High Barrier Pharmaceutical Packaging Films for Blister Market Forecast and Outlook (2025-2035)

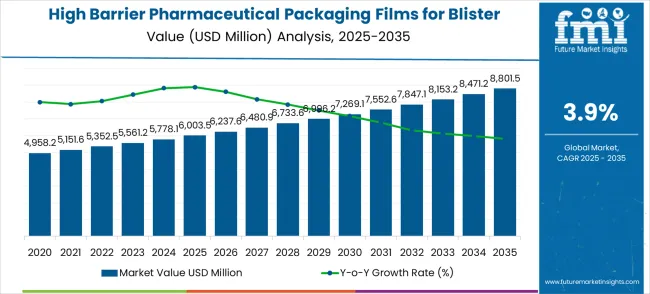

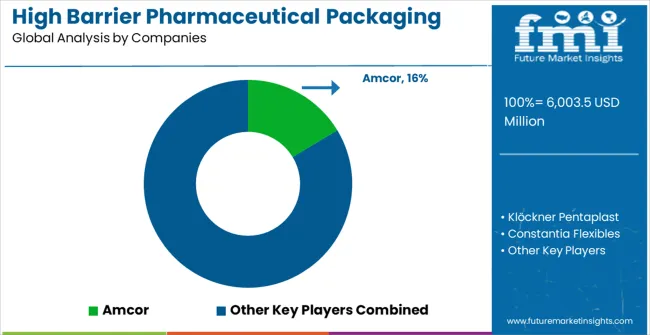

The high barrier pharmaceutical packaging films for blister market is forecast to experience steady growth, with a compound annual growth rate (CAGR) of 3.9% from 2025 to 2035. The market, valued at USD 6,003.5 million in 2025, is expected to reach USD 8,801.5 million by 2035, driven by increasing demand for high-quality, protective packaging solutions in the pharmaceutical industry. The need for pharmaceutical packaging films with high barrier properties has grown as the focus on patient safety, product integrity, and regulatory compliance intensifies. These films play a critical role in extending the shelf life of medications and maintaining their effectiveness, making them crucial in preventing moisture, oxygen, and light from affecting sensitive pharmaceutical products.

Quick Stats for High Barrier Pharmaceutical Packaging Films for Blister Market

High Barrier Pharmaceutical Packaging Films for Blister Market Value (2025): USD 6,003.5 million

High Barrier Pharmaceutical Packaging Films for Blister Market Forecast Value (2035): USD 8,801.5 million

High Barrier Pharmaceutical Packaging Films for Blister Market Forecast CAGR: 3.9%

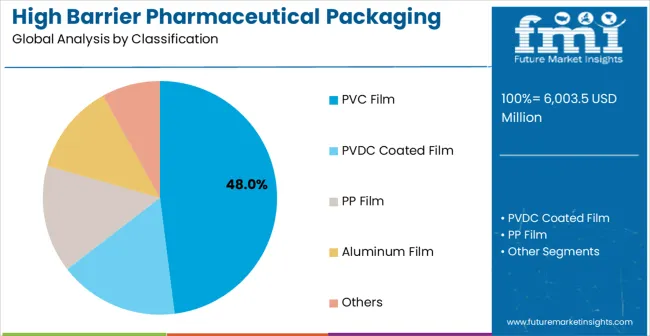

Leading Material Type in High Barrier Pharmaceutical Packaging Films for Blister Market: PVC Film (47.0%)

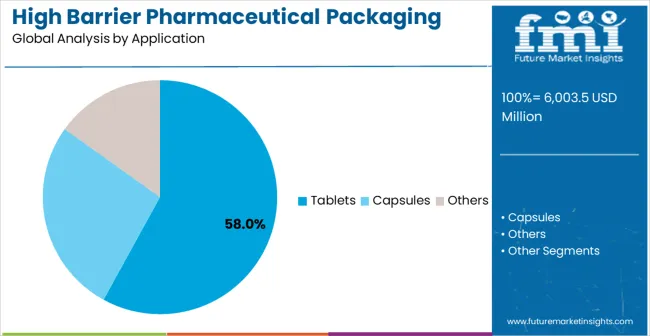

Leading Application in High Barrier Pharmaceutical Packaging Films for Blister Market: Tablets (58.0%)

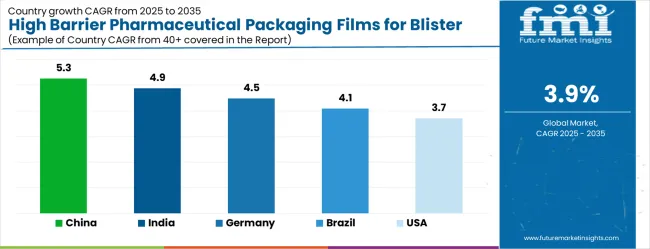

Key Growth Regions in High Barrier Pharmaceutical Packaging Films for Blister Market: China, India, and Germany

Top Key Players in High Barrier Pharmaceutical Packaging Films for Blister Market: Amcor, Klöckner Pentaplast, Constantia Flexibles, Perlen Packaging (CPH), Tekni-plex, Honeywell, Liveo Research GmbH, Sumitomo Bakelite, HySum, Aluberg, Bilcare, SÜDPACK, FlexiPack, Etimex Primary Packaging, Uniworth, Sichuan Huili Industry, Jiangxi Chunguang New Materials, Hangzhou Plastics Industry, Jiangsu Fuxin, Huakang Packaging, LIAONING TOTEM PACKAGING

The market is likely to witness consistent growth as pharmaceutical companies seek more reliable and effective packaging solutions to meet the rising demand for oral solid dosage forms, particularly in emerging markets. As regulatory standards around drug safety and packaging evolve, manufacturers of blister packaging films will continue to innovate, developing products that enhance protection against external environmental factors. Despite the modest growth rate, the need for high barrier films in protecting the integrity of critical medicines, especially in blister packs, will keep the market resilient, ensuring that pharmaceutical packaging remains a vital segment within the broader pharmaceutical supply chain.

High Barrier Pharmaceutical Packaging Films for Blister Market Key Takeaways

Metric

Value

Market Value (2025)

USD 6,003.5 million

Market Forecast Value (2035)

USD 8,801.5 million

Forecast CAGR (2025-2035)

3.9%

The high barrier pharmaceutical packaging films for blister market accounts for approximately 15% of the pharmaceutical packaging market, driven by the increasing demand for protective, tamper-proof, and moisture-resistant packaging solutions in the pharmaceutical industry. Within the flexible packaging market, it holds around 12%, reflecting its growing use in flexible, cost-efficient, and functional packaging designs. The barrier films market sees about 9%, as these films are crucial for maintaining the stability and efficacy of drugs. In the healthcare packaging market, the share is approximately 8%, as the demand for packaging solutions that preserve the integrity of pharmaceutical products continues to rise. Lastly, the blister packaging market captures about 10%, as high barrier films are a key component in modern blister packs. These contributions underscore the essential role of high barrier films in ensuring the safety, quality, and shelf-life of pharmaceutical products.

Why is the High Barrier Pharmaceutical Packaging Films for Blister Market Growing?

Market expansion is being supported by the rapid advancement of pharmaceutical manufacturing across developing economies and the corresponding need for protective packaging systems for drug stability and shelf life extension in diverse environmental conditions. Modern pharmaceutical operations require superior moisture and oxygen barrier properties to ensure optimal drug efficacy and regulatory compliance. The exceptional barrier performance and chemical resistance characteristics of high barrier pharmaceutical packaging films make them essential components in demanding pharmaceutical environments where product integrity is critical.

The growing emphasis on drug safety and regulatory compliance is driving demand for advanced packaging film technologies from certified manufacturers with proven track records of quality and regulatory approval. Pharmaceutical operators are increasingly investing in high-performance barrier systems that offer enhanced protection and extended shelf life over traditional packaging solutions. Regulatory standards and quality requirements are establishing performance benchmarks that favor precision-engineered high barrier packaging film solutions with advanced protective capabilities.

Segmental Analysis

The market is segmented by material type, application, and region. By material type, the market is divided into PVC film, PVDC coated film, PP film, aluminum film, and other configurations. Based on application, the market is categorized into tablets, capsules, and other applications. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

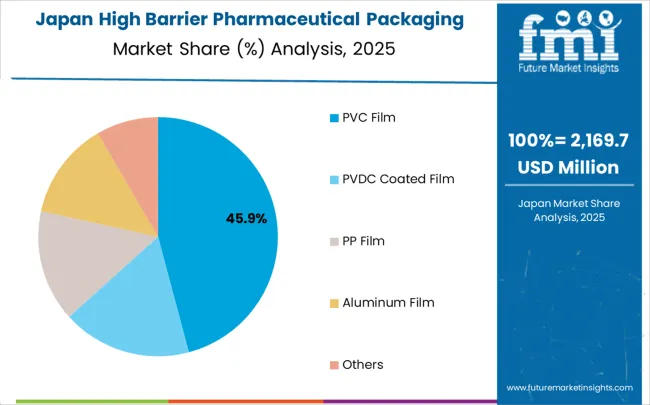

By Material Type, PVC Film Segment Accounts for 47% Market Share

PVC film configurations are projected to account for 47% of the high barrier pharmaceutical packaging films for blister market in 2025. This leading share is supported by the increasing demand for cost-effective barrier solutions in pharmaceutical packaging applications and growing requirements for versatile processing characteristics. PVC films provide excellent thermoforming properties and chemical resistance, making them the preferred choice for tablet packaging, generic drug applications, and standard pharmaceutical blister packs. The segment benefits from technological advancements that have improved the barrier properties and processing efficiency of PVC film formulations while maintaining cost-effectiveness and regulatory compliance.

Modern PVC pharmaceutical films incorporate advanced polymer formulations, barrier coatings, and surface treatments that enhance moisture protection and extend drug shelf life. These innovations have significantly improved pharmaceutical packaging performance while reducing total cost of ownership through enhanced processability and elimination of packaging failures. The generic pharmaceuticals and over-the-counter drug sectors particularly drive demand for PVC film solutions, as these industries require cost-effective protection to maintain drug quality and comply with regulatory standards.

Additionally, the emerging market pharmaceutical industry increasingly adopts PVC films to balance protection requirements with cost considerations and meet international packaging standards. Market accessibility requirements and regulatory compliance initiatives further accelerate market adoption, as PVC systems provide reliable protection while maintaining competitive pricing and processing efficiency.

By Application, Tablets Segment Accounts for 58% Market Share

Tablets applications are expected to represent 58% of high barrier pharmaceutical packaging films for blister demand in 2025. This dominant share reflects the critical role of blister packaging in tablet protection and the need for reliable barrier solutions capable of maintaining drug stability in diverse storage and distribution conditions. Tablet manufacturers require effective and durable packaging films for moisture protection, oxygen barrier, and tamper evidence. The segment benefits from ongoing expansion of oral solid dosage form production in developing countries and increasing quality requirements demanding enhanced barrier systems in pharmaceutical manufacturing facilities.

Tablet packaging applications demand exceptional barrier performance to ensure drug efficacy and shelf life stability. These applications require films capable of handling various environmental conditions, storage requirements, and distribution challenges while maintaining drug integrity throughout the product lifecycle. The growing emphasis on pharmaceutical quality standards, particularly in generic drug manufacturing and international market distribution, drives consistent demand for high-performance barrier film solutions. Emerging pharmaceutical markets in Asia-Pacific, Latin America, and European regions contribute significantly to market growth as drug manufacturers invest in modern packaging technologies to improve product quality and market competitiveness.

Additionally, the trend toward patient-friendly packaging and unit-dose applications creates opportunities for specialized barrier film systems equipped with enhanced protective capabilities and user convenience features. The segment also benefits from increasing chronic disease medication production and aging population demographics driven by growing demand for long-term medication storage and patient compliance solutions.

What are the Drivers, Restraints, and Key Trends of the High Barrier Pharmaceutical Packaging Films for Blister Market?

The high barrier pharmaceutical packaging films for blister market is advancing steadily due to increasing pharmaceutical production and growing recognition of drug protection technology importance. However, the market faces challenges including regulatory compliance complexity, need for specialized processing expertise, and varying barrier requirements across different pharmaceutical applications. Standardization efforts and certification programs continue to influence film quality and market development patterns.

Integration of Smart Packaging and Track-and-Trace Technologies

The growing deployment of intelligent packaging systems and digital authentication capabilities is enabling real-time drug monitoring and anti-counterfeiting protection capabilities in pharmaceutical blister packaging. Smart sensors and tamper-evident technologies provide continuous product verification while enhancing supply chain security and extending drug traceability. These technologies are particularly valuable for high-value pharmaceuticals that require comprehensive protection against counterfeiting and supply chain integrity monitoring.

Development of Sustainable and High-Performance Solutions

Modern pharmaceutical film manufacturers are incorporating recyclable materials and bio-based barrier layers that improve environmental sustainability while maintaining protective performance through advanced material formulations and coating technologies. Integration of renewable raw materials and reduced environmental impact enables superior sustainability credentials and significant environmental benefits compared to traditional petroleum-based packaging films. Advanced manufacturing processes and quality control systems also support development of more consistent and reliable pharmaceutical packaging films for demanding regulatory environments.

Analysis of High Barrier Pharmaceutical Packaging Films for Blister Market by Key Country

Country

CAGR (2025-2035)

China

5.3%

India

4.9%

Germany

4.5%

Brazil

4.1%

United States

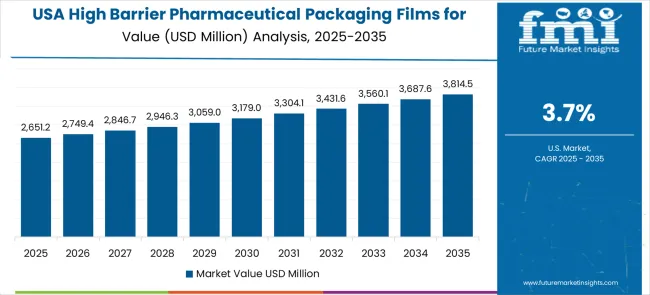

3.7%

United Kingdom

3.3%

Japan

2.9%

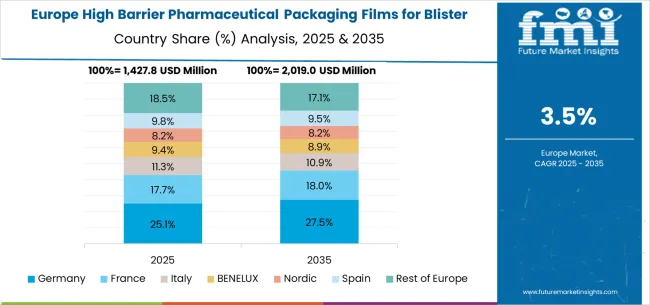

The high barrier pharmaceutical packaging films for blister market is growing steadily, with China leading at a 5.3% CAGR through 2035, driven by massive pharmaceutical manufacturing expansion, generic drug production growth, and domestic pharmaceutical market development. India follows at 4.9%, supported by rising pharmaceutical investments and increasing adoption of advanced packaging technologies in drug manufacturing and export operations. Germany records strong growth at 4.5%, emphasizing precision engineering, pharmaceutical excellence, and advanced packaging technology capabilities. Brazil grows steadily at 4.1%, integrating high barrier packaging films into expanding pharmaceutical production and healthcare infrastructure facilities. The United States shows moderate growth at 3.7%, focusing on pharmaceutical innovation and packaging technology advancement improvements. The United Kingdom maintains steady expansion at 3.3%, supported by pharmaceutical manufacturing programs. Japan demonstrates stable growth at 2.9%, emphasizing technological innovation and pharmaceutical packaging excellence.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

Sales Forecast for High Barrier Pharmaceutical Packaging Films for Blister Market in China

The high barrier pharmaceutical packaging films for blister market in China is projected to exhibit the highest growth rate with a CAGR of 5.3% through 2035, driven by rapid pharmaceutical manufacturing expansion and massive generic drug production development programs across pharmaceutical sectors. The country’s growing API manufacturing and expanding pharmaceutical export industries are creating significant demand for high-performance packaging film systems. Major pharmaceutical companies are establishing comprehensive packaging installations to support large-scale drug production operations and meet international quality standards.

China’s pharmaceutical sector continues expanding rapidly, with major investments in generic drug manufacturing, API production, and pharmaceutical export operations. The country’s position as a global pharmaceutical manufacturing hub drives substantial demand for reliable packaging film solutions that ensure drug quality and regulatory compliance across diverse pharmaceutical applications.

Pharmaceutical manufacturing modernization programs are supporting widespread adoption of advanced packaging film technologies across production facilities, driving demand for reliable and high-performance barrier protection solutions.

Generic drug production expansion and pharmaceutical export initiatives are creating substantial opportunities for specialized packaging applications in demanding pharmaceutical environments requiring international quality standards.

Revenue Prospects for High Barrier Pharmaceutical Packaging Films for Blister Market in India

The high barrier pharmaceutical packaging films for blister market in India is expanding at a CAGR of 4.9%, supported by increasing pharmaceutical investments across manufacturing sectors and growing adoption of advanced packaging technologies in drug manufacturing and export operations. The country’s expanding generic drug industry is driving demand for specialized packaging systems capable of handling diverse regulatory and quality requirements. Pharmaceutical facilities are investing in advanced barrier technologies to improve product quality and comply with international standards.

India’s pharmaceutical development initiatives and export expansion create significant opportunities for high barrier packaging film applications. The country’s growing pharmaceutical market drives demand for generic drugs and API production, requiring reliable packaging solutions to maintain drug quality and market competitiveness.

Pharmaceutical sector growth and generic drug expansion are creating opportunities for specialized packaging film applications across diverse manufacturing facilities requiring reliable drug protection solutions.

Government pharmaceutical programs and export promotion initiatives are driving investments in advanced packaging systems for drug manufacturing throughout major pharmaceutical production regions.

Growth Outlook for High Barrier Pharmaceutical Packaging Films for Blister Market in Germany

The high barrier pharmaceutical packaging films for blister market in Germany is projected to grow at a CAGR of 4.5%, supported by the country’s emphasis on pharmaceutical excellence and advanced packaging technology capabilities. German pharmaceutical facilities are implementing high-performance packaging systems that meet stringent quality standards and regulatory reliability requirements. The market is characterized by focus on technological innovation, advanced materials, and compliance with comprehensive pharmaceutical regulations.

Germany’s advanced pharmaceutical sector and packaging excellence capabilities drive demand for high-quality barrier film solutions. The country’s emphasis on pharmaceutical innovation, technological advancement, and quality precision creates opportunities for advanced packaging technologies that meet demanding pharmaceutical specifications.

Pharmaceutical industry investments are prioritizing advanced packaging film technologies that demonstrate superior performance and reliability while meeting German pharmaceutical quality and regulatory standards.

Packaging excellence programs and pharmaceutical innovation initiatives are driving adoption of high-performance barrier systems that support optimal drug protection conditions and enhanced regulatory compliance.

Market Assessment for High Barrier Pharmaceutical Packaging Films for Blister Market in Brazil

The high barrier pharmaceutical packaging films for blister market in Brazil is growing at a CAGR of 4.1%, driven by expanding pharmaceutical production and increasing healthcare infrastructure development across pharmaceutical sectors. The country’s growing generic drug manufacturing is investing in advanced packaging systems to improve drug quality and performance in competitive market conditions. Pharmaceutical facilities are adopting modern barrier technologies to support growing production requirements and quality standards.

Brazil’s expanding pharmaceutical infrastructure and healthcare development create substantial opportunities for packaging film applications. The country’s growing pharmaceutical market and domestic production expansion drive investments in drug protection solutions that enhance product competitiveness and operational efficiency.

Pharmaceutical infrastructure expansion and production development are facilitating adoption of reliable packaging film systems capable of consistent performance in diverse pharmaceutical manufacturing environments.

Healthcare development programs and pharmaceutical enhancement initiatives are increasing demand for advanced barrier solutions that meet evolving pharmaceutical standards and quality requirements.

Demand Assessment for High Barrier Pharmaceutical Packaging Films for Blister Market in United States

The high barrier pharmaceutical packaging films for blister market in the United States is expanding at a CAGR of 3.7%, driven by ongoing pharmaceutical innovation and increasing emphasis on packaging technology advancement solutions. Pharmaceutical facilities are upgrading existing packaging systems with advanced technologies that provide improved performance and enhanced drug protection capabilities. The market benefits from replacement demand and facility modernization programs across multiple pharmaceutical sectors.

The United States market emphasizes pharmaceutical innovation, technology advancement, and packaging improvement in barrier film applications. Advanced research and development activities drive the adoption of next-generation packaging technologies that offer superior performance and regulatory compliance capabilities.

Pharmaceutical facility upgrades and innovation programs are driving demand for advanced packaging film systems that offer superior drug protection and enhanced pharmaceutical capabilities.

Technology development initiatives and pharmaceutical advancement mandates are supporting adoption of innovative barrier technologies that demonstrate compliance with pharmaceutical standards and regulatory requirements.

Market Analysis for High Barrier Pharmaceutical Packaging Films for Blister Market in United Kingdom

The high barrier pharmaceutical packaging films for blister market in the United Kingdom is projected to grow at a CAGR of 3.3%, supported by ongoing pharmaceutical manufacturing programs and packaging technology facility upgrades. Pharmaceutical operators are investing in reliable barrier film systems that provide consistent performance and meet regulatory compliance requirements. The market is characterized by focus on system reliability, operational efficiency, and pharmaceutical compliance across diverse drug manufacturing applications.

The United Kingdom’s focus on pharmaceutical manufacturing and packaging excellence drives demand for high-performance barrier film solutions. The country’s emphasis on drug quality, manufacturing efficiency, and pharmaceutical compliance creates opportunities for advanced packaging technologies.

Pharmaceutical manufacturing initiatives and packaging enhancement programs are supporting adoption of advanced barrier film systems that meet contemporary pharmaceutical and regulatory standards.

Drug production programs and efficiency improvement initiatives are creating demand for specialized packaging applications that provide reliable performance and pharmaceutical excellence.

Opportunity Analysis for High Barrier Pharmaceutical Packaging Films for Blister Market in Japan

The high barrier pharmaceutical packaging films for blister market in Japan is expanding at a CAGR of 2.9%, driven by the country’s emphasis on technological innovation and pharmaceutical packaging excellence. Japanese manufacturers are developing advanced packaging film technologies that incorporate precision engineering and efficiency-optimized design principles. The market benefits from focus on quality, reliability, and continuous improvement in pharmaceutical packaging technology performance.

Japan’s technological leadership and pharmaceutical expertise drive the development of advanced barrier film solutions. The country’s emphasis on innovation, quality control, and packaging optimization creates opportunities for cutting-edge packaging technologies that set pharmaceutical industry standards.

Pharmaceutical excellence programs and technological innovation initiatives are driving development of advanced packaging film systems that demonstrate superior performance and operational reliability.

Packaging technology and precision manufacturing programs are supporting adoption of precision-engineered barrier solutions that optimize drug protection conditions and enhance pharmaceutical quality.

Competitive Landscape of High Barrier Pharmaceutical Packaging Films for Blister Market

The high barrier pharmaceutical packaging films for blister market is defined by competition among established packaging materials manufacturers, specialized pharmaceutical packaging companies, and emerging sustainable packaging solution providers. Companies are investing in advanced barrier technologies, regulatory compliance capabilities, standardized quality systems, and technical support services to deliver reliable, compliant, and cost-effective pharmaceutical packaging solutions. Strategic partnerships, technological advancement, and geographic expansion are central to strengthening product portfolios and market presence.

Amcor, operating globally, offers comprehensive pharmaceutical packaging solutions with focus on barrier excellence, regulatory compliance, and technical support services. Klöckner Pentaplast, multinational manufacturer, provides advanced packaging film systems with emphasis on pharmaceutical applications and regulatory integration capabilities. Constantia Flexibles, specialized provider, delivers innovative barrier packaging solutions for pharmaceutical applications with focus on quality and performance. Perlen Packaging (CPH) offers comprehensive packaging technologies with standardized procedures and pharmaceutical service support.

Tekni-plex provides advanced pharmaceutical packaging systems with emphasis on specialty applications and technical expertise. Honeywell, Liveo Research GmbH deliver specialized barrier solutions with focus on high-performance pharmaceutical applications. Sumitomo Bakelite, HySum, Aluberg offer comprehensive pharmaceutical packaging technologies for demanding regulatory environments with established manufacturing and service capabilities.

Bilcare, SÜDPACK, FlexiPack, Etimex Primary Packaging, Uniworth, Sichuan Huili Industry, Jiangxi Chunguang New Materials, Hangzhou Plastics Industry, Jiangsu Fuxin, Huakang Packaging, LIAONING TOTEM PACKAGING provide advanced packaging film systems with regional manufacturing capabilities, pharmaceutical industry expertise, and specialized knowledge across packaging technology and pharmaceutical compliance sectors.

Global High Barrier Pharmaceutical Packaging Films for Blister Market — Stakeholder Contribution Framework

The high barrier pharmaceutical packaging films for blister market underpins pharmaceutical quality excellence, drug safety advancement, regulatory compliance optimization, and patient health protection. With drug safety mandates, stricter regulatory requirements, and demand for protective packaging systems, the sector must balance cost competitiveness, barrier performance, and regulatory compliance. Coordinated contributions from governments, industry bodies, OEMs/technology integrators, suppliers, and investors will accelerate the transition toward performance-optimized, regulatory-compliant, and technologically advanced pharmaceutical packaging systems.

How Governments Could Spur Market Growth and Adoption

Pharmaceutical Quality Incentives: Provide subsidies or regulatory support for manufacturers upgrading to high-performance or sustainable pharmaceutical packaging solutions.

Drug Safety Standards: Enforce stringent pharmaceutical quality, patient safety, and drug stability standards, boosting demand in generic drug, branded pharmaceutical, and specialty drug sectors.

Healthcare Infrastructure Programs: Embed advanced packaging technologies into pharmaceutical manufacturing initiatives, drug safety projects, and healthcare quality enhancement programs.

Trade Facilitation: Lower tariffs for importing pharmaceutical-grade materials and packaging components while supporting local exports of compliant packaging systems.

Innovation Mandates: Recognize advanced and regulatory-compliant packaging solutions within national pharmaceutical competitiveness and healthcare quality frameworks.

How Industry Bodies Could Support Market Development

Standardization & Certification: Develop harmonized guidelines for barrier performance, regulatory compliance benchmarks, and pharmaceutical quality testing procedures.

Training & Workforce Development: Create curricula for packaging technology, regulatory compliance, and advanced pharmaceutical packaging systems to reduce skill shortages.

Global Recognition: Position regional manufacturers as leaders in high-performance and regulatory-compliant pharmaceutical packaging solutions.

Policy Advocacy: Engage with pharmaceutical regulators to shape favorable procurement policies and inclusion of barrier films in drug safety standards.

How OEMs and Technology Integrators Could Strengthen the Ecosystem

Technology Integration: Embed smart packaging systems, track-and-trace capabilities, and quality monitoring into pharmaceutical packaging films.

Partnerships: Collaborate with pharmaceutical companies, drug manufacturers, and regulatory bodies to design application-specific packaging configurations.

Product Innovation: Advance barrier materials, sustainable packaging, and enhanced protection technologies.

Comprehensive Solutions: Bundle packaging films with complete pharmaceutical packaging systems, offering end-to-end drug protection effectiveness.

How Suppliers Could Navigate the Market Evolution

Advanced Materials: Provide pharmaceutical-grade polymers, barrier coatings, and compliance-enhancing additives to extend packaging performance and regulatory approval.

Localized Manufacturing: Establish regional production facilities to reduce logistics costs and improve pharmaceutical market access.

Portfolio Diversification: Expand into specialty pharmaceutical materials, regulatory-specific solutions, and sustainable packaging technologies.

Customer Engagement: Build trust via regulatory compliance, performance guarantees, and comprehensive pharmaceutical service excellence.

How Investors and Financial Enablers Could Unlock Value

Infrastructure Financing: Fund pharmaceutical packaging facilities, regional distribution centers, and production plants in high-growth pharmaceutical markets.

Innovation Finance: Channel pharmaceutical-linked capital toward regulatory-compliant and high-performance packaging solutions.

M&A and Consolidation: Back cross-border mergers to integrate fragmented regional players into scalable global pharmaceutical packaging suppliers.

Technology Funding: Support startups developing advanced barrier technologies, smart packaging systems, or specialized pharmaceutical applications.

Risk Management Tools: Provide insurance and hedging products against raw material cost volatility and regulatory compliance risks.

Key Players in the High Barrier Pharmaceutical Packaging Films for Blister Market

Amcor

Klöckner Pentaplast

Constantia Flexibles

Perlen Packaging (CPH)

Tekni-plex

Honeywell

Liveo Research GmbH

Sumitomo Bakelite

HySum

Aluberg

Bilcare

SÜDPACK

FlexiPack

Etimex Primary Packaging

Uniworth

Sichuan Huili Industry

Jiangxi Chunguang New Materials

Hangzhou Plastics Industry

Jiangsu Fuxin

Huakang Packaging

LIAONING TOTEM PACKAGING

Scope of the Report

Item

Value

Quantitative Units

USD 6,003.5 million

Material Type

PVC Film, PVDC Coated Film, PP Film, Aluminum Film, Others

Application

Tablets, Capsules, Others

Regions Covered

North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa

Country Covered

United States, Germany, India, China, United Kingdom, Japan, Brazil, and other 40+ countries

Key Companies Profiled

Amcor, Klöckner Pentaplast, Constantia Flexibles, Perlen Packaging (CPH), Tekni-plex, Honeywell, Liveo Research GmbH, Sumitomo Bakelite, HySum, Aluberg, Bilcare, SÜDPACK, FlexiPack, Etimex Primary Packaging, Uniworth, Sichuan Huili Industry, Jiangxi Chunguang New Materials, Hangzhou Plastics Industry, Jiangsu Fuxin, Huakang Packaging, LIAONING TOTEM PACKAGING

Additional Attributes

Dollar sales by material type and application segments, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established manufacturers and emerging suppliers, buyer preferences for high-barrier versus cost-effective packaging systems, integration with pharmaceutical manufacturing and regulatory compliance technologies, innovations in barrier technology and sustainable materials for enhanced drug protection and environmental sustainability, and adoption of smart packaging solutions with embedded track-and-trace and tamper-evidence capabilities for improved pharmaceutical safety and regulatory compliance.