A cash usage continues to dwindle, more than half of Brits now use mobile wallets for online and contactless payments.

Editorial

This content has been selected, created and edited by the Finextra editorial team based upon its relevance and interest to our community.

There was a surge in mobile wallet use for payments from 42% of UK adults in 2023 to 57% in 2024, according to UK Finance figures.

Brits who register for a mobile wallet service, quickly seem to become frequent users, ditching cards for their handsets. Of those who used mobile payments, half used them monthly, and 44% weekly or more often. While younger people still lead the way in terms of adoption – 88% of 16-24-year-olds – among those aged 65 and over, registration rose from 14% in 2023 to 25% in 2024.

Meanwhile, mobile banking became the most common way to access accounts in 2024, used by 75% of UK adults, overtaking desktop banking for the first time.

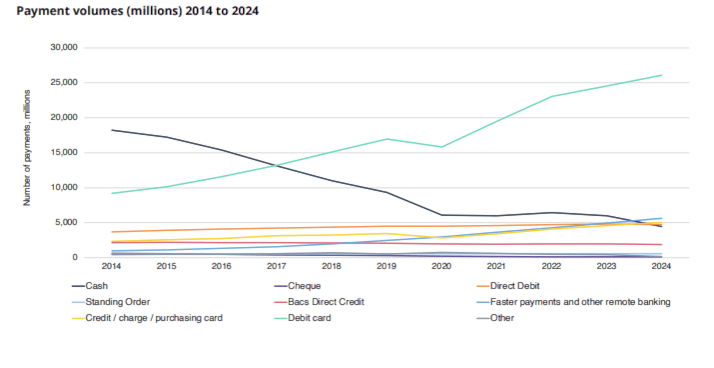

Cards (both physical and mobile) were the most used way to pay in the UK last year, making up 64% of all transactions. Debit cards led the way, with 26.1 billion payments – up six per cent from 2023. Credit and charge card use rose slightly, from 4.9 to five billion payments. Consumers made 18.9 billion contactless card payments in 2024 – mostly with debit cards.

In contrast, cash was used for 4.4 billion payments compared with six billion in 2023. For the first time, cash accounted for less than 10% of all payments.

A quarte of Brits used BNPL services, up from 14% in 2023, with younger adults the most frequent users.

Overall, the total number of payments made in the UK last year was 48.6 billion payments, up by 1.5%. Consumers were responsible for 84% of these, with businesses, government and not-for-profit organisations accounting for 16%.

Adrian Buckle, head of research, UK Finance, says: “2024 was a year of firsts, all pointing to the growing shift towards digital payments – more than half of UK adults used mobile wallets, mobile banking overtook desktop as the main way people access their accounts, and cash fell below 10 per cent of all payments.”