Data from the Bangladesh Bank shows that LC settlement in August decreased by $0.6 billion, reaching $4.88 billion compared to $5.48 billion in the same month last year – a 10.94% decrease.

30 September, 2025, 01:00 am

Last modified: 30 September, 2025, 02:03 am

Infographic: TBS

“>

Infographic: TBS

Despite having an adequate supply of US dollars, the country’s Letter of Credit (LC) settlement for imports declined significantly in August this year, primarily due to a drop in capital machinery imports, signalling a slowdown in new business and investment.

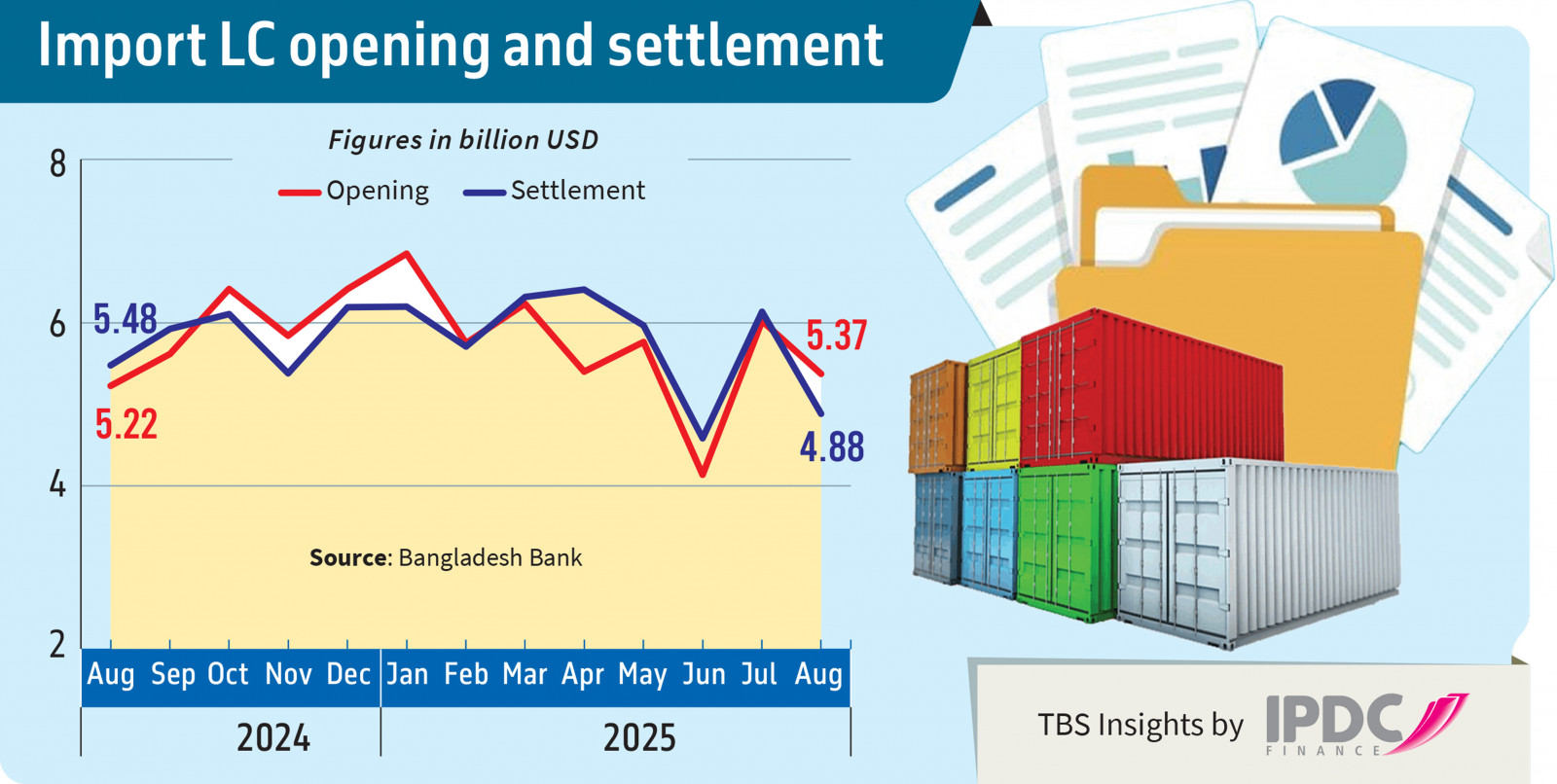

Data from the Bangladesh Bank shows that LC settlement in August decreased by $0.6 billion, reaching $4.88 billion compared to $5.48 billion in the same month last year – a 10.94% decrease.

Data from the Bangladesh Bank shows that LC settlements dropped by 10.94% year-on-year, standing at $4.88 billion in August 2025, compared with $5.48 billion in the same month of 2024. However, LC openings in August reached $5.38 billion, up 3.06% from $5.22 billion a year earlier.

Bankers, economists, and central bank officials attributed the decline in settlements to reduced new LC openings in previous months and lower pressure from overdue LCs. They also pointed to a slowdown in new business and investment, resulting in reduced imports of capital machinery. At present, traders are mostly importing consumer goods rather than raw materials or capital items.

Keep updated, follow The Business Standard’s Google news channel

A deputy managing director of a private bank told TBS that reduced investment naturally lowers business activity. “Currently, entrepreneurs are reluctant to pursue new investments, and deferred LCs are no longer being extended,” he said.

Decline linked to investment slowdown

Md Mazadul Hoque, executive director of the Policy Think & Economic Research Centre, said, “Other than consumer goods, LCs are hardly being opened. With investment slowing, there is little demand for raw materials or capital machinery. Private sector lending has declined, new investment is absent, and lending rates remain high. Against this backdrop, imports of non-essential goods are naturally low.”

Professor Mustafizur Rahman, distinguished fellow at the Centre for Policy Dialogue (CPD), noted that the ready-made garment sector continues to grow, so settlements there have not fallen. “The decline in LC settlements stems from lower imports of capital machinery, which is also reflected in weak private sector credit growth of only 6-7%,” he said.

Bangladesh Bank data shows that imports of capital machinery fell by 11.5% during July–August this year.

Tarek Reaz Khan, managing director of NRB Bank, observed, “Settlements are down mainly because fewer LCs were opened earlier. Towards the end of 2024 and at the beginning of this year, LC openings dropped significantly, which is now reflected in lower settlement figures.”

From dollar crunch to stability

Bangladesh’s dollar market became unstable in mid-2022, prompting the Bangladesh Bank to impose margins on LCs to stabilise the market. A subsequent shortage of foreign exchange led to overdue settlements across banks.

To revitalise trade and industry in 2024, the central bank lifted LC margins on all imports except luxury items and products manufactured domestically. Since then, businesses have been able to import capital machinery, consumer goods, and raw materials without upfront cash margins, based on client-bank relationships.

Risks ahead

Md Mazadul Hoque cautioned that reduced investment could worsen unemployment, increasing the risk of social and political unrest.

A senior central bank official added that with the current level of dollar supply, there should be no difficulty in LC openings or settlements. “Political stability will be crucial for restoring investor confidence and boosting new investments,” he noted.