Report Overview

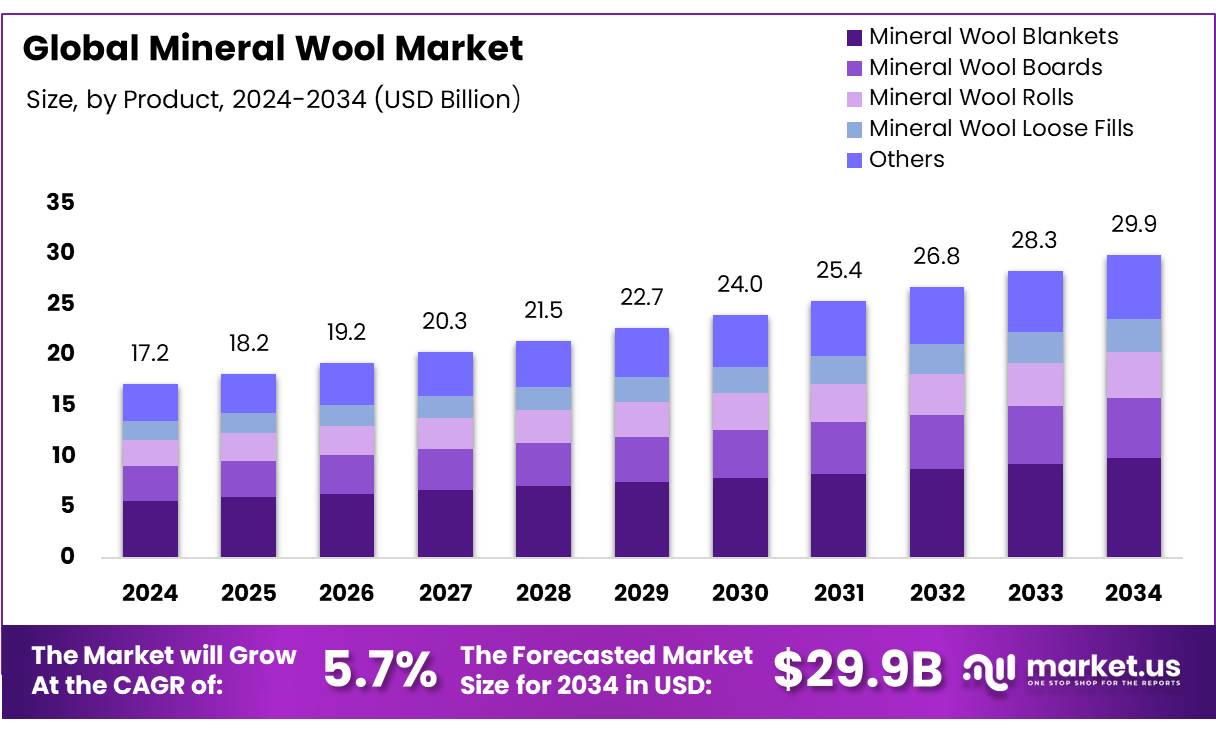

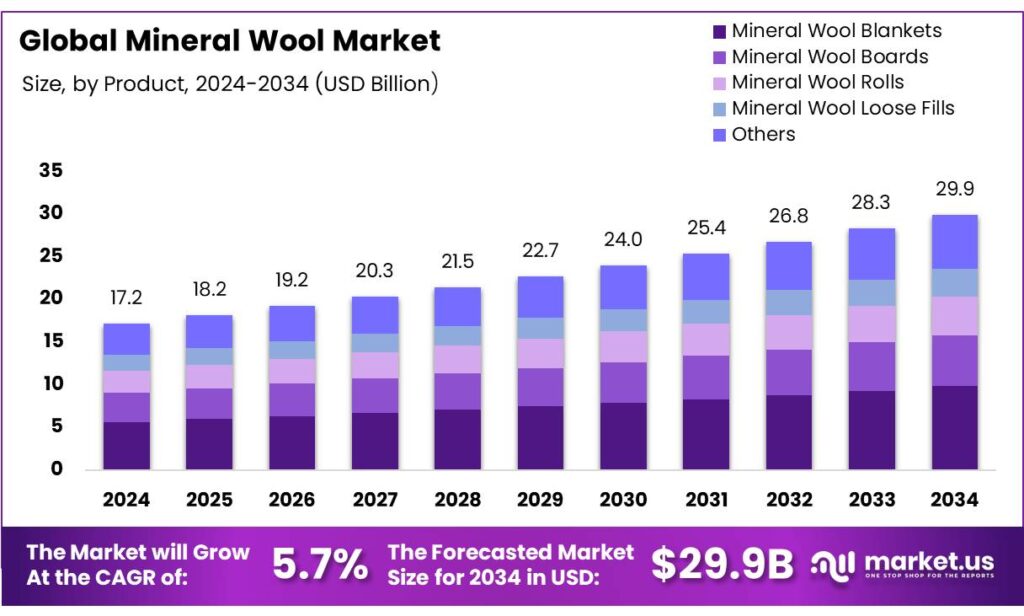

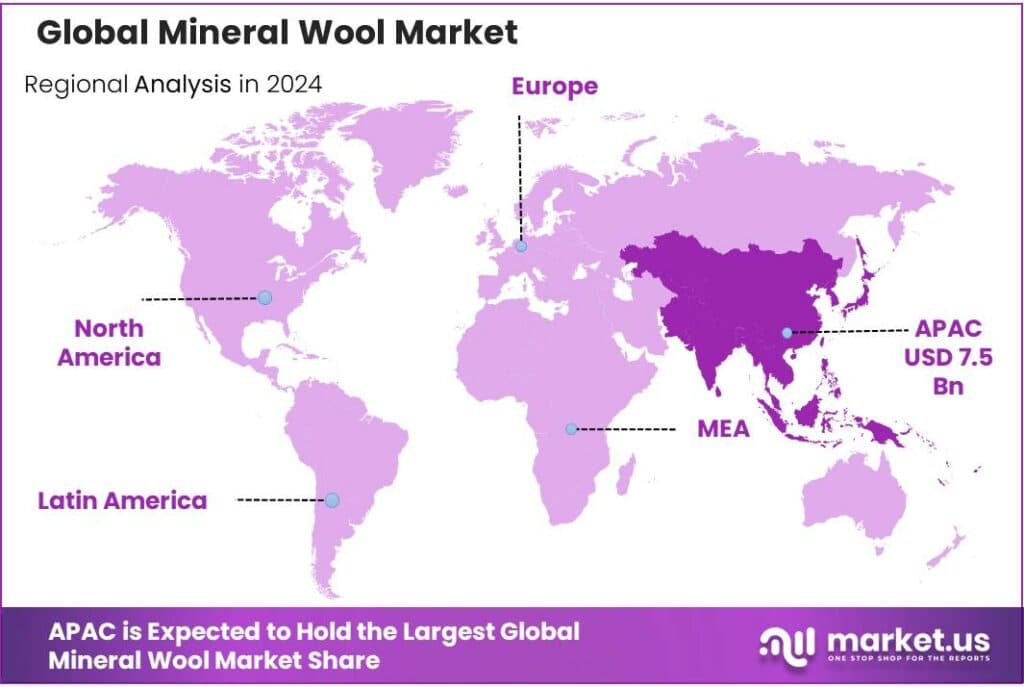

The Global Mineral Wool Market size is expected to be worth around USD 29.9 Billion by 2034, from USD 17.2 Billion in 2024, growing at a CAGR of 5.7% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 43.9% share, holding USD 7.5 Billion in revenue

Mineral wool, comprising stone (rock) wool and slag (glass) wool, is manufactured by melting natural minerals or industrial by-products and spinning them into fibrous insulation products. The material is widely applied in thermal and acoustic insulation, fire protection, and industrial process insulation. Mineral wool is explicitly categorized among primary insulation materials by the U.S. Department of Energy, which identifies rock wool and slag wool as distinct mineral-based insulation families used across building and industrial applications.

The mineral wool industry is integrated across raw-material supply (basalt, blast-furnace slag), high-temperature melting and fiberizing plants, and downstream fabrication for batts, boards and loose-fill products. Major manufacturers have reported substantial production and sales metrics that illustrate scale: for example, ROCKWOOL reported full-year 2023 sales of EUR 3,620 million, reflecting the capital intensity and global reach of primary producers.

Production has been modernized in many regions by investments in electric melting and automation to reduce energy intensity and increase throughput, while recyclability and fire-performance are emphasized in product development. The importance of insulation to broader energy and climate goals is underscored by the International Energy Agency’s estimate that roughly one-third 34% of global final energy consumption is associated with buildings, highlighting insulation’s role in demand reduction.

Driving factors Demand for mineral wool is being driven by regulatory tightening of building energy performance, fire-safety standards, and the need for industrial thermal management. Public policy incentive programs have materially supported retrofit and new-build uptake: the European Commission’s Renovation Wave targets renovation of 35 million buildings by 2030, effectively aiming to at least double annual energy-renovation rates in the EU and creating a structural demand tailwind for high-performance insulation products.

Future growth opportunities market opportunity is concentrated in deep-retrofit programs, decarbonisation of heating and cooling loads, and industrial energy-efficiency projects. Empirical analyses indicate that properly designed insulation retrofits can deliver substantial operational savings; estimates by technical analysts (cited in industry briefings) indicate energy reductions in retrofitted homes from roughly 10% up to 45%, depending on scope and baseline conditions — a range that demonstrates the cost-effectiveness of targeted insulation interventions in lifecycle terms.

Key Takeaways

Mineral Wool Market size is expected to be worth around USD 29.9 Billion by 2034, from USD 17.2 Billion in 2024, growing at a CAGR of 5.7%.

Mineral Wool Blankets held a dominant market position, capturing more than a 32.8% share.

Dry Process Mineral Wool held a dominant market position, capturing more than a 67.5% share.

Glass Wool held a dominant market position, capturing more than a 48.9% share.

Medium-Density Mineral Wool held a dominant market position, capturing more than a 51.4% share.

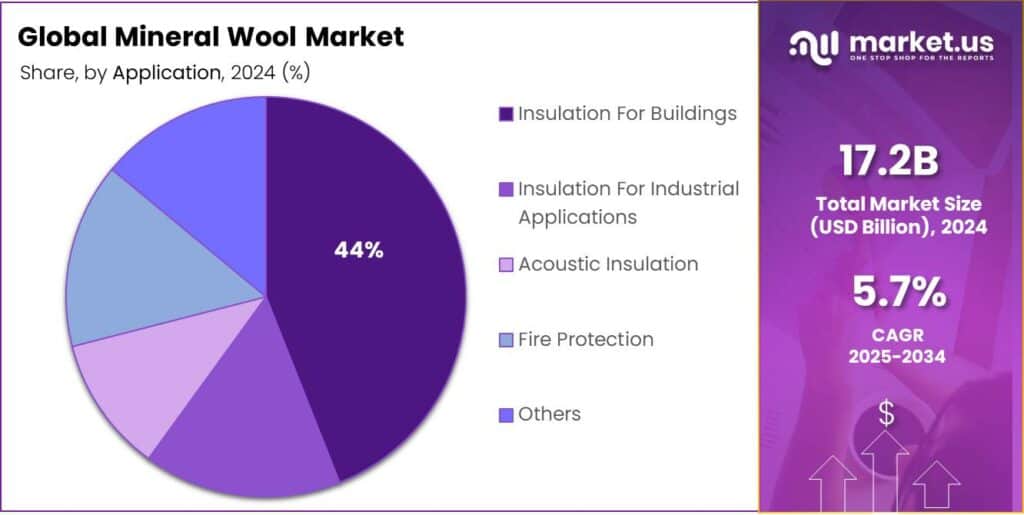

Insulation For Buildings held a dominant market position, capturing more than a 44.7% share.

Asia Pacific region dominated the global mineral wool market, accounting for 43.9% of the total market share, equivalent to approximately USD 7.5 billion.

By Product Analysis

Mineral Wool Blankets dominates with 32.8% share in 2024 due to high thermal and acoustic efficiency

In 2024, Mineral Wool Blankets held a dominant market position, capturing more than a 32.8% share of the overall mineral wool product segment. This leadership can be attributed to their exceptional thermal insulation properties, which make them highly suitable for both residential and industrial applications. The blankets offer consistent performance in energy conservation, noise reduction, and fire resistance, making them a preferred choice among builders and engineers. In 2025, demand for mineral wool blankets is expected to remain strong as construction activities continue to grow and awareness regarding energy-efficient building materials rises. Their ease of installation and adaptability across various building structures further reinforce their leading position in the market. The steady preference for mineral wool blankets highlights their continued relevance in modern insulation solutions.

By Processing Method Analysis

Dry Process Mineral Wool dominates with 67.5% share in 2024 due to its high efficiency and versatile applications

In 2024, Dry Process Mineral Wool held a dominant market position, capturing more than a 67.5% share of the overall mineral wool processing segment. The strong market preference for the dry process is driven by its ability to produce uniform, high-quality insulation materials that meet stringent thermal and acoustic standards. This method allows manufacturers to efficiently create blankets, boards, and other insulation forms with consistent density and performance, which is critical for both residential and industrial applications. In 2025, the demand for Dry Process Mineral Wool is projected to remain robust as construction growth accelerates and regulatory focus on energy-efficient buildings strengthens. The method’s cost-effectiveness, scalability, and adaptability to various end-use applications reinforce its leading position in the mineral wool industry, making it the preferred processing technique among producers.

By Fiber Type Analysis

Glass Wool dominates with 48.9% share in 2024 due to its superior thermal and acoustic insulation properties

In 2024, Glass Wool held a dominant market position, capturing more than a 48.9% share of the overall mineral wool fiber type segment. The preference for glass wool is largely driven by its excellent thermal insulation capabilities, lightweight nature, and high fire resistance, making it suitable for a wide range of applications including residential, commercial, and industrial buildings. In 2025, the demand for glass wool is expected to remain strong as energy-efficient construction practices continue to expand and building regulations increasingly emphasize sustainability. Its ease of installation, adaptability in various forms such as blankets and boards, and consistent performance across diverse climates further reinforce its leading position. The continued focus on reducing energy consumption in buildings ensures that glass wool remains the most favored fiber type in the mineral wool market.

By Density Analysis

Medium-Density Mineral Wool dominates with 51.4% share in 2024 due to its balanced performance and versatility

In 2024, Medium-Density Mineral Wool held a dominant market position, capturing more than a 51.4% share of the overall mineral wool density segment. This segment’s leadership is driven by its optimal balance of thermal insulation, acoustic performance, and structural stability, making it suitable for a variety of applications including walls, ceilings, and industrial equipment insulation. In 2025, demand for medium-density mineral wool is expected to remain strong as construction projects increasingly focus on energy efficiency and soundproofing. Its versatility, ease of installation, and consistent performance under varying environmental conditions reinforce its leading position. The continued emphasis on sustainable and safe building materials ensures that medium-density mineral wool remains the preferred choice among architects, builders, and industrial users.

By Application Analysis

Insulation for Buildings dominates with 44.7% share in 2024 due to growing construction and energy efficiency focus

In 2024, Insulation For Buildings held a dominant market position, capturing more than a 44.7% share of the overall mineral wool application segment. The segment’s strong performance is driven by the increasing demand for energy-efficient and sustainable building solutions in both residential and commercial constructions. Mineral wool provides excellent thermal insulation, soundproofing, and fire resistance, making it highly suitable for walls, roofs, and ceilings. In 2025, the demand for mineral wool in building insulation is expected to rise further, supported by growing urbanization, stricter building codes, and government initiatives promoting energy conservation and green construction practices. Its ease of installation, long-term durability, and ability to enhance indoor comfort continue to reinforce its dominant position, making it the preferred choice for builders and developers focused on efficiency and safety.

Key Market Segments

By Product

Mineral Wool Blankets

Mineral Wool Boards

Mineral Wool Rolls

Mineral Wool Loose Fills

Others

By Processing Method

Wet Process Mineral Wool

Dry Process Mineral Wool

By Fiber Type

Glass Wool

Stone Wool

Slag Wool

By Density

Low-Density Mineral Wool

Medium-Density Mineral Wool

High-Density Mineral Wool

By Application

Insulation For Buildings

Insulation For Industrial Applications

Acoustic Insulation

Fire Protection

Others

Emerging Trends

Growing Demand for Sustainable Building Materials

A significant trend driving the mineral wool market is the increasing demand for sustainable and energy-efficient building materials. This shift is largely influenced by stringent government regulations and growing environmental awareness among consumers and builders. Mineral wool, known for its excellent thermal and acoustic insulation properties, is gaining popularity as a preferred choice for insulation in both residential and commercial buildings.

In the United States, the federal government has introduced initiatives to encourage energy-efficient home improvements. The Energy Efficient Home Improvement Credit, effective from January 1, 2023, offers homeowners a 30% tax credit on qualifying insulation materials, up to $1,200 annually. This incentive is part of the broader efforts to reduce energy consumption and promote sustainable building practices. To qualify, insulation materials must meet the International Energy Conservation Code (IECC) standards, ensuring they contribute effectively to energy efficiency.

Similarly, the United Kingdom has launched the Great British Insulation Scheme, a £1 billion initiative running from 2023 to 2026. This program aims to enhance energy efficiency in residential properties by providing funding for various insulation measures, including cavity wall and loft insulation. The scheme is expected to assist thousands of households in reducing their energy bills and carbon footprints.

These government-backed incentives are pivotal in driving the demand for mineral wool insulation. By making the material more affordable and accessible, they encourage homeowners and builders to opt for energy-efficient solutions that align with both economic and environmental goals.

Drivers

Government Regulations and Energy Efficiency Standards

One of the primary drivers of the mineral wool market is the increasing emphasis on energy efficiency in building construction, largely propelled by stringent government regulations and energy efficiency standards. These regulations are not just guidelines; they are becoming mandatory requirements in many regions, compelling builders and homeowners to adopt materials that meet specific energy-saving criteria.

Similarly, in Europe, the European Union’s Energy Performance of Buildings Directive (EPBD) mandates that all new buildings must be nearly zero-energy by 2020, with existing buildings undergoing major renovations also required to meet stringent energy performance standards. This directive has led to a significant increase in the adoption of energy-efficient materials, including mineral wool. The demand for mineral wool insulation in Europe is projected to rise 2.6% annually, reaching a market value of $8.7 billion by 2028

These regulations are not just numbers on paper; they are influencing real-world decisions. Builders are increasingly choosing mineral wool for its superior insulation properties, which help in meeting these stringent energy standards. Homeowners, too, are opting for mineral wool insulation to ensure their homes are energy-efficient, leading to reduced energy bills and a smaller carbon footprint.

Moreover, governments are offering incentives to encourage the use of energy-efficient materials. These incentives can include tax rebates, grants, and low-interest loans, making it financially attractive for both builders and homeowners to choose mineral wool insulation. Such initiatives are accelerating the adoption of mineral wool, further driving its market growth.

Restraints

High Production Costs and Supply Chain Constraints

A significant challenge facing the mineral wool industry is the high production costs, which can impede its widespread adoption. The manufacturing process of mineral wool is energy-intensive, involving the melting of raw materials such as basalt rock and steel slag at temperatures exceeding 1,300°C. This requires substantial energy input, contributing to elevated operational expenses. Additionally, the production process generates waste materials, including non-fibrous particles known as “shot,” which necessitate proper disposal or recycling, further increasing costs.

The reliance on specific raw materials like basalt and recycled glass also makes mineral wool production susceptible to supply chain disruptions. Any fluctuations in the availability or price of these materials can lead to increased production costs. For instance, mining restrictions or shortages in steel slag can directly impact the production and pricing of mineral wool. These supply chain constraints can create uncertainties for manufacturers and potentially lead to price volatility in the market.

Furthermore, the transportation and logistics associated with sourcing raw materials and distributing finished products add another layer of complexity and cost to the mineral wool supply chain. The geographical distribution of these resources affects logistics, and any disruptions in transportation networks can delay production schedules and increase costs. These challenges highlight the need for efficient supply chain management and strategic sourcing to mitigate the impact of such constraints on production costs.

Opportunity

Government Incentives for Energy-Efficient Construction

A significant growth opportunity for the mineral wool market lies in the increasing government incentives aimed at promoting energy-efficient construction. These initiatives are not only encouraging the adoption of sustainable building practices but also creating a favorable environment for the widespread use of mineral wool insulation.

For instance, in the United States, the federal government offers substantial tax credits for homeowners who install energy-efficient insulation materials, including mineral wool. Homeowners can receive a 30% tax credit, up to $1,200, for qualifying insulation upgrades. Additionally, there is an extra $2,000 credit available for the installation of heat pumps, potentially allowing for total savings of up to $3,200 annually.

Furthermore, such initiatives are contributing to the growth of the mineral wool market. In Europe, for example, subsidies for sustainable insulation projects have led to increased investments in the sector. In 2024, Europe allocated $3.8 billion in subsidies for sustainable insulation projects, reflecting a strong commitment to energy efficiency and sustainability.

Similarly, in the United Kingdom, the government has launched the Great British Insulation Scheme, a £1 billion initiative running from 2023 to 2026. This program aims to enhance energy efficiency in residential properties by providing funding for various insulation measures, including cavity wall and loft insulation. The scheme is expected to assist thousands of households in reducing their energy bills and carbon footprints.

Regional Insights

Asia Pacific leads with 43.9% share in 2024, valued at USD 7.5 billion, driven by rapid urbanization and infrastructure development

In 2024, the Asia Pacific region dominated the global mineral wool market, accounting for 43.9% of the total market share, equivalent to approximately USD 7.5 billion. This significant share underscores the region’s pivotal role in the global insulation industry. The dominance is attributed to the rapid urbanization and industrialization occurring across countries such as China, India, Japan, and South Korea. These nations are witnessing a surge in construction activities, both residential and commercial, necessitating efficient insulation solutions to meet energy efficiency standards and enhance building performance.

China, in particular, stands out as a major contributor to the region’s market share, driven by its expansive construction sector and governmental initiatives promoting sustainable building practices. The country’s emphasis on green building certifications and energy-efficient infrastructure projects has spurred the demand for high-quality mineral wool products. Similarly, India’s burgeoning real estate market and increasing focus on energy conservation have further propelled the adoption of mineral wool insulation materials.

Key Regions and Countries Insights

North America

Europe

Germany

France

The UK

Spain

Italy

Rest of Europe

Asia Pacific

China

Japan

South Korea

India

Australia

Rest of APAC

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

GCC

South Africa

Rest of MEA

Key Players Analysis

Exxon Mobil Corporation is a global leader in the energy sector, known for its production of petrochemicals and materials, including mineral wool products. The company’s extensive research and development investments enhance the energy efficiency of its insulation materials. ExxonMobil’s strategic focus on sustainability, coupled with its expertise in materials technology, positions it as a key player in the mineral wool market, catering to the growing demand for energy-efficient building materials across residential, commercial, and industrial sectors.

Formosa Plastics Corporation is a prominent manufacturer of petrochemical products, including mineral wool insulation. The company has a strong presence in the global construction sector, providing high-quality, cost-effective insulation solutions. With a commitment to innovation, Formosa Plastics has expanded its product offerings to meet the growing demand for sustainable and energy-efficient building materials. Its mineral wool products are widely used in residential and commercial buildings for thermal and acoustic insulation, supporting sustainable construction practices worldwide.

LyondellBasell Industries Holdings B.V. is a leading global chemical and materials company with a strong footprint in the mineral wool market. The company produces high-quality insulation products that offer exceptional thermal and acoustic performance. LyondellBasell focuses on innovation and sustainability, contributing to the development of energy-efficient and environmentally friendly insulation solutions. The company’s broad product portfolio caters to various industrial, commercial, and residential applications, positioning it as a significant player in the global mineral wool market.

Top Key Players Outlook

ROCKWOOL International

Knauf Insulation

Sheth Insulation Pvt Ltd

John Manville

Owens Corning

A.M. INDUSTRIES

Saint-Gobain

Luyang Energy-Saving Materials Co., Ltd

Shandong Wiskind Architectural Steel Co., Ltd

China Iking Industrial Group Co., Ltd

Recent Industry Developments

In 2024 Formosa Plastics Corporation, introduced FormoleneEco™, its first polypropylene product containing 50% recycled content blended with virgin resin, marking a significant step towards sustainability in its product offerings.

In 2024 LyondellBasell Industries Holdings B.V, reported revenues of approximately $14.5 billion, with a net income of $2.1 billion. While specific figures for mineral wool production are not publicly disclosed, LyondellBasell’s extensive portfolio includes products used in insulation applications.

Report Scope