The Trump administration has now finalized plans to deliver Argentina a financial lifeline. On Thursday, Treasury Secretary Scott Bessent announced that the United States had directly purchased Argentine pesos as part of a $20 billion currency swap with the country’s central bank.

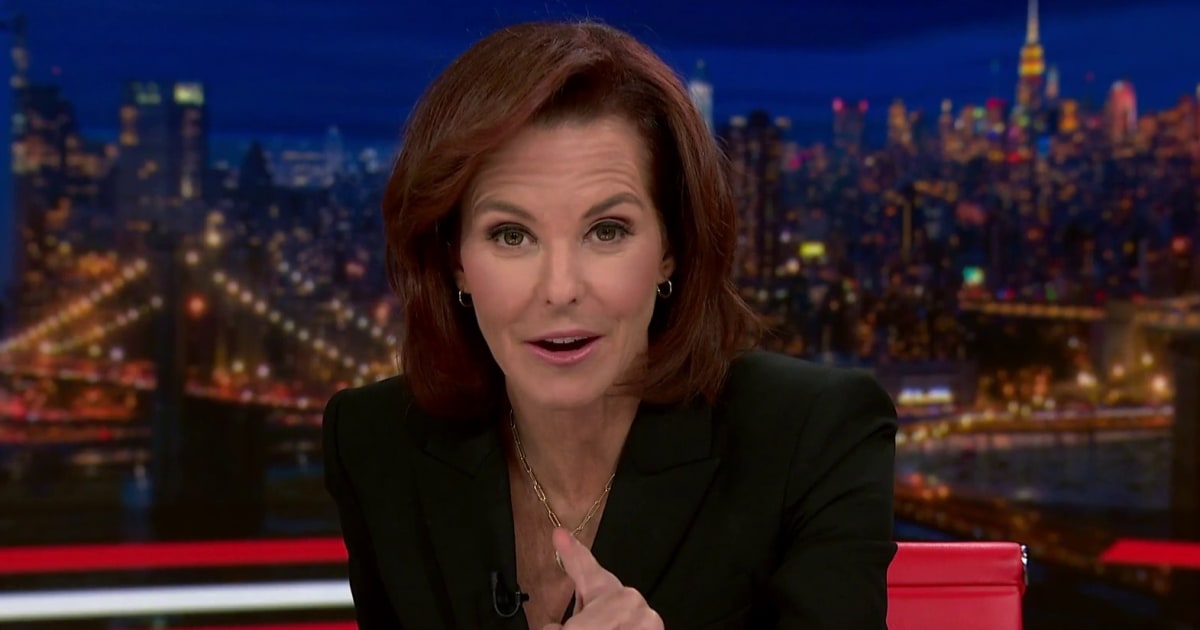

Bessent has repeatedly insisted that the deal with Argentina and its president, Javier Milei (a close ally of Donald Trump), does not amount to a bailout. But, according to Stephanie Ruhle, “downplaying it as merely a swap agreement, exchanging pesos for dollars to stabilize their economy” is “not the full picture.”

“We might not be writing a direct $20 billion check to Argentina,” she explained on “11th Hour” Thursday evening, “but we are still taking enormous risk to help out a friend of the president who’s up for re-election in a country that’s in trouble.”

Ruhle described the deal as a “massive loan” on behalf of the U.S. — and one that comes with a lot of risk. “If Argentina does default — and they may — it is a $20 billion loss for us. The Fed will be left holding a ginormous bag of pesos worth nothing.”

The MSNBC host said you could either call the deal “a hidden bailout, or direct bailout,” but that it was undeniably “a huge win for Argentina, its president and the group of U.S. investors Secretary Bessent knows very well, who bet big on Argentina.”

Ruhle told viewers to keep in mind what else is going on in the United States as the administration closes this $20 billion deal. “This is happening while the U.S. government is shut down, thousands of furloughed federal workers are not getting their paychecks this week.”

“So when we hear about ‘America First,’ know this,” she explained. “‘America First,’ in this instance, is the investor class. That right there is the full picture.”

You can watch Ruhle’s full analysis in the clip at the top of the page.