The US government shutdown continues; employment data not presented

According to CNBC, the US Senate has failed again to secure a deal that could end the government shutdown. A funding resolution acceptable to both the Democratic and Republican parties could not be reached. The implication is that the government shutdown will continue until at least Monday, and developments will need to be monitored closely. The longer the government shutdown persists, the greater the expected impact on the country’s economy and political stability.

Meanwhile, non-farm payrolls and unemployment rate data were not released by the Bureau of Labor Statistics, adding to the uncertainty regarding the decision the Federal Reserve will make at its next meeting. However, the odds measured by the CME Group’s FedWatch tool remain unchanged, as 84% of the market consensus anticipates a 25-bps cut.

In turn, the Institute for Supply Management presented the ISM Services PMI data, which showed a decrease in its latest reading. The Services PMI decreased to the neutral level of 50 points (neither expansion nor contraction), below analysts’ forecasts and the previous figure of 52 points. The data is notable, as the services sector in the US has shown strength and resilience, having remained consistently above the 50-point level in most monthly assessments of 2025. Therefore, it will be relevant to evaluate upcoming updates of the Services PMI to gain a clearer picture, as today’s decrease could be a momentary effect amid the current economic uncertainty.

Despite the US government shutdown, the main equity indices closed with gains in their weekly balance. The Dow Jones led with an increase of 1.02%, reaching a level of 46,758 points; in turn, the S&P500 advanced 0.72% to 6,715 points; while the Nasdaq100 closed with a weekly increase of 0.58%, finishing at 24,785 points. The Rut2000, which considers small-cap companies, achieved a weekly advance of 1.87%, reaching an all-time high of 2,476 points.

Figure 1. Weekly balance of US stock indices. Source: Own analysis conducted in TradingView.

Oil benchmarks close lower on expectations of higher supply

The Brent (BRNZ2025) and WTI (CLX2025) crude oil futures contracts closed the week with a considerable decline (see Figure 2). Brent fell 7.16% to $64.53 per barrel. In turn, WTI had a weekly fall of 7.85%, reaching a level of $60.88 per barrel. This negative performance can be explained by traders’ expectations that the Organisation of the Petroleum Exporting Countries (OPEC+) may increase its production targets from November. If this were to happen, higher production would increase the supply of the commodity and, consequently, prices could be pushed lower.

Another factor that could be contributing to the weakness in crude oil prices is the expectation of lower global demand amid economic uncertainty in the US. While the US economy has shown strength and resilience, the potential impact of growing political uncertainty on aggregate demand could be significant, which in turn could affect broad commodity consumption.

Figure 2. Weekly balance of Brent and WTI references. Source: Own analysis conducted in TradingView.

Gold rises on safe-haven demand amid political instability

The gold futures contract (GCZ2025) posted a weekly gain of 3.25%, reaching a level of $3,908 per ounce (see Figure 3). The precious metal continues to achieve new records, driven by a search for safe-haven assets by global investors and an increase in central bank reserves. On the one hand, the US government shutdown has generated uncertainty due to political instability, as well as the inherent risk of potential public job losses. On the other hand, the geopolitical risk premium remains in force amid the Russian-Ukrainian conflict and the conflict in the Middle East, given the direct stance taken by the US.

Figure 3. Weekly Gold Futures Contract Balance. Source: Own analysis conducted in TradingView.

Japanese yen leads major currency appreciation

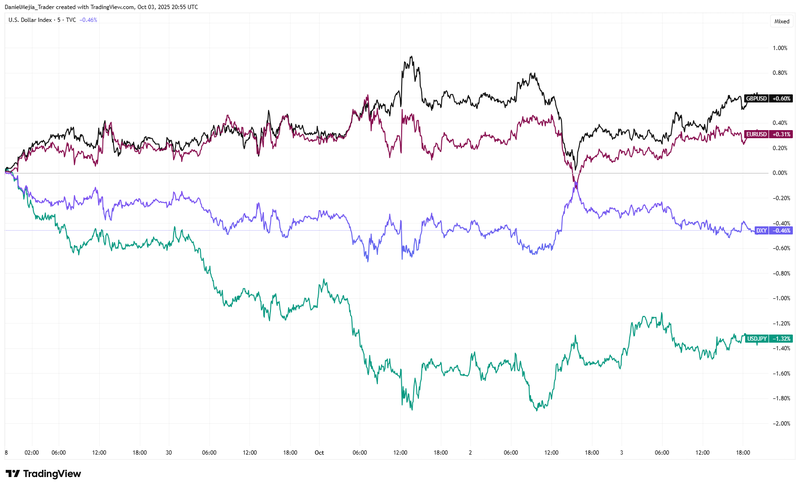

Regarding the weekly performance of major currencies, the Japanese yen has shown the greatest appreciation, probably due to expectations of monetary policy tightening by the Bank of Japan (BoJ) that may occur in the coming months. The dollar index (DXY) of the Intercontinental Exchange closed with a decrease of 0.46%, standing at a level of 97.71 points; the euro advanced by 0.31%, reaching 1.1739; in turn, the British pound increased by 0.60%, reaching 1.3478; meanwhile, USD/JPY showed a weekly depreciation of 1.32%, closing at a level of 147.39 yen per dollar, implying the greatest appreciation among the currencies analysed (see Figure 4).

Figure 4. Weekly balance of major currencies (EUR/USD, GBP/USD, USD/JPY and DXY). Source: Own analysis conducted in TradingView.