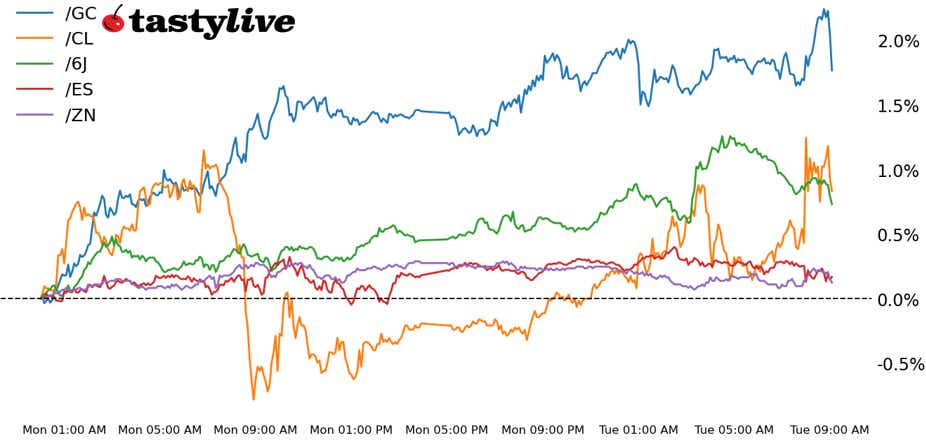

Also 10-year T-Note, Gold, Crude Oil, and Japanese Yen Futures S&P 500 E-mini futures (/ES): -0.06%10-year T-Note futures (/ZN): -0.25%Gold futures (/GC): +0.02%Crude Oil futures (/CL): +1.69%Japanese Yen futures (/6J): +0.13%

S&P 500 E-mini futures (/ES): -0.06%10-year T-Note futures (/ZN): -0.25%Gold futures (/GC): +0.02%Crude Oil futures (/CL): +1.69%Japanese Yen futures (/6J): +0.13%

Traders continue to line up bets for a 50-bps rate cut by the Federal Reserve next week in the wake of the BLS’ annual revision to nonfarm payrolls data. The 12-months through March 2025 saw -911,000 fewer jobs than previously expected, which comes after a -818,000 revision lower last year; jobs growth was -1.729M jobs less than otherwise measured over the past two years. What this means is that the run-rate for jobs growth was -72K less per month over this time period. That has material implications for expectations around earnings, growth, and the health of the American consumer. Volatility is up slightly following the release (spot VIX +0.25), but off of its highs (last seen at 15.36; intraday high was 15.82).

Symbol: EquitiesDaily Change/ESU5-0.06%/NQU5+0.11%/RTYU5-0.59%/YMU5+0.05%

S&P 500 futures were little changed Tuesday morning after a positive session on Monday to open the week. Energy and financials were leading sectors within the S&P 500, while materials and industrial stocks lagged. Investors are dialed into the upcoming inflation reports, with the producer price index (PPI) due out tomorrow followed by consumer prices on Thursday. As long as those prints don’t surprise hard to the upside, it may allow stocks to maintain their positive momentum. Oracle (ORCL) and GameStop (GME) are scheduled to report earnings after the bell today. UnitedHealth Group (UNH) rose nearly 4% after the insurer said that a majority of its members will be enrolled in high rates plans in 2026.

Strategy: (52DTE, ATM)StrikesPOPMax ProfitMax LossIron Condor

Long 6450 p

Short 6475 p

Short 6625 c

Long 6650 c

18%+937.50-312.15Short Strangle

Short 6475 p

Short 6625 c

46%+9237.50.50xShort Put Vertical

Long 6450 p

Short 6475 p

61%+332.50-917.50

Symbol: BondsDaily Change/ZTZ5-0.04%/ZFZ5-0.04%/ZNZ5-0.25%/ZBZ5-0.29%/UBZ5-0.54%

Symbol: BondsDaily Change/ZTZ5-0.04%/ZFZ5-0.04%/ZNZ5-0.25%/ZBZ5-0.29%/UBZ5-0.54%

10-year T-Note futures (/ZNZ5) fell 0.08% Tuesday morning despite the downward annual revision to payroll data, which bolstered Fed rate cut bets. Prices rose last week by 0.83%, marking the biggest weekly gain since June. Treasuries have rallied over the past several weeks, pushing prices to the highest level traded since early April. The current pullback likely reflects some profit taking in the market, as the path on rate cuts will likely remain supportive of lower yields over the short term.

Strategy (45DTE, ATM)StrikesPOPMax ProfitMax LossIron Condor

Long 110 p

Short 111 p

Short 115 c

Long 116 c

62%+218.75-781.25Short Strangle

Short 111 p

Short 115 c

66%+421.88xShort Put Vertical

Long 110 p

Short 111 p

90%+78.13-921.88

Symbol: MetalsDaily Change/GCZ5+0.02%/SIZ5-0.83%/HGZ5+0.03%

Symbol: MetalsDaily Change/GCZ5+0.02%/SIZ5-0.83%/HGZ5+0.03%

Gold prices traded higher Tuesday morning, rising about 0.49% an hour into New York trading. Traders were encouraged by the revision to the jobs data, encouraging rate cut bets and helping gold prices. The metal is on track to record a fourth weekly gain. Exchange-traded funds (ETFs) that track gold have caused increased demand pressures in the market, benefiting physical and futures prices in the market. Prices are up nearly 40% this year, marking the best performance through the first nine months of the year since 1979.

Strategy (49DTE, ATM)StrikesPOPMax ProfitMax LossIron Condor

Long 3450 p

Short 3475 p

Short 3900 c

Long 3925 c

63%+730-1770Short Strangle

Short 3475 p

Short 3900 c

70%+4410xShort Put Vertical

Long 3450 p

Short 3475 p

83%+370-2130

Symbol: EnergyDaily Change/CLV5+1.69%/HOV5+1.47%/NGV5+0.58%/RBV5+1.99%

Symbol: EnergyDaily Change/CLV5+1.69%/HOV5+1.47%/NGV5+0.58%/RBV5+1.99%

Crude oil prices (/CLV5) traded 1.5% higher Tuesday morning, extending its weekly gain to 2.5%, the best performance since late July. Israel reportedly struck a target in Doha, the Qatari capital, that contained Hamas leadership. Traders saw the move as an escalation in the region, heightening the geopolitical risk premium for the commodity. The development comes after OPEC+ agreed to a smaller-than-expected increase in oil output. The American Petroleum Institute (API) will report weekly crude oil inventory data later today.

Strategy (69DTE, ATM)StrikesPOPMax ProfitMax LossIron Condor

Long 53 p

Short 55 p

Short 72 c

Long 74 c

62%+470-1530Short Strangle

Short 55 p

Short 72 c

68%+1740xShort Put Vertical

Long 53 p

Short 55 p

78%+290-1710

Symbol: FXDaily Change/6AU5+0.09%/6BU5-0.04%/6CU5-0.05%/6EU5-0.19%/6JU5+0.13%

Symbol: FXDaily Change/6AU5+0.09%/6BU5-0.04%/6CU5-0.05%/6EU5-0.19%/6JU5+0.13%

Japanese Yen futures (/6JU5) was 0.13% higher an hour into the U.S. trading session. Traders trimmed some of the gains from overnight trading, but prices remained above the 21-day exponential moving average (EMA), a level that resisted bulls over the past two trading sessions. Still, the falling 50-day simple moving average (SMA) contained this morning’s bullish price action. Bulls will have to fight for a close above the level after surrendering above it from trading in the Asia session.

Strategy (59DTE, ATM)StrikesPOPMax ProfitMax LossIron Condor

Long 0.00675 p

Short 0.0068 p

Short 0.00695 c

Long 0.007 c

28%+437.50-187.50Short Strangle

Short 0.0068 p

Short 0.00695 c

55%+1937.50xShort Put Vertical

Long 0.00675 p

Short 0.0068 p

67%+237.50-387.50

Christopher Vecchio, CFA, tastylive’s head of futures and forex, has been trading for nearly 20 years. He has consulted with multinational firms on FX hedging and lectured at Duke Law School on FX derivatives. Vecchio searches for high-convexity opportunities at the crossroads of macroeconomics and global politics. He hosts Futures Power Hour Monday-Friday and Let Me Explain on Tuesdays, and co-hosts Overtime,Monday-Thursday. @cvecchiofx

Thomas Westwater, a tastylive financial writer and analyst, has eight years of markets and trading experience. @fxwestwater

For live daily programming, market news and commentary, visit tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.