Report Overview

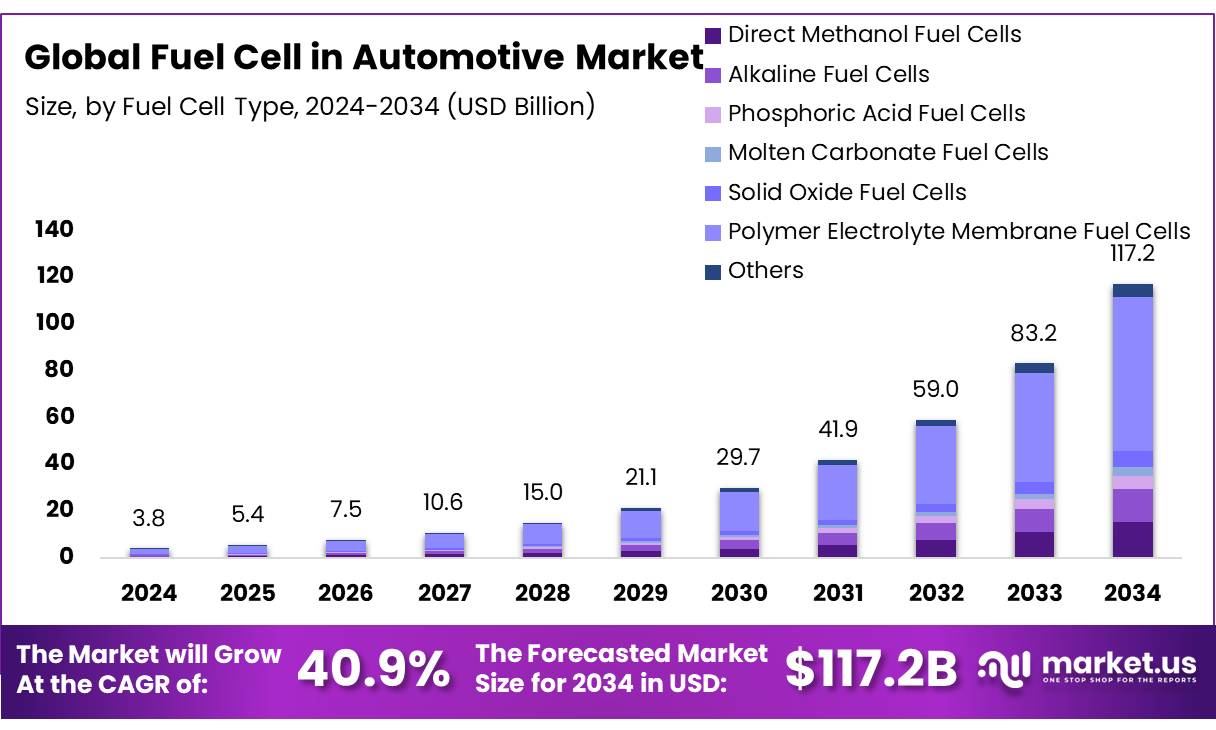

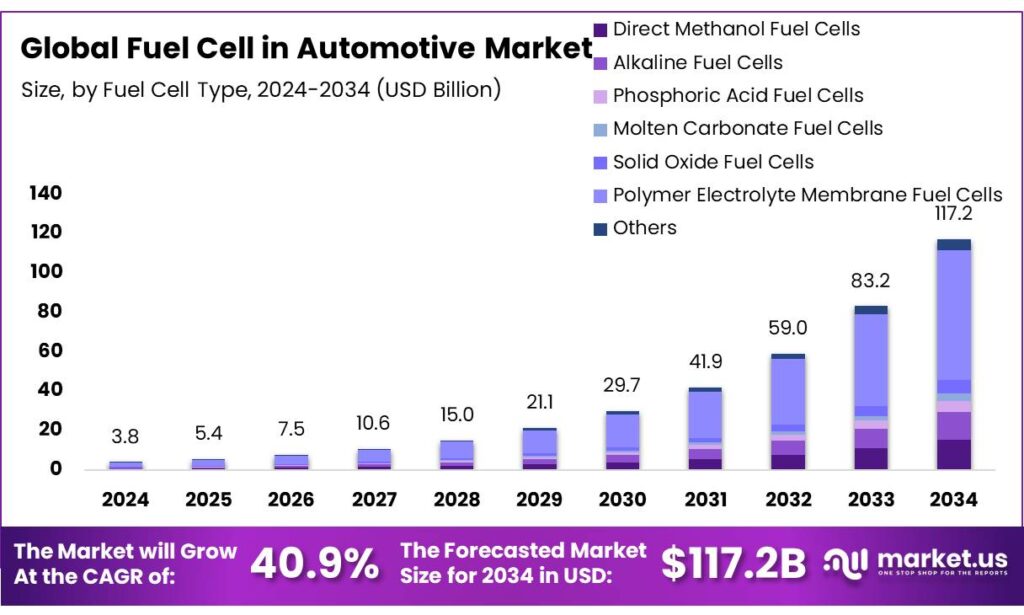

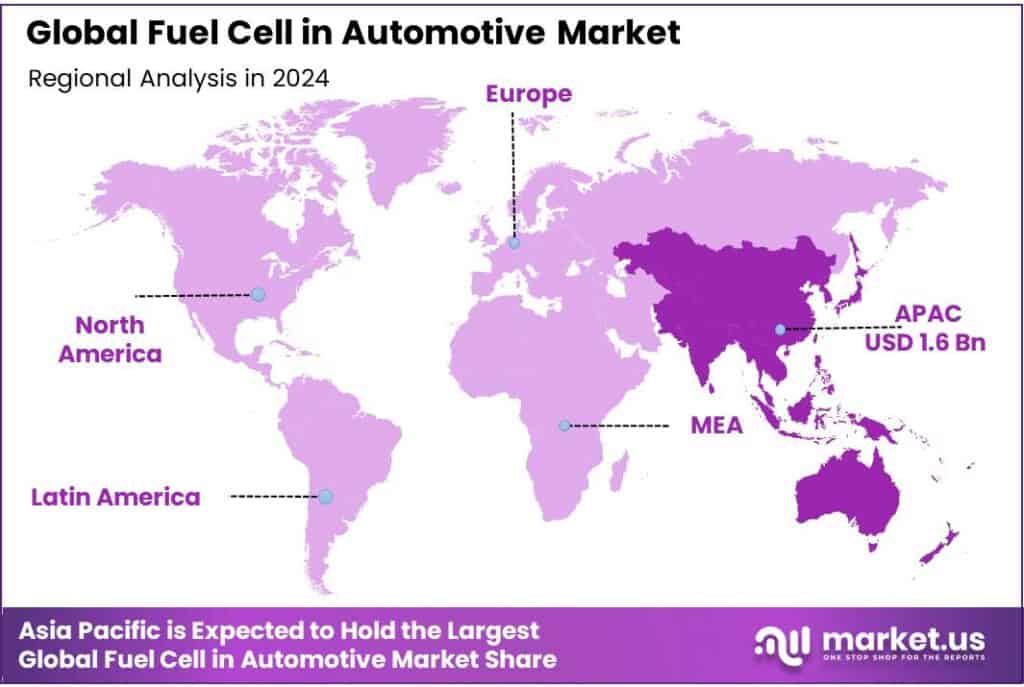

The Global Fuel Cell in Automotive Market size is expected to be worth around USD 117.2 Billion by 2034, from USD 3.8 Billion in 2024, growing at a CAGR of 40.9% during the forecast period from 2025 to 2034. In 2024 Asia-Pacific held a dominant market position, capturing more than a 43.2% share, holding USD 1.6 Billion in revenue.

The automotive fuel cell Market segment was positioned as a niche but strategically significant pathway for decarbonizing certain transport segments where battery electrification faces constraints, notably heavy commercial vehicles, buses and some long-range passenger applications. The technology base is centred on proton-exchange membrane (PEM) fuel cell stacks integrated with compressed hydrogen storage and power electronics; manufacturing scale-up has been pursued predominantly in Japan, South Korea, China, Europe and selected regions of North America.

Growth to date has been supported by parallel development of hydrogen supply and refuelling infrastructure; in 2024 more than 1,000 hydrogen refuelling stations were reported in operation worldwide, with an independent audit indicating about 125 new stations opened that year.

The industrial scenario is characterised by concentrated deployment and active government intervention. By the end of 2024, independent datasets reported 1,369 hydrogen refuelling stations deployed across 44 countries, underscoring the geographic clustering of infrastructure in a few leading markets. Major public programmes have been introduced to support both demand and supply. The European policy framework specifies binding uptake ambitions and has set electrolyser-scale objectives that align to 2030 targets, while national programmes in Japan, China and the United States have allocated targeted funding to trials and rollouts.

Driving factors for continued adoption have been identified as suitability of fuel cells for high-utilisation and long-range duty cycles, declining stack and system costs as volumes increase, and coordinated public support for hydrogen supply chains. Financial commitments and public instruments have been material: the U.S. Department of Energy documented a hydrogen program budget authority of approximately USD 431.5 million in FY2023, and issued a comprehensive Hydrogen Program Plan in 2024 to coordinate R&D and deployment.

Policy incentives have been material and numerically significant in select markets. For example, Japan’s 2024 vehicle subsidy schedule set maximum purchase subsidies at ¥2,550,000 for fuel cell vehicles (FCVs) under its clean vehicle support framework, illustrating direct demand-side intervention to improve total-cost-of-ownership for FCEVs. Such targeted subsidies have been implemented alongside manufacturing and supply-chain measures in several Asian and European states.

Key Takeaways

Fuel Cell in Automotive Market size is expected to be worth around USD 117.2 Billion by 2034, from USD 3.8 Billion in 2024, growing at a CAGR of 40.9%.

Polymer Electrolyte Membrane Fuel Cells (PEMFCs) held a dominant market position, capturing more than a 56.2% share.

Fuel Cell Stack held a dominant market position, capturing more than a 46.8% share.

The Less Than 150kW power rating segment held a dominant market position, capturing more than a 43.1% share in the global automotive fuel cell market.

Fuel Cell Electric Vehicles (FCEVs) held a dominant market position, capturing more than a 73.6% share.

Asia-Pacific (APAC) region held a dominant market position in the global automotive fuel cell industry, capturing more than a 43.2% share, valued at approximately USD 1.6 billion.

By Fuel Cell Type Analysis

Polymer Electrolyte Membrane Fuel Cells dominate with 56.2% share owing to high efficiency and suitability for automotive use

In 2024, Polymer Electrolyte Membrane Fuel Cells (PEMFCs) held a dominant market position, capturing more than a 56.2% share in the global automotive fuel cell segment. Their leadership can be attributed to their high power density, quick start-up capability, and operational efficiency at relatively low temperatures, making them particularly suitable for passenger vehicles and light-duty commercial applications. PEMFCs operate efficiently at temperatures below 100°C, allowing faster ignition and smoother performance compared to other types such as solid oxide or phosphoric acid fuel cells.

The growth of PEMFCs in the automotive sector has been reinforced by government-backed hydrogen mobility programs and expanding hydrogen refueling infrastructure. In 2024, several automakers, including Toyota, Hyundai, and Honda, continued large-scale deployment of PEMFC-powered models, while new entrants in commercial vehicle segments further strengthened adoption. Moreover, increasing production of green hydrogen and investments in refueling networks across Asia-Pacific and Europe supported the scaling of PEMFC vehicles.

By Component Analysis

Fuel Cell Stack dominates with 46.8% share driven by its critical role in energy conversion efficiency

In 2024, the Fuel Cell Stack held a dominant market position, capturing more than a 46.8% share in the global automotive fuel cell component segment. The stack serves as the heart of a fuel cell system, where the electrochemical reaction between hydrogen and oxygen generates electricity that powers the vehicle. Its ability to provide high power output, stable performance, and improved energy efficiency has made it the most essential and valuable component in fuel cell vehicles.

The increasing adoption of hydrogen-powered cars, buses, and trucks in 2024 has led to a surge in demand for advanced, durable fuel cell stacks capable of operating under diverse temperature and pressure conditions. Manufacturers have been focusing on enhancing membrane electrode assemblies and bipolar plates to reduce system costs and extend operational life. Additionally, advancements in catalyst coatings and lightweight materials have helped improve fuel economy and reduce maintenance needs, strengthening the market position of the fuel cell stack segment.

By Power Rating Analysis

Less Than 150kW dominates with 43.1% share due to its suitability for passenger and light-duty vehicles

In 2024, the Less Than 150kW power rating segment held a dominant market position, capturing more than a 43.1% share in the global automotive fuel cell market. This segment’s leadership is mainly due to its widespread use in passenger cars and light-duty commercial vehicles, which demand compact and efficient power systems rather than high-capacity stacks. Fuel cells under 150kW provide an ideal balance between energy efficiency, system weight, and cost, making them a preferred choice for automakers developing hydrogen-powered sedans, SUVs, and small utility vehicles.

Major manufacturers such as Toyota, Hyundai, and Honda continued integrating fuel cell systems in this power range within their popular models, including the Mirai and NEXO, enhancing market adoption. The technological improvements in smaller fuel cell stacks, especially in terms of faster start-up, higher power density, and improved heat management, have also strengthened the segment’s position. Additionally, the expanding network of hydrogen refueling stations in Asia-Pacific and Europe has made the deployment of sub-150kW vehicles more feasible for everyday consumers.

By Propulsion Analysis

FCEV dominates with 73.6% share driven by growing adoption of zero-emission hydrogen vehicles

In 2024, Fuel Cell Electric Vehicles (FCEVs) held a dominant market position, capturing more than a 73.6% share in the global automotive fuel cell market. The dominance of this segment was primarily due to the strong push toward zero-emission mobility, technological maturity of hydrogen-powered drivetrains, and supportive government initiatives across major economies. FCEVs operate by converting hydrogen into electricity through a fuel cell stack, producing only water vapor as an emission, which aligns with global efforts to achieve carbon neutrality in the transportation sector.

The witnessed accelerated FCEV deployment in passenger cars, public buses, and commercial fleets, supported by favorable policies in countries such as Japan, South Korea, Germany, and the United States. Strategic programs like Japan’s “Green Growth Strategy Through Achieving Carbon Neutrality” and South Korea’s “Hydrogen Economy Roadmap” significantly boosted vehicle production and refueling infrastructure. Major automakers including Toyota, Hyundai, and Honda continued to expand their FCEV offerings, while logistics and transport operators increasingly adopted hydrogen trucks to comply with tightening emission standards.

By Vehicle Type Analysis

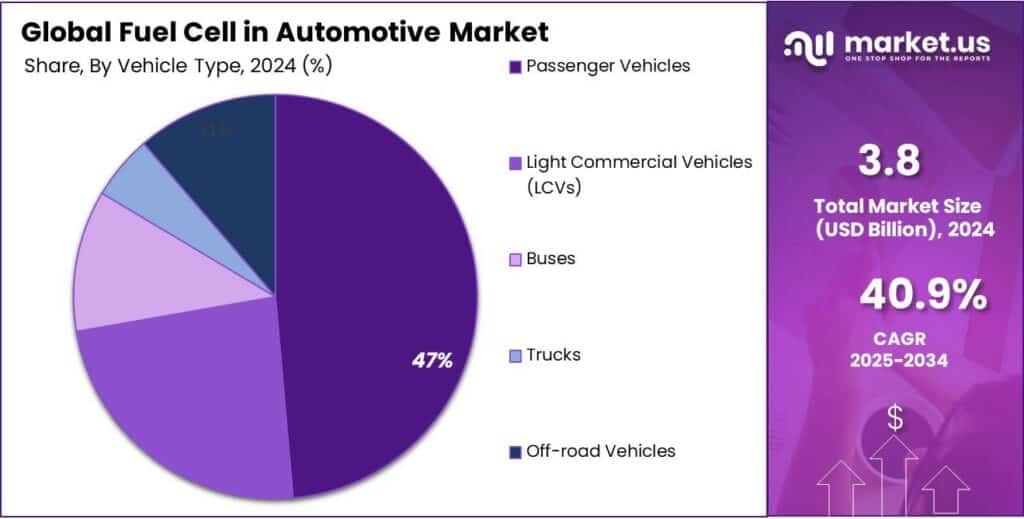

Passenger Vehicles dominate with 47.3% share driven by rising consumer adoption and government incentives

In 2024, Passenger Vehicles held a dominant market position, capturing more than a 47.3% share in the global automotive fuel cell market. This leadership was largely supported by increasing consumer demand for zero-emission mobility, advancements in fuel cell system integration, and expanding hydrogen refueling infrastructure. Passenger fuel cell vehicles such as sedans and SUVs have gained traction due to their longer driving range, faster refueling time, and quiet operation compared to battery electric vehicles.

South Korea’s Ministry of Trade, Industry and Energy reported a steady rise in fuel cell car registrations under its national Hydrogen Economy Roadmap, while Japan’s Clean Energy Strategy further encouraged manufacturers like Toyota and Honda to expand production of hydrogen-powered passenger cars. The combination of national subsidies, reduced hydrogen prices, and public-private collaboration has strengthened this segment’s dominance in the fuel cell automotive industry.

Key Market Segments

By Fuel Cell Type

Direct Methanol Fuel Cells

Alkaline Fuel Cells

Phosphoric Acid Fuel Cells

Molten Carbonate Fuel Cells

Solid Oxide Fuel Cells

Polymer Electrolyte Membrane Fuel Cells

Others

By Component

Fuel Cell Stack

Fuel Processor

Power Conditioner

Air Compressor

Humidifier

By Power Rating

Less Than 150kW

150 To 250kW

Greater Than 250kW

By Propulsion

By Vehicle Type

Passenger Vehicles

Light Commercial Vehicles (LCVs)

Buses

Trucks

Off-road Vehicles

Emerging Trends

Scaling Fuel Cell Vehicle Fleet with Rapid Station Growth

One major trend reshaping the fuel cell automotive space is the faster growth of vehicle fleets and supporting hydrogen stations together — the market is moving from isolated pilots toward broader ecosystem expansion. This means more fuel cell vehicles (FCVs) per region, and more hydrogen refuelling stations following quickly behind — the two reinforcing each other.

As of December 2023, the global fleet of fuel cell vehicles had approached 90,000 units, served by over 1,200 hydrogen fueling stations. That’s a big jump from earlier years, showing the commitment to build both supply (stations) and demand (vehicles) in tandem. The idea is that as more hydrogen stations come up, the “range anxiety” barrier drops, making it safer for fleet operators and individuals to adopt FCVs.

In the U.S., policy is catching up to this trend. The Infrastructure Investment and Jobs Act (IIJA) allocates USD 8 billion for regional clean hydrogen hubs. These hubs are designed to integrate hydrogen production, storage, distribution, and consumption — meaning some may directly feed transport networks. Such hubs can act as focal nodes to support fleet deployments.

Technological advances are also aiding this scaling. Innovations in electrolysis, compression, storage, and fueling hardware are reducing costs and increasing throughput. For instance, hydrogen production methods, including low-temperature electrolysis, are becoming more efficient, and cost models are expected to lower delivery and dispensing costs. As production and fueling become cheaper, station operators and fleet owners can more confidently commit to expansion.

Drivers

Supportive Government Policy & Large-Scale Hydrogen Hub Investments

One of the most powerful drivers pushing fuel cell vehicles (FCVs) forward is government policy and financial backing for hydrogen infrastructure and clean energy hubs. When governments commit real money, they reduce risk, build confidence, and attract private investment. That ripple effect is crucial in a technology area like fuel cells, which has steep initial costs and infrastructure challenges.

The Infrastructure Investment and Jobs Act (IIJA), Congress allocated USD 8 billion for Regional Clean Hydrogen Hubs, with USD 7 billion dedicated to selected hub projects spanning the full hydrogen value chain (production, delivery, use) for transport, industry, and power. This support helps link hydrogen supply to demand in a way that private players alone find too risky. In short, the government is acting as a catalyst.

These hubs don’t just serve as showcase projects — they help develop supply chains, refuelling stations, distribution pipelines and standards for safety, permitting, and operations. Once early hubs succeed, they lower the barrier for the next ones. The backing from government often mandates a cost share, ensuring commitment from private partners too.

Internationally, hydrogen and fuel cell policy support is growing. In the Global Hydrogen Review 2024, the IEA highlights that governments are now including hydrogen strategies in their national clean energy plans, with a spotlight on mobility and transport as key end-uses. These strategies often include subsidies, mandates, clean vehicle quotas, tax benefits, or co-financing of stations.

Restraints

High Cost and Economic Viability Challenges

One of the biggest storms in the path of fuel cell vehicles is simply how expensive everything still is—from making the fuel cell stacks to producing hydrogen and building refueling stations. These costs make it very hard for fuel cells to compete with batteries or fossil-fuel cars in many cases, especially without strong subsidies.

Green hydrogen today often costs between USD 2.28 and USD 7.39 per kilogram in many markets, depending on electricity prices, plant design, and scale. In contrast, “grey” hydrogen can cost as little as USD 0.67 to 1.31 per kilogram under current conditions. That large gap means that unless hydrogen becomes much cheaper, fuel cell vehicles (FCEVs) will struggle to be competitive.

In terms of fuel cell system cost, U.S. Department of Energy (DOE) targets help illustrate how far the gap is. DOE estimates aim for fuel cell systems for heavy-duty use to reach USD 80 per kilowatt by 2030. But today, many systems are several times more expensive. Likewise, DOE sets a target hydrogen dispensing cost for heavy-duty vehicles at USD 7 per kilogram by 2028. These are ambitious targets that si/gnal how much reduction is needed, but getting there is tough.

The high upfront capital cost also hits infrastructure. Building a hydrogen fueling station involves specialized compressors, storage, safety systems, and distribution equipment. When there are few stations, each one bears more of the fixed cost burden, which increases the price of hydrogen dispensed and discourages new stations.

Opportunity

Heavy-Duty And Commercial Vehicle Electrification with Fuel Cells

In many real-world applications—long-haul trucking, intercity buses, delivery fleets covering hundreds of kilometers daily—battery electric vehicles (BEVs) face limitations: battery weight, charging time, and range. Fuel cells, by contrast, offer high energy density and fast refueling, making them more suited for duty cycles where downtime is costly. As adoption of zero-emission mandates increases, fleets will look for solutions that blend low emissions with operational feasibility.

According to the International Energy Agency (IEA), novel uses of hydrogen in heavy industry and long-distance transport could account for one-third of global hydrogen demand by 2030 under a Net Zero Emissions (NZE) scenario. That projection signals that transport, beyond light vehicles, is expected to take a large slice of the hydrogen economy’s growth. Because heavy transport is more challenging for batteries, fuel cells have a comparative advantage in that sector.

Global hydrogen production reached over 97 million tonnes (Mt) in 2023, though less than 1 % of that was low-emissions or “green” hydrogen. The growth of low-emissions hydrogen production is a necessary enabling factor for fuel cell uptake in heavy vehicles, as fleets demand clean fuel to meet emissions goals.

Governments and institutions are already backing hydrogen hubs and infrastructure development that can serve heavy transport corridors. In the United States, the Infrastructure Investment and Jobs Act (IIJA) set aside USD 8 billion for clean hydrogen hubs, with most funds targeted at these integrated systems that link production, delivery, and end use.

Regional Insights

Asia-Pacific dominates with 43.2% share valued at USD 1.6 billion driven by strong government support and rapid hydrogen infrastructure development

In 2024, the Asia-Pacific (APAC) region held a dominant market position in the global automotive fuel cell industry, capturing more than a 43.2% share, valued at approximately USD 1.6 billion. The region’s leadership was underpinned by robust government initiatives, large-scale investments in hydrogen refueling infrastructure, and the active participation of leading automakers such as Toyota, Hyundai, and Honda.

Japan has been one of the earliest adopters of hydrogen-powered vehicles, supported by its “Green Growth Strategy” and the establishment of over 160 hydrogen refueling stations as of 2024, backed by the Ministry of Economy, Trade and Industry (METI).

Similarly, South Korea’s Hydrogen Economy Roadmap aims to deploy 200,000 hydrogen vehicles by 2025, positioning the country as a regional leader in fuel cell manufacturing and technology export. China, meanwhile, has accelerated hydrogen infrastructure deployment under its 14th Five-Year Plan, targeting 50,000 fuel cell vehicles by 2025, driven by strong provincial-level subsidies and partnerships between automakers and energy companies.

Key Regions and Countries Insights

North America

Europe

Germany

France

The UK

Spain

Italy

Rest of Europe

Asia Pacific

China

Japan

South Korea

India

Australia

Rest of APAC

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

GCC

South Africa

Rest of MEA

Key Players Analysis

In 2024, Ballard Power Systems remained a global leader in proton exchange membrane (PEM) fuel cell technology, focusing on automotive, bus, and commercial vehicle applications. The company’s modules such as FCmove™ were widely adopted in heavy-duty transport across North America, Europe, and Asia. Ballard continued to expand partnerships with OEMs and fleet operators to enhance hydrogen mobility solutions.

Plug Power continued to strengthen its leadership in hydrogen fuel cell solutions during 2024, focusing on mobility, logistics, and on-road commercial vehicles. The company’s GenDrive and ProGen systems were adopted across multiple automotive and fleet applications. Plug Power expanded its green hydrogen production capacity and infrastructure partnerships to support large-scale FCEV deployment.

In 2024, Delphi Automotive Systems advanced its fuel cell component technology through innovations in power electronics, stack integration, and thermal management. The company leveraged its automotive expertise to support OEMs transitioning to fuel cell-based propulsion. Delphi’s engineering focus on lightweight, efficient components helped improve overall vehicle performance and reduce system costs.

Top Key Players Outlook

Ballard Power Systems

ACAL

Nuvera Fuel Cells

Plug Power

Delphi Automotive Systems

H2 Logic

Symbio FCell

Proton Motors

Intelligent Energy

Infintium Fuel Cell Systems

Recent Industry Developments

In 2024, Ballard secured its largest order to date, a long-term agreement with Solaris Bus & Coach to supply up to 1,000 hydrogen fuel cell engines by 2027 for the European transit-bus market.

In 2024, Nuvera Fuel Cells reinforced its position in the automotive fuel cell sector by advancing its E-Series fuel cell engines and expanding into new applications. The company introduced the E-45 engine, a 45 kW module designed for integration into electric drivetrains, suitable for both primary power and hybrid configurations.

Report Scope