before your retirement.

The RM5,000 is the maximum lifetime incentive amount that the government will put into your EPF savings to match your i-Saraan contribution.

(You can get a maximum incentive of RM500 per year if you save at least RM2,500 annually under i-Saraan. But remember, the maximum you will get your entire life, or before you hit 60, is RM5,000.)

The illustration is also based on the hypothetical assumption of a five per cent annual EPF dividend for all 10 years.

The actual total amount at the end of 10 years will depend on the EPF dividend rate each year.

While Malaysia’s laws only guarantee a minimum 2.5 per cent dividend from EPF every year, EPF has consistently delivered a higher dividend rate than that for more than 60 years.

You can even help your child start their EPF savings journey from as early as age 14. The age limit for i-Saraan is 60 years old. EPF’s Relationship & Advisory (RA) adviser Mogana Murugan at the MyBar Carnival. — Picture by Ida Lim

Who is i-Saraan for?

Mogana said i-Saraan is meant for those who are:

self-employed (those who do not have an employer but are their own boss);those without fixed income (think: gig workers, informal workers);housewives; andstudents.

Just register with EPF to join i-Saraan.

The i-Saraan scheme is only for those aged 14 to 60. (You must be at least aged 14 to have EPF savings.)

“If you have kids (aged) 14 years and above, you can register them as an EPF member. You can start savings for them,” she said, adding that putting in RM25,000 under i-Saraan would create a financial base for them by the time they turn 25.

As for housewives without an active income, their husbands can top-up their i-Saraan savings as a sign of appreciation and to empower them, she said.

How much do you need to contribute to i-Saraan?

It is a voluntary contribution, so it is “very flexible”, Mogana said.

So you can put in any amount: As little as RM1, and as much as RM100,000 per year.

For more information on i-Saraan, visit this page on EPF’s website.