A PREVIOUS formula for paying into the Social Security Fund is based on out-of-date population projections and concerns raised about the long-term implications of plans to reduce the amount paid into it are “scaremongering”, the Chief Minister has said.

During States question time, Deputy Lyndon Farnham said that, when compared with similar funds in other jurisdictions, Jersey’s social security reserves were in a “strong state”.

If approved, the recently-unveiled 2026 to 2029 Budget includes plans for a “temporary rebasing” of the States grant to the Social Security Fund over the next four years.

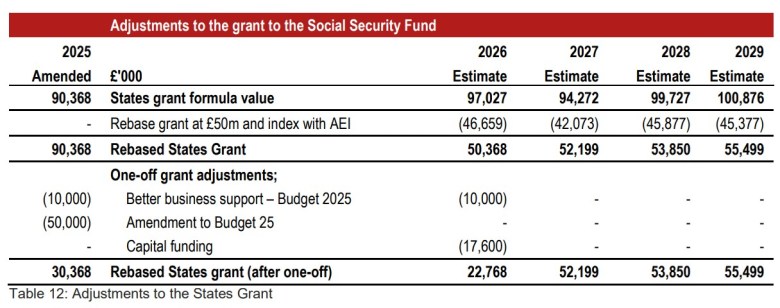

This would initially see the figure drop from its formula value of around £97 million to around £50 million, with further “one-off” reductions of £17.6 million and £10 million – to support the Government’s capital programme and living wage transition plans respectively – taking it down to £22.768 million in 2026 [see picture].

During questions without notice to Chief Minister Lyndon Farnham, Deputy Renouf questioned whether the public could have faith that the government’s proposed Capital Investment Programme to protect public spending when “that principle is being undermined with its raid on social security contributions”.

Deputy Farnham, in response, said: “They should have faith based upon the the foresight that established the Social Security Reserve Fund and the strong performance that has let it to grow to almost £2.5 billion with the projected growth of £3 billion by 2029.

“The Social Security Reserve Fund was based on a formula set up at a time when our long-term population projections were completely different to what they are now and the Deputy conveniently forgets that we are still proposing to put £186 million into the fund. I think it is important that we balance what the taxpayers puts into the fund and how it supports the fund with what the fund actually needs.

“It is still, by just about every other reserve fund around the world, in a strong state with seven or eight years of reserves which is unheard of in many other countries. I wish the Deputy and other Members would stop scaremongering about the impact on the fund.”

Earlier in the sitting, Social Security Minister Lyndsay Feltham sought to reassure Members that the proposed reduction “will not damage the ability of the fund to meet its future commitments”.

Deputy Renouf questioned what work had been undertaken prior to the proposed Budget’s publication to ensure that the reduction could be implemented “without damaging the ability of the fund to meet its future commitments”.

He also asked why, given the scale of the reduction, the next actuarial review had not been brought forward “to inform the budget decision”.

“Detailed estimates were prepared by Treasury and considered at length by Council of Ministers prior to the publication of the Budget,” Deputy Feltham said, citing figures elsewhere within the document that “show that the temporary reduction will not damage the ability of the fund to meet its future commitments”.

“The Social Security Reserve Fund balance is expected to increase to £2.5 billion at the end of 2025 and to £3 billion at the end of 2029,” she continued.

“The periodic actuarial review of the fund is a detailed and time-consuming piece of work designed to support longer-term policy decisions.

“The reviews are scheduled to give each government the most up-to-date information possible on long-term trends, and it would not be appropriate to move this timetable due to a proposal for a temporary reduction which does not have a long-term impact on the fund.”

Related