Australia’s top banker says she’s worried about the threat posed to the country’s payments system – and the personal data of its millions of residents – by quantum computing.In a speech in Sydney today, RBA Governor Michele Bullock flagged that the emerging technology will, at some point in the future, render current security standards obsolete, requiring widespread updates.

“The fight against fraud and scams will no doubt require further innovation, adaptation and cooperation by the payments industry – we can be certain that fraudsters won’t stand still in their efforts to steal people’s data and money,” Bullock told the Daily Telegraph’s Bradfield Oration this morning.

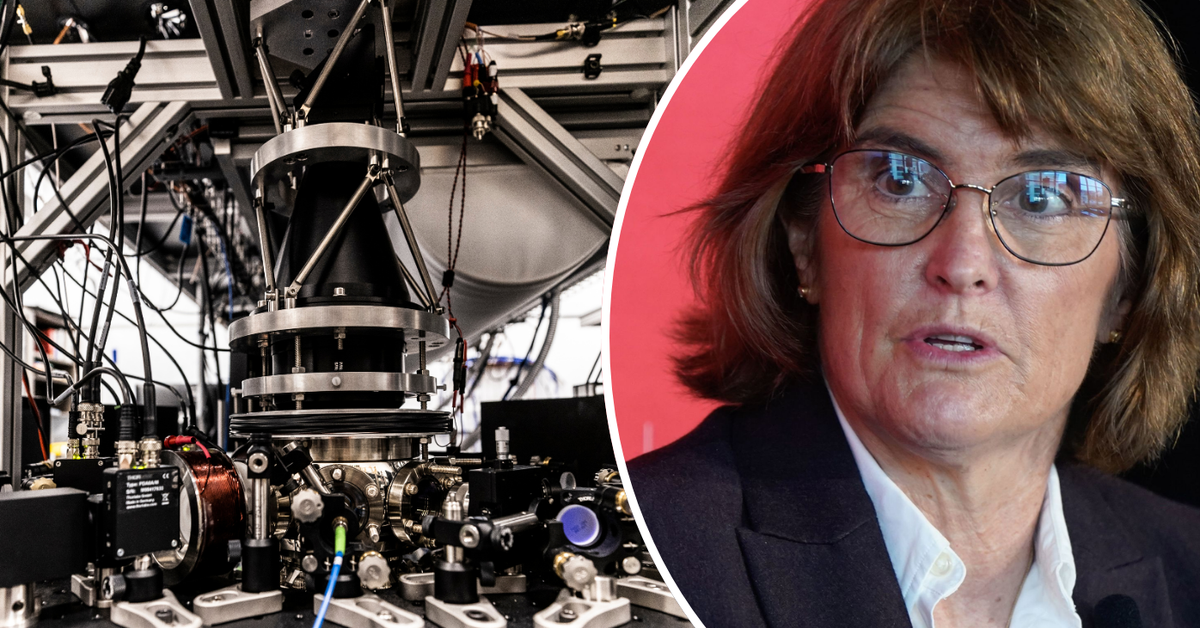

Michele Bullock has warned of the dangers of quantum computing. (Dominic Lorrimer)

Michele Bullock has warned of the dangers of quantum computing. (Dominic Lorrimer)

“One important example is the need to protect card users against advances in quantum computing, which is expected to result in current encryption standards being broken sometime in the future.

“This requires migrating card payments to the advanced encryption standard (AES), a quantum-safe solution.”

A University of NSW study last year found that the security algorithms used in IT networks across the globe, which take millions of years to break through even using modern supercomputers, could be decrypted in a matter of days or even hours by quantum computing.

“IT networks that use popular cryptographic security algorithms, like RSA, are currently quite secure against being hacked, even if supercomputers are used to try and decrypt the cryptographic algorithms,” lead researcher Dr Fida Hasan said at the time.

Quantum computers are capable of working far quicker than even modern supercomputers. (Brook Mitchell)

Quantum computers are capable of working far quicker than even modern supercomputers. (Brook Mitchell)

“Using current conventional supercomputers, it would still take millions or even billions of years to hack those security cryptosystems, but with the power of quantum computers, the time taken to decrypt those algorithms would be significantly reduced, potentially to a day or even less.

“There are some predictions that suggest a quantum computer, with the ability to rapidly decrypt cryptographic security algorithms, could be developed within the next decade.”

When asked whether the emerging technology was the biggest threat to Australia’s payments system, Bullock admitted it is frightening.

“It’s something I worry about,” she said.

“If you believe what they say (about) quantum computing, what takes 200 years to decrypt now, to break, will take a matter of minutes. So it is a big threat.

“But I have to say … advanced encryption standards have been developed to meet that challenge of quantum computing.

“At the moment, we trust our financial institutions to keep our data safe and they do that through encryption.

“So it is a worry that we need to make sure we keep up with that quantum computing situation, because otherwise it’s not safe.”

Australians lost a combined $173.8 million to scams and financial fraud in the first half of the year, up 26 per cent from the same time last year, according to the ACCC.

“Technology is helping scammers reach more people than ever before and we see scams becoming more sophisticated and harder for people to detect,” ACCC deputy chair Catriona Lowe said in August.