Europe C5ISR Market Summary

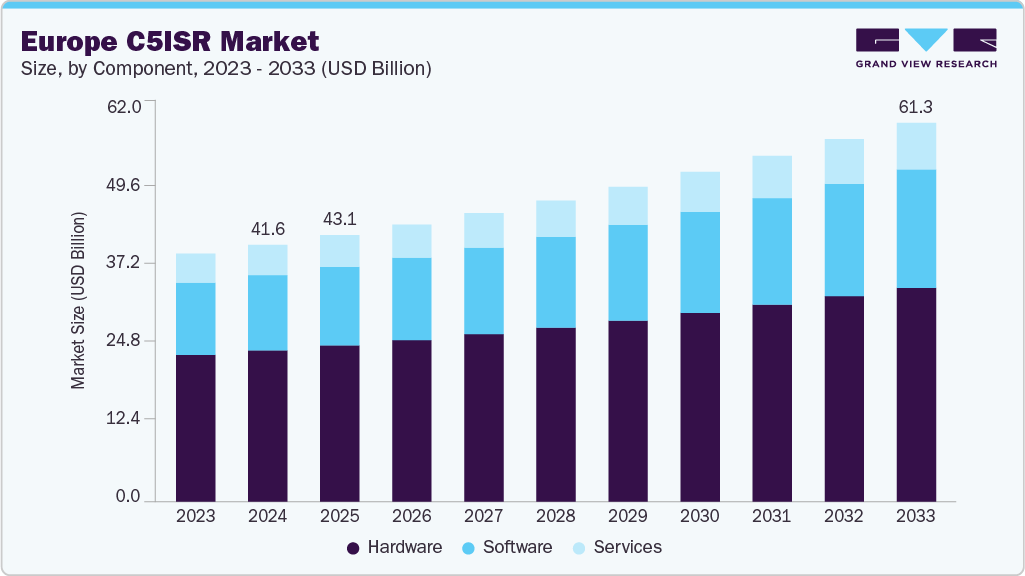

The Europe C5ISR market size was estimated at USD 41.56 billion in 2024 and is expected to reach USD 61.31 billion by 2033, growing at a CAGR of 4.5% from 2025 to 2033. The market growth is primarily driven by increasing defense expenditures across key European nations, including the UK, Germany, and France. These countries are significantly investing in modernizing their defense surveillance, command, and communication systems to address evolving security challenges and geopolitical tensions in the region. The surge in defense budgets is enabling the procurement of advanced C5ISR technologies to improve real-time situational awareness and decision-making capabilities for military operations across land, sea, and air domains, which is expected to drive the Europe C5ISR industry in the coming years.

The growing integration of cutting-edge technologies such as artificial intelligence (AI), machine learning (ML), and advanced data analytics into ISR capabilities. These technologies enhance the efficiency and accuracy of intelligence gathering, threat detection, and battlefield management. European defense forces are focusing on the development of AI-enabled ISR systems and sophisticated sensor fusion to maintain technological superiority against emerging regional threats. In addition, satellite-based ISR and secure communication networks are prioritized for enhanced national security and interoperability with NATO allies.

In addition, the digital infrastructure and defense ecosystem in Germany exemplify the regional focus on secure, network-centric warfare. Germany is investing heavily in cloud-based C5ISR platforms and next-generation sensors that provide customized, real-time intelligence to support joint operations with EU and NATO partners. Similarly, the UK emphasizes upgrading its defense infrastructure, with substantial government investments aimed at future-generation command, control, and communication systems that sustain military dominance and foster multinational defense integration. Such factors are expected to drive the Europe C5ISR industry in the coming years.

Furthermore, the increasing regional security threats and geopolitical instability is a critical factor accelerating market growth. The heightened tensions involving Russia and neighboring countries have underscored the need for robust C5ISR systems to strengthen border security, enhance electronic warfare capabilities, and support counterterrorism efforts. This volatile security landscape compels European nations to adopt advanced C5ISR solutions that provide rapid and reliable intelligence and communication in complex combat and surveillance scenarios, thereby driving the Europe C5ISR industry in the coming years.

Moreover, the market is witnessing a shift towards service-oriented offerings to ensure continuous maintenance, upgrades, and operational readiness of C5ISR systems. The rising trend of leveraging human intelligence augmented by AI for faster data analysis and decision support, combined with the rollout of 5G technologies for high-speed, low-latency communication, is transforming the Europe C5ISR industry. Vendors and defense forces are focusing on interoperability, cybersecurity, and the seamless integration of multi-domain platforms to meet the rigorous demands of modern defense operations. These factors are expected to boost the Europe C5ISR industry expansion in the coming years.

Component Insights

The hardware segment dominated the market with a share of 58% in 2024, driven by the critical need for high-performance, mission-essential components such as ruggedized sensors, secure communication devices, and integrated computing platforms that support real-time data acquisition, processing, and transmission on the battlefield. The push for modular, scalable, and upgradable hardware solutions aligns with military modernization programs and lifecycle cost-efficiency strategies, stimulating strong investment in next-generation C5ISR hardware throughout Europe.

The software segment is predicted to register the fastest CAGR of 5.2% from 2025 to 2033, driven by the growing integration of artificial intelligence (AI), machine learning (ML), and big data analytics that enhance real-time data processing, decision-making, and operational efficiency in military operations. The increasing adoption of software-defined networking (SDN), network virtualization, and cloud-based solutions enables flexible, scalable, and interoperable C5ISR systems, which are critical for modern defense forces.

Application Insights

The intelligence, surveillance, and reconnaissance (ISR) segment accounted for the largest market revenue share in 2024, driven by the escalating need for real-time threat detection and situational awareness. European defense agencies are increasingly investing in high-resolution imaging technologies, signal intelligence platforms, and autonomous surveillance drones to enhance battlefield visibility significantly. The integration of AI and machine learning within ISR systems further accelerates data analysis, pattern recognition, and decision-making processes. This strong focus on data-driven intelligence and persistent monitoring underpins the robust growth trajectory expected for the ISR segment in the European C5ISR market.

The command and control segment is expected to register a significant CAGR from 2025-2033, fueled primarily by the increasing demand for Internet of Things (IoT)-based systems and modern military warfare capabilities. This segment growth is driven by the need for integrated, real-time situational awareness and enhanced decision-making capabilities to support complex, multi-domain operations within NATO and European defense frameworks. Furthermore, advancements in AI and machine learning improve data processing and operational efficiency, coupled with robust investments in defense modernization by European countries, are powerful growth enablers.

End Use Insights

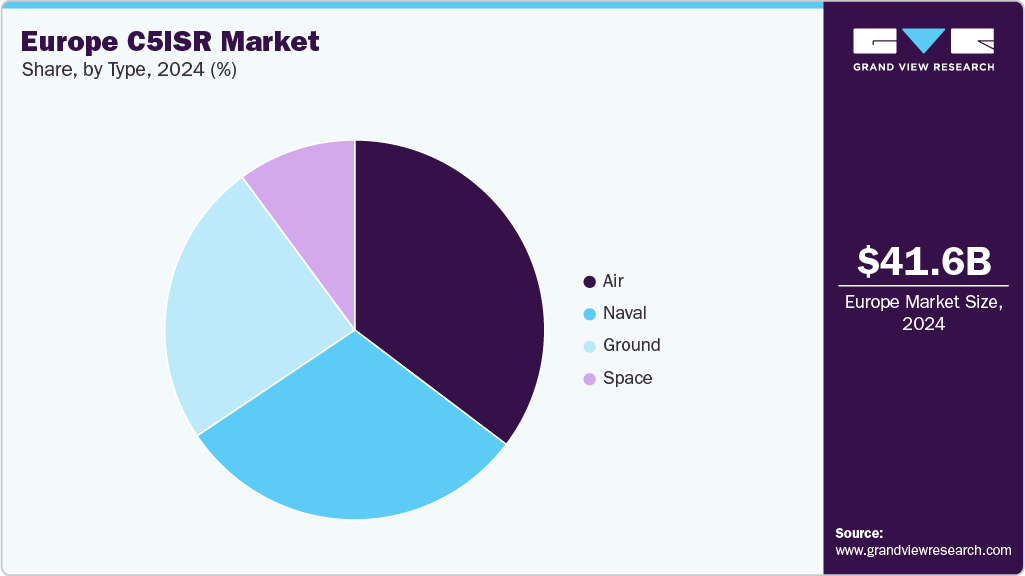

The air segment accounted for the largest market revenue share in 2024, driven by the rising demand for real-time aerial intelligence and high-altitude surveillance capabilities. European armed forces are increasingly deploying advanced manned aircraft and unmanned aerial vehicles (UAVs) equipped with cutting-edge sensors, secure communication systems, and AI-enabled data processing. These airborne platforms are critical for early threat detection, reconnaissance, and precision targeting across extensive operational theaters. As European defense agencies emphasize rapid, flexible response capabilities in multi-domain operations, investments in technologically advanced airborne C5ISR systems are set to surge, reinforcing aerial situational awareness and strategic superiority.

The naval segment is expected to grow at the fastest CAGR from 2025 to 2033, driven by increasing demand for enhanced maritime domain awareness, robust electronic warfare systems, and secure naval communications amid evolving global and regional maritime security challenges. European naval forces are progressively outfitting surface vessels and submarines with integrated radar, sonar, electronic warfare, and satellite communication suites. These systems enable real-time tracking, threat detection, and coordinated command and control across both blue-water and littoral environments. With growing emphasis on safeguarding critical maritime routes and NATO interoperability, investments in advanced naval C5ISR capabilities are expected to accelerate, strengthening Europe’s maritime defense posture.

Country Insights

U.K. C5ISR Market Trends

The C5ISR Market in the UK is expected to grow at the fastest CAGR of 5.2% from 2025 to 2033, primarily driven by the government’s strategic investments in upgrading defense infrastructure and enhancing intelligence capabilities to maintain military dominance. The country is also advancing the integration of C5ISR systems within joint and multinational defense frameworks, with growth propelled by the adoption of AI, machine learning, and secure communication networks to enhance operational effectiveness and situational awareness in complex defense environments.

Germany C5ISR Market Trends

The C5ISR market in Germany held a significant share in 2024, driven by robust digital infrastructure and high defense expenditures focused on integrated defense solutions. Major drivers include investments in secure communication systems, advanced ISR technologies, and network-centric warfare capabilities aimed at real-time, customized intelligence to support operations and foster military cooperation within the EU and NATO.

Key Europe C5ISR Company Insights

Some of the key players operating in the market include BAE Systems, PLC, and Carrier Global Corporation, among others.

BAE Systems PLC is a dominant defense contractor in Europe with a comprehensive presence in the C5ISR market. It offers a wide range of advanced command, control, communications, intelligence, surveillance, and reconnaissance solutions to multiple European governments and NATO allies. The company is renowned for developing integrated defense systems, including electronic warfare, sensor technologies, and secure communications, benefiting from decades of experience and extensive government contracts.

Thales Group specializes in providing sophisticated defense electronics and systems engineering capabilities. It specializes in interoperable and multi-domain solutions essential for modern warfare across land, sea, air, and space domains. The company is recognized for its high-reliability command and control platforms, intelligence systems, and secure communications designed to serve European armed forces and multinational coalitions. The company emphasizes innovation in data fusion, AI, and network-centric warfare to support seamless operational integration across allied forces.

Rheinmetall AG and Leonardo S.p.A are some of the emerging participants in the Europe C5ISR market.

Rheinmetall AG, a German defense contractor, has strong expertise in C5ISR through its capabilities in sensor systems, battlefield management, and integrated communications. The company combines traditional manufacturing strength with modern digital solutions, supporting mechanical and electronic platforms used by European militaries. Rheinmetall is particularly active in land defense but is expanding its role in networked defense systems that enhance situational awareness and command efficiency. It emphasizes modular and scalable architectures consistent with NATO standards to support coalition interoperability.

Leonardo S.p.A. is a key European player known for its innovation in aerospace, electronics, defense, and C5ISR systems. The company provides advanced radar, electronic warfare, surveillance, and reconnaissance solutions critical to various European defense markets. The company integrates sensors, software, and communication systems to enable real-time battlefield awareness and command decisions.

Key Europe C5ISR Companies:

Thales Group

Airbus SE

Saab AB

Leonardo S.p.A

Rheinmetall AG

BAE Systems

Elbit Systems

General Dynamics

HENSOLDT AG

CACI International

Recent Developments

In September 2025, HENSOLDT AG introduced its latest radar system, tailored for C5ISR applications. The system offers enhanced detection capabilities and is designed to operate in challenging environments, supporting various defense and security operations across Europe.

In September 2025, BAE Systems plc announced plans to assist Poland in producing 155 mm heavy artillery rounds, addressing shortages affecting Ukraine and NATO allies. This collaboration is part of a broader defense initiative to construct three ammunition factories, aiming to boost defense capabilities against potential threats from Russia.

In July 2025, Leonardo S.p.A. strengthened its cyber solution portfolio in Europe by acquiring a Finnish cybersecurity firm, SSH Communications Security Corporation. This strategic investment and partnership aim to advance Leonardo’s leadership in the European Zero Trust ecosystem for C5ISR.

Europe C5ISR Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 43.12 billion

Revenue forecast in 2033

USD 61.31 billion

Growth rate

CAGR of 4.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 – 2023

Forecast period

2025 – 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, end use, application, country

Country scope

UK; Germany; France

Key companies profiled

Thales Group; Airbus SE; Saab AB; Leonardo S.p.A; Rheinmetall AG; BAE Systems; Elbit Systems; General Dynamics; HENSOLDT AG; CACI International

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe C5ISR Market Report Segmentation

This report forecasts revenue growth at the regional level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Europe C5ISR market report based on component, end use, application, and country:

Component Outlook (Revenue, USD Billion, 2021 – 2033)

Hardware

Software

Services

End Use Outlook (Revenue, USD Billion, 2021 – 2033)

Application Outlook (Revenue, USD Billion, 2021 – 2033)

Intelligence, Surveillance, and Reconnaissance

Command and Control

Electric Warfare

Missile Defense and Radar

Combat Systems

Others

Country Outlook (Revenue, USD Billion, 2021 – 2033)