Report Overview

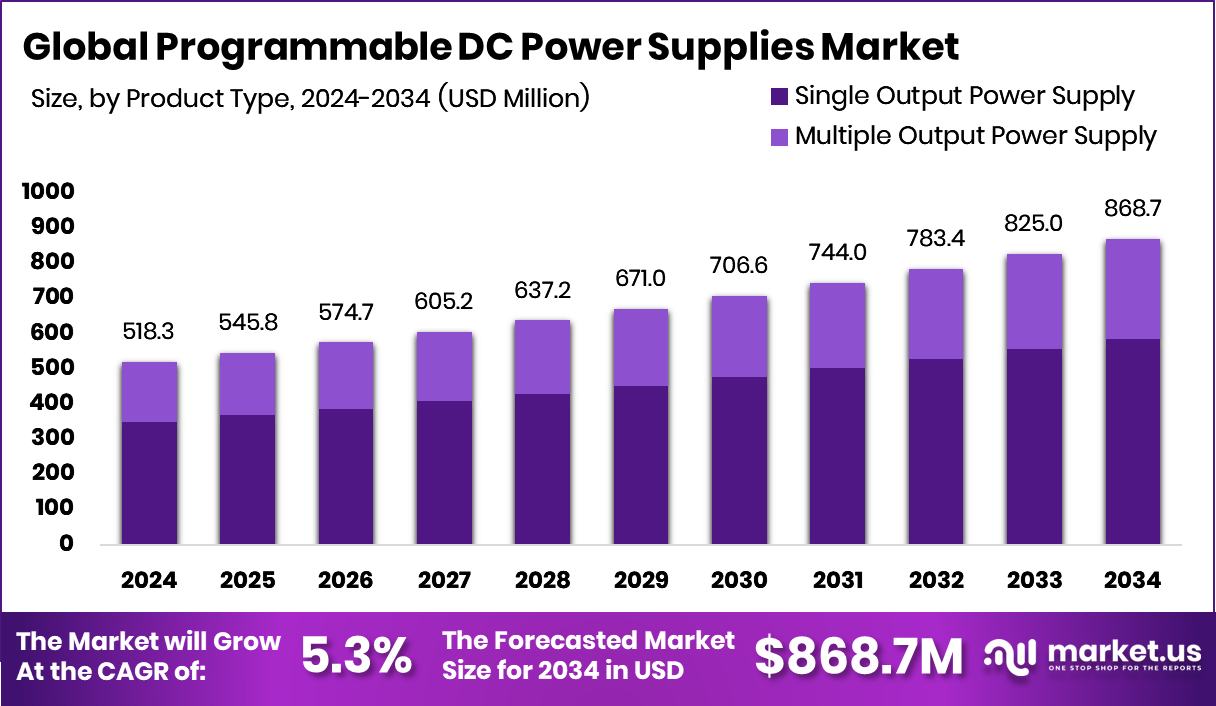

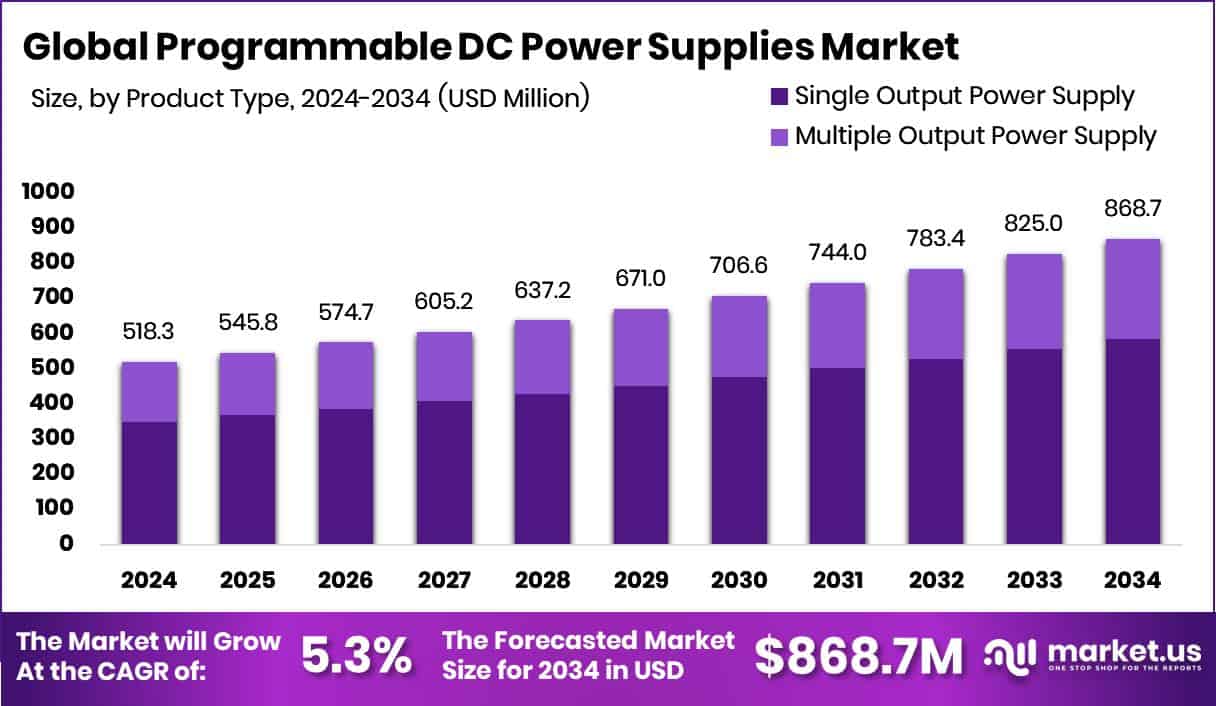

The Global Programmable DC Power Supplies Market is expected to be worth around USD 868.7 million by 2034, up from USD 518.3 million in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034. Growing automation and renewable energy testing significantly boosted North America’s 45.80% market expansion in 2024.

A Programmable DC Power Supply is an electrical instrument that can provide a precisely controlled direct current (DC) output, where parameters such as voltage, current, and slew rate can be adjusted through a digital interface or software. Engineers and developers use these supplies during design, testing, and validation phases of electronics to simulate battery behavior, stress test devices, or automate dynamic load conditions. The “programmable” feature enables running sequences, ramps, or steps automatically, which accelerates testing and improves repeatability.

The Programmable DC Power Supply market refers to the global demand, production, distribution, and application of these precision supplies across industries such as consumer electronics, automotive, energy storage, telecommunications, aerospace, and industrial automation. It encompasses product development, sales, aftermarket services, and integration into test systems.

Key growth factors include the increasing complexity of electronic devices (e.g., IoT, power electronics, EVs) that demand more stringent power-cycling and stress tests, the push for automation and Industry 4.0 in manufacturing and testing labs, and the growing importance of renewable energy storage systems (which require precise charging/discharging setups). Another growth driver is regulatory pressure on energy efficiency and power quality testing, which in turn demands more advanced programmable supplies.

In terms of demand, sectors like electric vehicles, energy storage systems, semiconductor labs, wireless infrastructure, and aerospace heavily need programmable DC sources to simulate real-world conditions, test battery packs, or validate power modules under dynamic loads. Also, research labs and universities fuel demand as they work on next-generation power conversion, grid integration, and new energy systems.

Regarding opportunity, there is room for innovation in higher power densities, improved efficiency, compact modular designs, integration with software platforms and AI for predictive control, and remote or cloud-based management. In addition, funding in the energy and clean tech sectors is opening paths for more R&D and deployment: Brookfield raises $20 billion in its second energy transition investment fund; a Canadian cleantech company closed an oversubscribed pre-seed round of over $1.3 million for wave energy tech; the Arab Energy Fund led a $26.3 million equity round in a biofuels feedstock platform Tagaddod (and similarly a $26.3 million Series A); Sunrise New Energy gets $600,000 in national science funding; on the other hand, policy and funding risks exist as the DOE canceled $7.6 billion in clean energy funding and the EPA’s cancellation of $7 billion in solar grants prompted legal pushback by labor leaders and nonprofit lawyers—such shifts impact how much capital flows into adjacent sectors and thus influence demand for precision power-test instruments.

Key Takeaways

The Global Programmable DC Power Supplies Market is expected to be worth around USD 868.7 million by 2034, up from USD 518.3 million in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034.

In 2024, single output programmable DC power supplies dominated with a 67.3% market share.

Low-output programmable DC power supplies held a 46.9% share and are widely used in low-power testing.

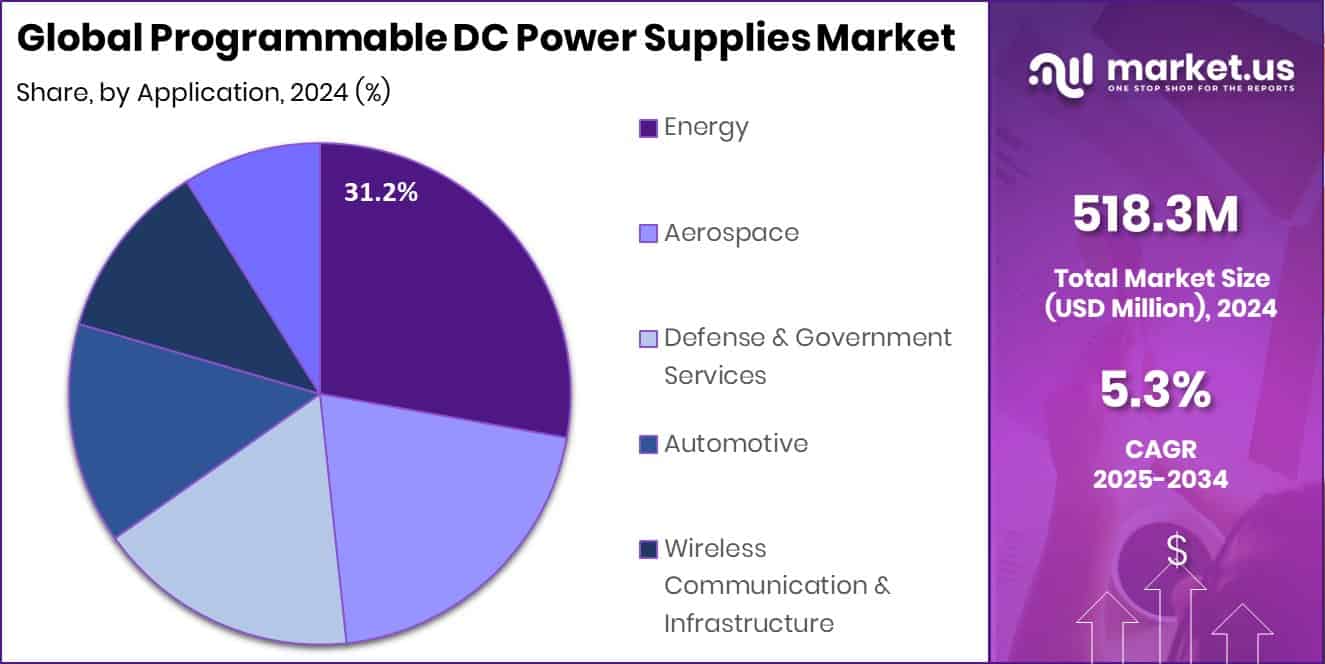

The energy segment captured 31.2% of the programmable DC power supplies market in 2024.

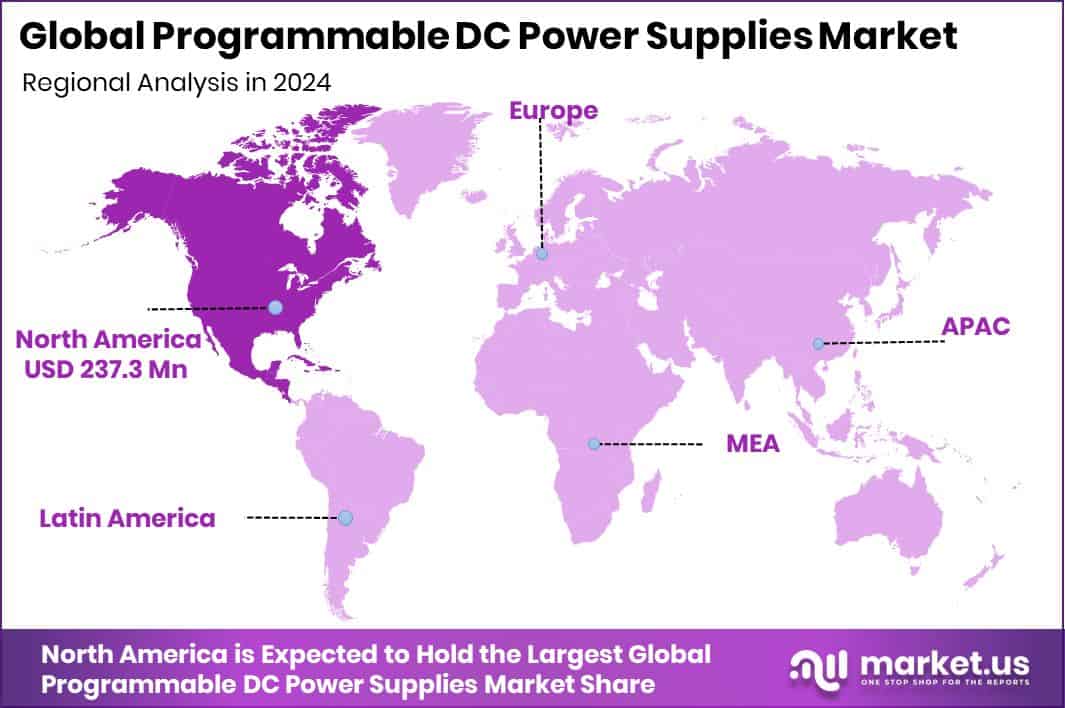

The North American market value reached USD 237.3 million, highlighting strong industrial demand.

By Product Type Analysis

In 2024, Single Output Power Supply dominated the Programmable DC Power Supplies Market with a 67.3% share.

In 2024, Single Output Power Supply held a dominant market position in the By Product Type segment of the Programmable DC Power Supplies Market, with a 67.3% share. This dominance reflects its widespread use across research laboratories, electronic testing, and industrial automation, where stable and precise voltage is essential. The simplicity, reliability, and cost-effectiveness of single-output units make them highly preferred for applications requiring a consistent DC output without complex control systems.

These supplies are extensively utilized in testing consumer electronics, power modules, and communication devices. Their compatibility with automated test setups and ability to maintain output accuracy under variable load conditions further support their continued preference among end-users in 2024.

By Output Power Analysis

Low output models up to 10 kW held 46.9% market share.

In 2024, Low Output (up to 10 kW) held a dominant market position in the Programmable DC Power Supplies Market by output power, with a 46.9% share. This strong presence is driven by its extensive use in electronics testing, battery research, and low to medium-power industrial applications. These systems are ideal for laboratories and production lines that require precise voltage and current control for smaller components and circuit validation.

Their compact design, cost efficiency, and high accuracy make them suitable for various R&D and quality assurance environments. The growing demand for controlled power solutions in educational institutions and small-scale renewable energy testing further reinforced the segment’s leadership in 2024.

By Application Analysis

The energy segment led the Programmable DC Power Supplies Market with a 31.2% share.

In 2024, Energy held a dominant market position in the Programmable DC Power Supplies Market by application, with a 31.2% share. This leadership is attributed to the increasing need for precise power control in renewable energy testing, battery simulation, and energy storage research. Programmable DC power supplies are widely used in evaluating solar inverters, fuel cells, and grid-connected systems to ensure efficiency and stability under varying load conditions.

Their ability to deliver accurate and repeatable power profiles makes them essential for performance verification and development in clean energy technologies. The growing emphasis on sustainable power generation and testing of next-generation energy solutions supported the segment’s strong market share in 2024.

Key Market Segments

By Product Type

Single-Output Power Supply

Multiple Output Power Supply

By Output Power

Low output (Up to 10 kW)

Medium output (10 to 100 kW)

High output (100 to 250 kW)

By Application

Energy

Aerospace

Defense and Government Services

Automotive

Wireless Communication and Infrastructure

Others

Driving Factors

Rising Demand for Efficient Power Testing Systems

One of the key driving factors for the Programmable DC Power Supplies Market is the growing need for accurate and efficient power testing systems across industries. As electronic devices, renewable energy systems, and electric vehicles become more advanced, manufacturers rely on programmable DC supplies for precise voltage and current control during design and validation. These instruments help ensure product reliability and energy efficiency while supporting automation in modern testing environments.

Furthermore, increased investments in grid modernization and clean energy infrastructure continue to drive market growth. For instance, Entergy Texas secured approval for a major transmission investment and $200 million in grant funding to strengthen the grid, boosting the demand for programmable DC power systems in energy testing and integration.

Restraining Factors

High Equipment Costs and Reduced Funding Support

One major restraining factor for the Programmable DC Power Supplies Market is the high cost of advanced equipment and the reduced availability of government funding. Programmable DC power supplies, especially those designed for high precision and multi-channel testing, require significant investment in design, calibration, and maintenance. This makes them less accessible for small manufacturers, research labs, and educational institutions.

Moreover, fluctuations in public energy funding directly affect demand from energy testing and renewable sectors. For example, the U.S. Department of Energy (DOE) cut $7.5 billion in energy funding, focusing exclusively on Democrat-led states, which limited ongoing clean energy projects. Such uneven financial support can slow infrastructure upgrades and delay new testing initiatives that depend on programmable DC systems.

Growth Opportunity

Expanding Role in Renewable Energy Testing Applications

A major growth opportunity for the Programmable DC Power Supplies Market lies in their expanding use in renewable energy testing and development. As industries move toward cleaner power sources, there is a growing demand for precise and programmable testing tools to evaluate solar panels, battery systems, and energy storage modules. These supplies help simulate real-world power conditions, ensuring better efficiency and reliability of renewable technologies.

Despite some challenges, such as Minnesota losing more than $600 million through the termination of federal energy grants, private and state-level projects continue to explore renewable integration. This shift toward decentralized and sustainable power generation creates long-term opportunities for programmable DC power systems in energy research and performance testing.

Latest Trends

Integration of Smart Control and Automation Features

One of the latest trends in the Programmable DC Power Supplies Market is the integration of smart control and automation technologies. Modern programmable DC systems now feature remote monitoring, digital interfaces, and data-driven control that enhance testing accuracy and operational efficiency. These innovations allow engineers to program complex power sequences, automate repetitive testing, and collect performance data in real time, improving productivity in laboratories and manufacturing setups.

Additionally, the focus on sustainable energy projects continues to influence market advancement. However, recent policy setbacks, such as Trump’s EPA being sued for axing a $7 billion solar energy program, have raised concerns over funding stability. Even so, industries remain committed to digital and automated testing solutions to improve energy efficiency.

Regional Analysis

In 2024, North America dominated the Programmable DC Power Supplies Market with 45.80%.

In 2024, North America held a dominant position in the global Programmable DC Power Supplies Market, accounting for 45.80% of the total share and reaching a market value of USD 237.3 million. The region’s growth is strongly supported by the expanding demand for advanced testing equipment in sectors such as electric vehicles, renewable energy, and industrial automation. Government initiatives promoting energy efficiency and strong investments in grid modernization have further enhanced market adoption.

Europe continues to follow with steady growth, driven by stringent energy regulations and increased R&D activities in electronics and clean energy technologies. Meanwhile, the Asia Pacific region is witnessing growing demand from manufacturing hubs and semiconductor industries, especially in countries like China, Japan, and South Korea.

The Middle East & Africa, along with Latin America, are gradually emerging as promising markets due to infrastructure development and growing energy research. While these regions show potential, North America remains the clear leader in technological integration and testing automation, setting the global benchmark for performance and innovation in programmable DC power systems.

Key Regions and Countries

North America

Europe

Germany

France

The UK

Spain

Italy

Rest of Europe

Asia Pacific

China

Japan

South Korea

India

Australia

Rest of APAC

Latin America

Brazil

Mexico

Rest of Latin America

Middle East & Africa

GCC

South Africa

Rest of MEA

Key Players Analysis

In 2024, TEKTRONIX, INC. continued to strengthen its position in the global Programmable DC Power Supplies Market by focusing on advanced power measurement and precision testing technologies. The company’s instruments are widely used in research laboratories and industrial automation, offering high accuracy, user-friendly interfaces, and seamless connectivity. Tektronix’s emphasis on integrating programmable systems with digital control and automated test environments supports engineers in evaluating power efficiency, reliability, and circuit performance.

B&K Precision Corporation maintained a strong presence through its extensive range of programmable DC power supplies tailored for educational, industrial, and R&D purposes. The company’s focus on reliability and cost-effectiveness enables users to achieve accurate performance testing at multiple output levels. In 2024, B&K Precision enhanced its offerings with products supporting higher resolution, flexible programming, and real-time monitoring, catering to modern electronic testing demands.

Keysight Technologies remained a prominent name in precision measurement and programmable power systems. The company’s programmable DC power solutions are known for their advanced control, high-speed response, and multi-output configurations. Keysight’s continued investment in power electronics and renewable energy testing applications highlights its commitment to supporting next-generation research and industrial needs. Its collaboration-driven approach and integration of smart automation features further enhance efficiency, making it a leading contributor to technological advancement in programmable DC power supply innovation.

Top Key Players in the Market

TEKTRONIX, INC

B&K Precision Corporation

Keysight Technologies

Chroma Systems Solutions, Inc.

NFcorp

Kikusui Electronics Corporation

AMETEK, Inc.

HOCHERL & HACKL GMBH

Unicorn

Maynuo Electronic Co.,Ltd

Recent Developments

In January 2025, B&K Precision released a new HPS Series 20 kW DC Power Supply. The lineup includes two models (HPS20K800 and HPS20K1500) with high efficiency, up to 1,500 V, and a 5-inch touchscreen.

In April 2024, Tektronix acquired EA Elektro-Automatik, a specialist in high-efficiency regenerative power supplies, thereby expanding its power portfolio to support energy storage, mobility, and renewable energy testing.

Report Scope