Q4 2025 Stock Market Outlook Key TakeawaysThe US stock market is at 3% a premium; it has traded this high only 15% of the time since 2010.Small-cap and value stocks are the last bastions of value left.Following this year’s rally, only real estate, energy, and healthcare remain undervalued.

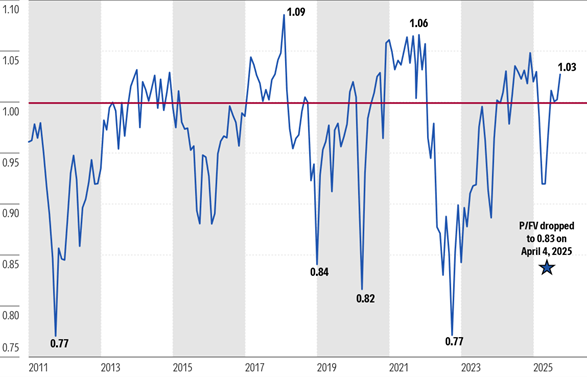

As of Sept. 30, 2025, the US equity market was trading at a 3% premium over our fair value estimates. While this is not unprecedented, since 2010 the US stock market has traded at a higher premium only 15% of the time.

With the market trading slightly above fair value and almost 40% of market capitalization concentrated in just 10 mega-caps whose valuations are mostly leveraged to the build-out of artificial intelligence, it feels like there is no margin for error to deviate from our robust AI forecasts. Many AI mega-cap stocks already trade near or exceed our fair value estimates, offering no cushion should AI growth slow. For future returns to outpace the market’s average cost of equity (minus the dividend yield), several things could happen, including valuations stretching into overvalued territory, AI development surpassing already lofty expectations, or productivity gains driving earnings growth beyond base-case forecasts.

Looking ahead, the market is walking a tightrope. The positive momentum from AI buildout and anticipated monetary easing is just barely offsetting negative macroeconomic headwinds and inflationary pressures. Positively, AI spending is helping maintain growth that might otherwise have faltered. Additionally, the Fed is expected to cut rates twice by year-end, and long-term rates are projected to decline, with the 10-year Treasury averaging 3.9% in 2026. However, over the next four quarters, slowing consumption growth, sluggish new homebuilding, and fading stimulus measures will take their toll on the economy.

Trade negotiations and tariffs remain a wildcard. While tariffs have yet to have a meaningful impact on inflation, we forecast inflation as measured by personal consumption expenditures will rise to 3.0% in 2026 before easing.

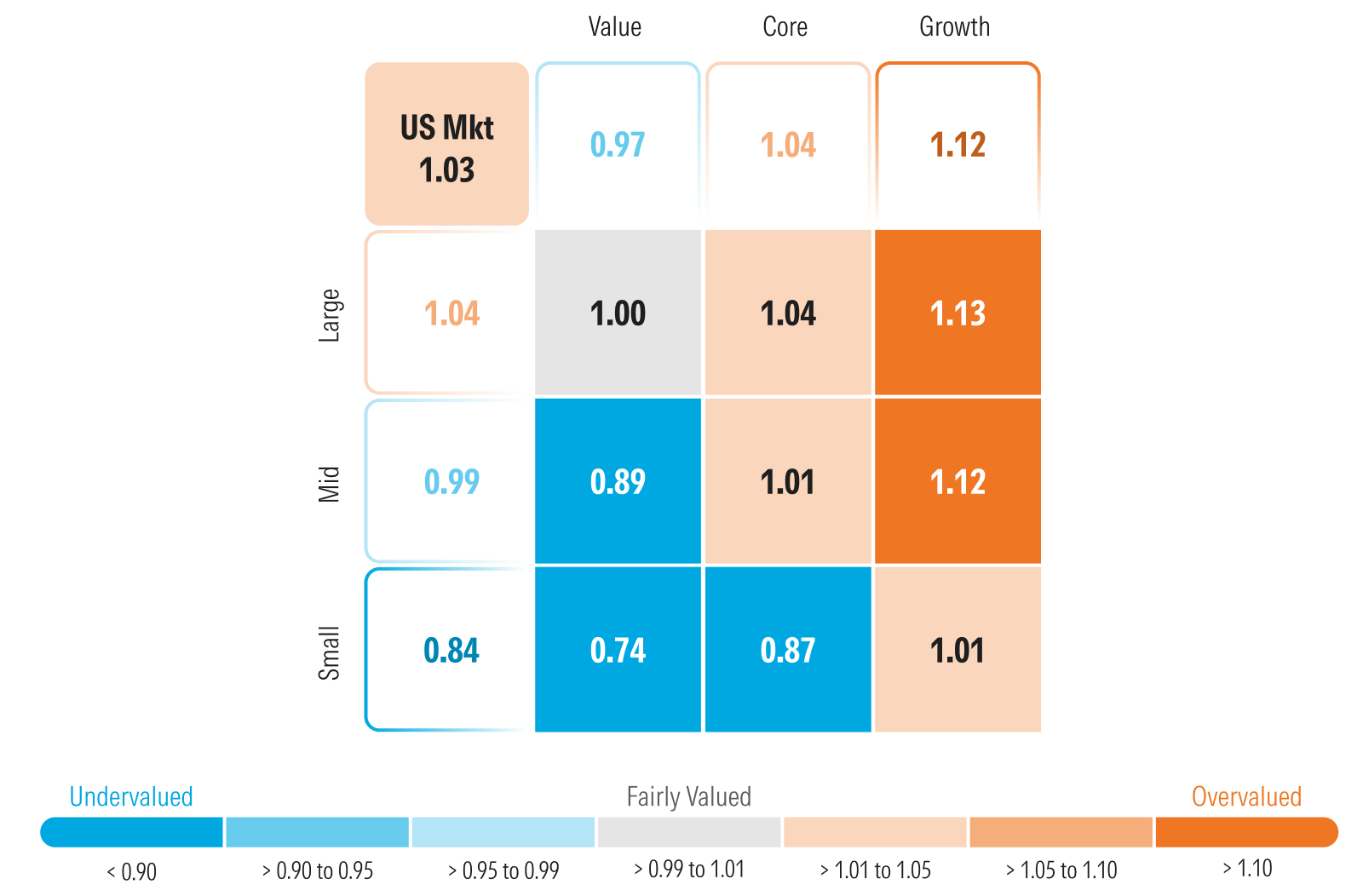

Source: Morningstar Research Services, LLC. Data as September 30, 2025. Positioning Is Especially Important

Source: Morningstar Research Services, LLC. Data as September 30, 2025. Positioning Is Especially Important

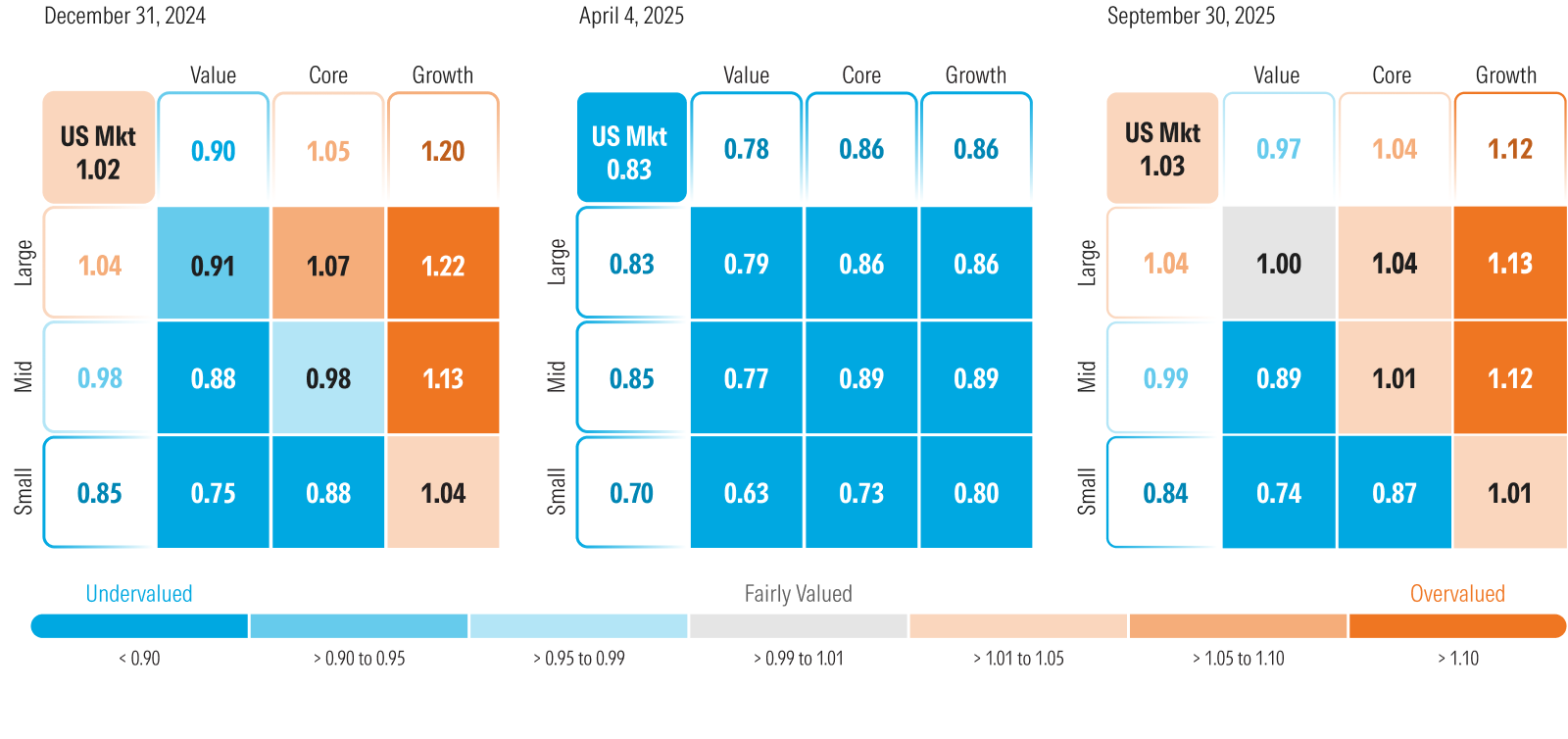

With the markets trading at a premium to a composite of our fair values, positioning is even more important than usual. By capitalization, small-cap stocks remain very attractive, trading at a 16% discount to our fair value estimate. According to our valuations, small caps are especially attractive on both an absolute value and a relative value basis. Mid-cap stocks trade just a hair under fair value, and large-cap stocks are at a 4% premium.

By style, value remains undervalued, trading at a 3% discount, whereas core stocks are at a 4% premium and growth stocks are at a 12% premium. Since 2010, the growth category has traded at a higher premium only 5% of the time. Considering how highly valued growth stocks are, value is much more attractive on a relative value basis.

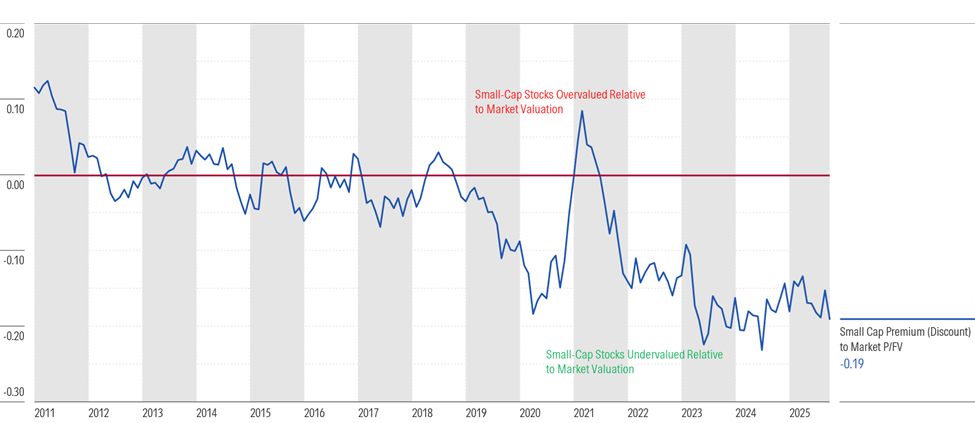

Source: Morningstar Research Services, LLC. Data as September 30, 2025.

Source: Morningstar Research Services, LLC. Data as September 30, 2025.

In our Q2 2025 Market Outlook, we noted that “Historically, small-cap stocks have performed best when the Fed is easing monetary policy, long-term interest rates are falling, and the economy is poised to begin rebounding. That does not appear to be the case in the near term, and while these stocks are undervalued, it may not be until later this year that they start to work.” Then, in our September 2025 Market Outlook, we highlighted that “two of these three conditions are coming to fruition, with the third still an outstanding question.”

Looking forward, even though we forecast the rate of economic growth to slow on a sequential basis over the next few quarters, we think that investors searching for value will focus on the small-cap space, looking for undervalued opportunities that have been overlooked and left behind as AI has absorbed all the oxygen in the market this year.

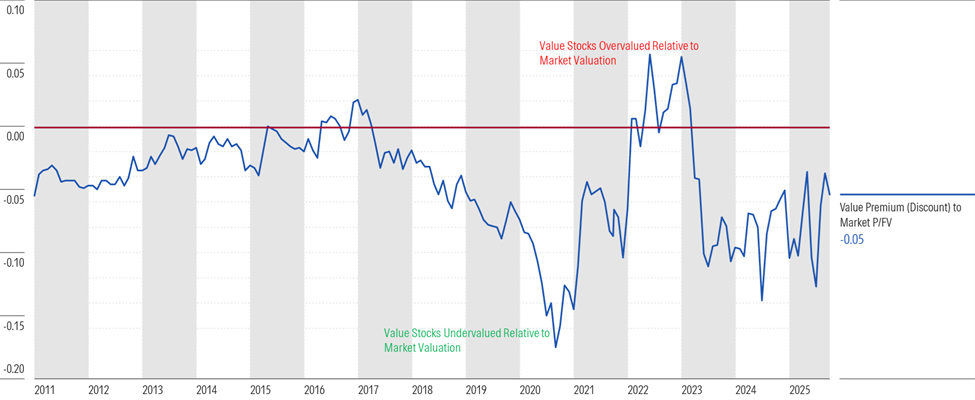

Source: Morningstar Research Services, LLC. Data as September 30, 2025.

Source: Morningstar Research Services, LLC. Data as September 30, 2025.

In a market that is becoming overvalued, we see value in the relatively higher dividend yields found in the value category. Undervalued stocks with higher dividend yields can provide investors with both upside appreciation potential from the stock price, as well as provide a return while you wait. In addition, these lower-duration types of stocks should trade off less than the broad market in a downside scenario.

Source: Morningstar Research Services, LLC. Data as September 30, 2025. Where We See Value by Sector

Source: Morningstar Research Services, LLC. Data as September 30, 2025. Where We See Value by Sector

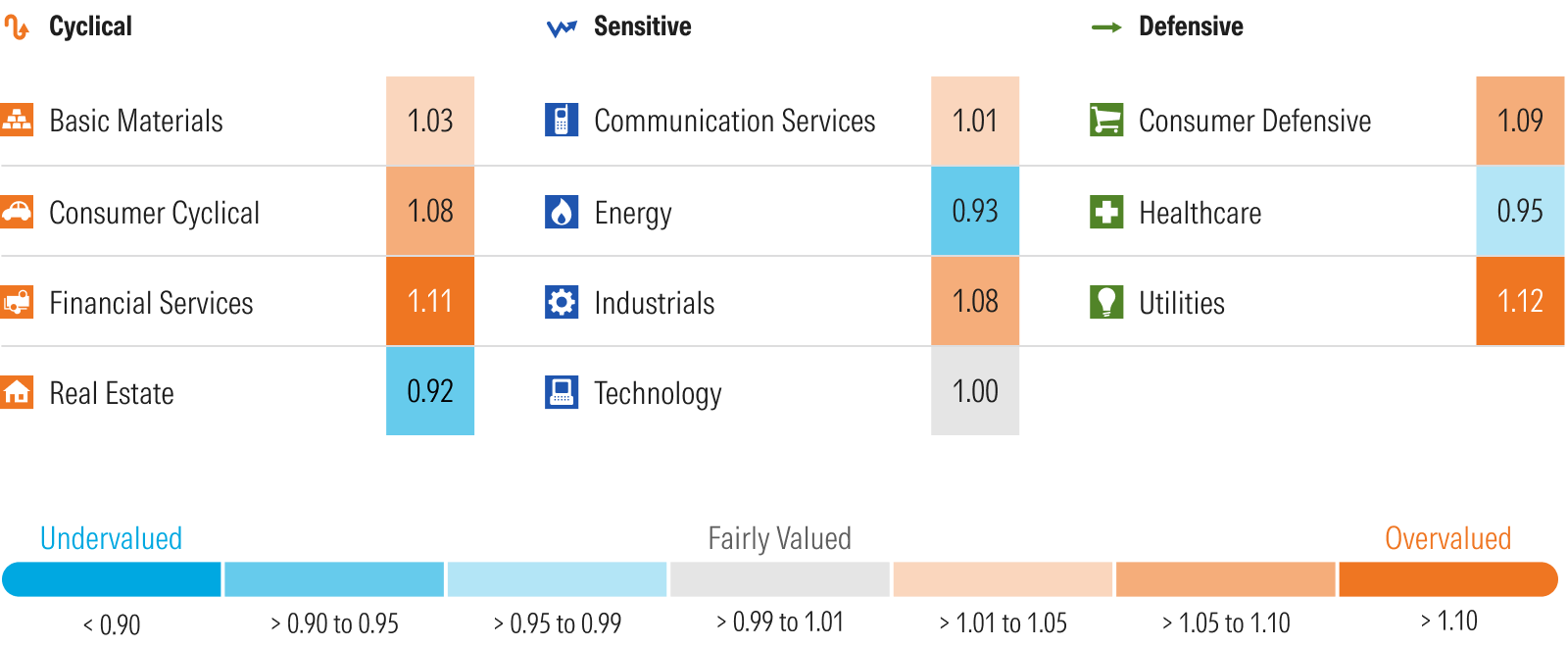

Following the rally this year, it has become harder to find undervalued opportunities, and at this point only real estate, energy, and healthcare remain undervalued on a sector basis.

Even though real estate should benefit from easing monetary policy and lower interest rates, its returns have lagged far behind the broad market. Wireless towers and housing-related stocks have been some of the worst performers recently; however, we think the market has overcorrected to the downside and see value in these stocks following the selloff. Generally, we see better value and opportunities in real estate whose tenants are defensive in nature.

Energy became further undervalued, mainly from our increase in valuations across many of the oil and gas producers. We increased our midcycle forecast for oil prices by $5 per barrel, such that our projection for West Texas Intermediate is $60 per barrel and Brent is $65 per barrel. Even though we expect oil demand to peak later this decade and begin to decline thereafter, the price increase stems mainly from our updated expectations for future supply constraints.

Healthcare remains undervalued as it has significantly underperformed the broad market this year. The greatest detractor to the sector has been the 30% decline in UnitedHealth Group UNH this year owing to higher medical costs and utilization rates, combined with intense regulatory scrutiny. Concerns regarding potential changes to government regulations, vaccine demand, and reimbursement rates weigh on the global pharmaceuticals industry. Within healthcare, we see significant value among the medical-device makers, medical technology, and medical consumable products.

The greatest change in sector valuations since last month occurred in the communications sector. The price/fair value has risen to a 1% premium from a 7% discount last month. The increase follows Alphabet’s GOOGL 14% surge in September. Alphabet’s two share classes account for 43% of the sector index, and as such, changes in its price have an outsize impact on the sector. Following this price increase, Alphabet stock has now moved to a 3-star rating from a 4-star rating, and the sector should now be equally weighted as opposed to overweighted. While the sector is fairly valued, we note that there are still a significant number of traditional communications providers such as 4-star-rated Verizon VZ, whose stocks remain significantly undervalued.

The second-greatest valuation change occurred in the consumer cyclical sector, which moved into overvalued territory. However, while the sector is overvalued, the entire increase in valuation came from Tesla’s TSLA dramatic 33% surge in September. Tesla accounts for 18% of the market capitalization of the sector.

The utilities sector has become further overvalued and is now trading at a 12% premium to fair value. Since the end of 2010, there have only been a few other instances when the sector has traded at a higher premium. While we incorporate a significant increase in demand for electricity to power the AI buildout, we think the market is overestimating the amount of profitability this demand will generate.

The technology sector has moved to fair value after trading at a slight discount last month. The rise in Apple AAPL and Nvidia NVDA stock prices during the month accounted for a substantial amount of the increase in market valuation.

Source: Morningstar Research Services, LLC. Data as September 30, 2025. An Especially Volatile Year

Source: Morningstar Research Services, LLC. Data as September 30, 2025. An Especially Volatile Year

Oftentimes, stock markets act like a pendulum and swing from overvalued to undervalued and back again. This year has been one of those times. While we continue to guide investors to invest for the long term, recent short-term market swings have created opportunities.

In our 2025 Market Outlook, we noted that the US stock market started the year at a rare premium to fair value. The release of DeepSeek in January was the catalyst that began the selloff in overvalued and overextended AI stocks, and the downside was further exacerbated following the announcement of sweeping tariffs in April. The market fell to a rare discount to fair value. In our special Market Outlook update published on April 7, 2025, and on the April 7 episode of our weekly podcast, The Morning Filter, we moved to an overweight recommendation on US stocks. Soon thereafter, stocks began an especially steep recovery as the tariffs were put on pause and the market realized DeepSeek was not the threat to AI spending initially feared.

Source: Morningstar Research Services, LLC. Data as September 30, 2025. Q4 2025 Market Outlook Webinar

Source: Morningstar Research Services, LLC. Data as September 30, 2025. Q4 2025 Market Outlook Webinar

Interested in doing a deeper dive into this year’s market returns and our outlook?

Join me and Morningstar’s chief US economist Preston Caldwell on Wednesday, Oct. 8, 2025, at 11 a.m. Central/noon Eastern as we:

Break down our valuations and identify undervalued opportunities across categories, sectors, and stocksHighlight investable long-term secular growth themesProvide our forecasts for real US gross domestic product, inflation, and interest ratesAnswer live audience questions

Register here.