People with public sector jobs are much more likely than those working for private companies to enjoy a comfortable retirement, new research reveals.

The gap between them narrows, but not by a lot, when other financial assets like savings and investments are added to pensions for a fuller picture of household retirement finances.

Public sector workers ‘rule the roost’ when it comes to saving enough for old age because they have more generous final salary pensions, according to the study by Hargreaves Lansdown.

It analysed whether different groups of workers, in the public and private sectors or self-employed, are on track to have an ‘adequate’ retirement income.

This measure is based on the likelihood of people successfully managing to replace a certain percentage of their salary with a pension income that will cover their needs when they stop work (see below for how this works).

Private sector workers in all sizes of company are much less likely to be on track for a decent retirement than those with public sector jobs

Hargreaves calculates that 58 per cent of households with workers in the public sector are on course to hit this target when it comes to pension income.

But that rises to 65 per cent when their other assets – including emergency cash funds – are also taken into account.

By comparison, 41 per cent of households with people working for large private sector employers are on track when it comes to pensions only, but this goes up to 51 per cent when their non-pension wealth is included.

The figures are not dissimilar for people working at small and medium-sized firms (with fewer than 250 employees) at 42 per cent and 51 per cent respectively.

People employed in the public sector still have final salary or career average pensions – known in financial jargon as ‘defined benefit’ – which pay a guaranteed income until you die.

Aside from legacy schemes which are being wound down, these have been virtually wiped out in the private sector and replaced with ‘defined benefit’ pensions, which take sums from both employers and employees and invest them to provide a pot of money at retirement.

These are stingier in terms of employer contributions, and the employee bears the investment risk.

However, auto enrolment forced employers to make minimum contributions into the majority of staff members’ pensions, and the initiative has ensured most private sector workers are saving for old age.

Meanwhile, 36 per cent of self-employed people are heading for a decent pension income, rising to 47 per cent when their other assets are counted.

‘Public sector worker households continue to rule the roost when it comes to retirement adequacy,’ says Clare Stinton, head of workplace saving analysis at Hargreaves Lansdown. ‘These figures put them streets ahead of private sector households.

‘This owes much to the prevalence of final salary pension schemes in the public sector, which can play an enormous role in helping people to build a resilient retirement income.

‘While auto-enrolment has brought more people into pensions, it is clear that more needs to be done to boost contribution rates.’

She adds: ‘The self-employed continue to struggle. This can be due to this group being locked out of auto-enrolment as well as favouring more flexible ways of saving beyond pensions.’

When it comes to improving your personal pension situation, Stinton says: ‘Small steps – nudging up pension contributions, maximising what’s on offer from an employer, or delaying retirement – can also shift the dial significantly.’

The figures above on the likelihood of achieving ‘retirement adequacy’ come from Hargreaves’ Saving and Resilience Barometer, which it compiles in partnership with forecasting firm Oxford Economics.

This is based on data from the Wealth and Asset survey by the Office for National Statistics – which draws its information from 10,000 households – plus other data from official sources.

Find out below how Hargreaves works out retirement adequacy, and how you can apply it to your own situation.

Percentage of households likely to achieve decent retirement income Type of employment Pension income All assets Public sector 58%65% Private sector (large firms) 41%51%Private sector (medium and small firms42%51%Self-employed 36% 47% Source: Hargreaves Lansdown. Large employers have 250-plus workers. medium ones have 50-plus, and small ones employ between 1 and 50 people.Are YOU saving enough for retirement?

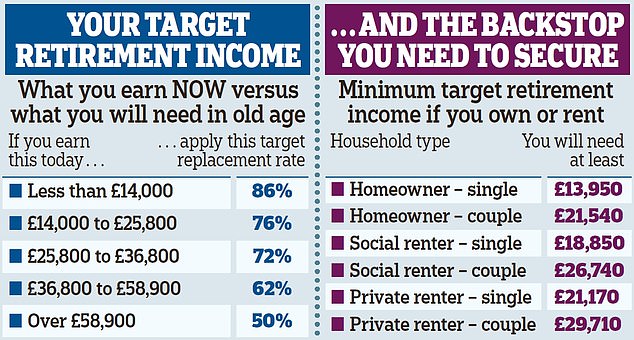

Hargreaves uses people’s current income as a starting point for what they will need to live on in retirement.

It then uses a ‘target replacement rate’ benchmark, based on figures from the think tank Resolution Foundation

Check the table below to see which income category you fall into, then apply the percentage in the right-hand column to your own annual earnings.

If you are on £30,000 a year before tax, your replacement rate is 72 per cent, so your pensions and other assets would need to generate you an income of £21,600 a year in retirement. On £45,000 a year, your replacement rate falls to 62 per cent, so the income you are aiming for is £27,900.

Hargreaves also uses a ‘backstop’, based on the Living Pension which published by the Living Wage Foundation, to ensure people have at least enough to cover basic everyday needs.

This number depends on whether you will be living in a single, dual (or more) income household in retirement, and whether you own your home. Rental costs do not factor in housing benefit and other subsidies for lower-income households.

If you qualify for a full state pension – currently worth £12,000 a year – and you are saving into a work pension under automatic enrolment, you should meet the Living Pension minimum target.

Hargreaves’s approach to working out what people need for decent retirement, which is based on replacing a percentage of their previous income, differs from the commonly cited Retirement Living Standards, published by industry group Pensions UK.

That study puts a pounds and pence figure on what is needed for a minimum, moderate or comfortable retirement lifestyle.

The most recent suggested a couple needed £21,600 for a minimum lifestyle, £43,900 for a moderate one and £60,600 for a comfortable one. The figures do not include income tax, housing or care costs.

Pension calculator: When can you afford to retire?

When can you afford to retire and how much do you need to get the lifestyle you want?

This is Money’s pension calculator, powered by Jarvis, uses benchmark PLSA Retirement Living Standards amounts to help you work out what your retirement could look like – and what you need to save.

> Pension calculator: Work out whether you are on track

<!- – ad: https://mads.dailymail.co.uk/v8/us/money/moneypensions/article/other/mpu_factbox.html?id=mpu_factbox_1 – ->

SIPPS: INVEST TO BUILD YOUR PENSION

AJ Bell

AJ Bell

0.25% account fee. Full range of investments

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing, 40% off account fees

Interactive Investor

Interactive Investor

From £5.99 per month, £100 of free trades

InvestEngine

InvestEngine

Fee-free ETF investing, £100 welcome bonus

Prosper

Prosper

No account fee and 30 ETF fees refunded

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.