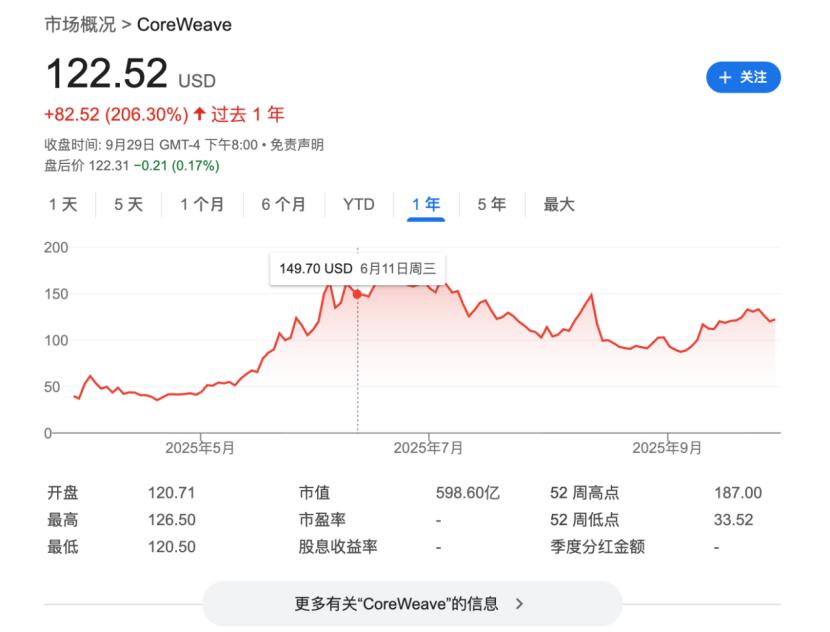

One of the most eye – catching technology stocks in 2025 is definitely CoreWeave, which went public this year. Backed by NVIDIA, CoreWeave went public in 2025. Since its IPO, its stock price has more than tripled, with a maximum increase of nearly four times.

CoreWeave: From “Mining Farm” to “Computing Power Factory”

CoreWeave is an American AI cloud computing enterprise with its headquarters in Livingston, New Jersey. Founded in 2017, the company initially operated under the name of “Atlantic Crypto”, a cryptocurrency mining enterprise. Its core business was to use GPUs for Ethereum mining and rent related services to other cryptocurrency miners. However, as the cryptocurrency market entered a cooling – off period from 2018 to 2019, the company renamed itself CoreWeave and shifted its business focus to cloud computing and GPU – accelerated infrastructure services, making full use of its large GPU inventory to meet the needs of enterprise customers.

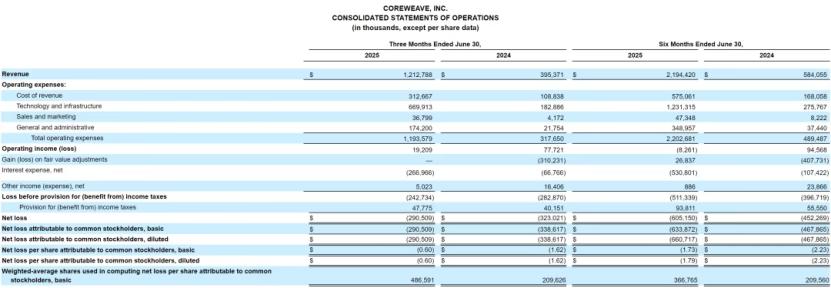

Financial reports show that CoreWeave’s revenue in the first half of 2025 was $2.194 billion, a 275.68% increase from $584 million in the same period of the previous year. As of June 30, 2025, CoreWeave held $1.153 billion in cash and cash equivalents, with current total assets of $3.946 billion, total assets of $26.2 billion, total liabilities of $22.4 billion, and shareholders’ equity of $2.658 billion.

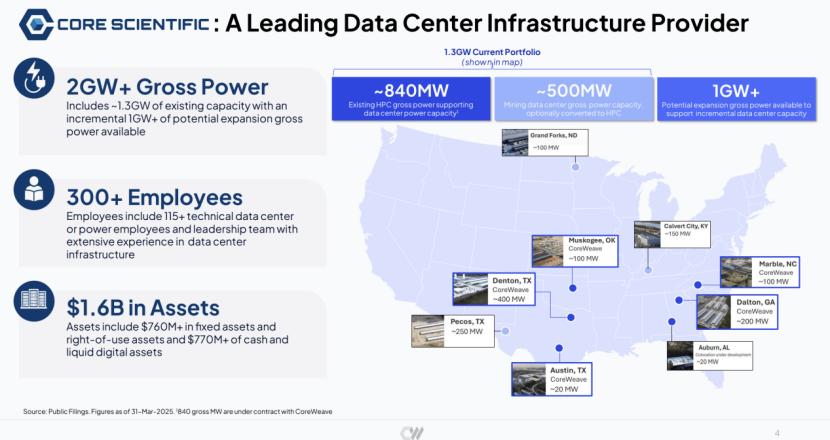

As of August 2025, CoreWeave had built 33 data centers, owned more than 250,000 NVIDIA GPUs, and established partnerships with server supply – chain manufacturers such as Gigabyte, Wistron, and Dell. In addition, NVIDIA is also one of its shareholders, holding a 6% stake.

Against the backdrop of such rapid development, CoreWeave is still going full – throttle. Michael Intrator, the co – founder and CEO of the company, said that the company is expanding rapidly to meet the unprecedented demand for artificial intelligence.

On September 25, CoreWeave announced a new cooperation agreement worth $6.5 billion with OpenAI; in the second quarter of 2025, CoreWeave reached an expansion agreement worth $4 billion with OpenAI, in addition to the previously announced $11.9 billion agreement; currently, the transaction amount between CoreWeave and OpenAI alone has reached $22.4 billion, which is close to the company’s total assets in the first half of the year.

After the announcement of the new agreement, analysts at Wells Fargo also raised CoreWeave’s target price from $105 to $170, demonstrating their high recognition of the company.

The Secret to Getting Rich in the AI Era

Analysts believe that CoreWeave’s growth potential mainly comes from the following aspects:

1. Ultra – large – scale market demand: Cloud – computing giants continue to invest billions of dollars to enhance computing power, enabling companies like CoreWeave to continuously receive orders.

Due to the insufficient cloud – computing capacity to run AI workloads, companies like Microsoft have a large backlog of orders. Even other cloud – computing giants such as Google under Alphabet and Amazon have also seen a significant increase in their backlog of orders due to the rapid growth in the demand for training and running cloud – based AI applications.

2. Fixed partnership: According to reports, CoreWeave has further cooperated with well – known customers such as Microsoft, OpenAI, and Google. In fact, not only CoreWeave, but also companies of the same type as CoreWeave receive orders from industry giants, and the cooperation time is relatively long. The strong binding relationship with these large customers is also an important factor for the industry to be optimistic about these computing – power leasing companies.

3. Considerable profitability of the company: The products (computing power) of these companies are in high demand, and their customers are price – insensitive giants. Therefore, they have a relatively high profit margin in pricing. Wells Fargo expects CoreWeave to raise the hourly price of its GPUs to $2.50. In terms of cost, NVIDIA will also sign contracts with its “distributors” on preferential terms, making CoreWeave’s cost relatively low. It can be said that CoreWeave’s strong vertically integrated stack and lower – than – expected financing interest rates are the key levers that may increase its profits.

CoreWeave is not the only new – type enterprise targeting computing – power leasing. Nebius, Nscale, and Crusoe are all its strong competitors.

Nebius

Nebius was formerly the Russian company Yandex. After being spun off in 2024, it sold its Russian business and assets, moved its headquarters to Amsterdam, the Netherlands, and renamed itself Nebius Group N.V. It completed its IPO on the NASDAQ in October 2024, raising $750 million for the expansion of its global GPU data centers. Similar to CoreWeave, Nebius leases its GPU – based data centers to customers who want to run AI workloads in the cloud.

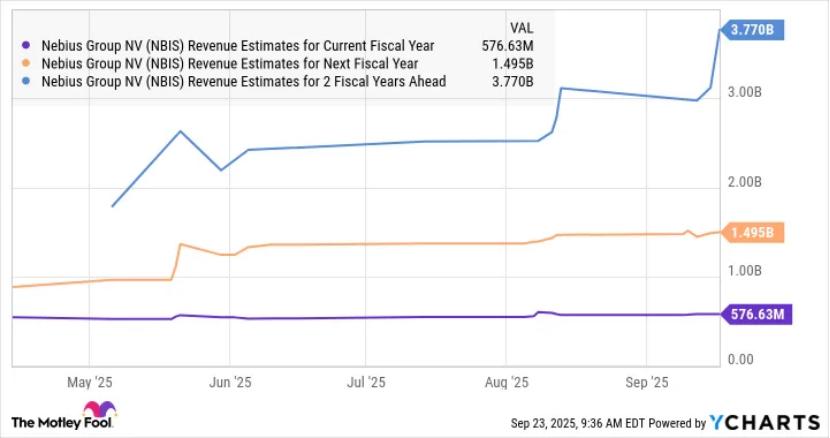

Nebius’s stock price has risen 309% so far in 2025. Its revenue in the first half of 2025 was $156 million, a 545% year – on – year increase. Analysts expect Nebius’s revenue to grow 390% by the end of the year, reaching $576 million.

The Motley Fool predicts that Nebius’s revenue may increase by more than 6.5 times in two years.

Nebius’s major customer is Microsoft. Recently, Nebius announced a five – year contract worth $17.4 billion with Microsoft. If Microsoft chooses to use more of Nebius’s services, the value of this transaction could reach up to $19.4 billion. Nebius said that it plans to sign agreements to obtain more than 1 gigawatt of data – center capacity by the end of 2026.

Nscale

Nscale is a small startup headquartered in London. Similar to CoreWeave, Nscale is also a company that has transformed from cryptocurrency mining. Its major customer is also OpenAI. On September 25, Nscale announced that it had raised $1.1 billion in its Series B financing, and NVIDIA also participated in this round of financing.

Jensen Huang’s comment on Nscale was, “I’ve never seen a startup take off like this.” The background for Jensen Huang to make such a compliment is that NVIDIA will deploy 120,000 GPUs in the UK. Among them, up to 60,000 Grace Blackwell Ultra chips will be deployed in cooperation with Nscale.

Nscale’s major customer is also OpenAI. Nscale will cooperate with OpenAI on the “Stargate” project in the UK. In addition, Nscale will build the largest AI supercomputer in the UK with Microsoft.

Nscale CEO Payne refused to disclose how many GPUs the company has currently deployed when interviewed by Forbes in August but said that the company has 40 megawatts of online AI capacity. This is far lower than its competitor Coreweave, which has a capacity of 1.3 gigawatts and announced last week that it plans to build its own data center in the UK.

Nscale raised $155 million from investors in December 2024. Nscale’s website only provides detailed information about its Glomfjord data center, which is said to have an operating capacity of 30 megawatts.

In addition to reaching an agreement with OpenAI to build a “Stargate” facility with 30,000 GPUs in the UK, Nscale has also signed an agreement with Microsoft to lease a 50 – megawatt data center in the southwest of England that is still under construction.

Crusoe

Crusoe is the leading developer of the first Stargate site for OpenAI. Currently, Crusoe is collaborating with OpenAI and Oracle to build the original 4.5 – gigawatt “Stargate” data center in Abilene, Texas.

Crusoe was founded in 2018. Currently, the company focuses on large – scale artificial – intelligence data projects. It is worth noting that this company was also a mining company in the past. With the cooperation with OpenAI, Crusoe is also shifting its bitcoin – mining business.

Computing Power is Currency, and Opportunities are Everywhere

When analyzing the business backgrounds of CoreWeave, Nscale, Crusoe, and Nebius, a common feature can be found: the founding teams or core technical architectures of these leading AI computing – power leasing service providers are all rooted in the cryptocurrency – mining industry.

The business transformation from mining to AI computing – power services is obviously a strategic move by these companies based on the high reusability of their core assets and capabilities. Bitcoin mining and AI high – performance computing both rely on large – scale, high – power data – center facilities and high – performance computing hardware. In their past businesses, these companies have accumulated key capabilities in obtaining low – cost electricity globally, deploying hardware on a large scale, and conducting 24/7 operation and maintenance.

When the demand for computing power in the AI industry shows exponential growth and presents a clearer long – term business prospect, these companies naturally redirect their existing infrastructure and operational capabilities to serve the emerging market of AI model training and inference. However, the essence of their core business has not changed, that is, they still provide computing power to customers.

From this perspective, the era of “computing power is currency” has actually arrived earlier than we thought.

In such an era, leasing computing power is not the only new business. In fact, various startups are looking for new opportunities.

Silicon Data: Computing – Power Index

Silicon Data was founded in 2024 and is headquartered in New York, supported by DRW and Jump Trading.

Silicon Data has created a daily index that tracks AI – specific chips. Just like the function of a stock – market index, the Silicon Data H100 Leasing Index tracks the hourly cost of renting GPUs. The company is building a platform aimed at bringing price transparency and structure to the GPU market. The goal is to transform GPUs into a benchmark asset class that can be traded like any other financial instrument.

The company’s founder said, “Currently, there is zero transparency in GPU costs. This is the first step to help market participants understand the complex world of AI costs.”

Clarifai: Computing – Power Accelerator

Clarifai was founded in 2013 and was initially launched as a computer – vision service. As the AI boom has significantly increased the demand for GPUs and the data centers that house them, the company has become increasingly focused on computing orchestration.

Recently, Clarifai released a new inference engine that can double the running speed of AI models and reduce costs by 40% through optimized hardware use. The system is designed to adapt to various models and cloud hosts, using a variety of optimization techniques to obtain more inference capabilities from the same hardware.

“This includes various types of optimizations, from CUDA kernels to advanced speculative decoding techniques,” said CEO Matthew Zeiler. “Basically, you can get more performance from the same graphics card.”

A series of benchmark tests conducted by third – party company Artificial Analysis have verified these results, setting industry – best records in both throughput and latency.

Hyper Accel: Computing Power at a 90% Discount

Of course, in addition to software products, some manufacturers want to break into the computing – power hardware market monopolized by NVIDIA through low – priced products. South Korean startup Hyper Accel plans to launch a 4nm AI chip in 2026, with the price set at 10% of the H100 graphics card.

Hyper Accel was founded in January 2023. The company has designed and launched an AI chip specifically for large – language models (LLMs), achieving low power consumption through a unique architecture and maximizing memory bandwidth, aiming to solve the bandwidth and energy – consumption problems in AI data centers.

The global AI competition has entered a new stage, shifting from “model competition” to “computing – power competition.” However, in the frenzy of computing – power investment, what needs to be considered is what kind of return on investment this investment will bring. The reality is that during the three – year AI boom, the investment of major US technology companies in AI data centers, chips, and energy has exceeded the total cost of building the US interstate highway system over more than 40 years. If the AI infrastructure investments in 2023 and 2024 are to be profitable, consumers and enterprises need to purchase about $800 billion worth of AI products within the service life (3 – 5 years) of these chips and data centers.

So, is the market really ready?

This article is from the WeChat official account “Semiconductor Industry Insights” (ID: ICViews), author: Liu Qian, published by 36Kr with authorization.