Market & Trading calls

Americas:

Supportive for US exports with favourable pricing and domestic refining maintenance incentivising seaborn flows.Supportive TMX flows with greater Asia demand pull and lower US midcontinental runs.Bullish on Latin American sour grades with weaker Brent-Dubai EFS and expensive Middle Eastern freight favouring West-to-East crude flows.

Europe and Africa

Neutral on Senegalese crude output around 100 kbd, with all production made up of medium sour Sangomar.Stable on Ivory Coast’s crude supply outlook, with Baleine reaching Phase 2 (50 kbd) this year.Slightly supportive on Lokele and Doba Blend imports into Fujairah given the subsiding of Sudanese crude inflows.

Middle East and Asia

Bearish on Dubai time spreads as medium sour supply lengthens from the Middle East and OPEC+ seaborne flows rise.Neutral to Bullish on condensate differentials as light crude tightness is set to persist through early October, driven by strong East of Suez naphtha cracks and limited Qatari supply.Neutral to decreasing on Chinese import demand although a rebound from current levels is likely. High flat prices, quota constraints, and rising freight rates to cap spot buying.Americas: Open arbitrage economics push seaborne flows higherUS crude loadings surge

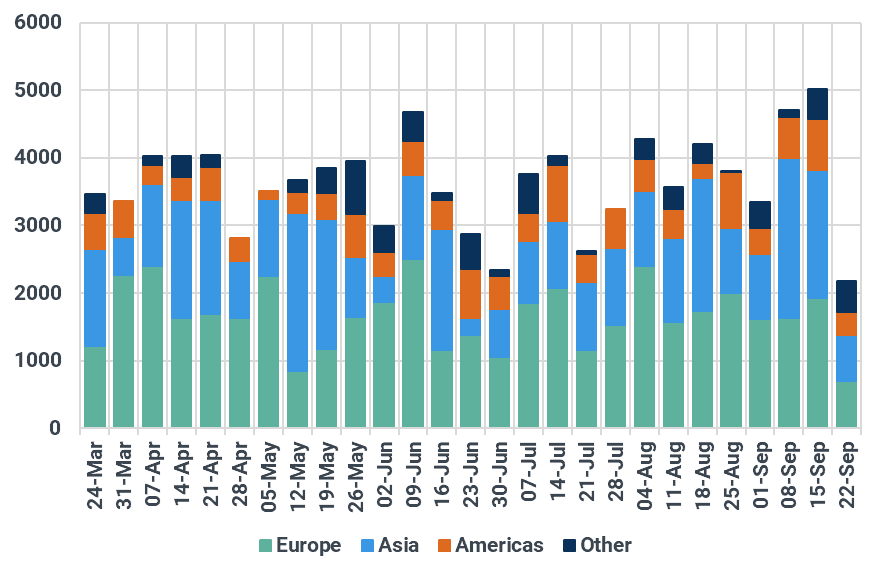

US crude exports surged to their highest level since March 2024, reaching nearly 5 Mbd for the week ending September 19, according to Kpler’s tracking.

This rise in exports, driven by weak WTI pricing and open arbitrage economics, comes as domestic refinery inputs have declined by 400 kbd in mid-September, according to EIA data. Most cargoes continue to head for Europe, but the most significant development is the resumption of trade with China after a 7-month hiatus.

Kpler fixture data shows five VLCCs chartered by major traders and refiners for October loading in the US Gulf Coast with discharge destinations in China. If realized, these flows could reach 335 kbd—a level unseen since June of last year.

This trade had previously halted after the Trump administration announced new import tariffs. The sudden resumption may indicate market expectation for improved trade relations ahead of a planned meeting between the two countries’ leaders at the APEC summit in late October.

US weekly crude and condensate exports by destination region, kbd

Source: Kpler

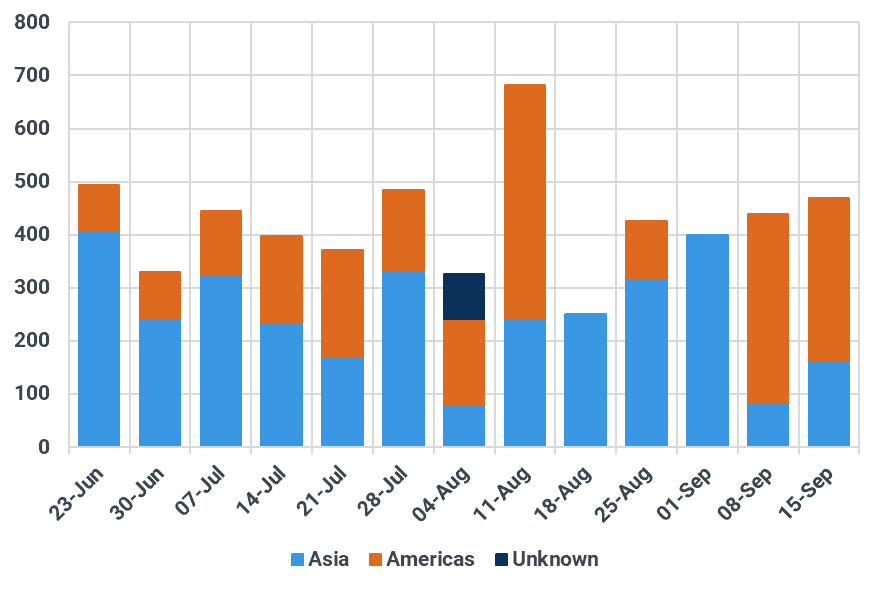

October Enbridge flows to be unapportioned with TMX strength

Canada’s 3 Mbd Enbridge Mainline crude system will be unapportioned for October, contrary to market expectations. Enbridge accepted all shipper nominations, a move driven by two key factors: stronger flows on the competing Trans Mountain (TMX) pipeline and weak US demand.

An open shipping arbitrage on TMX likely diverted more barrels from the Alberta oil sands to Vancouver and the Puget Sound to capture higher profits. In tandem, US midcontinent refinery demand is seasonally weak due to fall turnarounds.

While market participants had expected some apportionment due to rising Canadian production, these logistical shifts will allow all nominated volumes to flow.

This dynamic may be temporary, as Canadian supply is set to increase in the fourth quarter. Kpler data suggests production will average 5.36 Mbd, up by 162 kbd on the quarter, as new projects like Cenovus’s Narrows Lake come online and other producers ramp up output.

Weekly Westridge (Western Canada) crude oil exports, kbd

Source: Kpler

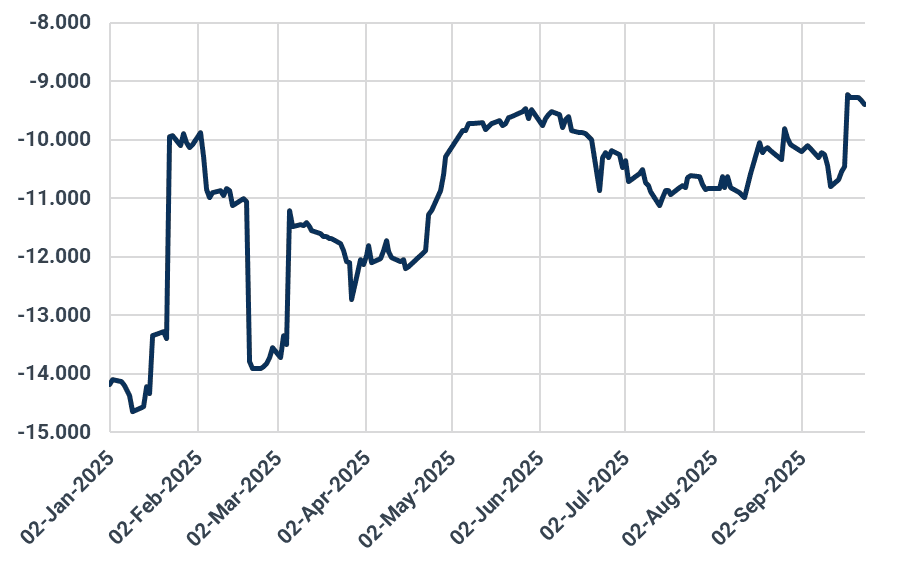

Napo differential rises with Far East interest

Differentials for Ecuador’s heavy sour Napo crude reached their highest levels in over a year, driven by a surge in demand from China. Napo’s discount to Dated Brent narrowed to nearly $9/bbl this week, compared to around a $10.50/bbl discount last month, according to Argus Media.

The strength was underpinned by a recent Petroecuador tender for October-loading cargoes, where China’s Unipec was a key buyer. Trade sources suggest that tight end-of-year import quotas for independent refiners are forcing China’s state-run giants to seek out alternative barrels like Napo to maintain high utilization rates.

While Ecuador’s overall exports are set to dip this month, Kpler data shows a third of the 339 kbd of crude scheduled for export is destined for China.

In a notable development, a small parcel of Napo was also sent to Turkey in August, a rare trade that may signal an effort by Turkish refiners to pivot away from Russian crudes ahead of a potential new EU sanctions package and increase availability of Latin American crudes in the Atlantic Basin.

Napo crude differential to Dated Brent, $/bbl

Source: Argus Media

This week’s Americas related Market Pulse Reports:

EIA Digest: US crude intake remains high, but gasoline stocks keep fallingAtlantic Basin: Ivory Coast‘s Baleine ramps up amid declining Baobab and Espoir streamsSenegal’s refined products imports mainly sourced from Russia

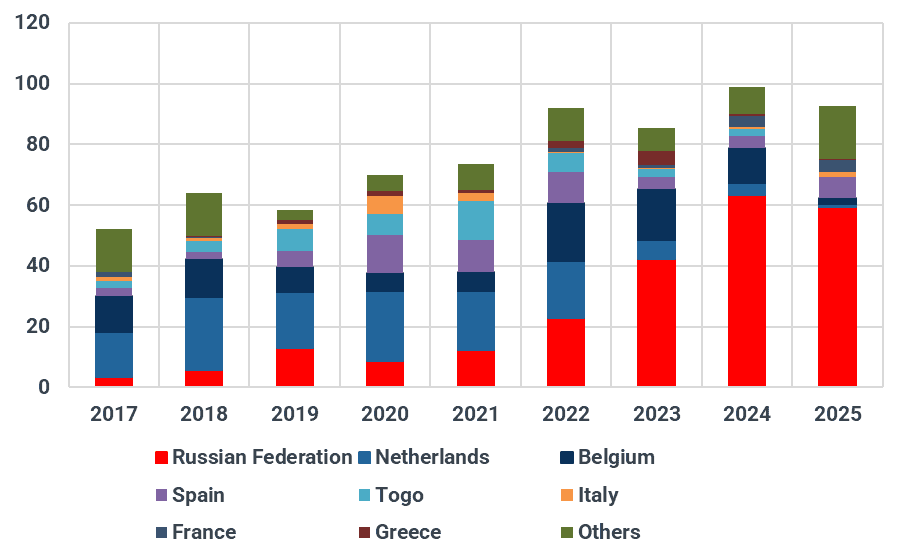

Senegal became an oil producer in mid-2024, when the offshore Sangomar field (100 kbd), after several delays, finally came onstream. Kpler data shows that the first export cargo of medium sour Sangomar crude (31° API, 1.0% sulfur) departed in July 2024, with outflows averaging 90–100 kbd since then. In line with exports, we estimate that Senegal’s crude supply has averaged around 100 kbd since July last year, effectively reaching the nameplate capacity of the Sangomar Phase 1 project.

Phase 2 of Sangomar, currently under approval, involves the drilling of roughly 33 wells. While reports point to a 2027 start-up, this timeline appears optimistic. Over the past year, the top three buyers of Sangomar crude have been Spain, Italy, and the Netherlands, where it competes with grades such as Johan Sverdrup and Oman. We expect Senegal’s crude output to remain stable at 100 kbd, with all volumes directed toward exports.

Meanwhile, Senegal’s 30 kbd Dakar (SAR) refinery—configured to process lighter, sweeter crudes—is currently running on Nigeria’s Erha crude (36° API, 0.2% sulfur), with imports into Dakar averaging 30 kbd in recent months. To fully meet domestic product demand, Senegal relies heavily on refined imports, particularly from Russia. Of the 90–100 kbd of refined products imported during 2024–2025, 50–60% originated from Russia, mainly gasoil, fuel oil, and diesel.

Senegal products imports, kbd

Source: Kpler

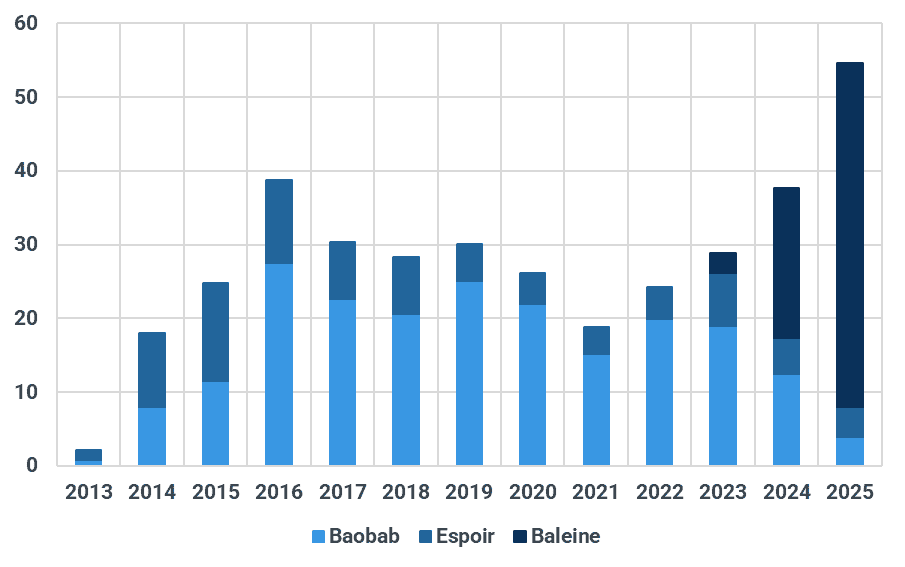

Baleine phase 2 (50 kbd) reached in 2025

Until 2023, Ivory Coast produced only 20–30 kbd from its Espoir and Baobab fields, which began production in 2002 and 2005, respectively. The medium sweet Baobab crude (24° API, 0.4% sulfur) and the light sweet Espoir crude (31.3° API, 0.3% sulfur) were largely exported to Europe and Asia, but output from both fields has declined sharply in recent years. In early 2025, the FPSO Baobab Ivoirien MV10 was taken offline for refurbishment, removing roughly 20 kbd of production from Canadian Natural Resources Ltd.’s Baobab field.

In August 2023, Eni launched Phase 1 of oil and gas production at the Baleine field—discovered in September 2021, 80 km southwest of Abidjan. The FPSO has capacity for around 15 kbd of oil and 25 Mscfd of associated gas, with all gas delivered onshore via a newly built export pipeline designed to help meet domestic power demand.

Kpler data shows that light sweet Baleine exports more than doubled from 20 kbd in 2024 to nearly 50 kbd in 2025, mainly purchased by refiners in Italy, the UK, and Romania, with occasional cargoes sent to Brazil. These higher outflows reflect two dynamics: first, Baleine volumes broadly replacing declining Baobab and Espoir flows; and second, a sharp increase in Ivory Coast’s crude production—from 30 kbd to 45 kbd (+15 kbd from Baleine Phase 1) and now 80–90 kbd with the addition of Phase 2.

Ivory Coast crude exports, kbd

Source: Kpler

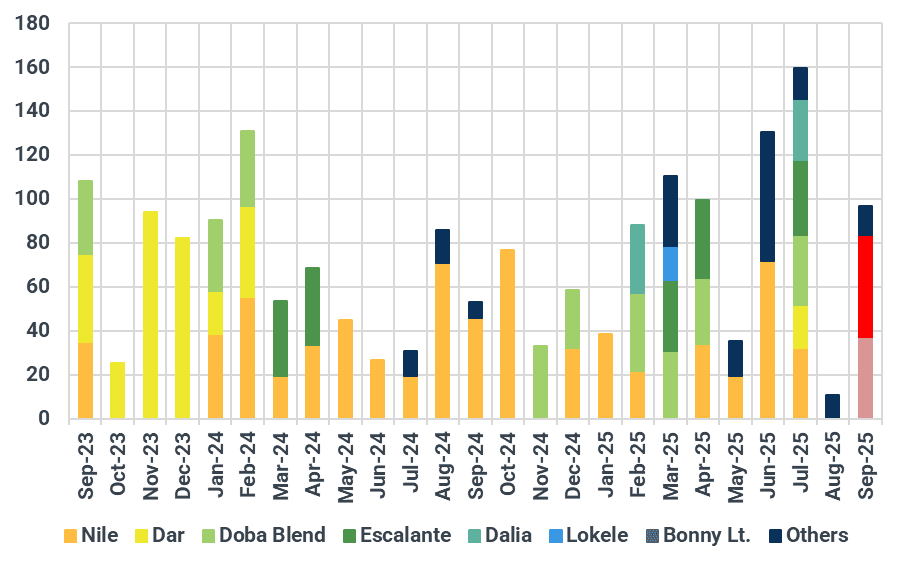

Heavy sweet Lokele imports into Fujairah as substitute for lacking Sudanese inflows

Exports of Cameroon’s heavy sweet Lokele and Chad’s Doba Blend, both shipped from Cameroonian ports, have averaged 190–200 kbd in recent years. In 2025, Lokele (22.3° API, 0.4% sulfur) has mainly been purchased by China and several European countries, including the Netherlands, Italy, and France. Notably, this month marked only the second-ever arrival of a Lokele cargo in the UAE: the Agios Fanourios departed Cameroon on 15 August and discharged in Fujairah on 16 September.

By contrast, imports of Chad’s Doba Blend (21.4° API, 0.1% sulfur) into Fujairah have been more frequent, with the latest delivery in early July. The uptick in Cameroonian flows may reflect a substitution effect, as heavy sweet Sudanese crude imports into the UAE have collapsed. Following the UAE’s ban on maritime trade with Sudan, Sudanese arrivals dropped from 50–70 kbd in June–July—comprising light sweet Nile (32.8° API, 0.1% sulfur) and medium sweet Dar (25° API, 0.1% sulfur)—to zero in August. Crude arrivals in Fujairah are typically used for VLSFO production.

Hence, this explains also we have seen a record high in LSFO imports into Fujairah in September, a trend that is likely to continue into October amid a lack of alternative heavy-sweet crude oil imports so far.

Crude imports into Fujairah, kbd

Source: Kpler

This week’s Atlantic Basin-related Market Pulse Reports:

Kazakhstan’s BTC pipeline restart highlights diversification challengesAssessing the impact on Russian energy infrastucture from renewed Ukrainian drone strikesMiddle East and Asia: Barrel imbalance widens, China starts drawing inventoriesAmple supply of medium sour crude to continue weigh on Asian medium sour market

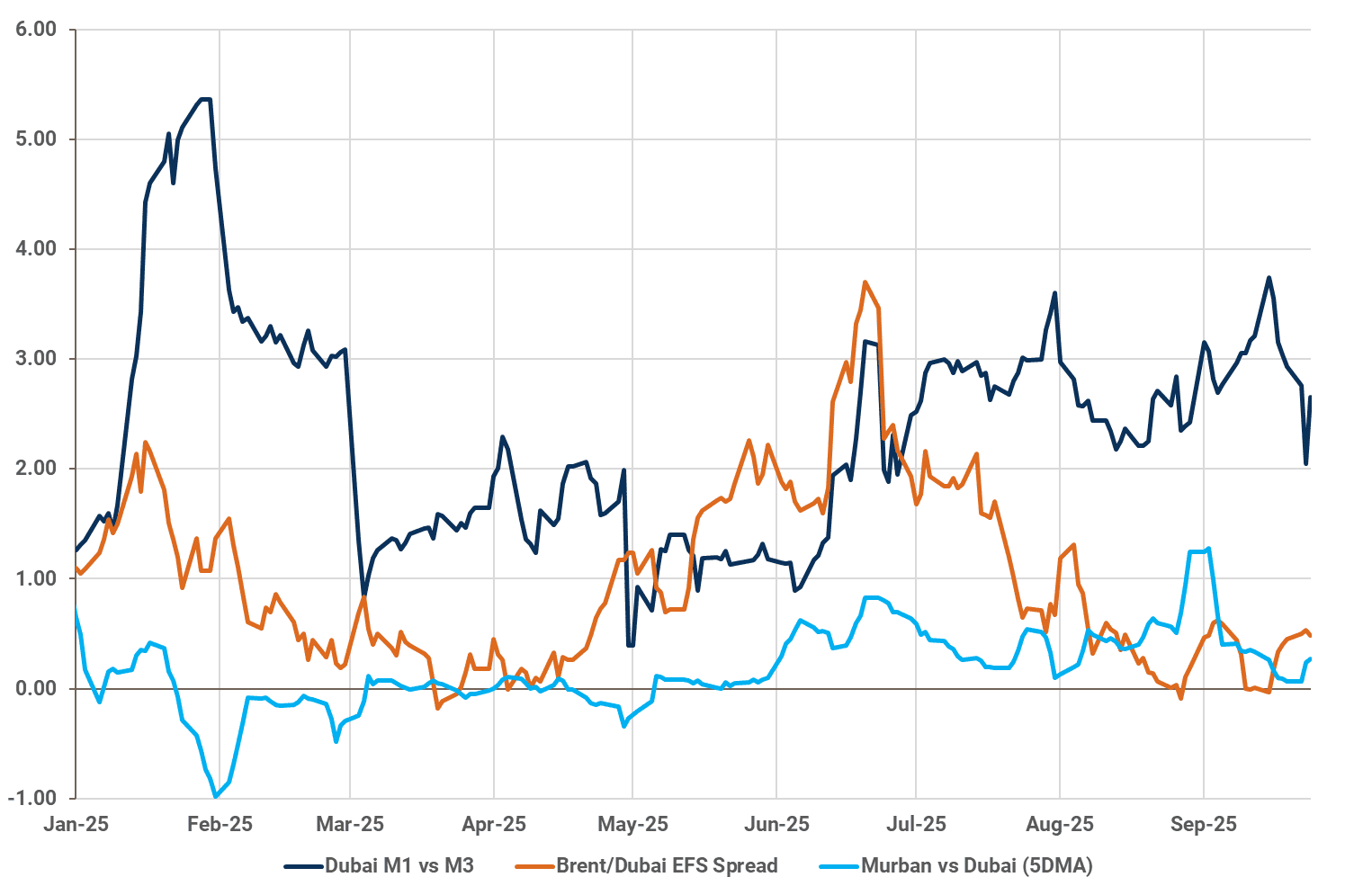

As we predicted last week, the Dubai structure has weakened sharply, with the 1–3 month backwardation compressing to ~$2.60/bbl from over $3/bbl last week. This was driven by ample supply from the Middle East, where exports have strongly rebounded, and waning demand from Indian and Chinese buyers. Ongoing weakness in Brent-Dubai EFS – now holding near $0.50/bbl (Argus Media) – continues to open the door to Atlantic Basin grades. We’re seeing stepped-up Mars purchases in East Asia, alongside more Johan Sverdrup, CPC, and Brazilian barrels heading East, although rising freight rates start to limit these flows.

While Russian supply risks provide short-term support due to drone disruptions, fundamentals point to further narrowing in the Dubai curve. Middle East offline refining capacity will climb nearly 500 kbd across October–November. Simultaneously, OPEC+ seaborne exports are surging and are up 1.1 Mbd mtd in September, driven by Saudi Arabia (+743 kbd), Iran (+332 kbd), and UAE (+262 kbd). October quotas rise by 177 kbd with lower compensation volumes. The regional medium sour market remains oversupplied.

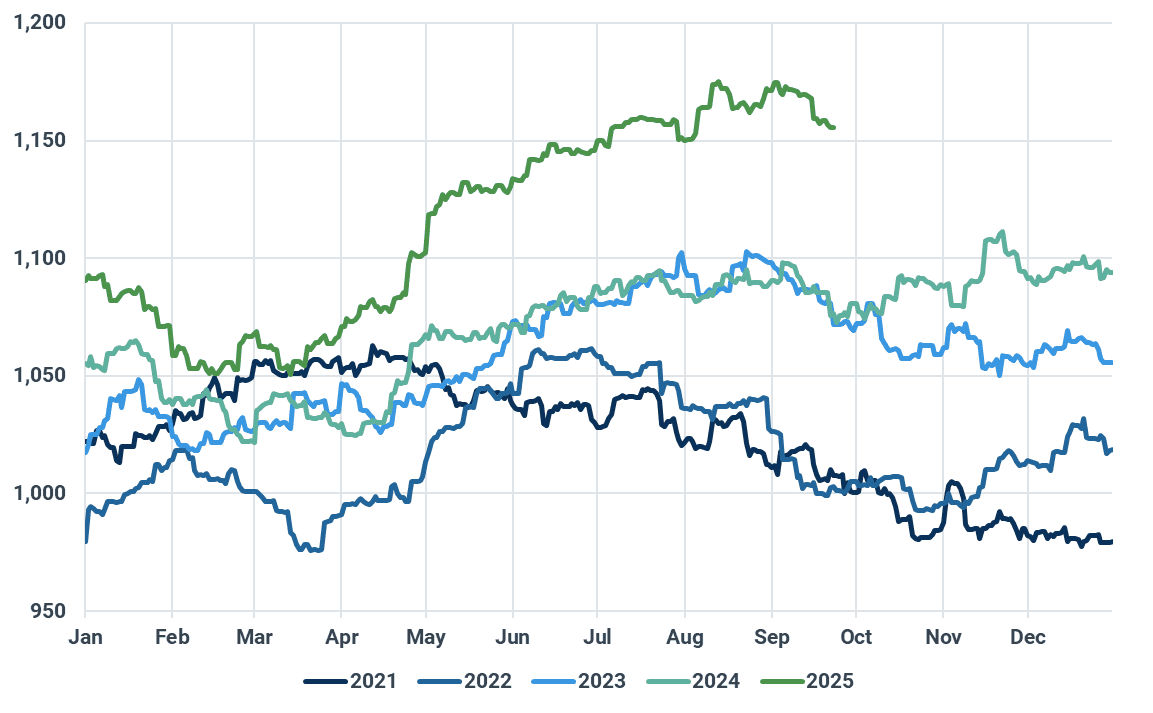

Key Asian market structures, $/bbl

Source: Argus Media

Tight light supply boosts condensate differentials

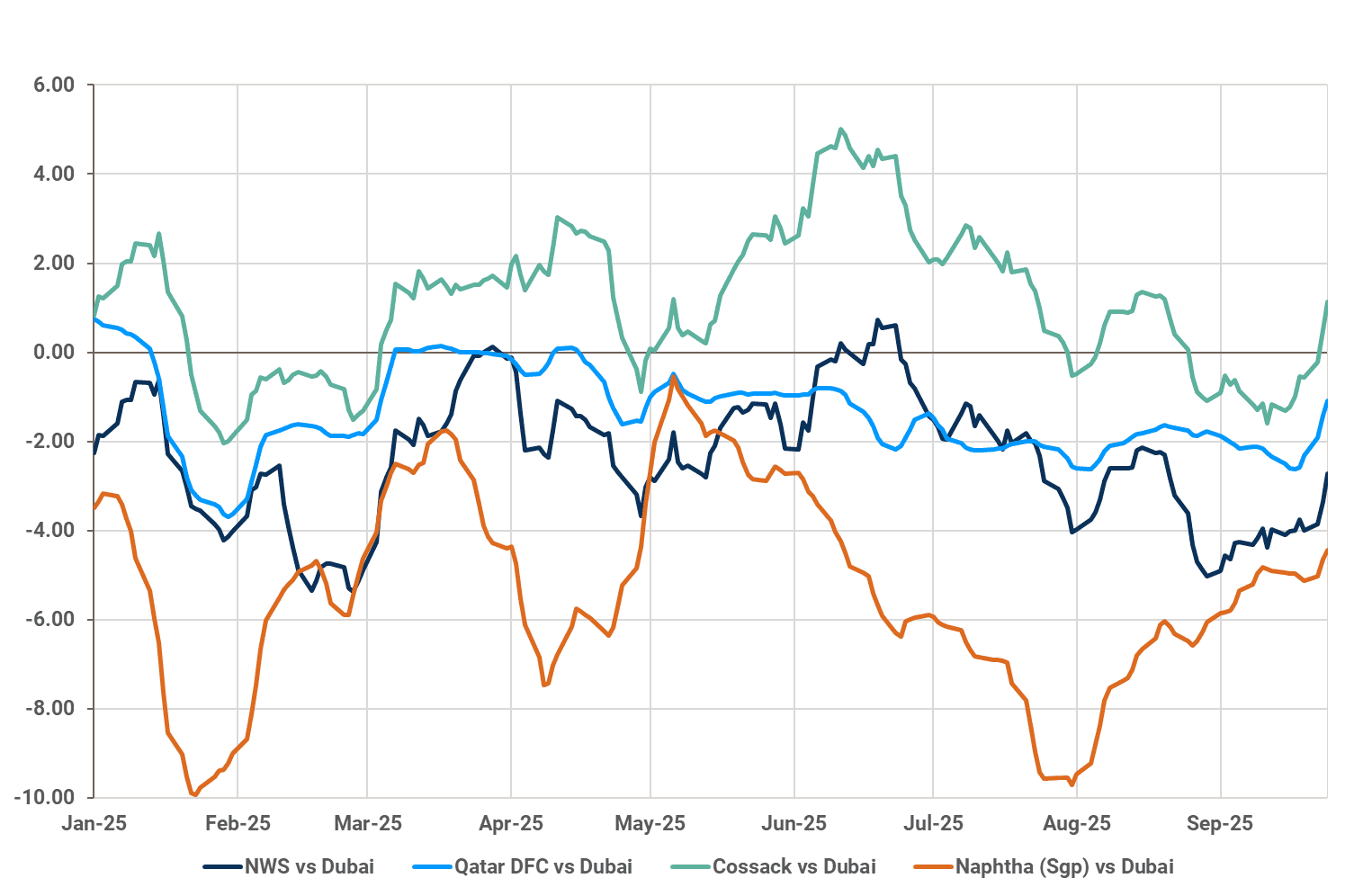

Asia’s light crude market is facing acute tightness. ESPO shipments from Russia are down 307 kbd mtd vs. August, averaging just 718 kbd so far in Sept. We discussed some potential reasons last week, but domestic fuel shortages in Siberia may also be curbing exports. Murban volumes have also declined by 100 kbd m/m to 1.37 Mbd. We believe the trend will accentuate as higher UAE quotas will mainly add medium sour production (Upper Zakum, Das), Murban supply will remain tight. Still, competition from West of Suez light grades could cap upside.

As predicted two weeks ago, condensate markets have surged. Drone strikes on Russian refineries have hampered naphtha output, reducing exports to Asia. This has lifted East of Suez naphtha cracks, driving strong spot demand for condensate. Regional maintenance, with ~220 kbd of refining capacity going offline in Japan and Thailand (IIR), has not dampened appetite. South Korean and Japanese refiners have returned to the condensate market, pushing differentials up ~$1.60/bbl w/w vs. Dubai.

We expect sustained support in the near term but rebounding Qatari exports will cap the upside from mid-October. Qatari condensate volumes are down to just 137 kbd mtd vs. ~243 kbd May–Jul., due to maintenance at the North Dome. A rebound is likely by October (~200 kbd), which may pressure differentials. Russian supply recovery or renewed flows from WoS could also trigger correction.

Asian condensate diffs against Dubai, and Asian naphtha cracks, $/bbl

Source: Argus Media

China’s oil stocks begin drawing as high prices deter imports

As flagged earlier this month, China’s oil stocks are more likely to draw by year-end, rather than continue building. Chinese onshore crude stocks have fallen by 12 Mbbls over the past week. With resilient oil prices despite lengthening balances, buyers are pulling back. The disconnect between high flat prices and weakening balances pushes refiners to throttle spot buying. Independent refiners face tight import quotas, and higher freight costs are starting to erode WoS arbitrage. Brazil’s Tupi is now priced at a $5.80/bbl premium to ICE Brent on a DES Shandong basis (Argus Media), slightly above Arab Medium based on Kpler’s arbitrage model.

Refinery runs are peaking this month near 15.5 Mbd, but arrivals have slowed. September seaborne crude imports are averaging 9.6 Mbd mtd, down 1.2 Mbd m/m and marking the lowest level since January. The pullback is led by Latin America (-741 kbd m/m) and West Africa (-154 kbd). While narrowing EFS should drive more WoS arrivals in October, rising freight and limited quotas for independents will likely keep Chinese imports muted, supporting our view of further inventory draws ahead.

Chinese onshore oil inventories, Mbbls

Source: Kpler

Market insights you can trust

Kpler delivers unbiased, expert-driven intelligence that helps you stay ahead of supply, demand, and market shifts.

Trade smarter. Request access to Kpler today.