Company Logo

Key opportunities in the global health insurance market include rising demand for affordable healthcare access, private sector growth due to regulatory support, and digitalization enhancing claim processing. PPO plans, term insurance, and adult demographics show strong potential, while North America leads and Asia-Pacific sees rapid expansion.

Health Insurance Market

Health Insurance Market

Dublin, Oct. 02, 2025 (GLOBE NEWSWIRE) — The “Health Insurance Market Size and Share Outlook – Forecast Trends and Growth Analysis Report 2025-2034” report has been added to ResearchAndMarkets.com’s offering.

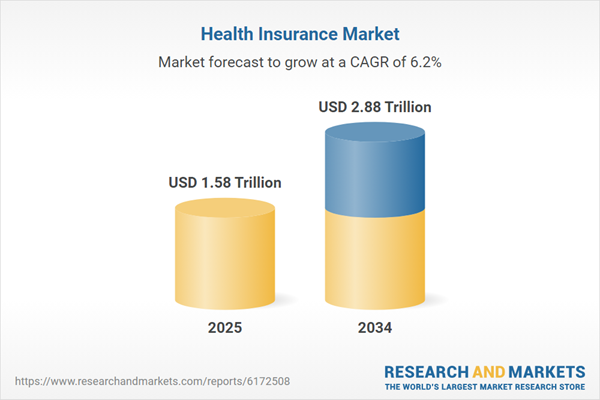

The global health insurance market was valued at USD 1.58 Trillion in 2024, driven by the increasing prevalence of chronic diseases and expanding awareness and adoption of health insurance policies across the globe. The market is anticipated to grow at a CAGR of 6.20% during the forecast period of 2025-2034, with the values likely to reach USD 2.88 Trillion by 2034. The market is driven by rising demand for affordable healthcare access, regulatory reforms supporting private insurers, and increasing digitalization, which enhances claim processing and customer engagement during the forecast period.

Health insurance plays a vital role in ensuring access to quality healthcare while minimizing out-of-pocket expenses for individuals and families. It supports timely medical intervention and promotes preventive care, contributing to improved public health outcomes. The global market for health insurance is witnessing steady expansion, driven by increasing healthcare awareness, rising chronic disease cases, and supportive government policies. Growing demand for digital health solutions and private sector participation further accelerates market growth.

Health Insurance Market Growth Drivers

Rising Burden of Chronic Disease to Accelerate Market Growth

The increasing prevalence of chronic diseases is a significant driver accelerating the expansion of the global health insurance market. As reported by the Centers for Disease Control and Prevention (CDC) in 2024, chronic diseases such as heart disease, cancer, and diabetes account for most deaths and disabilities in the United States and contribute to over USD 4.5 trillion in annual healthcare costs. With six in ten adults affected by at least one chronic condition, the need for comprehensive and accessible health insurance coverage is growing rapidly. This mounting demand is expected to significantly propel market growth over the forecast period.

Health Insurance Market Trends

The market is experiencing several emerging trends, including the development of tailored solutions for small and medium-sized enterprises (SMEs) and the growing geriatric population.

Customized SME Solutions to Accelerate the Market Expansion

The market is experiencing a notable trend toward personalized, modular insurance plans designed for small and medium-sized enterprises (SMEs) with international teams. As global mobility increases, businesses are demanding flexible healthcare solutions that support employees across borders. In November 2024, a major insurer launched a scalable plan tailored for SMEs with 1-74 employees, featuring a digital health app and a tap-and-go payment system. This shift toward customizable and tech-driven offerings is expected to accelerate market growth by aligning coverage with modern workforce dynamics.

Rising Geriatric Population to Boost the Health Insurance Market Demand

The rising geriatric population is a significant trend driving the market growth. According to the World Health Organization (WHO), as of 2020, there were 1 billion individuals aged 60 years and above, a number projected to reach 1.4 billion by 2030. By 2050, this figure is expected to double to 2.1 billion. This demographic shift, highlighted in a WHO report released in October 2023, underlines the increasing demand for accessible and comprehensive health coverage. The growing elderly population is anticipated to substantially enhance market growth in the coming years.

Health Insurance Market Share

Adults are Expected to Dominate the Market Dominance Based on the Demographics

The market is segmented into minors, adults, and senior citizens. Among these, adults are expected to lead due to growing health awareness, increasing employment-based coverage, and rising demand for private healthcare. In the United Kingdom, private medical insurance among adults rose to 14% in 2024, totaling 7.6 million people, according to Broadstone. With NHS waiting lists exceeding 7.4 million, more mid-career adults are opting for private health plans, fueling market growth.

Health Insurance Market Analysis by Region

The regions included in the report are North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa. The market is witnessing notable regional growth, with North America leading due to high healthcare spending, advanced infrastructure, and supportive policy initiatives. In the United States, enhanced premium subsidies under the Affordable Care Act led to a record 21 million people enrolling in marketplace plans in 2024, as reported by the Commonwealth Fund in November 2024. This reflects the region’s commitment to expanding coverage, improving affordability, and ensuring access to quality healthcare for a broad population.

Leading Players in the Health Insurance Market

The key features of the market report comprise strategic initiatives by the leading players. The major companies in the market are as follows:

UnitedHealth Group

UnitedHealth Group, a leading player in the health insurance market, offers a comprehensive range of Medicare plans through its UnitedHealthcare division. These include Medicare Advantage plans, Prescription Drug Plans (Part D), Medicare Supplement Insurance (Medigap), and Special Needs Plans (C-SNPs and D-SNPs). As the top provider of Medicare plans in the United States, the company continues to expand its offerings to support diverse healthcare needs, particularly for aging and dual-eligible populations.

AXA

AXA is a leading player in the health insurance market, offering comprehensive international medical coverage through AXA Global Healthcare. The company provides tailored insurance solutions, including annual, long-term, and short-term plans, with access to over 2.1 million healthcare providers in various countries. Its offerings include emergency care, virtual doctor consultations, mental health support, and second medical opinions, underscoring AXA’s commitment to delivering seamless, worldwide healthcare access.

CVS Health

CVS Health, through its subsidiary Aetna, plays a significant role in the Global Health Insurance Market by offering a wide range of health coverage solutions, including commercial, Medicaid, Medicare, vision, and dental plans. The company enhances member access through over 1,000 MinuteClinic locations, virtual care, in-home health support, and predictive analytics-driven management tools like Aetna One, aiming to improve outcomes and reduce costs.

Ping An Insurance Group

Ping An Insurance Group, a leading Chinese insurer, plays a prominent role in the global health insurance market through its subsidiaries, Ping An Life, Ping An Annuity, and Ping An Health Insurance. The company’s “insurance + service” model integrates health and senior care with financial protection. In 2024, Ping An provided health management services to nearly 16 million customers and launched premium senior care communities, enhancing access to personalized, long-term care solutions.

Other key players in the market are The Cigna Group, Aetna, Niva Bupa, Humana Inc., and Life Insurance Corporation of India.

Key Market Trends and Insights

PPO plans are likely to lead due to flexibility and broad provider networks.

Among the providers, private providers are expected to dominate with advanced service offerings and faster processing and witness a CAGR of 6.9%.

Term insurance has a higher chance of leading the market owing to lower premium costs.

Based on demographics, the adult segment is likely to lead due to a growing workforce and lifestyle-related ailments.

North America is expected to lead the market share by region, whereas, Asia-Pacific will likely witness exponential growth in the forecast period.

Key Attributes:

Report Attribute

Details

No. of Pages

176

Forecast Period

2025 – 2034

Estimated Market Value (USD) in 2025

$1.58 Trillion

Forecasted Market Value (USD) by 2034

$2.88 Trillion

Compound Annual Growth Rate

6.2%

Regions Covered

Global

Market Size and Forecast

Market Size (2024) : USD 1.58 Trillion

Projected Market Size (2034) : USD 2.88 Trillion

CAGR (2025-2034) : 6.20%

Largest Market in 2024 : North America

Companies Featured

Health Insurance Market Segmentation

Market Breakup by Type

Health Maintenance Organization (HMO) Plans

Preferred Provider Organization (PPO)

Exclusive Provider Organization (EPO)

Point of Service (POS)

Others

Market Breakup by Provider

Market Breakup by Coverage

Life Insurance

Term Insurance

Others

Market Breakup by Demographics

Minors

Adults

Senior Citizens

Market Breakup by Mode

Market Breakup by End User

Individuals

Corporates

Others

Market Breakup by Distribution Channel

Direct Sales

Agents

Brokers

Banks

Others

Market Breakup by Region

North America

Europe

Asia-Pacific

Latin America

Middle East and Africa

For more information about this report visit https://www.researchandmarkets.com/r/tkmaut

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source for international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, the top companies, new products and the latest trends.

Attachment

CONTACT: CONTACT: ResearchAndMarkets.com Laura Wood,Senior Press Manager press@researchandmarkets.com For E.S.T Office Hours Call 1-917-300-0470 For U.S./ CAN Toll Free Call 1-800-526-8630 For GMT Office Hours Call +353-1-416-8900