Sometimes, when people find out my work relates to markets, they’ll bring up an exciting investment trend. Artificial intelligence is by far the most popular topic of conversation right now. Renewable energy used to come up more. Cannabis also had a day in the sun (or hydroponic lamp).

I always squirm a bit when I hear about investing based on themes. Earlier this year, I wrote about getting burned buying Internet stocks 25 years ago. As a theme, the Internet was perfectly valid; it changed the way we all live and work. But the 1990s market got way too far ahead of itself. Internet business models took years to develop. Then prices reflected highly unrealistic growth expectations.

No doubt, it’s an extreme example. Yet, it reflects the pitfalls of thematic equity investing that my colleague Dan Sotiroff described in a terrific article called Don’t Fall for a Good Story. Dan sees thematic investors as making a trifecta bet: First, that the theme will pan out; second, that chosen investments will benefit; and third, that stock prices will rise. Themes are typically widely appreciated. Perceived beneficiaries tend to be high-priced.

Last year, Morningstar launched 15 Thematic Consensus Indexes, which include the stocks most commonly held by mutual funds and ETFs focused on specific themes. Their behavior and composition highlight the challenges thematic investors face.

Picking Winning Themes Is Hard

My first takeaway from the exhibit is that it’s difficult to beat the market. Seven of the themes outperformed the broad global equities universe over the past five years; seven underperformed. (Thematic consensus indexes’ prelaunch returns were simulated based on historical fund holdings data. Nano Technology & New Materials‘ history was insufficient.)

At a glance, all the themes look like legitimate growth trends. Who doesn’t like food—especially as diets in the developing world change? The global energy transition, the healthcare needs of an aging demographic, and the spread of digital payments and cryptocurrencies will all be familiar to readers. The technology trends captured by the indexes all seem inexorable.

I’m not surprised to see that the best-performing themes in recent years are tech-focused, given that sector’s market leadership. But the fact that two themes outperformed the Morningstar Global Artificial Intelligence + Big Data Consensus Index over the past five years was eyebrow-raising.

I wouldn’t say the two top performers, Future Mobility and Robotics & Automation, have been more successful than AI as themes. AI is attracting trillions in corporate spending, even as questions remain about its impact. When I look at those two thematic indexes, I notice both have devoted more weight to Nvidia NVDA, whose gain of more than 1,200% over the past five years is a key driver of relative returns. Nvidia’s technology enables autonomous vehicles and robots, as well as AI.

Review Top Stocks in Morningstar’s Global Consensus Indexes

On the other end of the performance spectrum, the healthcare sector has been a serious laggard in recent years, which explains poor returns from Wellness and Life Sciences. Policy concerns are a big part of the story. The sector has been weighed down by expectations of downward pressure on pricing. While that has opened up company-specific investment opportunities, according to my colleagues on Morningstar Equity Research, it has made for a disappointing recent investment experience.

Why has Battery Technology been such a dud? Isn’t energy storage crucial to decarbonization, electric vehicles, and all manner of devices? Yes, but the index contains a bunch of lithium producers who have been hit by a price collapse thanks to oversupply. Investing in commodities is not for the faint of heart.

More Top Stocks in Morningstar’s Thematic Consensus Indexes Do Themes Add to a Portfolio?

Thematic investors might ask themselves whether they are not already sufficiently exposed through other portfolio holdings. The tech sector already exceeds 25% of global equities market value; in the US, tech stocks represent one-third of the market. Many of the thematic consensus indexes are heavy on technology, and because they are market-capitalization-weighted, they include generous helpings of mega-caps like Nvidia.

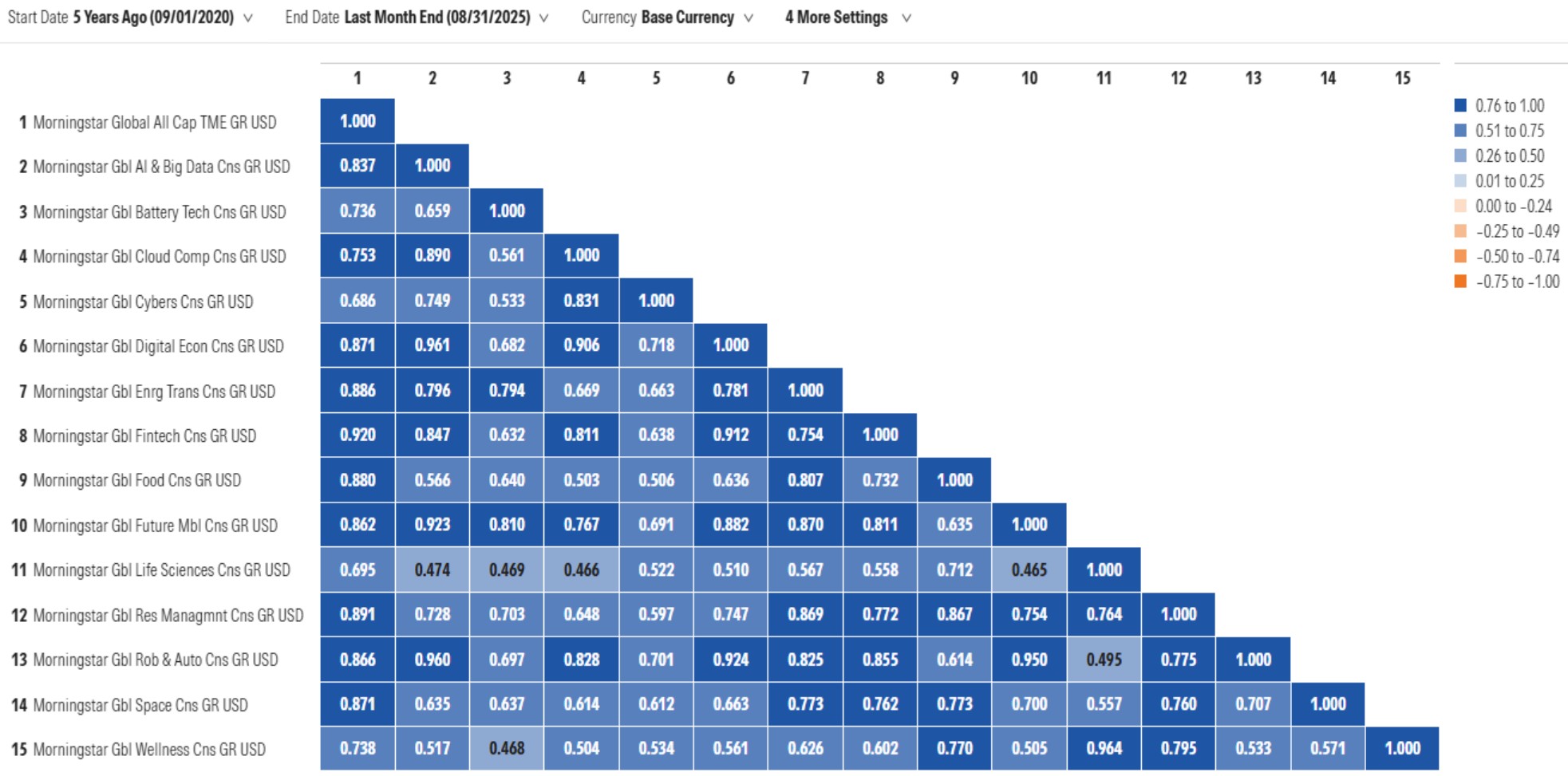

Given holdings overlap, correlations are unsurprisingly high between some of the thematic indexes and the broad global equities universe (the first index listed in the matrix below.)

Source: Morningstar Direct.

Source: Morningstar Direct.

You’ll see that the healthcare-focused themes have lower correlations. That’s not surprising given the underperformance of the healthcare sector and its falling share of the global equities market. I was surprised to see the cybersecurity index with a relatively low correlation to the broad equity market, though.

Lessons for Thematic Investors

Lessons for Thematic Investors

Mixed performance for thematic indexes is telling. Bets against the broad stock market are hard to get right. That’s evident in the woeful performance of most active managers. It also goes for systematic approaches, like those based on investment factors.

Meanwhile, high correlations between many themes and the broad market should prompt questions about whether separate thematic investments are superfluous. Growth trends like AI explain much of the market’s recent gains. Most of the largest stocks are thematic beneficiaries. It’s also the case that many of the companies on the leading edge of themes are private. That goes for SpaceX, OpenAI, and Stripe, a fintech.

Contrarian investors, for their part, might be drawn to underperformers and less-correlated themes. Perhaps the coming years will see a recovery for themes like Life Sciences and Wellness, or those that include lots of basic materials stocks. The diversification they provide will be especially appreciated if AI, like the internet and many prior growth trends, leads to a bubble, then a crash.

Hear Dan on Investing Insights Podcast: How to Spot Dividend Traps

Morningstar, Inc., licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. A list of ETFs that track a Morningstar index is available via the Capabilities section at indexes.morningstar.com. A list of other investable products linked to a Morningstar index is available upon request. Morningstar, Inc., does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.