Kinsale Capital Group recently met with analysts and management, resulting in upbeat projections for earnings per share and revenue growth, as well as favorable ratings from key industry observers. This positive outlook is partly fueled by strong premium growth in core markets such as Texas and Florida, and management’s reaffirmed long-term growth targets. We’ll explore how robust premium growth in key states could influence Kinsale’s ongoing investment narrative and future outlook.

Trump has pledged to “unleash” American oil and gas and these 22 US stocks have developments that are poised to benefit.

Kinsale Capital Group Investment Narrative Recap

To be a shareholder in Kinsale Capital Group, you have to believe in the company’s ability to sustain premium growth in specialty insurance markets, particularly through disciplined underwriting and expansion in high-opportunity regions like Texas and Florida. The latest round of upbeat analyst projections and management’s reaffirmation of long-term growth targets does support the main short-term catalyst, robust premium growth, while competitive pricing pressures in commercial property remain the most significant near-term risk. So far, the news does not materially shift the balance of these factors.

Of the recent company announcements, Kinsale’s strong second-quarter 2025 results, surpassing earnings and revenue expectations, stand out as directly relevant. This performance, alongside positive analyst sentiment and ongoing buybacks, reinforces optimism around continued premium and earnings growth, but it’s important to watch if intensifying competition could eventually curtail these gains or pressure margins.

However, investors should be alert, especially if optimism about growth is tested by persistent margin pressure in core commercial property lines…

Read the full narrative on Kinsale Capital Group (it’s free!)

Kinsale Capital Group’s outlook anticipates revenue of $2.3 billion and earnings of $546.8 million by 2028. This is based on analysts forecasting annual revenue growth of 9.5% and an increase in earnings of $100 million from current earnings of $446.7 million.

Uncover how Kinsale Capital Group’s forecasts yield a $499.11 fair value, a 7% upside to its current price.

Exploring Other Perspectives KNSL Community Fair Values as at Oct 2025

KNSL Community Fair Values as at Oct 2025

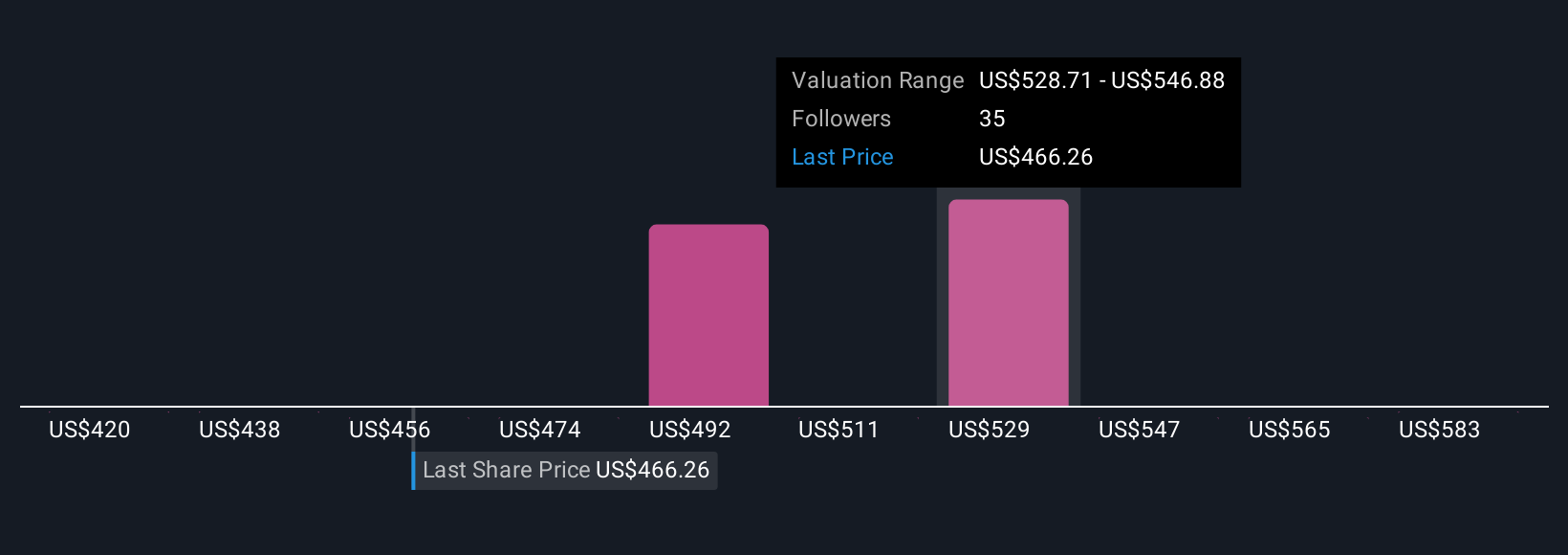

Six private investors in the Simply Wall St Community estimated Kinsale’s fair value between US$419.65 and US$601.41 per share. With peer competition intensifying, these wide-ranging views show just how differently expectations around current growth can impact your outlook on Kinsale’s future performance.

Explore 6 other fair value estimates on Kinsale Capital Group – why the stock might be worth 10% less than the current price!

Build Your Own Kinsale Capital Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

A great starting point for your Kinsale Capital Group research is our analysis highlighting 3 key rewards that could impact your investment decision.Our free Kinsale Capital Group research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Kinsale Capital Group’s overall financial health at a glance.Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we’re here to simplify it.

Discover if Kinsale Capital Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com