Report Overview

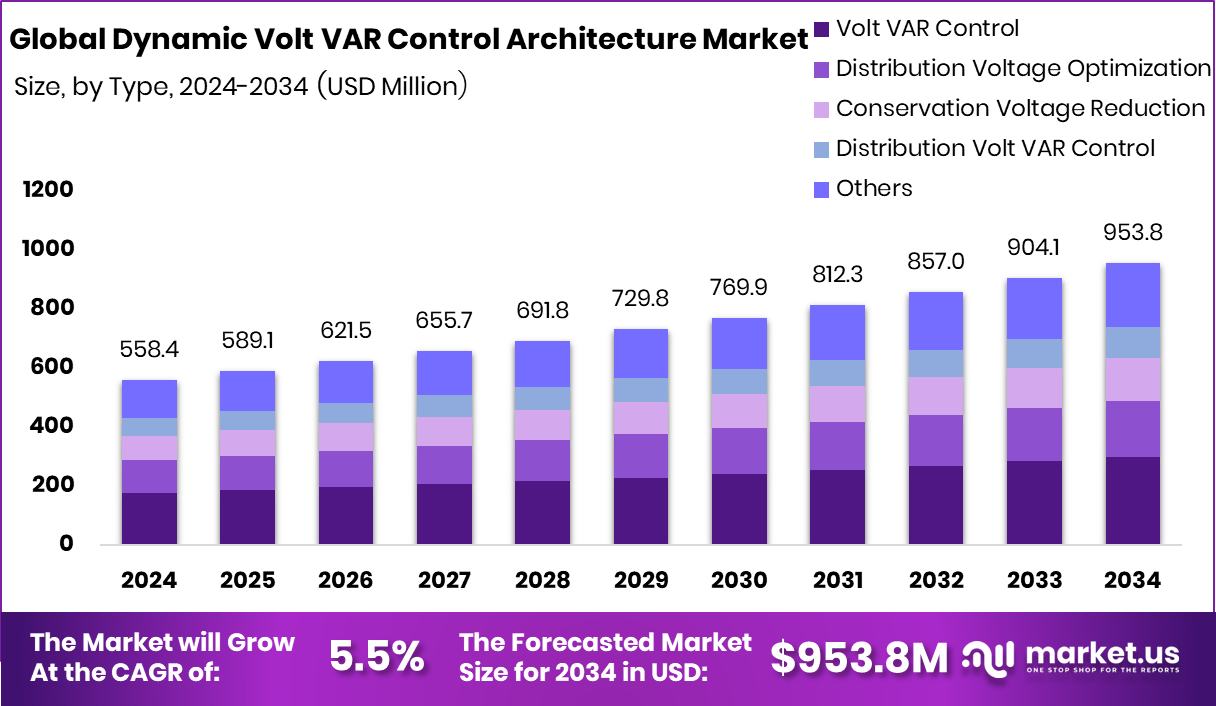

The Global Dynamic Volt VAR Control Architecture Market is expected to be worth around USD 953.8 Million by 2034, up from USD 558.4 Million in 2024, and is projected to grow at a CAGR of 5.5% from 2025 to 2034. Growing renewable integration and smart grid projects strengthened North America’s USD 217.2 Mn market position.

Dynamic Volt VAR Control Architecture (DVVC) is a framework used in modern electrical distribution systems to regulate voltage levels and manage reactive power flow in real time. It comprises voltage sensors, reactive power compensators, control logic, and communication layers that respond dynamically to fluctuations. Its role is to maintain voltage stability, reduce losses, support power quality, and enable more efficient grid operations under varying load conditions and with the penetration of distributed energy sources.

The growth of DVVC is being driven by rising electricity demand, growing urbanization, and the increasing complexity of electrical grids. As grids become more stressed, utilities need smarter voltage regulation tools for improved efficiency, network stability, and reduced losses. Further, the push toward decarbonization means more renewables (solar, wind) are being integrated into distribution networks, which introduces voltage variability—making DVVC more attractive as a solution to manage these fluctuations.

Demand for DVVC systems is coming from utilities and grid operators who want to modernize legacy networks, reduce the frequency of voltage sags or swells, and maintain power quality for consumers. Industrial parks, large commercial centers, and areas with high renewable installations are especially interested. Governments’ policies for grid modernization and incentives also stimulate this demand.

There is a clear opportunity in retrofitting existing grids with DVVC systems rather than entirely replacing infrastructure. Because DVVC is a “smart add-on,” utilities can gradually deploy it in targeted zones. The announced funding of $8 million for New High-Voltage Direct Current Grid Modernization and $11 M in High Voltage Direct Current Transmission Projects can stimulate investment in advanced voltage and reactive-power control technologies like DVVC. As grids evolve and new transmission investments flow in, DVVC can become part of the digital upgrade path.

Key Takeaways

The Global Dynamic Volt VAR Control Architecture Market is expected to be worth around USD 953.8 Million by 2034, up from USD 558.4 Million in 2024, and is projected to grow at a CAGR of 5.5% from 2025 to 2034.

In 2024, Volt VAR Control held a 31.2% share in the Dynamic Volt VAR Control Architecture Market.

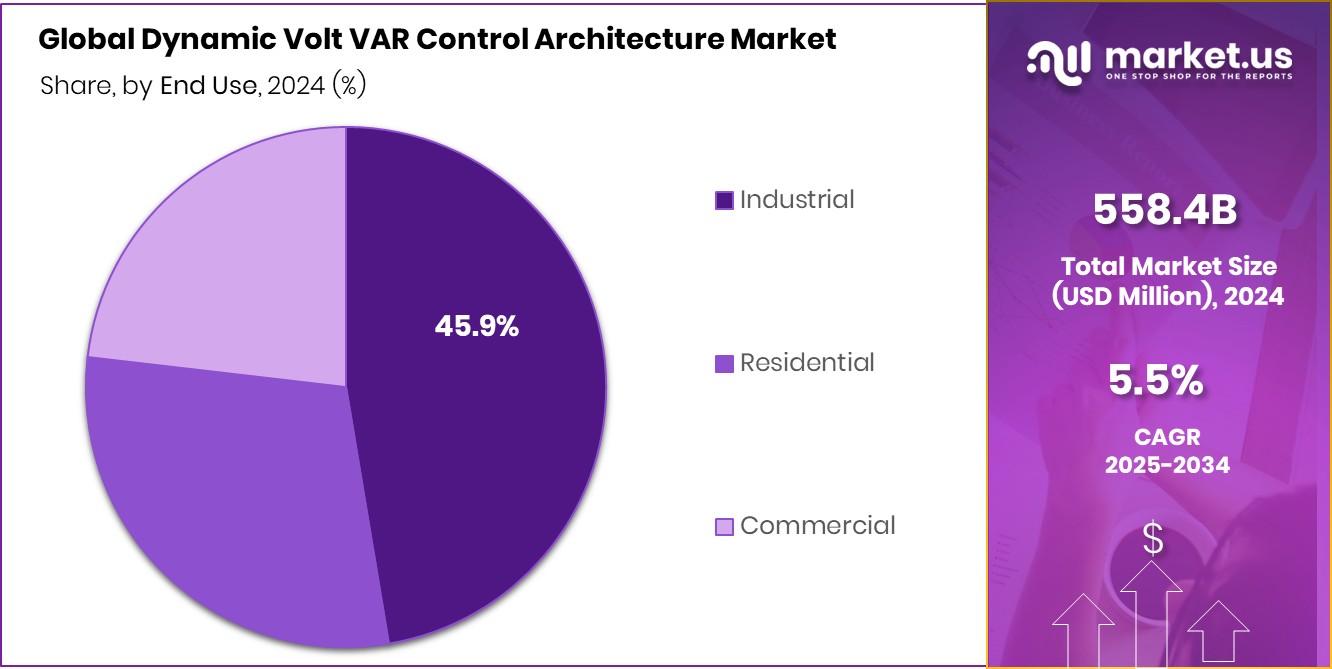

In 2024, the industrial segment captured a 45.9% share in the Dynamic Volt VAR Control Architecture Market.

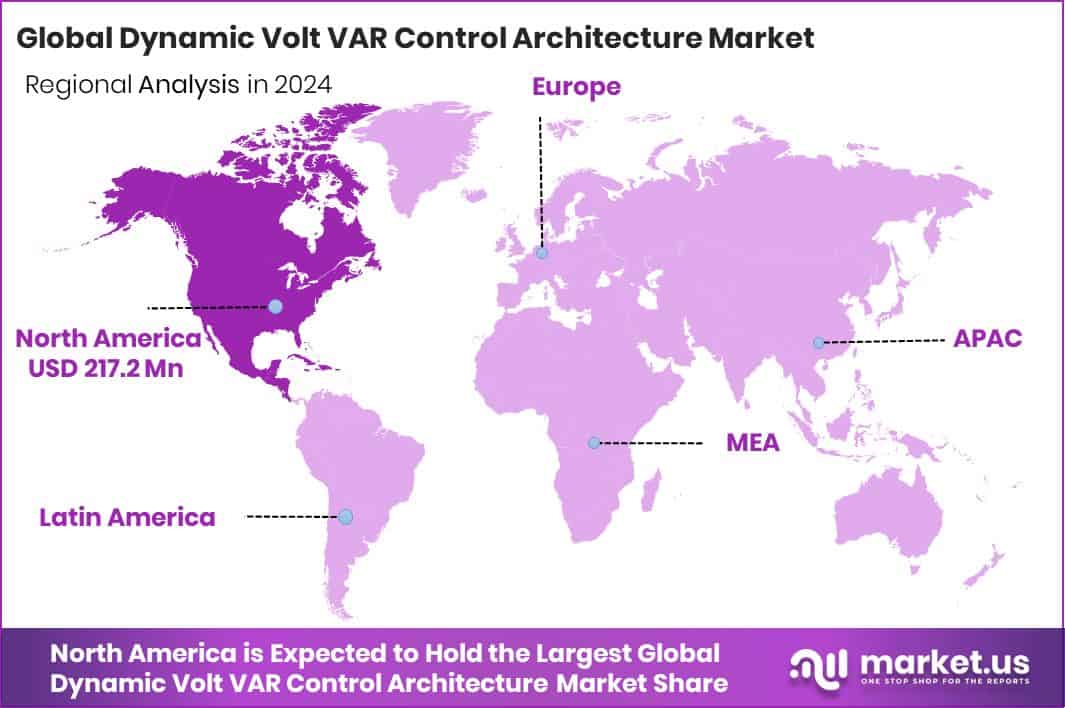

North America recorded a market value of USD 217.2 million, driven by advanced energy infrastructure.

By Type Analysis

In 2024, Volt VAR Control dominated the Dynamic Volt VAR Control Architecture Market, holding a 31.2% share.

In 2024, Volt VAR Control held a dominant market position in the By Type segment of the Dynamic Volt VAR Control Architecture Market, with a 31.2% share. This leadership reflects its critical role in maintaining voltage stability and optimizing reactive power across distribution networks. Utilities increasingly adopted Volt VAR Control systems to improve grid efficiency, reduce energy losses, and enhance power quality under varying load conditions.

The technology’s ability to support renewable integration and adapt to real-time voltage fluctuations made it essential for modern grid operations. Its growing application in smart grids and advanced power management systems further strengthened its dominance, positioning it as a key component in ongoing grid modernization efforts worldwide.

By End Use Analysis

The industrial sector led the Dynamic Volt VAR Control Architecture Market with a 45.9% share.

In 2024, Industrial held a dominant market position in the By End Use segment of the Dynamic Volt VAR Control Architecture Market, with a 45.9% share. The strong adoption in industrial facilities stems from their high and fluctuating power demand, which requires precise voltage and reactive power management to maintain operational stability.

Industries rely on Dynamic Volt VAR Control systems to enhance equipment performance, reduce energy losses, and prevent voltage irregularities that could disrupt production. The integration of advanced monitoring and automated control has allowed industrial users to optimize power quality and improve energy efficiency. This focus on maintaining consistent power flow and reducing downtime has firmly established the industrial sector as the leading end-use segment.

Key Market Segments

By Type

Volt VAR Control

Distribution Voltage Optimization

Conservation Voltage Reduction

Distribution Volt VAR Control

Others

By End Use

Industrial

Residential

Commercial

Driving Factors

Growing Need for Smarter Grid Modernization Systems

A major driving factor for the Dynamic Volt VAR Control Architecture Market is the growing need for smarter grid modernization systems. Power networks are becoming more complex due to increasing electricity consumption and the rising integration of renewable energy sources. Utilities are focusing on upgrading their grids with intelligent systems that can automatically manage voltage and reactive power in real time. This helps improve stability, reduce energy losses, and ensure better power quality for consumers.

The U.S. Department of Energy’s $13 million funding in new grid modernization projects is expected to further accelerate advancements in voltage control systems. Such initiatives encourage utilities to adopt dynamic control technologies, enhancing overall grid efficiency and supporting sustainable energy transition goals.

Restraining Factors

High Installation and Integration Cost Challenges

A key restraining factor for the Dynamic Volt VAR Control Architecture Market is the high installation and integration cost of these advanced systems. Implementing dynamic voltage and reactive power control requires specialized hardware, sensors, communication networks, and software platforms that can operate seamlessly across existing grid infrastructure. Many utilities, especially in developing regions, face financial and technical barriers when upgrading legacy systems to accommodate such technologies.

Additionally, integrating new control architectures with older grid components often demands extensive customization, skilled labor, and time, which raises overall project costs. These financial and operational challenges slow down adoption rates, making utilities hesitant to invest in large-scale deployments despite the long-term benefits of improved grid efficiency and reliability.

Growth Opportunity

Expanding Opportunities Through Large-Scale Grid Upgrades

A major growth opportunity for the Dynamic Volt VAR Control Architecture Market lies in large-scale grid upgrade initiatives. As global power demand grows and renewable energy integration increases, utilities are investing in smarter, more responsive systems to stabilize voltage and optimize energy flow. The rollout of $2.2 billion by the U.S. Department of Energy for grid upgrades is set to open new avenues for advanced control technologies like Dynamic Volt VAR systems.

These upgrades aim to strengthen transmission infrastructure, enhance grid flexibility, and improve real-time monitoring capabilities. By embedding intelligent voltage regulation and reactive power management solutions, utilities can achieve better efficiency and reliability, creating strong opportunities for long-term adoption and technological advancement in the power sector.

Latest Trends

Rising Adoption of Advanced Transmission Control Systems

One of the latest trends in the Dynamic Volt VAR Control Architecture Market is the growing adoption of advanced transmission control systems. Utilities are increasingly investing in digital and automated solutions that enable precise voltage and reactive power management across transmission networks. These systems help maintain grid stability, reduce losses, and ensure seamless integration of renewable energy sources.

The DOE’s $371 million award to boost permitting and local benefits from transmission projects highlights the focus on building smarter, faster, and more resilient transmission infrastructure. This trend is leading to the deployment of real-time monitoring tools, intelligent sensors, and data-driven control systems that enhance power delivery efficiency, strengthen grid reliability, and support large-scale modernization efforts nationwide.

Regional Analysis

In 2024, North America led the market with a 38.90% share, reflecting strong grid modernization efforts.

In 2024, North America dominated the Dynamic Volt VAR Control Architecture Market, accounting for a 38.90% share, valued at USD 217.2 million. The region’s dominance stems from rapid grid modernization efforts, strong investment in renewable integration, and early adoption of smart distribution technologies. The presence of advanced infrastructure and supportive energy policies has further accelerated deployment across utilities and industrial networks.

Europe followed with growing adoption of digital grid control systems to improve voltage stability and support clean energy goals under regional decarbonization initiatives. Asia Pacific is witnessing significant growth due to expanding urbanization, rising electricity demand, and government-led grid automation programs across major economies.

Meanwhile, the Middle East & Africa are gradually embracing advanced control architectures to improve power quality and reduce transmission losses, especially in industrial hubs. Latin America is focusing on grid reliability upgrades and reactive power optimization to support its growing renewable capacity.

Collectively, these regions show a clear shift toward smarter, data-driven grid management, but North America remains the leading market, driven by robust investments, policy incentives, and the integration of intelligent voltage and reactive power control technologies across high-demand utility sectors.

Key Regions and Countries

North America

Europe

Germany

France

The UK

Spain

Italy

Rest of Europe

Asia Pacific

China

Japan

South Korea

India

Australia

Rest of APAC

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

GCC

South Africa

Rest of MEA

Key Players Analysis

Beckwith Electric Co. Inc. continues to strengthen its position through expertise in protective relays, voltage regulators, and distribution automation controls. Its focus on grid reliability and adaptive voltage management systems supports utilities in maintaining power quality and efficiency across distribution networks. The company’s technology-driven approach allows flexible voltage and VAR coordination to reduce system losses and improve overall grid performance.

Eaton Corporation plc remains a leader in intelligent power management solutions, advancing real-time voltage control through its automation platforms and grid optimization systems. Eaton’s emphasis on digital integration and interoperability enhances dynamic control capabilities across both transmission and distribution levels. The company’s ongoing development in power quality and reactive power solutions reinforces its strategic alignment with evolving grid modernization efforts.

Hitachi Energy (Hitachi Ltd.) is advancing innovative power automation and energy management systems that enable dynamic, adaptive voltage regulation. With deep expertise in high-voltage systems and grid integration, Hitachi Energy continues to deliver advanced solutions for balancing voltage fluctuations and ensuring grid resilience. Its focus on digital substation technologies and sustainable energy transformation supports utilities’ shift toward intelligent and flexible grid infrastructures globally.

Top Key Players in the Market

Beckwith Electric Co. Inc.

Eaton Corporation plc.

Hitachi Energy (Hitachi Ltd.)

Siemens AG

ABB Ltd.

Schneider Electric SE

General Electric Company

Eaton Corporation plc

S&C Electric Company

Landis+Gyr

Survalent Technology Corporation

Recent Developments

In August 2025, Hitachi Energy completed the acquisition of the remaining stake in Eks Energy, a company specializing in power-conversion and control technologies. This strengthens their capabilities in converters, which tie into reactive power and voltage control in power systems.

In July 2025, Eaton signed an agreement to acquire Resilient Power Systems Inc., a company working on innovative power solutions, including solid-state transformer technologies that could strengthen Eaton’s offerings in grid and distribution systems.

Report Scope