The Samsung Galaxy S21 is perhaps the first Android phone I’m holding onto for this long, even though it’s not in great condition. That’s partly because I’ve grown used to some of its features and can’t find suitable alternatives.

Samsung Wallet is one of those features, and I heavily rely on it to make payments. Credit to Samsung for this, but I try to stay platform-agnostic and switch between products for the same purpose.

I switched to Google Wallet and used it for a few months for that specific reason. Google Wallet delivered more than I expected, but it still couldn’t replace Samsung Wallet for me. I blame Google more than I credit Samsung for that.

Google Wallet came so close to making me forget Samsung Wallet, but it ultimately failed for reasons that should’ve been fixed a long time ago.

Here is what Samsung Wallet gets right that Google Wallet doesn’t.

Samsung Wallet feels like a complete payment solution

Credit: Samsung

The technology that works behind the scenes to make payments possible is pretty much the same in both Samsung Wallet and Google Wallet.

They both rely on tokenized payments, require biometric authentication, support digital IDs and Passes, and can hold digital car keys. However, it doesn’t mean they have the same strengths and weaknesses.

One of the major complaints I have with Google Wallet is its lack of support for peer-to-peer (P2P) payments. It wasn’t always the case, though.

You could send, request, or receive money from others in the US before June 4, 2024. The company quit the P2P payments space and never reintroduced it in Google Wallet.

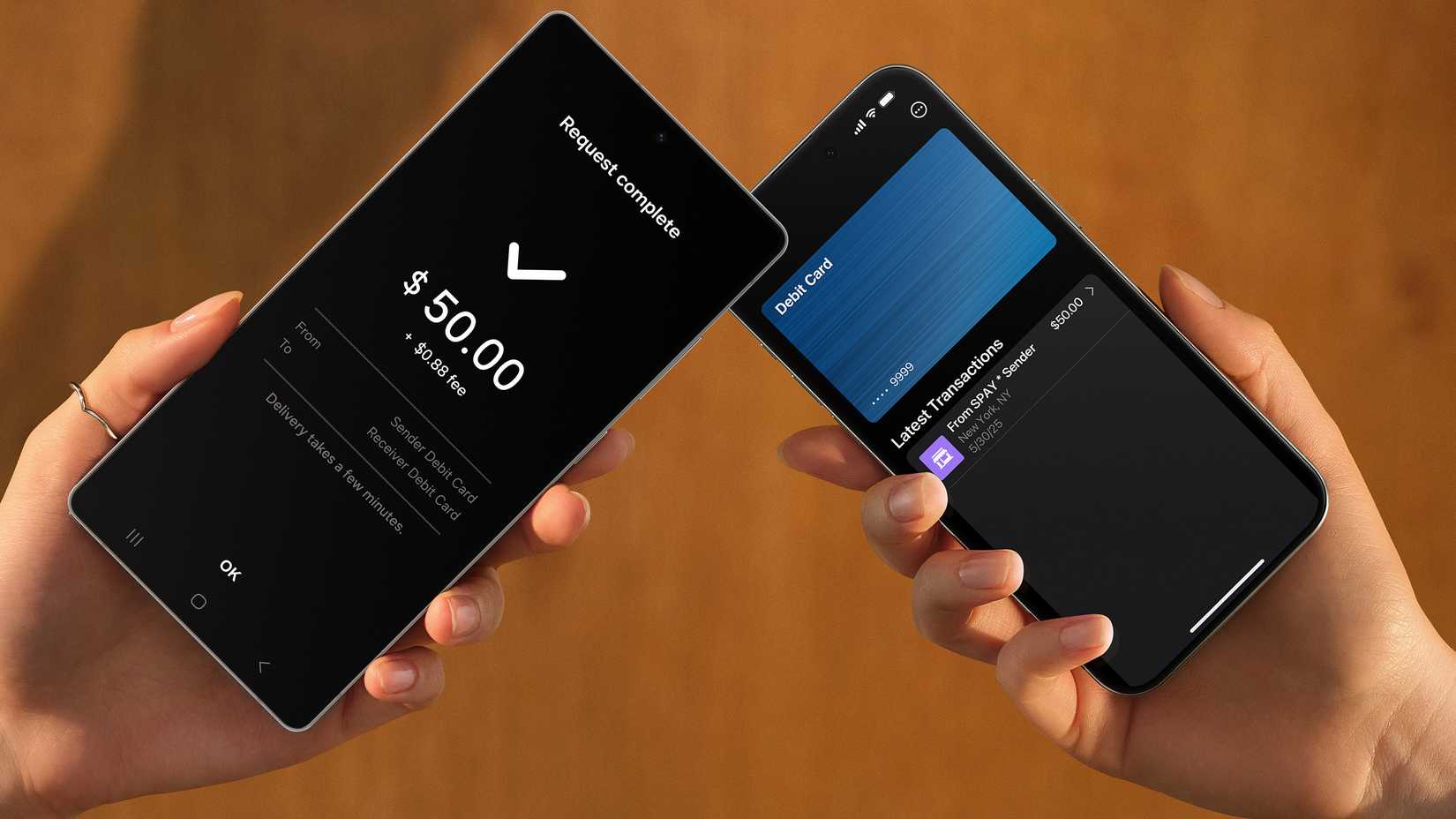

On the other hand, Samsung entered P2P transactions only in 2025 with the “Tap to Transfer” feature.

You can transfer money from your Visa or Mastercard debit cards stored in Samsung Wallet to the recipient’s wallet app or physical debit card.

You don’t need to use Samsung Wallet to receive payments because “Tap to transfer” uses NFC to directly connect to the recipient’s card.

I use this feature whenever I split bills with my friends after dining out. If the recipient is a Galaxy Wallet user, it works even better.

You can complete P2P transactions remotely if the recipient also uses Samsung Wallet, provided you have their phone number.

The money will be deposited directly into the bank account via the registered debit card.

Google Wallet feels stuck between two worlds

Google Wallet is available in over 80 countries, while Samsung Wallet works only in 29 countries. While this is a win for Google, its wallet app doesn’t work the same way in every part of the world.

For users in the US, the Google Wallet app handles payment directly using the Google Pay payment system. It works smoothly, even when you aren’t connected to the internet while making the payment.

However, this isn’t the case everywhere. For example, in India and many other countries, Google Pay still exists as a standalone app for making payments.

In India, Google Wallet doesn’t handle payment directly. Instead, it redirects to Google Pay’s Tap & Pay. In other words, it needs another app to complete the payment process.

It wouldn’t be a dealbreaker for me on other non-Galaxy handsets if Google Pay worked offline. The Google Pay app won’t open if you aren’t connected to the internet.

So, Google Wallet feels like two different apps, depending on where you live.

In some parts of the world, it can handle payments offline with ease, whereas in others, it struggles to function without an internet connection.

Only Google Wallet’s split personality is to blame for this inconsistency. Google Wallet deserves a more unified approach across regions.

Samsung Wallet isn’t for everyone

Google Wallet and Samsung Wallet work mostly in similar ways, but their priorities aren’t always the same. That said, it isn’t hard to answer which one you should use.

One of Samsung Wallet’s biggest strengths is its integration with the Galaxy ecosystem. It can quickly make payments by swiping up from the bottom of your home screen or lock screen on Galaxy handsets.

You can also use Samsung Wallet to make payments from your Galaxy Watch.

It’s designed to work smoothly with Samsung-specific hardware. If you don’t have a Galaxy phone, you can’t use Samsung Wallet on your phone to make payments.

While Google Wallet lags Samsung Wallet in certain areas, one of the biggest advantages of the former is that you can install it on any Android phone that meets the minimum hardware and software requirements.

If you’re a Samsung Galaxy user, the best payment app for you is Samsung Wallet. For every other Android handset, Google Wallet is a great choice for making fast, secure payments and storing essential items beyond credit cards.