Key TakeawaysStocks climbed 8% in the third quarter, driven largely by continued gains in tech, while bond yields fell and prices rallied.Small-cap stocks rallied as interest rates fell, while value stocks rallied but continued to lag growth stocks.The Fed cut interest rates for the first time this year. Traders anticipate more cuts before the end of 2025.

The stock market pushed to fresh record highs in the third quarter as artificial intelligence and other technology stocks were back in the driver’s seat. In a twist, small-company stocks soared in September, but they ultimately failed to outperform big-company stocks in the quarter. Meanwhile, bond yields fell and prices rose as traders anticipated the Federal Reserve’s first interest rate cut since 2024.

Investors appeared to look beyond a host of risk factors that could pull markets lower in the months ahead, including rising valuations, elevated inflation, a weakening labor market, and ongoing uncertainty surrounding US fiscal deficit and US trade policy.

But in a sign that some investors are concerned about the risks bubbling under the surface, gold powered to a record high of more than $3,800 per ounce as it jumped 17% in the third quarter. At the same time, markets like Canada, China, and Japan continued to outperform the United States, while Europe fell behind.

Key Stats: Q3 2025 Stock and Bond Market PerformanceStocks ended the quarter 8% higher, a continuation of the powerful rally that began when the market bottomed out in April.Value stocks rallied, with the Morningstar US Value Index returning 6.36%, but the Morningstar US Growth Index narrowly retained the lead with returns of 6.89%.The Morningstar US Core Bond Index returned 2.04% for the quarter, as yields fell across the board and the yield curve steepened.Dividend stocks again lagged the broader market, though the Morningstar Dividend Composite Index returned 6.42% for the third quarter, beating its second quarter performance.The Fed cut interest rates for the first time since September 2024 as evidence of a rapidly cooling labor market began to mount.Gold rallied again, with prices rising 17% as investors continued to flock to the safe haven asset.Bitcoin saw muted gains, while ether rocketed higher.Q3 Stock Market Performance

The equity market again appeared unstoppable in the third quarter, powering higher despite concerns about stretched valuations, uncertain policy, and the ongoing impact of tariffs.

Stocks rose 8% in the third quarter and are now up 35% since bottoming out on April 8, in the wake of President Donald Trump’s sweeping tariff announcements. The Morningstar Wide Moat Composite Index, which includes stocks our analysts believe have the largest and most durable competitive advantages, gained 8.7% between July and September and is now up more than 15.0% for the year.

In July, Nvidia NVDA became the first company in the world to reach a market capitalization of more than $4 trillion. Meanwhile, the IPO market rebounded as investors clamored for more exposure to new technology and AI firms.

Analysts say stocks could keep climbing over the course of the fall, as long as fundamentals hold up and the third-quarter earnings season delivers solid results.

Value vs. Growth Performance

Value vs. Growth Performance

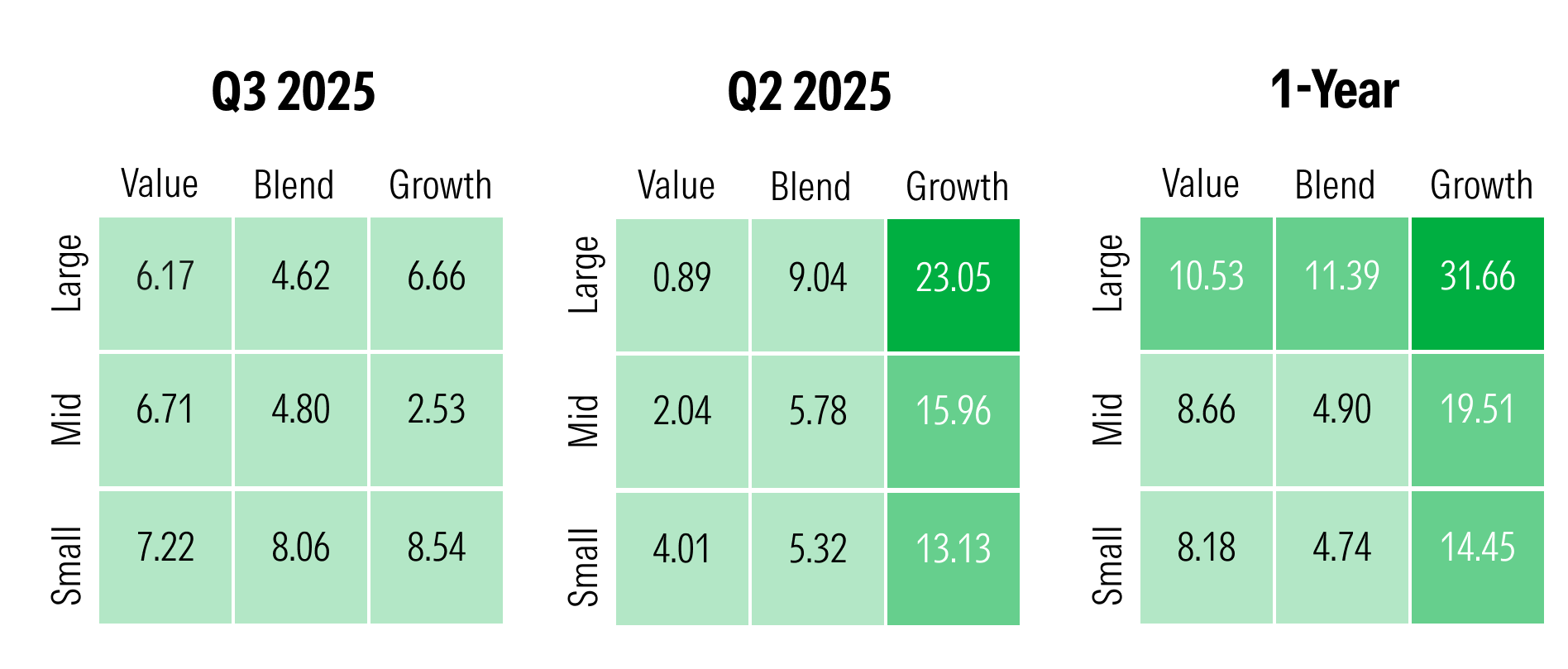

Within the Morningstar Style Box, growth stocks continued to outperform value by a slim margin, even as value stocks rebounded from the second quarter. Small-cap growth saw the best returns, climbing 8.54% in the third quarter, compared with 7.22% returns for the small-cap value category. Large-cap growth stocks edged ahead of the large-cap value category, with returns of 6.66%, compared with 6.17% for large value stocks. The most muted returns came from mid-cap growth stocks, which saw gains of 2.53%.

Overall, the Morningstar US Small Cap Index trailed the Morningstar US Large Cap Index, thanks to the outsized influence of mega-cap tech names like Nvidia.

Stock Sector Performance

Tech stocks continued to outperform the rest of the market in the third quarter, building on the blistering rally that began after the market hit a low in April. Communication services stocks climbed 12.75%, while technology was up 12.4%.

Energy stocks returned 5.8%, while consumer cyclicals climbed 8.9% as tariffs failed to dent discretionary spending. Consumer defensives were the only sector in the red, with losses of 2.71%. Healthcare stocks, which have lagged all year, found themselves in positive territory with a return of 4.51%.

Q3 Dividend Stock Performance

Dividend stocks again lagged the broader market’s 8% gain in the third quarter, though they posted higher returns compared with the second quarter. The Dividend Composite Index rose 6.4% for the quarter, compared with a 3.7% gain in the second quarter.

The Morningstar US Dividend Growth Index rose 7.0%, while the Morningstar Dividend Leaders Index, which includes the 100 stocks from the Composite Index with the highest yields, saw the smallest gains with a return of 4.8%.

Global Market Performance

As investors turned their attention to the US tech rally, international markets saw more muted returns in the third quarter after their blistering rally in the first half of the year.

Chinese markets saw the strongest returns, climbing 20.1% for the quarter. Canadian markets outperformed the US with gains of 10.4%, while Japanese markets returned 8.57%.

Meanwhile, European markets lagged. The Morningstar Eurozone Index was up 4.15% for the quarter after second-quarter gains of more than 15.00%.

Fed Cuts Interest Rates

After a year of holding steady, the Fed cut interest rates at its September meeting. That brings the target federal-funds rate to a range of 4.00%-4.25%.

The rate cut came amid what Fed Chair Jerome Powell described as a challenging situation for central bankers. Inflation remains above target, thanks to the ongoing impact of tariffs, while the job market has cooled significantly. Analysts say the Fed is likely to lean more dovish to protect the economy. They expect more cuts through the end of the year and into 2026.

Q3 Bond Market Performance

The bond market remained in the green in the third quarter as yields fell ahead of the Fed’s first rate cut.

Yields on the 10-year Treasury note ended the quarter at 4.16%, down from 4.26% at the beginning of July, while yields on the 30-year Treasury Bond dropped from highs above 5.00% in July to 4.73% at the end of the quarter.

Those falling yields helped bond investors pick up a little extra price appreciation in their portfolios. The US Core Bond Index returned 2.04% in the quarter, up from 1.17% in the second quarter. US Treasuries returned 1.52%. Investors in long-term core bonds saw the highest returns of 3.26%—a turnaround from losses of 0.27% in the second quarter. Municipal bonds returned 3.14%.

With longer-dated fixed income, worries remain that uncertain fiscal policy and stubborn inflation could keep yields from falling much further.

Yield Curve Continues to Steepen

As short-term interest rates fell this summer, the US Treasury yield curve began to steepen. Long-term rates fell too, though not as dramatically. The curve is a graphical representation of government bond yields across different maturities. It measures how much compensation bond investors expect for the extra risk of having money locked up with the federal government for longer periods. A steeper curve means investors are demanding higher yields for longer-dated bonds.

At the end of the third quarter, the spread between the 10-year and two-year Treasury yields was 0.56 percentage points, roughly the same spread at the end of the second quarter but wider than the 0.38-basis-point spread at the end of the first quarter.

Strategists expect the trend to continue with more cuts on the horizon, as short-term Treasury bond yields fall while yields on bonds with longer maturities stay relatively elevated.

Stock and Bond Volatility

Volatility in US, developed and emerging stock markets fell dramatically in the third quarter as the shock of tariff-related announcements faded. Meanwhile, volatility in the bond market fell below its five-year average.

Cryptocurrency Performance

Bitcoin prices climbed 6.4% over the third quarter—a solid gain, albeit slower than the blistering 30.0% rally in the second quarter, which was driven by trader optimism over crypto-friendly regulatory developments in Washington. The most popular cryptocurrency peaked in mid-August at an all-time high of roughly $123,000 per coin.

Meanwhile, ether prices have risen 65.5% over the past three months.

Commodity Market Performance

Gold prices soared higher in the third quarter with gains of 17.1%, outpacing the second quarter’s 5.0% return. The rally in gold marked a continuation of a multi-year trend that has seen the precious metal double in price. Gold is traditionally viewed as a safe haven asset, and it has become more attractive to investors amid rapid and unpredictable changes in trade policy and the geopolitical landscape. A retreat from USD-denominated debt by foreign governments has also pushed up prices.

Meanwhile, crude oil prices slumped 4.2% in the third quarter as the US and member countries of the OPEC+ cartel increased production. Copper prices fell 4.4% in the third quarter after trading relatively flat in the second quarter.